Justin Sullivan/Getty Images News

Investment Thesis

With Kohl’s Corporation (NYSE:KSS) recently trading at <$40/share, the Franchise Group, Inc. (FRG) offer of $60/share would give shareholders a near-term absolute return of 50%+ and the opportunity to recycle capital during a market downturn. I argue that even if one has strong conviction in Kohl’s long-term potential, which is obviously not without its risks, accepting the $60/share offer would still be in the interests of shareholders. Furthermore, Kohl’s shareholders could gain exposure to any forgone upside by becoming shareholders of Franchise Group, in the event of a deal.

At the time of writing, the latest rumour was that Franchise Group was considering lowering its offer “closer to $50/share“. Given that management and the Board had just in February rejected a $64/share offer, and are enthusiastic about their long-term prospects, I expect that they will balk at any offer below $60/share. In considering the broader context, I suspect that Franchise Group would follow through with $60/share, however there are risks involved. With news stories flip-flopping every day on KSS, I assign a “hold” rating, although I own a position.

The $60/Share Deal Offers a Better Risk-Adjusted Annualized Return than Alternatives

Fair business deals don’t necessarily leave both parties completely satisfied — both sides likely would’ve wished to get more favourable terms, by extracting more from the other party. But fair deals do leave room for both sides to benefit, as well, e.g. avoiding the so-called “winner’s curse“, for the successful bidder.

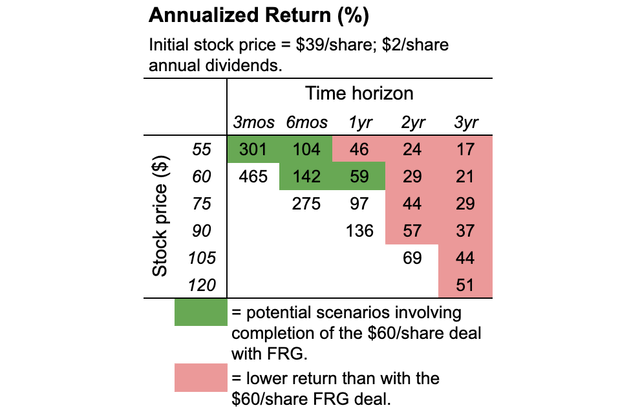

Seeking Alpha contributors have suggested in recent articles on KSS that $60/share is not enough, and that Kohl’s could be worth $110/share or more, in the longer-term. But this wouldn’t happen overnight –– so to better compare the different plausible scenarios, we have to adjust for the investment time horizon.

The table below depicts the annualized return for a range of scenarios, including a $2/share forward dividend. I’ve only filled in the cells that look reasonably plausible to me –– note that I also don’t include potential downside scenarios, which I’ll get to, in a moment. The scenarios involving a deal closure appear to provide a better annualized return, versus ones that result in a higher stock price, but at a longer-term horizon. In the event that Kohl’s accepts the $60/share offer, I’d assume that arbitrageurs would drive the stock price above $55 until deal close.

Admittedly, it’s not necessarily reasonable to annualize the return from a short period like three months — but on the other hand, if the deal falls through, there is no guarantee, either, that the loftier price targets would be achieved. Even if management realizes its vision for the company, there’s the risk that the market wouldn’t care much — at least, by enough to assign much-higher multiples. There is a perception, indeed, a reality, that department stores, overall, are a declining business.

Downside Risks, and Possible Arguments Against the Deal

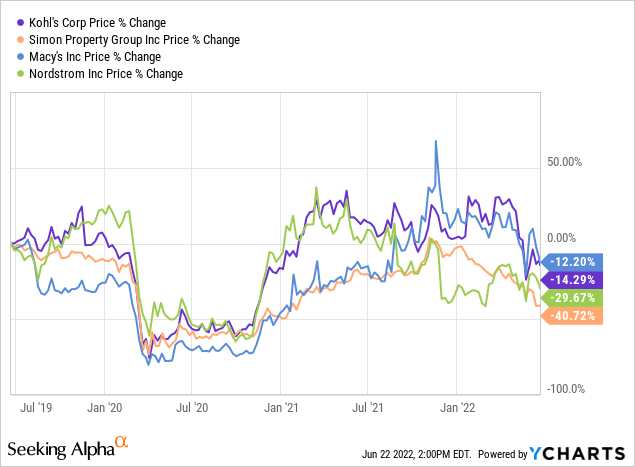

If the deal with Franchise Group falls through, it looks like Kohl’s could drop closer to $30/share, e.g. back to a November-2020 level. The following chart shows KSS, along with other retail-related stocks Simon Property Group, Inc. (SPG), Macy’s, Inc. (M), and Nordstrom, Inc. (JWN), which are also mostly below pre-pandemic and early-2021 levels.

One argument in favour of rejecting the deal could be to let the stock price tank, so as to load up on more Kohl’s shares. If one had a strong conviction in management’s vision and ability to deliver strong returns in a challenging industry, then this could lead to an even better absolute return, over a multi-year horizon. But I doubt that this would appeal to the majority of shareholders, many of whom would perhaps not want to increase their exposure to Kohl’s –– furthermore, if any investors had such strong conviction, the recent price of <$40/share would probably still look attractive to them.

One could also contend that Kohl’s represents such a unique opportunity that the greater potential absolute return over a long-term horizon, even if less in an annualized sense, is worth the uncertainty and wait. But given the broad pullback in the market, year-to-date, I find it unlikely that there are not good opportunities to recycle capital.

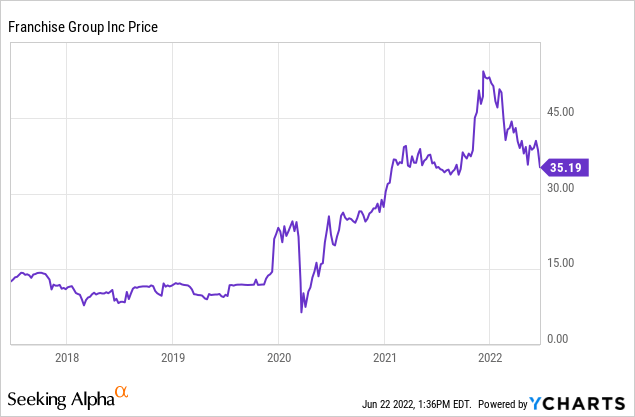

For example, shareholders that would lament Kohl’s longer-term potential of >$60/share would have the option of rolling their capital into Franchise Group, among other opportunities in a beaten-down market. Franchise Group has a market cap of only ~$1.5B, so I would assume that a Kohl’s acquisition would leave Franchise Group, and its investors, with fairly concentrated exposure to Kohl’s (currently more than a ~$5B market cap).

(Put another way, even if one embraces the premise that $60/share for KSS is wildly undervalued, the deal would help to drive the market closer to efficiency. Franchise Group just happens to be the lucky vessel called upon to do the bidding of the Invisible Hand, when no one else stepped up to the plate, after the 2022Q1 earnings miss. And investors would fortuitously be able to buy FRG, instead, to get exposure to Kohl’s upside.)

An analysis of Franchise Group is beyond the scope of this article, but Seeking Alpha provides many contributor efforts to which readers can avail themselves. Taking a quick look at FRG, it would appear that some things have been going well over the past few years (at least according to the market’s assessment).

Deal or No Deal?

The latest rumour is that Franchise Group is considering lowering its offer closer to $50/share –– in this event, I expect that prospects for a deal would be over. But given that Franchise Group made the $60/share offer less than three weeks ago, reportedly aims to continue talks past the three-week exclusivity period, would keep management in place, and should already be familiar with recessionary implications for a retail business, there’s a meaningful chance that the leak about $50/share deliberations could also be posturing (although sneaky, given what’s at stake, it would be in the interest of parties to leak reports that could favourably influence their bargaining position).

Regardless, I’ve so far mostly just argued that accepting a $60/share FRG offer looks like the best option for KSS shareholders. But what is the actual likelihood that the Board accepts the offer? While it wouldn’t be possible to pin this down precisely, I would guesstimate that it’s about 50/50. There are a few reasons to be optimistic that the Board could accept the offer:

- With the crash in KSS following 2022Q1 results getting as low as ~$35/share, one would hope that management and the Board has realized that the market is not as enamoured of their long-term plans as they are.

- Despite having rejected the $64/share offer earlier in the year, the $60/share bid by Franchise Group still allows management and the Board to save face — particularly given the broader market pullback.

- Franchise Group CEO Brian Kahn’s approach has appeared to be more deft, relative to the cavalier approach of some activist investors. This should help to improve the chances of deal closure — there is a natural human tendency to reject overtures from those that take a more abrasive tact.

- For instance, Brian Kahn and Franchise Group have reportedly sought to keep management in place, and have an apparently strong track record with M&A.

- Franchise Group has deep expertise in the retail space –– this should provide strategic alignment to Kohl’s plans.

Still, there’s a sizeable risk that Kohl’s rejects the deal, and that KSS crashes even further. Investors should take this into account as they arrive at their own decisions. Management and the Board could have an overly optimistic view of their probability of success, and ability to avoid the secular woes to which some other department stores have eventually succumbed. They could also be failing to consider the types of arguments in this article, as obvious as these arguments would seem — maybe this article will help in some modest way, however small that is.

FRG’s financing could conceivably also fall through, or they might indeed lower their offer –– it’s certainly possible that they could change their mind. The impact of inflation could be biting harder than expected even just a couple of weeks ago. In the event that the deal doesn’t happen, KSS is still a value stock, and all hope would not be lost –– supply chain and recessionary pressures will eventually subside, providing a better tailwind to the retail sector. But personally, I would prefer to see a deal go through, and then reallocate the capital elsewhere.

Final Words

While it’s unfortunate that the market reacted so harshly to Kohl’s recent quarter, fairly or unfairly, this is the hand that has been dealt to Kohl’s management, its Board, and investors. Accepting the $60/share Franchise Group bid, in my opinion, looks like the best risk-adjusted return that’s available from among the plausible scenarios for Kohl’s investors.

Let me know your thoughts and feedback on KSS, in the comments below. Should Kohl’s Board accept the Franchise Group offer, and how do you view the probability that they will?

Be the first to comment