Eugene Gologursky/Getty Images Entertainment

Kohl’s Corporation (NYSE:KSS) is the “other” takeover saga in the news, on-again, off-again, in 2022. Twitter (TWTR) vs. Elon Musk is all the rage in the business news section on your favorite website, inside the Wall Street Journal, and debated on CNBC television. Yet, another drama playing out is the ever-changing story for a Kohl’s department store sale.

Some background first. Earlier in the year, Kohl’s received a per-share offer of $64 from Starboard-backed Acacia Research. At one point, as many as 25 different firms showed some interest in reviewing the accounting books at Kohl’s, before rising interest rates and slowing retail sales scared away nearly the whole bunch of potential suitors. A few weeks ago, Kohl’s management turned down a revised lower bid of $53 per share from Franchise Group (FRG), falling from an original $60 price under negotiation in early June.

Continuing today, rising interest rates have changed the profit outlook and discount multiples for a successful deal. And, since June, it has become increasingly clear a weaker retail environment will exist later in 2022 and perhaps for all of 2023 with the appearance of a consumer-led recession in spending. The puzzle pieces are definitely interesting to contemplate.

Why Is Kohl’s For Sale?

Several activist hedge funds, including Macellum Capital, Legion Partners Asset Management, 4010 Capital, and Engine Capital, have purchased stakes in Kohl’s since 2021 and demanded either a sale of the company or a major financial engineering exercise to unlock the value of its significant real estate holdings.

Unlike smaller clothing retailers and many department stores that focus on leasing retail locations to reduce debt loads, retailers like Walmart (WMT), Target (TGT), and Kohl’s actually own many of their physical brick-and-mortar stores, plus warehouses and distribution equipment. The idea is higher price levels over time (inflation) will push the cost of leases up, while effectively lowering the “relative” fixed costs of doing business with owned assets as a function of sales dollars.

McDonald’s (MCD) is another backdoor real estate holding company, controlling franchise decisions by owning the land under restaurants, and keeping strong locations as fully-owned units. One of the reasons for its steady gains and decent support during recessions has come from this quasi-holding company design for prime retail real estate locations across America (and the world).

For Kohl’s, the main attraction for most all the buyout interest revolves around real estate ownership by the company, with some 35% of stores operated by this U.S. retail giant fully-owned. A total of 410 owned locations, 238 stores with ground leases but buildings owned, and 12 industrial properties were part of the business structure at the end of 2021. Altogether, they represent $1.1 billion in land and $8 billion of real estate held on the balance sheet, using depreciated accounting on prices paid.

Chris Volk and Brad Thomas posted an excellent article last week here, explaining the real estate asset angle, alongside the potential for either a sale-leaseback transaction at Kohl’s or the creation of a REIT vehicle spinoff of properties as possible ways to unlock value not currently priced into shares. They estimated total land, property and owned building improvements have amounted to roughly $11 billion over the years, using upfront cost accounting (before depreciation).

When you contemplate most of its real estate was purchased over a decade ago, the latest round of money printing by the Federal Reserve and spike in real estate values means Kohl’s could be sitting on a gold mine for underlying value, ready to be pulled out for shareholders. Thomas and Volk concluded their article with this summary (which in my mind is completely understating the real estate setup),

… even with conservative estimates [$6.2 billion on liquidation], real estate value comprises approximately 60% of enterprise value. Once again, this demonstrates that Kohl’s is more REIT than retailer…

Absent an acquisition, we strongly encourage Kohl’s to seek a sale-leaseback of its real estate.

Based on our rough estimate, this could allow it to pay off its debt. From there, it could either pay out a $2 billion special dividend to its shareholders or effect a share repurchase.

Perhaps the best explanation of what Franchise Group was trying to accomplish mathematically in its bid for Kohl’s is described in this expanded Seeking Alpha review in early June by contributor Michigan Value Investor. If you are serious about buying shares of Kohl’s, I also recommend you read this strong research effort. Again, the working assumption was Franchise Group could extract at least $6 billion in cash from the sale of Kohl’s properties vs. a current equity capitalization of $3.8 billion at $30 per share.

In management’s mind, selling the whole company for basically the accounting value of its real estate position did not make sense for shareholders. The $6.7 billion takeout worth at $53 per share, plus $4.6 billion in debt and finance lease obligations (April 2022) assumed would only be slightly above the land and depreciated real estate value of $9 billion on the balance sheet. If the real-world value of these assets was ABOVE the cost accounting (pre-depreciation) value of $11 billion, they would effectively be giving away for FREE an operating business generating $1.5 billion in cash flow and $900 million in earnings over the last four quarters.

Anyway, to simplify the math, Franchise Group was willing to pay $50+ per share a few weeks ago, which would have generated serious profits on their end after selling the underlying real estate in a sale-leaseback transaction, while keeping all future retailing profits from Kohl’s.

Bargain Valuation On Current Business Setup

If turning down $50+ in a buyout proposal made sense, what are investors being paid as a backup plan by management? I think the underlying valuation of Kohl’s is getting quite absurd, regardless of the real estate debate.

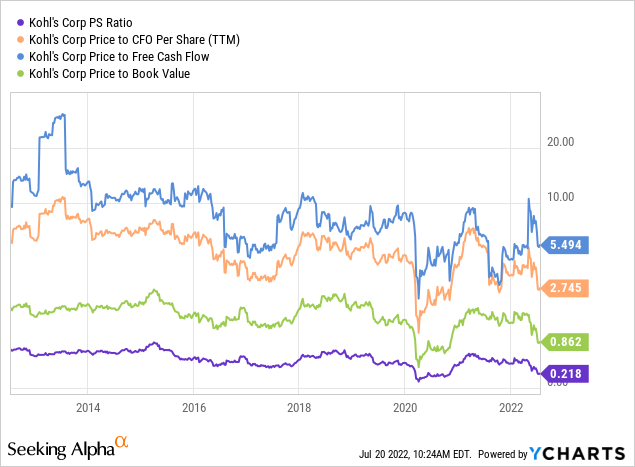

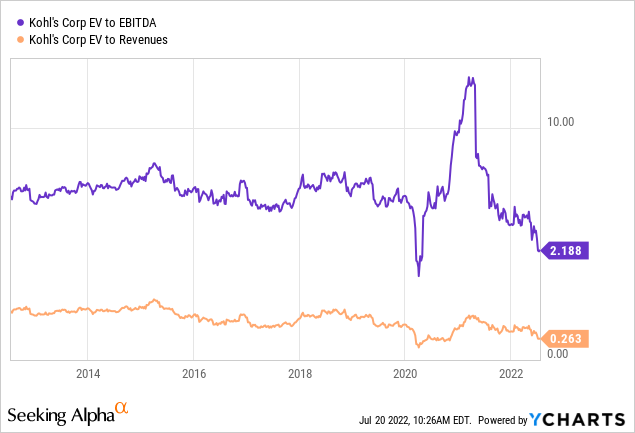

The company is trading very near its lowest valuation in decades, just above the government-mandated store-closure period of March-June 2020 during the first days of the pandemic. Below is a 10-year graph reviewing basic fundamental ratios of price to trailing annual results on sales, cash flow, free cash flow, and book value.

YCharts

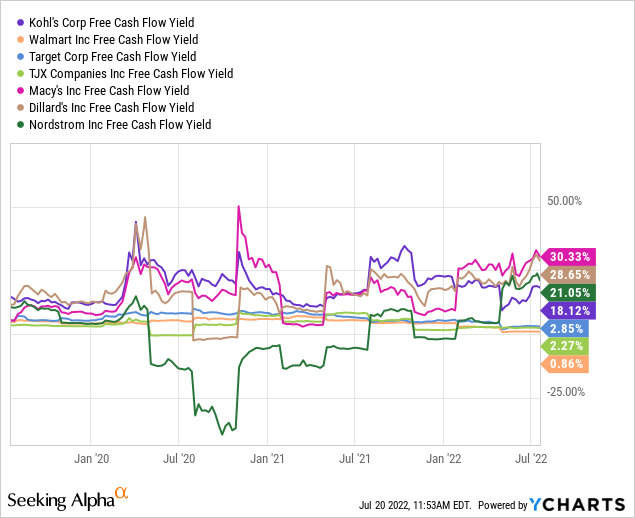

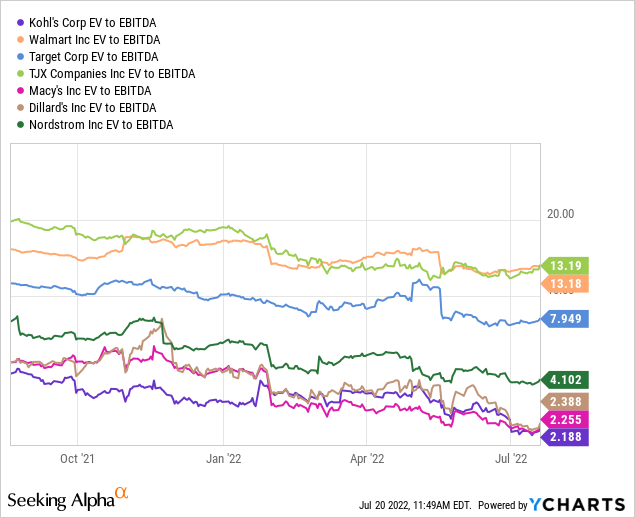

Measured against large department store competitors and peers, free cash flow generation really stands out. I have included Walmart, Target, TJX Companies (TJX), Macy’s (M), Dillard’s (DDS), and Nordstrom (JWN) for comparison. During the whole COVID-19 pandemic span on the 3-year graph below, Kohl’s has produced incredibly positive free cash flow, unlike many other department store retailers.

YCharts

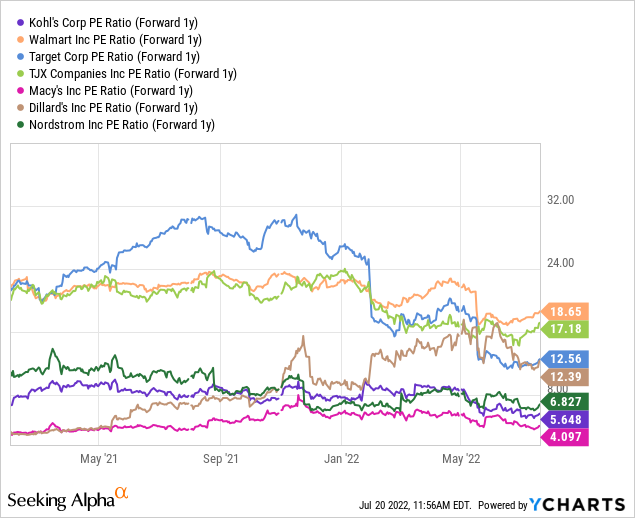

Analyst projected operating results have fallen since the beginning of the year, but the stock quote has dropped even faster. Compared to peers in July, the forward 1-year price to earnings ratio is super-cheap at 5.6x.

YCharts

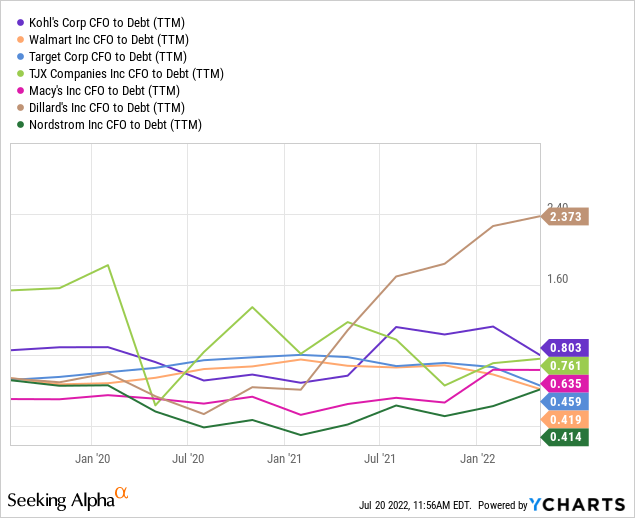

Debt is very low vs. peers/competitors, which is a huge positive going into a recession in consumer spending. As a function of cash flow, Kohl’s has one of the most conservative leverage setups.

YCharts

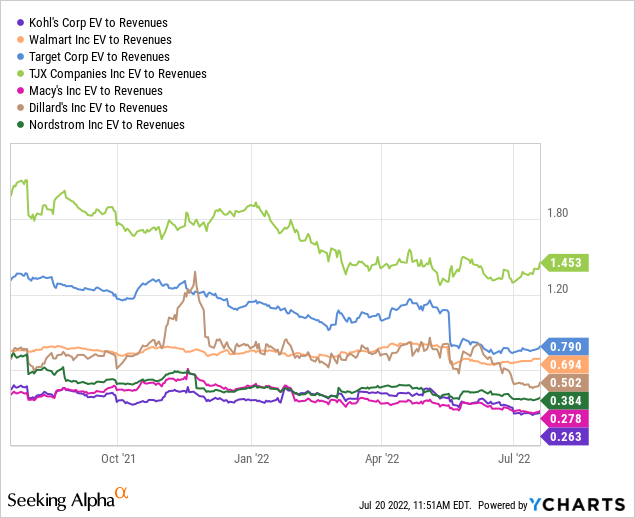

When we add debt totals to the stock market capitalization, enterprise value numbers look like an even bigger bargain. Today, EV to EBITDA of 2.2x and EV to Revenue of 0.26x are HALF of their decade averages, drawn below. Plus, EV calculations vs. peer investment alternatives are insanely low.

YCharts YCharts YCharts

Technical Chart

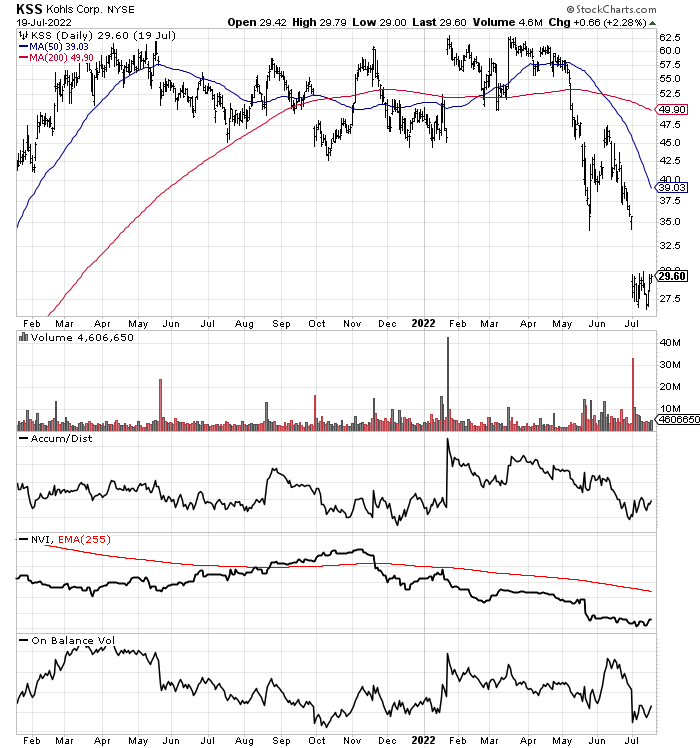

The only difficult part of the Kohl’s investment equation is timing a bottom. The 18-month chart below highlights a stock plummeting almost 50% over the past year, with most of the losses coming since early May, as the dealmaking fell into disarray, and consumer spending weakness became abundantly clear for Wall Street.

There are not any concrete momentum signals of oversized buying presently. So, without a takeover deal to be had over the short term, Kohl’s will likely follow the fortunes of other retailers during the rest of 2022. A weak run of quarterly reports could easily push price to $25 or even $20 in the months ahead. My view is the lower price goes, the more interested you should become as an investor.

StockCharts.com

Final Thoughts

Sure, in a deep recession the “underlying value” of Kohl’s (including a weak operating environment and steady real estate prices) could fall to $40 or even $30 for a period of months. However, an economic recovery and another round of Federal Reserve money printing in response to the slowdown could ignite a huge rally in shares well above $60, similar to 2021’s level. Remember, the future of Kohl’s as an investment is not only dependent on the health of consumer spending and smart inventory management, but the worth of its vast real estate holdings.

I feel the value proposition under $30 is strong enough to put a Buy rating on Kohl’s shares. Keep in mind even weaker quotes are possible in a severe recession led by reduced consumer spending. Opening a small starter position, with a goal of cost averaging on the way down, might be the best investment approach. You can buy a third of your full position around $29 now, another third around $25, and if need be price declines all the way to $20, a final third could be allocated.

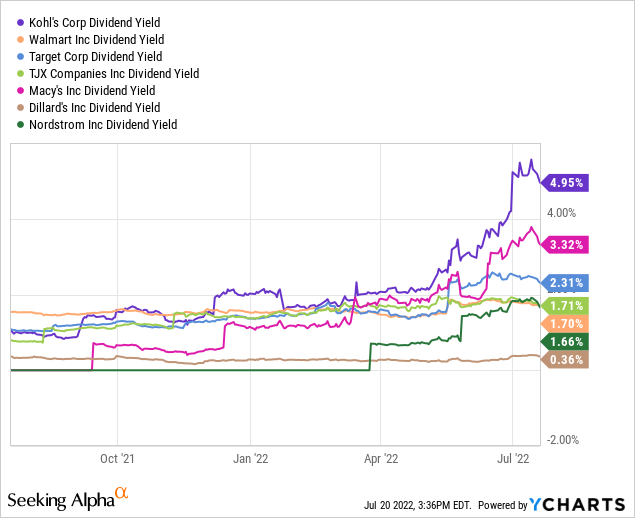

The decider for me to begin a bullish outlook is the huge dividend yield, easily covered as a $200 million annual payout on $1.5 billion in trailing cash flow generation. After the price dump from $60, the Kohl’s cash distribution smokes the other peer retailers.

YCharts

Why not buy a retailing bargain under $30, when an outside buyer just offered $50+ per share? I have a worst-case recession scenario down to $20 per share, and a best-case outcome for 2023 above $60. That’s potential total return (including the dividend) risk of -28% vs. upside of +105%. Finding another risk/reward proposition this slanted in favor of ownership is still difficult in today’s market, even after a 25% bear slide for the average U.S. equity in 2022.

My family shops at Kohl’s either online or at our local location several times a month, at a minimum. The latest push to add Sephora – LVMH (OTCPK:LVMHF) beauty and makeup items to drive traffic is not exactly the worst idea. Target/Ulta Beauty (ULTA) are trying the same concept. I am quite confident this large U.S. retailer is in good shape to be around for years to come. Buying KSS shares when in the bargain bin is how smart investors shop.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment