diegograndi/iStock Editorial via Getty Images

Looking for high yield income in a niche industry? The shuttle tanker industry is less than 1% of the world’s total shipping fleet.

We’ve covered KNOT Offshore Partners LP (NYSE:KNOP), a leader in the industry of offshore shuttle tankers, in several of our articles over the years.

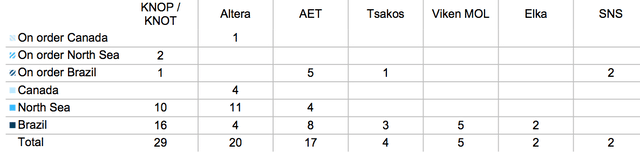

KNOP and its parent, NYK Knutsen, dominate this industry, owning 37% of the global shuttle tanker fleet.

KNOP site

Shuttle tankers perform a vital service for offshore oil producers which utilize them to get their product to the mainland. Shuttle tankers service a growing proportion of all offshore production, recently surpassing 90% in Brazil. KNOP’s management estimates that there are ~12 customers and ~3 suppliers in this sub-industry.

These are specialized vessels that take 2.5-3 years to build, which helps support KNOP’s re-contracting efforts as its customers often utilize the extension options on these vessels. However, with so much uncertainty in the world since the advent of the pandemic, charterers are waiting longer to recharter, usually due to reduced capex budgets.

These vessels have a lifespan of ~25 years. KNOP’s fleet utilization has typically been steady and strong, with an average of ~99.5% since KNOP’s 2013 IPO, which has resulted in steady revenues.

Recently, however, KNOP’s fleet utilization has been lower due to several off-hires – in Q4 ’21 the fleet operated with 96% utilization, due to the scheduled drydocking of the Tordis Knutsen, which was off-hire for 35 days, and the off-hire of 27 days related to the installation of the volatile organic compound (“VOC”) emissions recovery plant on the Bodil Knutsen.

Fleet:

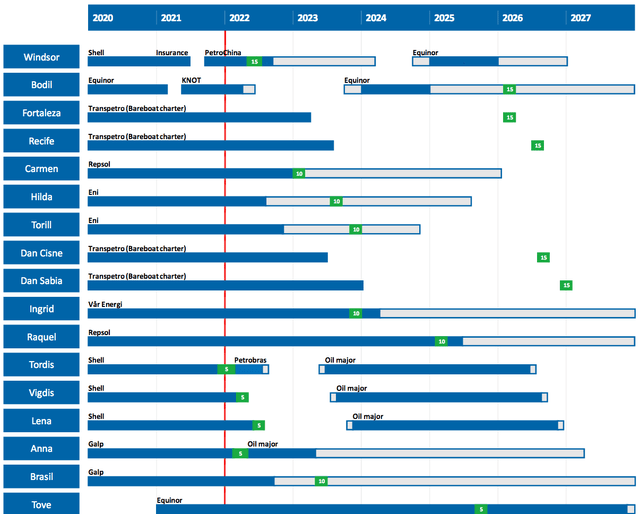

KNOP had remaining forward contracted revenue of $560M, with an average remaining firm charter of 2.0 years, with charterers’ options to extend by a further 2.7 years, as of 12/31/21.

The charterer of the Anna Knutsen, Galp Sinopec, did not exercise its option to extend the time charter of the vessel. On Feb. 11, 2022, the Partnership agreed on the commercial terms for a new 1-2 year charter contract plus extension options, for the Anna Knutsen with a major oil company, to commence in Q2 2022.

KNOP entered into a new time charter agreement for the Tordis Knutsen with Petrobras that commenced on Feb. 23, 2022, for a fixed period of five months, with a one-month extension option.

KNOP entered into a new 1-2 year charter contract for the Bodil Knutsen with Equinor to commence in Q4 2023 or Q1 2024.

KNOP entered into a new time charter contract for the Windsor Knutsen with Equinor to commence in Q4 2024 or Q1 2025.

KNOP site

Dropdowns:

KNOP’s parent Knutsen NYK has been supportive through the years – it retains at least 25% of the limited partner interest in KNOP through both direct investment and ownership of the general partner. This company pioneered the shuttle tanker business.

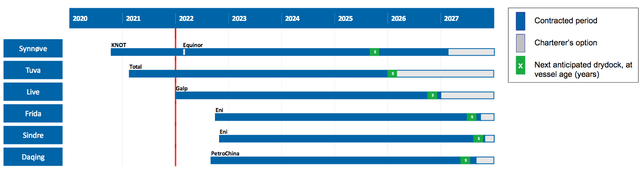

Knutsen has six vessels available for dropdown to KNOP, all with multi-year contracts. KNOP’s last dropdown was in 2020 when it acquired the Tove Knutsen for $117.8M, less $93.1M of outstanding indebtedness. It was financed on a non-dilutive basis using cash on hand and borrowings under KNOP’s existing revolving credit facility.

Management is reviewing potential dropdowns in 2022. As we’ve previously mentioned, one way to help finance a dropdown would be to issue a new preferred series at a much lower rate than the common units’ current 12%-plus yield. Of course, refinancing rates would be even lower than that. Management should be able to refinance the 2023 debt maturity at a lower rate.

KNOP site

Earnings:

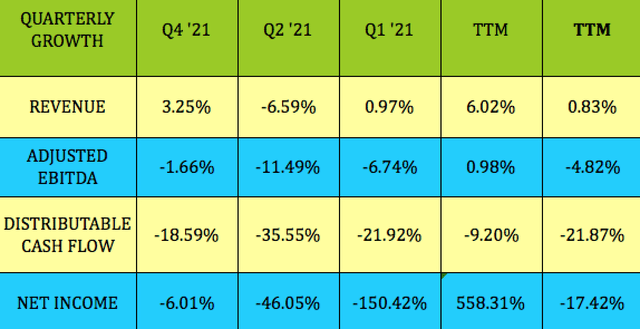

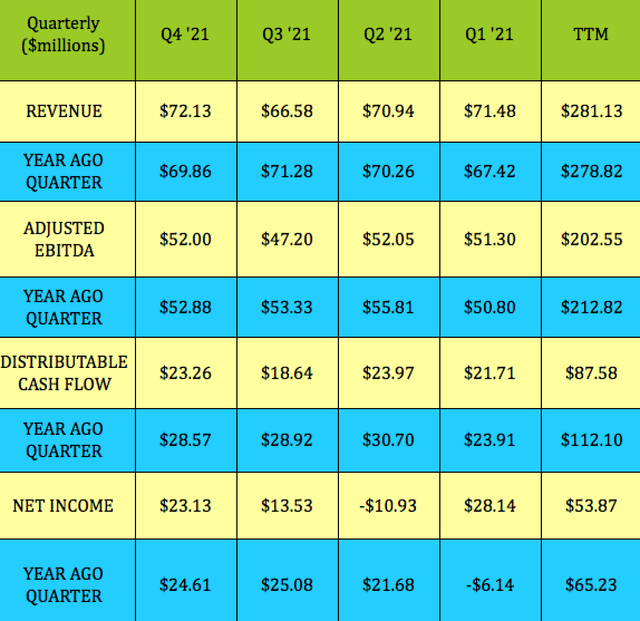

While revenue was up ~3% in Q4 ’21, EBITDA was down -1.66%, net income dropped -6%, and DCF was down -18.6% vs. Q4 ’20, due to the scheduled drydockings of the Tordis Knutsen and the Bodil Knutsen.

Hidden Dividend Stocks Plus

However, revenue, EBITDA, DCF, and net income all grew sequentially vs. Q3 ’21, with revenue hitting its highest mark in the past eight quarters.

Hidden Dividend Stocks Plus

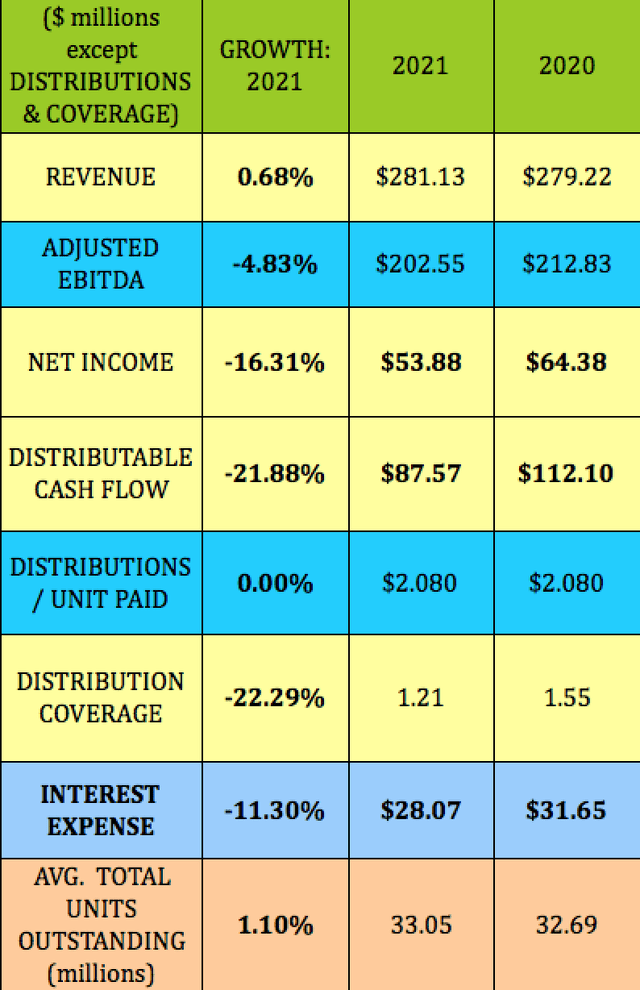

Full-year 2021 earnings figures were mostly underwhelming, with flat revenue, and declines in EBITDA, net income, and DCF due to the off-hire and technical issues in the fleet. One bright spot has been interest expense, which decreased by 11.3% in 2021, after a 38% decrease in 2020.

Hidden Dividend Stocks Plus

Dividends:

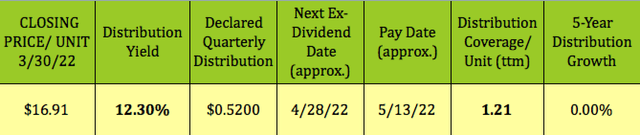

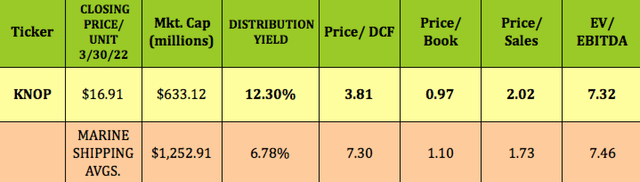

At its 3/30/22 closing price of $16.91, KNOP yields 12.30%, and should go ex-dividend next on ~4/28/22, with a pay date of ~5/13/22. There have been 26 consecutive $.52 payouts, hence the lack of dividend growth. The flip side to that is that management has maintained a steady dividend since 2015, and even did so during the pandemic.

Hidden Dividend Stocks Plus

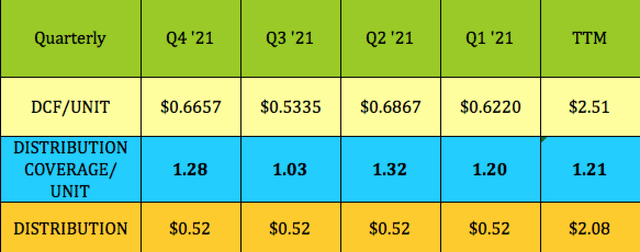

Distribution coverage dipped to 1.03X in Q3 ’21, but bounced back in Q4 ’21 to 1.28X, averaging 1.21X in 2021.

Looking ahead to Q1 ’22, management said on the Q4 ’21 call, that “our first quarter 2022 revenue will be impacted by the scheduled drydock works related to three vessels; the Tordis Knutsen, Vigdis Knutsen and Anna Knutsen. This concentration of drydock work impacting one quarter, whilst unusual is anticipated by the partnership and an impact on revenue on coverage for our first quarter 2022 should be expected.

However, aside from these planned drydocks works, it is important to note that all of the partnerships vessels are otherwise employed on contracts during the first quarter of 2022. And the partnership does not mechanically link our quarterly distribution to any single quarter’s results or coverage ratio.”

Hidden Dividend Stocks Plus

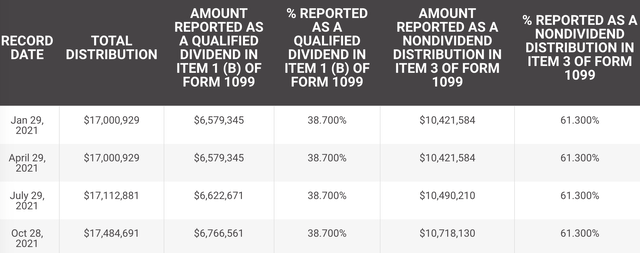

Taxes:

KNOP has elected to be treated as a C-Corporation for tax purposes – investors receive the standard 1099 form and not a K-1 form. There was a 34%/61% split between Qualified and Non-Dividend Distributions in 2021.

KNOP site

Profitability and Leverage:

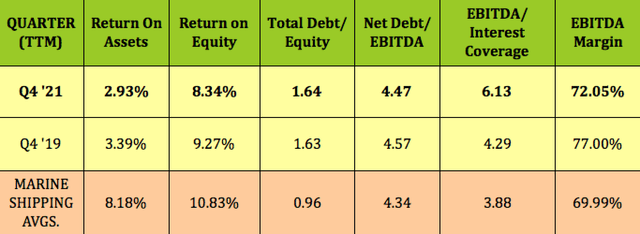

Trailing ROA and ROE were a bit lower than pre-COVID figures, and also lower than industry averages. EBITDA Margin was down by ~500 basis points, but still roughly in line with industry averages.

Debt/equity was steady in Q4 ’21, while net debt/EBITDA leverage was slightly lower than in Q4 ’19. With the decline in interest, EBITDA/interest coverage improved a great deal, rising to 6.13X, vs. 4.29X in Q4 ’19, and much higher than the 3.88X industry average:

Hidden Dividend Stocks Plus

Debt and Liquidity:

Management closed a $345 million refinancing in September, via a new senior secured credit facility for the Tordis, Vigdis, Lena, Anna and the Brazil Knutsen. The credit facility bears interest at a rate per annum equal to LIBOR plus a margin of 2.05%.

With that done, KNOP has no further refinancings due until the third quarter of 2023.KNOP also entered into a sales agreement with B. Riley Securities for an ATM equity program, whereby the partnership may offer and sell up to $100M of common units from time-to-time.

KNOP had $117.3M in available liquidity, which included cash and cash equivalents of $62.3 million as of Dec. 31, 2021.

Performance:

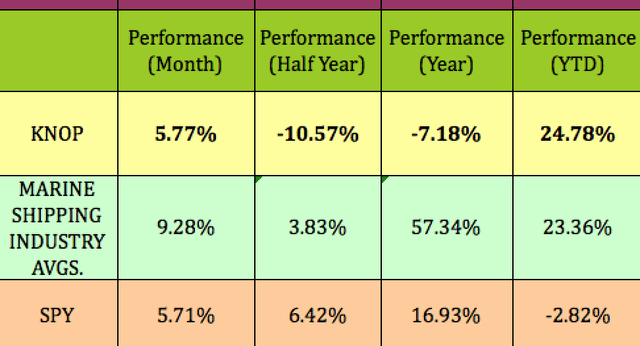

Many marine shipping and energy-related stocks have surged in 2022, following the rise in energy prices, due to the Russian invasion of Ukraine, and other pressures.

Although its business isn’t directly affected by the war, KNOP has tagged along for the ride, gaining nearly 25% so far in 2022, and outperforming the S&P 500 by a wide margin. One-year and half year performance has been negative, due to concerns about potential dividend coverage and rechartering issues. KNOP has kept pace with market over the past month.

Hidden Dividend Stocks Plus

Valuations:

The most striking undervaluation here is KNOP’s Price/DCF of just 3.81X, which is 48% lower than the 7.3X industry average. Since DCF is the source of distribution coverage, this is significant. KNOP’s P/Book is below 1X, while its EV/EBITDA is slightly cheaper than the industry average.

Hidden Dividend Stocks Plus

Tailwinds:

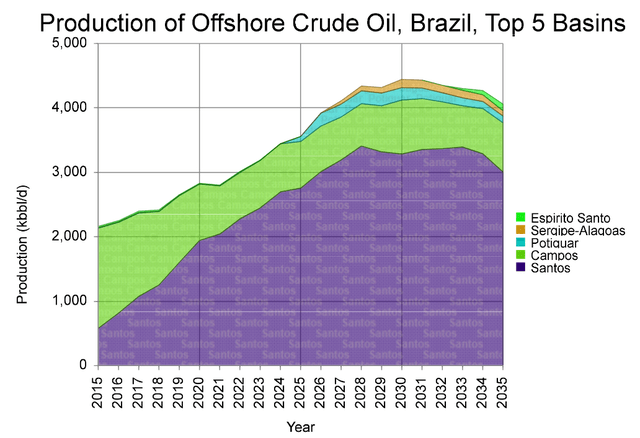

In addition to there not being speculative newbuilding in this sub-industry, costs for newbuilds are up substantially, and also take 2.5 to 5 years to arrive. It’s clear that Brazil, an important region for shuttle tankers utilization, is planning major Capex amounts over the coming years, which should support ongoing shuttle tanker usage.

KNOP site

Parting Thoughts:

We’ve been fortunate enough to have collected KNOP’s steady distributions for several years.

Although its distribution coverage will be lower in Q1 ’22, due to multiple drydockings, management reiterated, “After safety, our number one priority is the maintenance of our distribution and to do this we are targeting stable cashflows and looking to maximize fleet utilization.” (KNOP site)

All tables by Hidden Dividend Stocks Plus, except where otherwise noted.

Be the first to comment