onurdongel/E+ via Getty Images

On Wednesday, January 19, 2022, energy and midstream giant Kinder Morgan, Inc. (NYSE:KMI) announced its fourth-quarter 2021 earnings results. These results generally impressed the market as the company managed to beat the expectations of analysts in terms of both revenues and earnings, although the stock price remained flat over the course of the next day. The company’s management expects that 2022 will be much stronger as the energy industry has not only fully recovered from the devastation of the coronavirus pandemic but is now arguably much stronger than ever. This company has long been a favorite of income investors due to its impressive 6.20% yield, and should it manage to deliver the performance that its management expects, then the company will most certainly continue to be so.

As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Kinder Morgan’s fourth-quarter 2021 earnings results:

- Kinder Morgan brought in total revenues of $4.425 billion in the fourth quarter of 2021. This represents a 42.05% increase over the $3.115 billion that the company brought in during the prior-year quarter.

- The company reported an operating income of $950 million in the reporting period. This compares somewhat unfavorably to the $980 million that the company reported in the year-ago period.

- Kinder Morgan transported an average of 2.088 million barrels of oil equivalent per day in the most recent quarter. This represents a 5.78% increase over the 1.974 million barrels of oil equivalents per day that the company averaged in the equivalent quarter of last year.

- The company reported a distributable cash flow of $1.093 billion during the quarter. This represents a 12.56% decrease over the $1.250 billion that the company reported in the same quarter last year.

- Kinder Morgan reported a net income attributable to itself of $637 million in the fourth quarter of 2021. This represents an increase of 4.94% over the $607 million that the company reported in the fourth quarter of 2020.

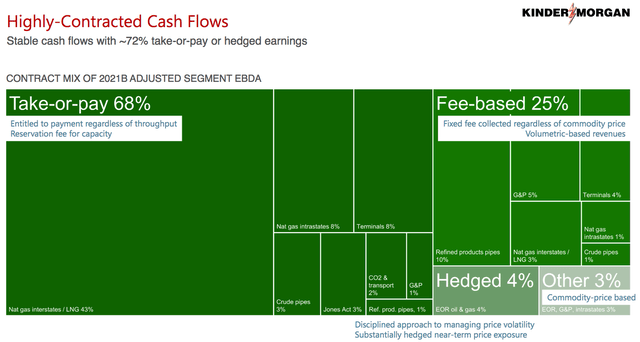

The first thing that anyone reviewing the highlights is likely to notice is that Kinder Morgan saw a fairly substantial revenue increase compared to the prior-year quarter. One of the reasons for this is that the company saw its transported volumes increase relative to the previous year. As I have discussed in various previous articles, Kinder Morgan’s basic business model revolves around volumes. Basically, the company charges its customers a fee for each unit of resources that moves through its pipelines. In fact, 93% of the company’s cash flow comes from this business model:

The fact that the company’s volumes increased year over year is somewhat surprising considering that many shale oil operators are actively decreasing their output in order to focus on free cash flow. However, the volume increase was not evenly spread across the company’s product lines. The most significant increase in volumes can be found in the refined product pipeline systems, which saw volumes increase by 9% year over year. This was largely due to a growing demand for refined products, which makes a lot of sense. In 2020, the lockdowns and general fear of COVID-19 caused people to curtail their traveling and stay home. This naturally reduced the demand for gasoline, diesel fuel, jet fuel, and similar products. As the volume of resources moving through the company’s pipelines is a direct function of the demand for these products, Kinder Morgan’s refined product pipeline volumes were much lower than normal in 2020. The demand for these products has been recovering over the course of 2021 for a variety of reasons and by extension so have Kinder Morgan’s volumes.

The company’s natural gas transportation unit did not do nearly as well as pipeline volumes declined by 3% year over year. This was due largely to declining natural gas production throughout the Rocky Mountains. This is certainly more in line with the statements that we have been hearing from upstream exploration and production companies with regard to the changes in their business models that were already mentioned. With that said though, the company did see volumes increase by 6% year over year on its Eagle Ford gathering systems, so we have not seen all of the predicted production cuts take effect yet. As these declines take effect over the next year or two though, the company may see its transported volumes decline in the near future.

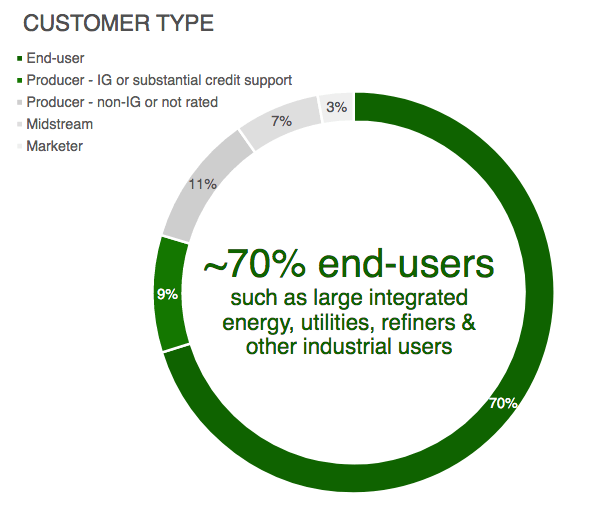

Despite energy companies’ intentions to let production decline, which could be expected to decrease volumes, Kinder Morgan may have some growth prospects. This is because the majority of Kinder Morgan’s customers are end-users of the products that it transports. In fact, about 70% of Kinder Morgan’s revenues come from companies such as utilities and industrial users:

Kinder Morgan Investor Presentation

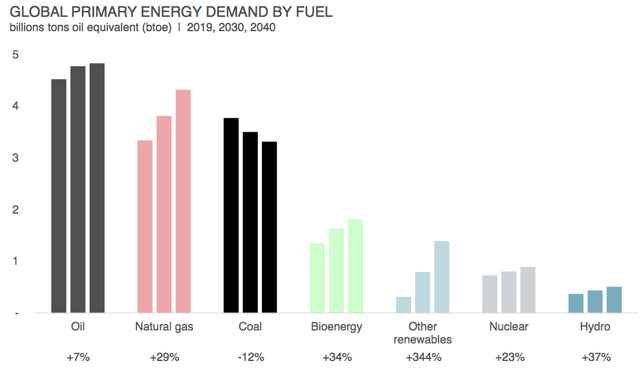

This could prove to be an important distinction because it means that Kinder Morgan’s volumes are more a function of demand than supply. The demand for the products that Kinder Morgan transports is expected to grow going forward. According to the International Energy Agency, the global demand for crude oil is expected to increase by 7%, and the global demand for natural gas is expected to increase by 29% over the next twenty years:

Kinder Morgan/Data from IEA 2021 World Energy Outlook

This would point towards rising volumes flowing through Kinder Morgan’s pipelines going forward as the company’s customers, particularly utilities, increase their demand for natural gas. This would at first glance appear to be at odds with the statements from energy companies about allowing production to roll off, but in fact, the two are not mutually exclusive. As production declines but demand increases, it is likely that the price of these resources will increase. This could allow the nation’s shale operators to increase their production while remaining focused on maximizing free cash flow and shareholder returns. Thus, the long-term story could still be pointing towards production growth, despite what upstream producers are currently saying. This would result in growth for Kinder Morgan as these dynamics cause volumes to grow.

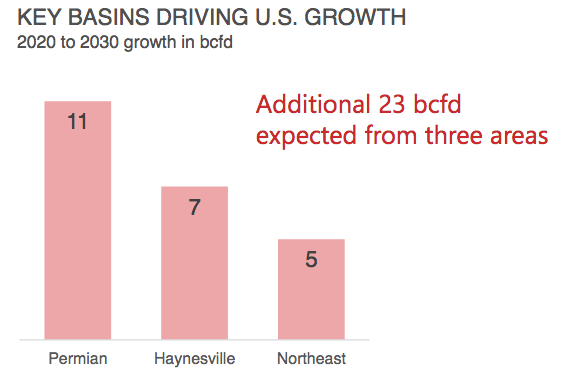

This scenario seems somewhat more likely than one of sustained production declines. According to Wood Mackenzie, the United States will increase its production of natural gas by 23 billion cubic feet per day over the 2020-2030 period:

Kinder Morgan/Data from Wood Mackenzie, North America Gas Markets Long-Term Outlook, June 2021

We can clearly see that this production growth is expected to come from three major basins, all of which are likely to be quite familiar to most energy investors. Kinder Morgan does have a presence in all three of these regions, although admittedly its presence in the Northeast Appalachian basins is somewhat limited. This provides further confirmation that Kinder Morgan will likely see its volumes steadily grow over the long term as these newly produced resources need to be transported from the resource fields to the market.

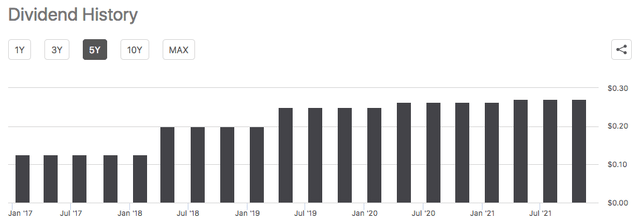

Kinder Morgan has long been a staple in the portfolios of many income-focused investors for a very good reason. The company has consistently sported a remarkably high dividend yield and even in today’s overheated market, it yields 6.20%. The company also has a history of growing its dividend over time, which it has consistently done since 2018:

The company intends to continue this trend going forward, with management stating that it expects a 3% dividend increase in 2022 over 2021 levels. As is always the case though, it is critical that we ensure that the company can actually afford the dividend that it pays out. After all, we do not want it to be forced to reverse course and both reduce our income and probably cause the stock price to decline. The usual way that we analyze this is by looking at the company’s distributable cash flow, which is a non-GAAP measurement that theoretically tells us the amount of cash that was generated by the company’s ordinary operations and is available to be distributed to the shareholders. As noted in the highlights, Kinder Morgan reported a distributable cash flow of $1.093 billion in the fourth quarter of 2021. However, the company’s dividend only costs $638 million at the current level. Thus, the company’s distributable cash flow is sufficient to cover the dividend 1.71 times over. Analysts generally consider anything over 1.20x to be reasonable and sustainable, but I am somewhat more conservative and like to see this figure over 1.30x to be comfortable with the investment. As we can clearly see, Kinder Morgan manages to meet both of these requirements so we can conclude that the dividend is likely to be reasonably secure.

In conclusion, Kinder Morgan’s results during the fourth quarter of 2021 largely show that the energy industry has recovered from the challenges that it faced in 2020. The long-term story here remains quite strong as rising global demand for both crude oil and natural gas will ultimately prompt energy companies to boost their output, consequently boosting the volumes flowing through Kinder Morgan’s infrastructure. Unfortunately, though, many energy companies have stated that they expect near-term production declines in order to better align their businesses with the demands of investors. This may have a short-term adverse impact on the company, but Kinder Morgan’s management is quite optimistic and believes that the company will be able to continue to showcase the characteristics that have long made it a favorite of income investors.

Be the first to comment