onurdongel

(Note: This article was in the newsletter on July 23, 2022, and has been updated as needed.)

Kinder Morgan, Inc. (NYSE:KMI) has been reporting some rather generous cash flow that management has been using to reduce debt. That debt reduction will give management some flexibility to increase debt as the capital projects begin to build. This company like many has been waiting for customers to request more capacity as industry production builds. It is now getting to the point where those requests are increasing. Investors should therefore expect free cash flow to decline as the capital budget climbs during this part of the cycle.

The dividend has been well protected and will likely be maintained. Management has stated that for roughly 6 years, the company has lived within its cash flow. That is going to continue. Despite the low payout ratio, the dividend will probably not be changed during the current fiscal year. Instead, management will wait to see the capital demands of the current industry cycle before raising the dividend. That will likely allow management to continue to live within its means by reinvesting excess cash flow into the business.

Raising the dividend will only happen after the demands for increasing capacity have been met through the proper financing of capital projects while maintaining an investment grade rating. There is a possibility that capital projects will be accepted, and the debt levels will continue to decline as management works towards a conservative balance sheet with still lower debt ratios.

But that reinvestment of cash flow should result in compounding returns to shareholders. Kinder Morgan is too large to grow at the rate of some of my smaller recommendations. However, it is very likely that the combined returns of the current dividend along with capital appreciation will result in long-term total returns in the teens.

The midstream industry is often thought of as the utility part of the oil and gas industry. Most of the contracts are long term, with protection in the form of “take or pay” clauses. There is also the fee-based business. The result is that this business has nothing close to the volatility of the upstream business.

However, the midstream companies often follow the upstream companies down, despite the lack of volatility of the underlying business. That movement often creates buying opportunities for long-term investors who do not want the volatility of upstream businesses. But they still want to participate in the oil and gas business.

Buying Opportunity

There was a recent pullback in the prices of oil and gas.

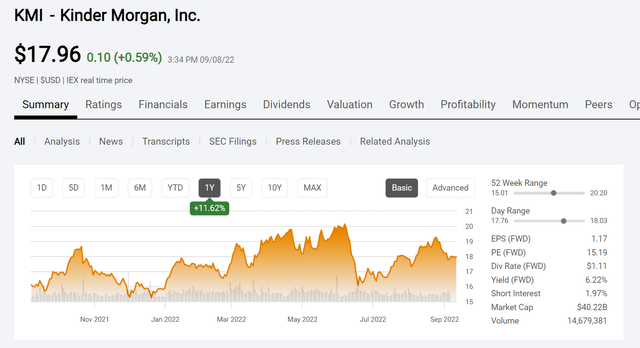

Kinder Morgan Stock Price History And Key Valuation Measures (Seeking Alpha Website September 8, 2022.)

From the chart above, one can tell exactly when the market became obsessed about the possibility of a recession. Fear definitely sells, and the market went overboard on the fear side as shown above. During fiscal year 2020, which was easily one of the more challenging years, business declined in the single digits. That was nothing close to the results of upstream.

Yet the stock price as shown above is anticipating a much greater business decline in a climate that is far less hostile than was the case in fiscal year 2020. Despite the relative lack of volatility in the actual business, Mr. Market is clearly worried that it will be different this time.

KMI’s Dividend Yield

Yet, the well-covered dividend provides a return that is only a couple of percent short of the average return that most studies show investors make long term. Any recovery in the price of the stock will likely provide a long-term return in the teens with the lower risk of a diversified midstream company. This is one of those “Mr. Market never learns” stories that enable investors to easily outperform the “pros.” Clearly, the reasons for that stock price decline were blown way out of proportion for this industry leader.

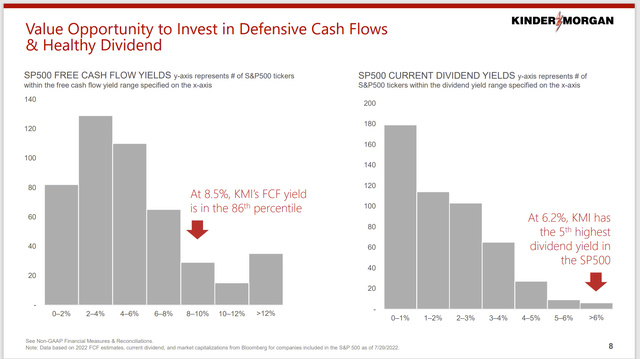

Kinder Morgan Dividend Yield In Comparison To Other Major Companies (Kinder Morgan September 2022, Investor Presentation)

The dividend yield is clearly getting to the point where the market expects a dividend cut or no growth. Yet, the well-covered dividend and the continuing influx of capital project requests would argue against such a scenario.

History Will Not Repeat

The reason this is happening is that the industry went through a very rough period starting in 2014 and ending in 2020. Even though this company sailed through that period, the market expects a repeat with far worse consequences given the inflationary environment along with current Federal Reserve policies.

But oil and gas prices remain sky-high compared with historical levels. Even if those prices decline, there is every indication they will remain at favorable levels. This industry has a long history of giving into decent commodity prices by raising production.

The only thing preventing that currently is the need throughout the industry to repair upstream balance sheets from the damage caused by the challenges of fiscal year 2020. But those repairs are probably getting near the end. That means there will be more cash flow available to fund production increases and shareholder returns. Hence, this midstream management like many is beginning to report inquiries for more capacity.

Unexpected Growth

In the meantime, this management made a small acquisition. That is in addition to another one made this year. Acquisitions have long been a part of the company’s history, which has augmented organic growth. Now, acquisitions will also be made while living within cash flow. That means the company will grow with smaller acquisitions that are generally less risky than large acquisitions until capital requirements cyclically climb.

The geographic diversification of this industry leader combined with the generous, well-protected distribution makes this an investment consideration for income investors as well as those investors that want relatively lower risk growth.

The stock is generally a consideration for those investors anytime there is a pullback as was recently the case. There is little to no risk of a distribution cut. The company has recovered from the debt market demands of lower debt ratios. Management will still reduce debt because this allows for greater financing flexibility of projects in the future.

Compared to several competitors, the debt ratios already allow for some project financing flexibility. As far as I am concerned, the more financial flexibility, the better. So, I am definitely “on board” with lower debt ratios. However, I would not be upset with climbing debt ratios as the demand for more capacity climbs (cyclically) because I know sooner or later there will be an industry downturn that will again allow for a lot of free cash flow that will likely reduce debt ratios to begin the cycle again.

Be the first to comment