Mikhail Mishunin

Pipeline owner and operator Kinder Morgan (NYSE:KMI) is serving up a 6.3% yield after the firm raised its distribution in the second-quarter. Strong business performance in natural gas and CO2 drove Kinder Morgan’s EBDA and DCF growth in Q2’22 and the firm’s low DCF payout ratio all but guarantees continual dividend growth. Kinder Morgan’s shares remain undervalued and have a risk profile that is skewed to the upside!

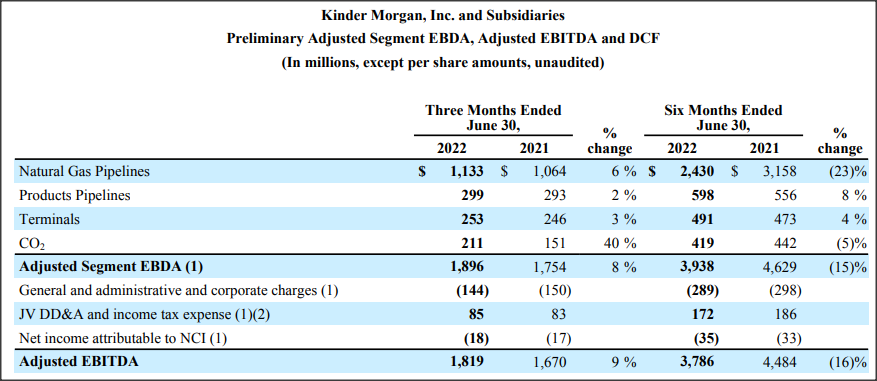

Improving performance in natural gas and CO2 results in strong distributable cash flow growth

Kinder Morgan’s natural gas and CO2 businesses did well for the firm in the second-quarter. In Q2’22, Kinder Morgan’s natural gas business saw a 6% increase in adjusted EBDA year over year to $1.13B which was the second-strongest performance of all of Kinder Morgan’s businesses. The natural gas segment benefited from the completion of the Stagecoach acquisition in FY 2021, a natural gas pipeline and storage joint venture that included 4 natural gas storage facilities with a capacity of 41B cubic feet and 185 miles of natural gas pipelines. The acquisition cost Kinder Morgan $1.23B last year and the integration of these natural gas assets are starting to make a positive EBDA contribution. EBDA stands for earnings before depreciation and amortization and is used by midstream firms to show operating performance without the distorting impact of non-cash expenses.

Kinder Morgan’s CO2 business had a windfall quarter due to higher prices for crude, NGL and CO2 which resulted in 40% year over year growth in CO2 segment EBDA. Kinder Morgan’s total adjusted EBITDA increased 9% year over year to $1.8B in the second-quarter.

Kinder Morgan

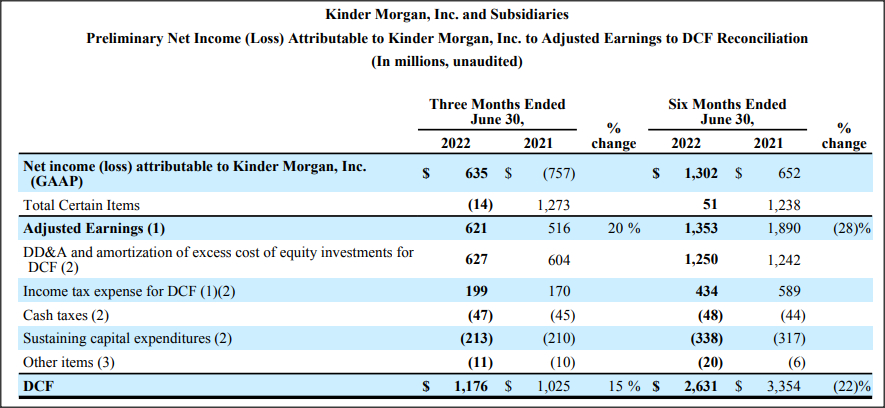

Because of strong business results in natural gas and CO2, Kinder Morgan’s distributable cash flow — which is the firm’s most important figure for shareholders as far as distribution safety goes — gained 15% year over year to $1.18B.

Kinder Morgan

Low payout ratio indicates attractive potential for dividend growth

Kinder Morgan’s DCF-based payout ratio in Q2’22 was just 53.4% which means that the midstream firm paid out only 53.4 cents of every dollar in distributable cash flow. The payout ratio has not risen above 61.4% since Q2’21. The implication is that Kinder Morgan’s payout is very, very safe and the firm retains potential to keep growing its dividend. All figures in the table below are per-share figures.

|

KMI |

Q2’21 |

Q3’21 |

Q4’21 |

Q1’22 |

Q2’22 |

|

Distributable Cash Flow |

$0.45 |

$0.44 |

$0.48 |

$0.64 |

$0.52 |

|

Declared Dividends |

$0.27 |

$0.27 |

$0.27 |

$0.28 |

$0.28 |

|

DCF Payout |

60.0% |

61.4% |

56.3% |

43.4% |

53.4% |

(Source: Author)

Outlook for FY 2022

Kinder Morgan’s outlook for FY 2022 remains unchanged: the energy firm expects $7.2B in adjusted EBITDA — 53% of which Kinder Morgan already secured in the first six months of operations — and $4.7B in distributable cash flow. However, based on current business momentum in the natural gas and CO2 businesses, Kinder Morgan now sees up to 5% upside in adjusted EBITDA and distributable cash flow relative to its submitted budget at the beginning of the year.

Cheap valuation, attractive dividend growth prospects

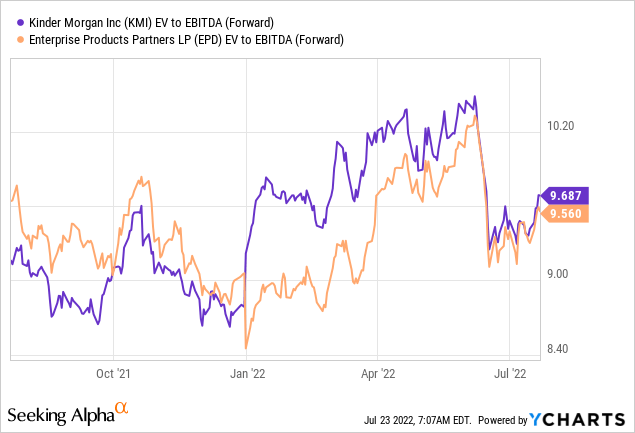

Kinder Morgan is attractively valued despite a 14.8% increase in the firm’s share price year to date. Based off of EBITDA, Kinder Morgan has an enterprise-value-to-EBITDA ratio of 9.7 X which is on the same level as Enterprise Products Partners’ (EPD) enterprise-value-to-EBITDA ratio of 9.6 X. I like Enterprise Products Partners, too.

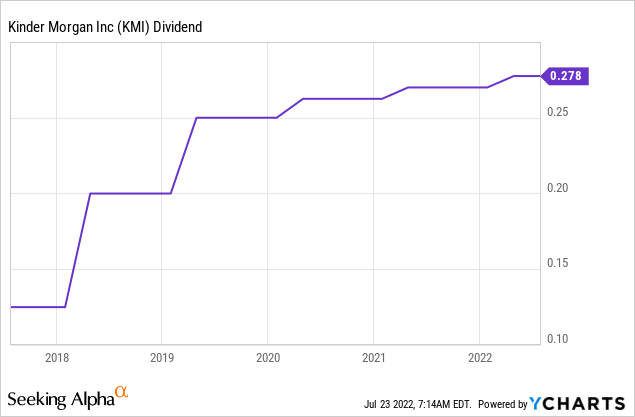

Kinder Morgan increased its divided by 2.8% to $0.2775 per-share in the second-quarter, fulfilling its promise of about 3% dividend growth made earlier this year. Because of Kinder Morgan’s low DCF payout ratio, I believe the dividend is very safe. Investors may expect Kinder Morgan to grow its dividend at the same rate going forward. Kinder Morgan currently has a yield of 6.3%.

Risks with Kinder Morgan

Kinder Morgan faces a large set of risks that includes the potential for ransomware attacks on its pipeline system and adverse regulation. The appearance of a recession may result in lower commodity prices and, at least in the CO2 business, create EBITDA and cash flow headwinds. The biggest risk for Kinder Morgan, as I see it, is the US government which seems to be increasingly opposed to long term investments in the fossil fuel industry. Regulation that is aimed at preventing midstream firms to invest in additional pipeline capacity would limit the industry’s long term growth potential which may result in a lower valuation factor for Kinder Morgan and slowing dividend growth going forward.

Final thoughts

Kinder Morgan executed well in the second-quarter although the firm has no control over market prices which boosted CO2 segment results. Nevertheless, Kinder Morgan benefited from a 15% increase in distribution cash flow and the DCF-based payout ratio remained low at just 53.4%. The payout ratio indicates potential for continual dividend growth and Kinder Morgan’s shares are attractive based off of valuation as well as yield!

Be the first to comment