Luis Alvarez/DigitalVision via Getty Images

I’ve been an active investor of smaller-cap sort of REITs, especially when you consider that I’m not actually from the US. I love doing research on players like Kimco (NYSE:KIM) or Weingarten, back when it still was its own symbol. So back when the two companies merged, I was happy.

Kimco Article (Seeking Alpha Kimco Article)

I’m unchanged in my overall sentiment that this is a quality company with the sort of foundations we want to see in our long-term REIT investments.

But all pieces of the puzzle have to fit. And while it all checks out in quality, yield and coverage – the valuation piece doesn’t yet fit into place for me.

Let me show you why.

Revisiting Kimco

Kimco’s great, and I mean that.

BBB+ credit rating, a history going back to 1991 in terms of its IPO, part of some of the major indexes, an excellently covered 3%+ yield – this company really has “most of it” when it comes to some things.

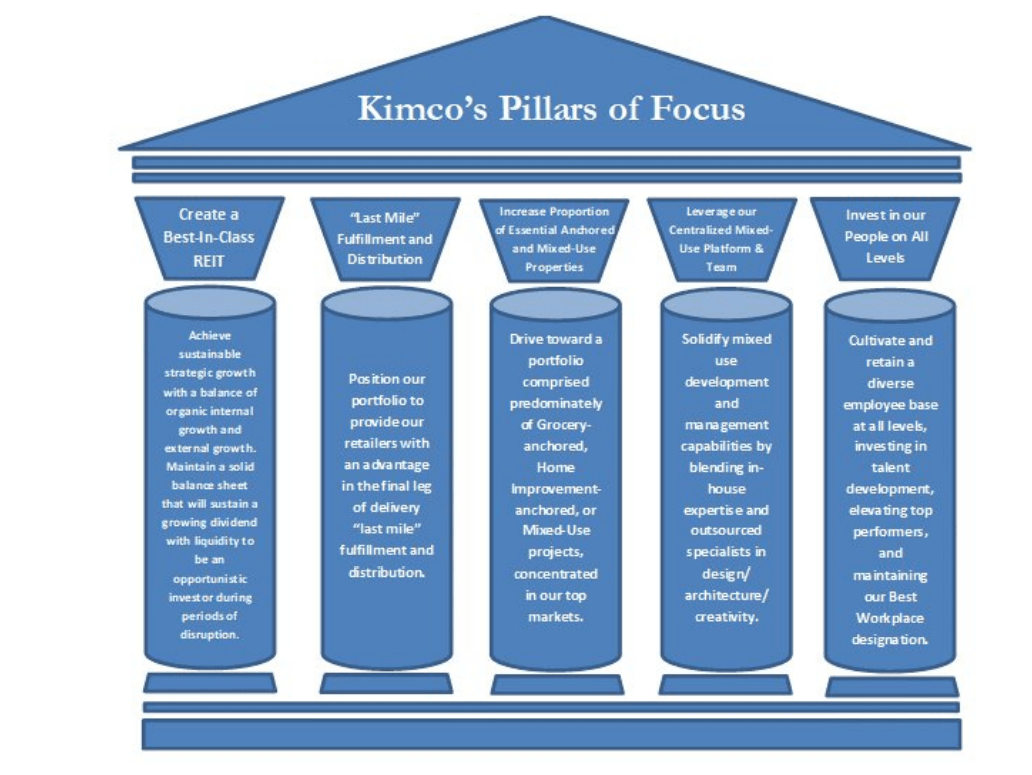

The company’s exposure to coastal market and sun-belt states/cities is a benefit, as is the company’s focus on necessity-based goods tenants. The anchor model is part of what made Weingarten so appealing to me, and this continues to Kimco, with its so-called pillars of focus.

Kimco Pillars (Kimco IR)

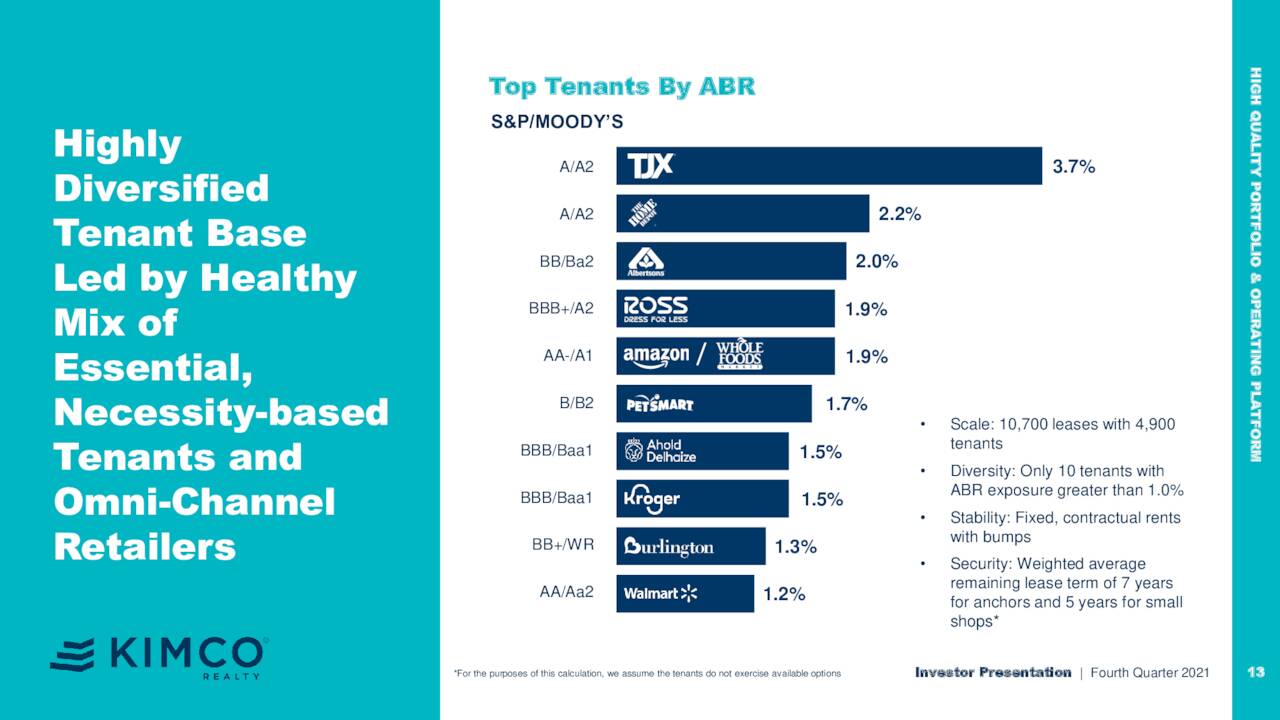

I went through some of the basic appeals in my original article that you can find here. To summarize, the company has excellent tenant diversification, and the largest tenants are investment-grade superb companies with safeties in their own right, with the largest Kimco tenant at no more than 3.7% of the annual rent (ABR).

Kimco Tenants (Kimco IR)

Now, this is a popular REIT, with plenty of current coverage and bullish sentiment based on these fundamentals. However, as we clearly can see based on the company’s 5-6 month returns, this REIT is not exactly outperforming by a wide margin – or even necessarily a positive one. Quality isn’t the problem. COVID-19 isn’t the problem either.

Recent earnings/results aren’t the problems either. The company reported high FFO growth, and occupancy closing in on the 95% level, 14.1% pro-rata rent spread on comp. new leases, and high NOI growth. Add to this the company’s very appealing 80% ABR from grocery-anchored centers, which increases safety here. The company has zero liquidity issues with $2.3B in liquidity and managed to price notes at 3.2% in February.

The company is, in fact, reaching its goals of 3-5% AFFO growth rate, and its climbing toward that 85% grocery-anchored target.

The debt isn’t low – at 6.6X it’s not as bad as something like Macerich (MAC), but it’s still up there compared to some. Still, the BBB+ rating should tell you exactly what risks the company is believed to be here – namely none. The company’s target is to crawl back down that 6X level, and this actually seems likely to happen in the coming year or so. The chance of something interrupting the company’s credit rating seems very low at this time.

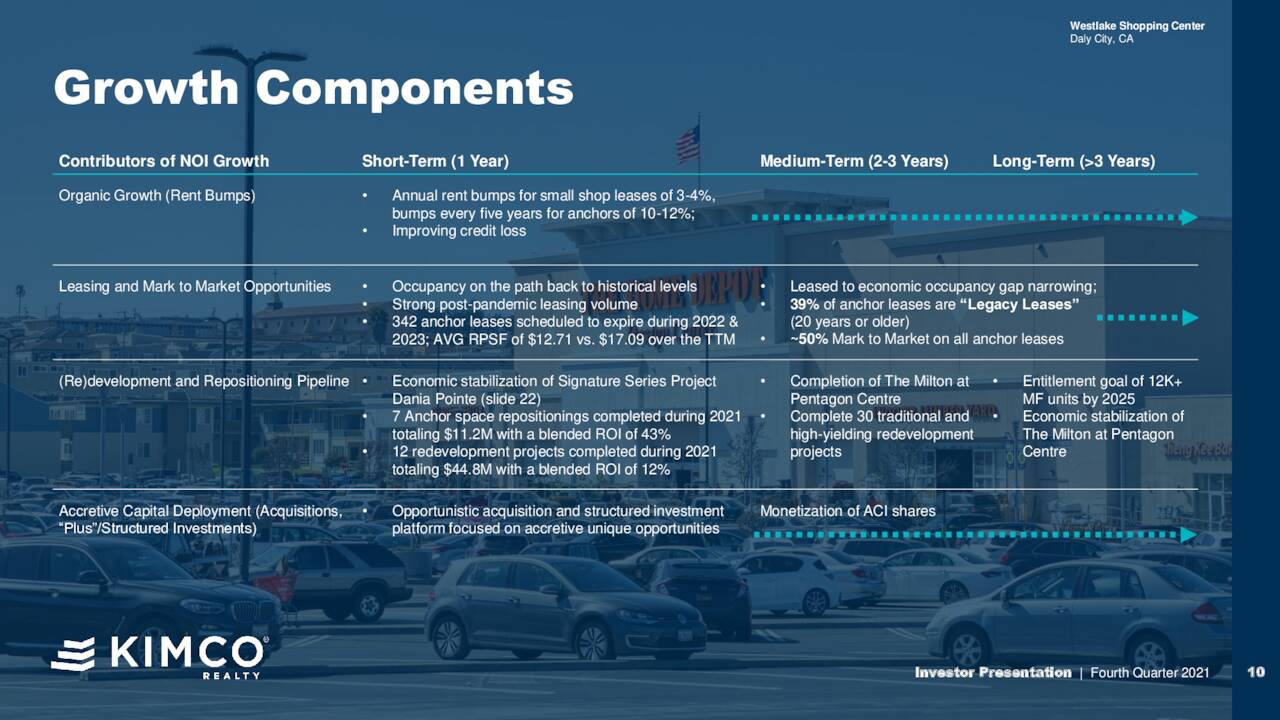

Kimco can pull plenty of levers to deliver its FFO growth targets. Possible ways include organic rent growth, leasing/mark2market opportunities, development/renovation and repositioning, acquisitions, investments, and monetization.

There’s plenty to do, and the company is planning plenty of it as well.

Kimco Growth Components (Kimco IR)

The company’s triad of arguments, namely its tenant quality/diversification, its grocery anchors, and its well-positioned real estate portfolio makes up the core of what is a positive view for Kimco here. The relative risks of the debt is small when you compare to what the company actually owns and operates – and this is what’s being reflected in the ratings and the view on the company here. Many of the company’s tenants are also expanding.

Kimco expanding retailers (Kimco IR)

No, the problem is that COVID-19, despite the high occupancy at this time, saw an occupancy decline of close to 2% for the company. We also had some unfavorable leasing spreads for some time. It also saw a surprising level of COVID-19 impacted rent collections, with double-digit percentages applying for rent deferrals (though only 2% getting it). Still, I want to go on record and state clearly that these risks seem small to be compared with the potential upsides in this company, at the right price.

Kimco is, simply put, among the better REITs in this segment. The company has already identified 40+ potential mixed-use projects and master plans, most of them in high-growth areas like coastal and sunbelt. The company launched its own investment vehicle, in order to be able to invest in attractive opportunities. The merger with Weingarten also brought a lot of new quality to the table.

The company is a proven capital allocator and manager. Investing your money in Kimco is likely to grant you “safety” over time. While the company did see a stumble during COVID-19 and has seen 3 consecutive years of FFO decline with the crowning -19% in 2020, things are likely to look up from here on out.

The problem, as I will show you in the next segment, is the company-specific valuation trend.

Kimco’s valuation

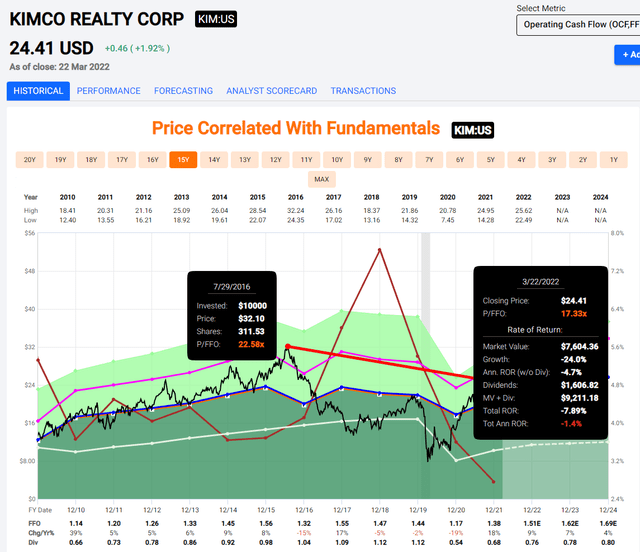

All the positives in the entire world aren’t enough to make me buy an overvalued company, and certainly not an overvalued REIT. Kimco Realty went into 2016-2017 with a massive FFO/share price decline that bottomed first in 2018 to the tune of -50% from a high back in 2016 of $31.76 per share. Then COVID-19 happened, and the shares troughed even lower. From its 22.5X P/FFO multiple high, you would have lost 63.62% in around 4 years, and putting it crudely, you’re still not in the positive if you invested anywhere close to that 2016 high.

Kimco 5-year results (F.A.S.T. graphs)

This isn’t rocket science. If you buy something expensive, your potential downside is a lot higher than if you buy it cheaply. Kimco has the unfortunate characteristic of being, oftentimes, overestimated due to its many wonderful qualities, many of which I’ve mentioned in the first part of this article. Making money with Kimco is entirely possible – if you’re willing to wait for the right price. The company is expected to grow FFO at an average rate of 7% for the next 2-3 years, which would be above the company’s own targets. This would be an excellent achievement for Kimco, and it’s likely to support the current high multiple we’re seeing – around 17.5X P/FFO.

But history tells us that Kimco has the very real potential to go down – and go down for several years, and hard, despite all of these wonderful qualities.

Even in a positive scenario where we assume an 18X P/FFO multiple, which is 2-4x above any average the company has traded at for long, your RoR is capped at around 9.5% annually, or less than 30% until 2024. That’s the positive case.

In the negative, or let me call it “realistic” case, of around 13-15X P/FFO, you’re barely breaking even at 1% annually, or around 2.5-3% annually. These are not good returns – not even with these safety levels.

There are implications that Kimco isn’t necessarily expensive. The company trades at a current sub-1X to NAV, and S&P global follows 22 analysts, that come in at a range of $22 on the low end and $30 on the high, to an average of $26.5/share. The company is still below this level. I will say though that analysts have a tendency of perhaps overestimating Kimco Realty just a bit too much, coming to a consistent target premium of about 5-10%. That’s exactly the range you’re looking at, and if Kimco does reach this target, the company usually goes back down.

Given the company’s FFO growth rate estimates, I honestly don’t see that Kimco should trade a whole lot higher than it does – and my PT is well below this one we see from analysts here.

Look – there’s no shortage of quality undervalued REITs.

I should know. I work with one of the foremost names/experts in the entire industry, Brad Thomas. I also do copious amounts of my own research on the subject, and it’s my clear view that Kimco isn’t really that complicated a thesis to make, for a few reasons.

The right time to “BUY” Kimco was when it traded at distressed levels. I bought it once at under 10X P/FFO and made excellent returns on the investment. At a multiple that’s over 7X higher than back then, this is not a great investment. Kimco doesn’t have the best balance sheet in the business, or even the best credit rating or yield. It doesn’t even have the best dividend tradition. Those honors go to the REITs public comps – companies such as Federal Realty (FRT), Realty Income (O), and others. Kimco plays with some heavy-hitting names, and currently, most of the company’s peers not only yield better dividends, but they also trade at multiples that imply similar or better-level upsides.

That’s a tough spot to be in.

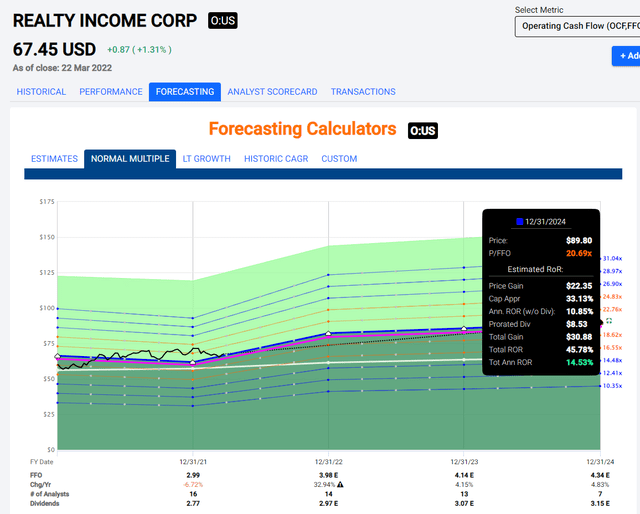

I argue, for instance, that Realty income deserves that 20X+ P/FFO multiple, and the company yields 4.4% here with a comparative 20.6X P/FFO upside in 2024E of no less than 14.5%. That’s a solid investment right there, and I see that it’s better than Kimco.

Realty income Upside (F.A.S.T. Graphs)

That’s also why I have almost 5% invested in Realty Income, and why I continue pushing money to work at under $68/share.

Even Dividend King Federal Realty Investment Trust now trades at levels of around 21X P/FFO, and this company also deserves that premium to my mind. This one yields around 3.6%, higher than Kimco, has a better balance sheet and dividend tradition, and an upside of 12-13% to a 20-22X P/FFO.

So, it’s not that Kimco is in any way bad. It’s just that it suffers from an unfortunate quality of public comps, as well as a somewhat less “sublime” balance sheet than some of these peers, which point out its flaws in comparison.

So, if someone was to ask me to invest in Kimco, I’d want a pretty high discount for doing so. It needs to be appealing even compared to its comps in order to make for a good investment.

At anywhere close to $24, that’s not really the case.

The fact is, when taking public comps into account and looking at its growth rate, which isn’t really much higher than those aforementioned, more qualitative peers, I wouldn’t “BUY” Kimco above $21/share. Preferably quite a bit lower.

Thesis

While this company has all of the upsides of a good REIT, it suffers from overvaluation and unfavorable public comps by being compared to market leaders which are not only better in terms of balance sheets, yields and size, but that is also valued much better in terms of their comparative P/FFO positioning.

Because of this, it’s impossible for me to recommend a “BUY” on Kimco at this valuation. I’m sticking to my low-end price target, now set at $21/share, even after the Weingarten deal. At this price, I’d be interested in starting a position in Kimco again – but not before.

Options for Kimco aren’t that appealing at this time. You could go for some $0.25 premium $20 strike options with an October 2022 expiration, but the fact is, I’d rather just invest my capital in Realty Income or Federal Realty Investment Trust at those specifics/return levels.

To me, it seems a relatively simple case here that Kimco here simply isn’t justifiably investable. It can’t be compared in terms of premium to its better peers – it doesn’t share the same specifics. And when compared to its own estimates and forecasts, the current valuation makes sure that it doesn’t hold any significant upside compared to these companies either.

That makes it a “HOLD”.

Thank you for reading.

Be the first to comment