CHUNYIP WONG/iStock via Getty Images

Rising interest rates, a looming recession, and concerns about the future of the office have hit shares of West coast office REIT Kilroy Realty (NYSE:KRC) hard in 2022, knocking shares down 40%. While conditions are murky, I believe that Kilroy shares represent excellent value for contrarian investors as its portfolio of best-in-class assets should outperform in a tough office market.

Unappreciated Positives – not all office is created Equal

While work from home dynamics have weighed heavily on the office REIT space since the onset of the pandemic, Kilroy Realty boasts a best-in-class portfolio of West Coast office real estate. While commodity Class B office space in secondary locations will likely to continue to struggle, Class A office space in supply constrained locations is likely to fare much better.

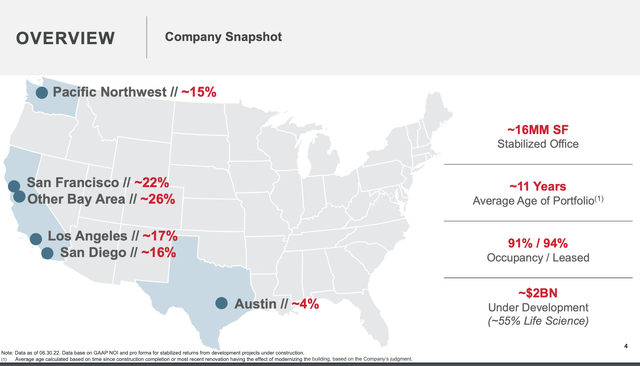

Kilroy Overview (Kilroy Investor Presentation)

Highest Portfolio Quality Among REITs

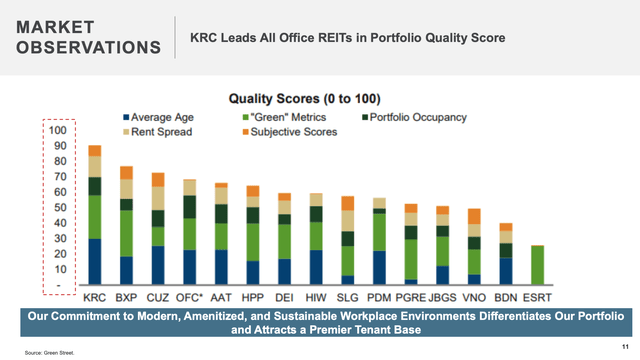

Green Street Office REIT Quality Ranking (Kilroy Investor Presentation)

As shown above, Kilroy boasts the highest quality office portfolio according to third party real estate consultancy Green Street Advisors. Its portfolio comprises Class A properties which average just 11 years in age, have leading ‘green’/ESG metrics (which are relevant to both tenants and investors), and is expected to have favorable mark-to-market lease spreads despite the economic downturn.

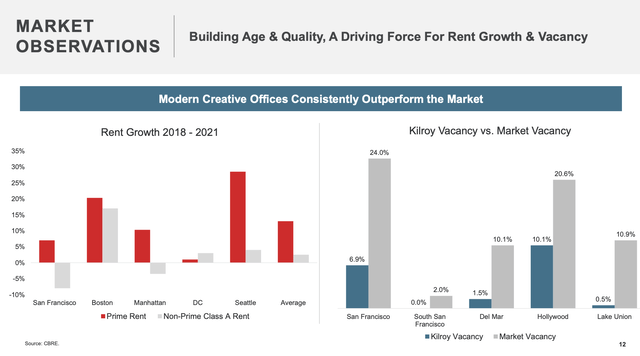

Kilroy Portfolio vs. Market Average (Kilroy Investor Presentation)

Since the onset of the pandemic, Class A office space has fared much better than commoditized office space which is reflected in lower vacancy levels and rent growth (Class B and below has seen rents decline in many markets).

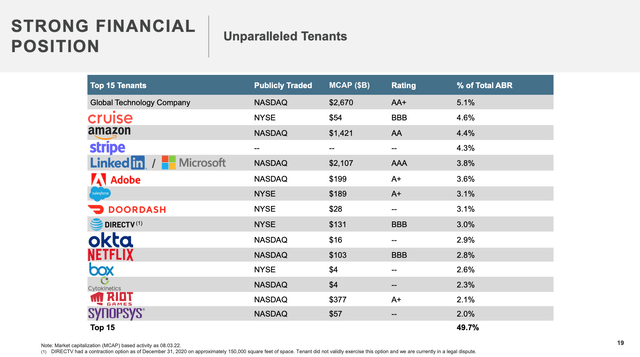

Tenant Roster (Kilroy Investor Presentation)

As shown above, Kilroy boasts an impressive tenant roster with top tech tenants like Apple, Microsoft, and Amazon among others. Further, Kilroy has a weighted average lease term of six years – despite a tough leasing environment, Kilroy’s leases ensure a stable cash flow profile for the next several years.

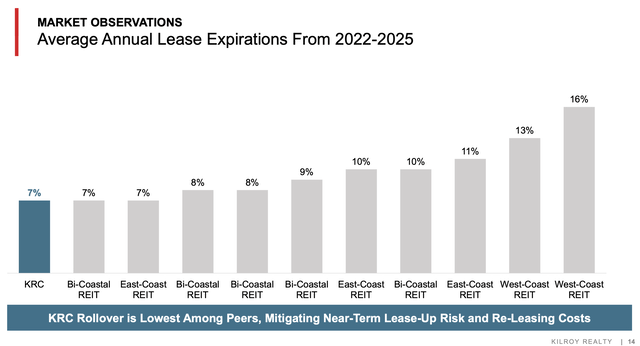

Lease Expiries 2022-25 (Kilroy Investor Presentation)

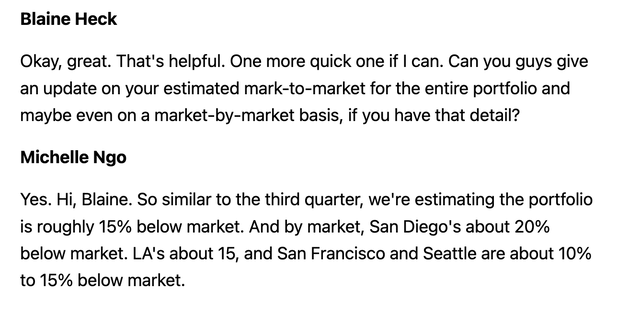

At the beginning of 2022, Kilroy estimated that its portfolio has a positive ~15% mark to market on its portfolio. While deteriorating economic conditions have likely reduced this spread, this cushion should further ensure a durable cash flow profile as leases expire.

4Q21 Kilroy Conference Call (Seeking Alpha Transcripts)

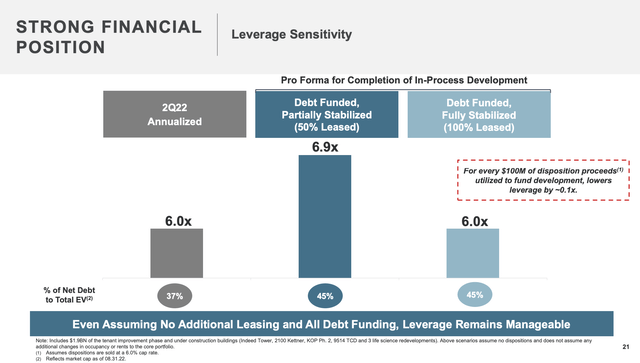

Solid Balance Sheet

Balance Sheet Strength (Kilroy Investor Presentation)

As shown above, Kilroy has a strong balance sheet with Net Debt to EBITDA of 6.0x. The balance sheet was been further strengthened earlier this month as Kilroy secured additional funding on very attractive terms.

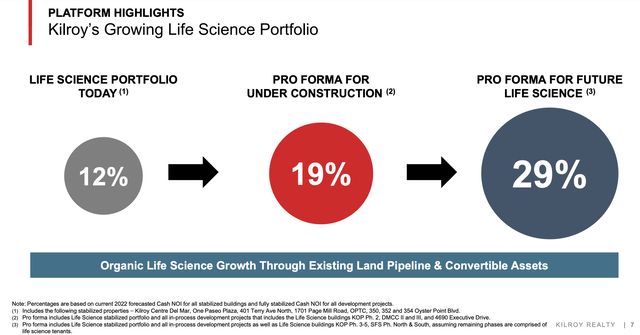

Life Sciences & Apartments represent over 20% of NOI

Expanding in Life Sciences (Kilroy Investor Presentation)

Upon completion of its current development pipeline (mainly Oyster Point Phase 2), nearly 20% of Kilroy’s NOI will come from life sciences real estate. Life sciences space does not face work from home headwinds and has seen growing demand throughout the pandemic.

In addition, Kilroy derives another 3% of NOI from its portfolio of 1,000 apartments. Kilroy’s apartment portfolio is comprised of Class A apartments in supply constrained markets in Southern California.

Value & Conclusion

At a recent price of $41 per share, Kilroy trades at an implied cap rate just under 9%. This is a discount to Class A office peer Boston Properties (BXP) which trades at a 7.7-7.8% cap rate and in-line with other office REITs which trade in the 8.5-9.5% range. Life Sciences REIT Alexandria (ARE) trades at roughly a 6% cap rate. West Coast apartment REIT Essex (ESS) trades at a 5.6% cap rate.

Valuing Kilroy’s life sciences and apartment assets in-line with Alexandria and Essex and valuing the office portfolio at 7.8% (in line with best-in-class peer BXP), Kilroy has an NAV per share of $56 which represents 37% upside.

I believe that Kilroy’s true NAV is actually greater than $56 per share as I believe that top quality commercial real estate is being overly discounted in public markets. Historically Class A office space in Kilroy’s markets has traded in the 4-5% range, life sciences has traded at 4-5.5% cap rates, and apartments have been in the low 4s (as mentioned in my recent piece on Essex). A reversion to historical values would put KRC’s NAV closer to $90 per share.

Regardless of whether an investor wants to use current (depressed) comparables or historical values, Kilroy is a discounted collection of assets which I see as an attractive investment opportunity for long-term, contrarian investors.

Risks

1. REITs and in particular office REITs are heavily out of favor and Kilroy shares could continue to perform poorly in the near term.

2. Work from Home trends may persist which could hamper leasing going forward. I believe this is mitigated by Kilroy’s favorable lease expiry schedule, best-in-class portfolio and cushion from estimated mark-to-market.

Be the first to comment