Sundry Photography/iStock Editorial via Getty Images

Keysight Technologies (NYSE:KEYS) has solid growth prospects not only from its heavy investment in the 5G supercycle but also from its broader Communications Solutions Group (CSG) and Electronics Industrial Solutions Group (EISG) sectors that performed strongly last quarter. There is also a lot of room for these segments to grow in the future, and for this reason I’m rating KEYS as a buy.

Company Overview

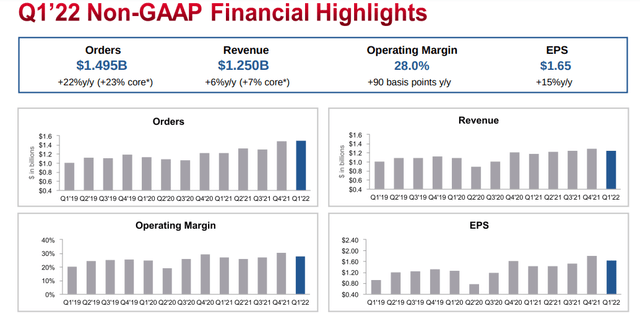

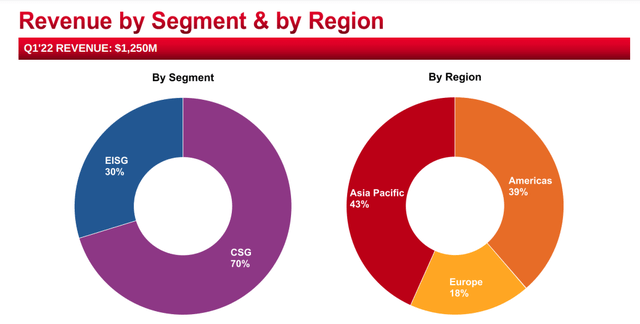

KEYS had an interesting quarter. It managed to beat its EPS estimate by $0.10, ending on $1.65, which was the second highest EPS on record and was the high end of its guidance. The company also beat its revenue estimate by $7.78M, ending on $1.25BN, or a 5.93% Y/Y increase.

There were other wins from the previous quarter as well. The company continues to experience strong demand for its products as it boasted record order numbers for Q1’22. During the earnings call, executives said that it increased its YoY orders by 22%.

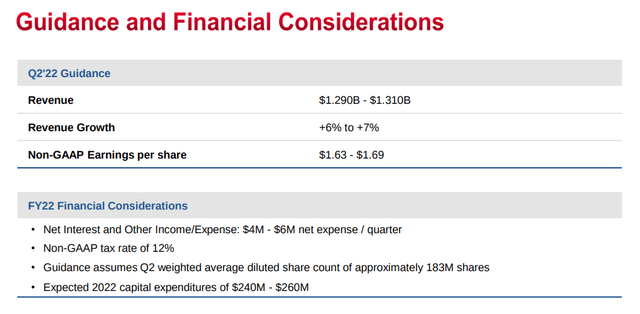

The company also released the following guidance, expecting a 6% to 7% revenue growth with total revenue falling between $1.290BN to $1.310BN and an EPS of $1.63 to $1.69.

Management said that due to the rising volatility and uncertainty in the market it had accelerated its share repurchase programs. In November last year the company announced that it would buy back $1.2BN of its common stock, which is a bullish sign that it has confidence in its future financial performance.

Industry analysis

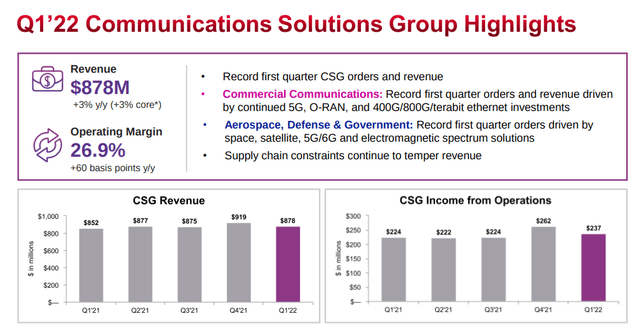

For both its EISG and CSG sectors, it was stated in the earnings call presentation that software and services were 33% of the company’s revenue. The CSG sector continues to be where it experiences the largest revenue contribution.

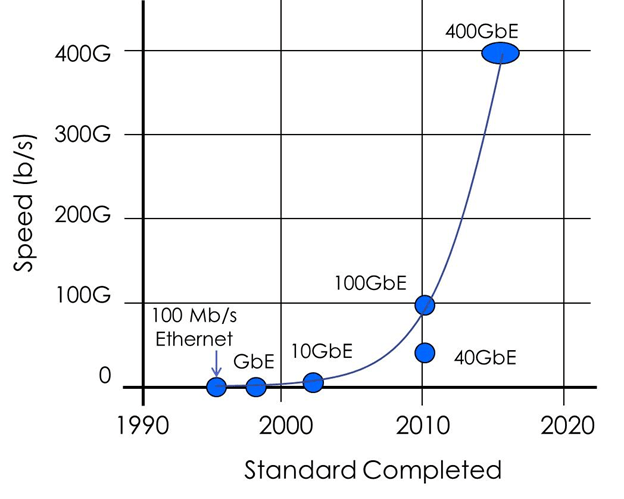

The CSG sector encompasses several products and services sold by KEYS. Aside from 5G, the products I’m the most bullish on are its Ethernet investments. The Ethernet market is set to grow 11.3% from 2021 to 2030.

The scope of demand for Ethernet becoming more popular in the future is also on the cards as speeds rise exponentially. Ethernet speeds grow at an approximate rate of 116% per year. With greater file growth and increased reliance on faster internet speeds to facilitate many company’s digital transformations, I see 400G/800G/terabit Ethernet connections only becoming more important in the future.

Ethernet Alliance

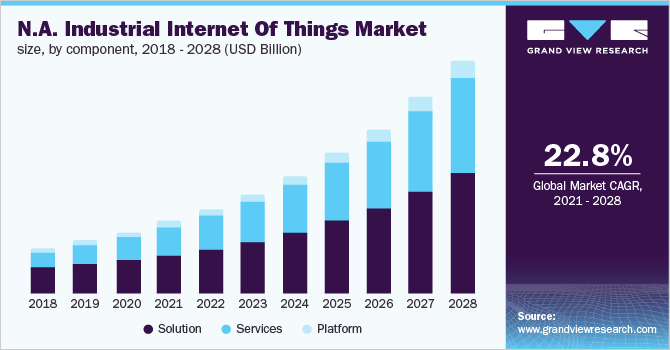

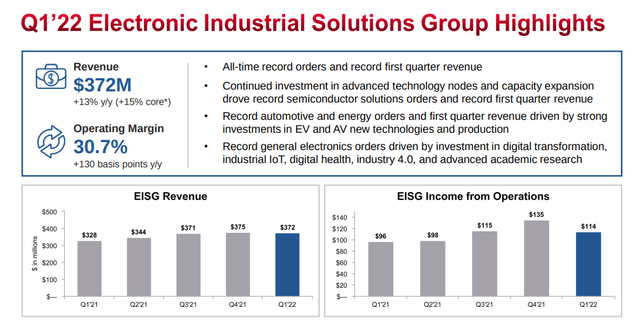

EISG revenue accounts for another broad range of products and services sold by the company including industrial IoT, which I believe to hold the most potential.

Industrial IoT lets businesses monitor, automate, and predict outcomes in their technology stacks. The main benefit of this technology is through increased efficiency and less wasteful energy expended. It also streamlines processes and can help reduce overheads with less equipment downtime.

The industrial IoT market is growing quickly at a CAGR of 22.8%

Grandview Research

Financials

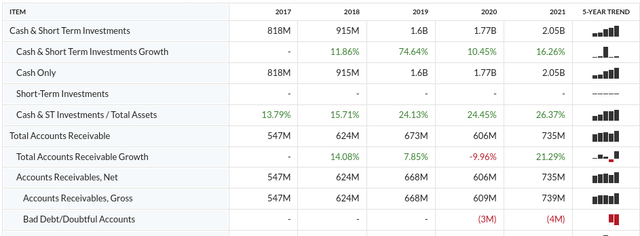

KEYS has an impressive balance sheet with a growing cash account growing from year to year. From 2020 to 2021 its balance grew 16.26% and is currently on an upwards trend.

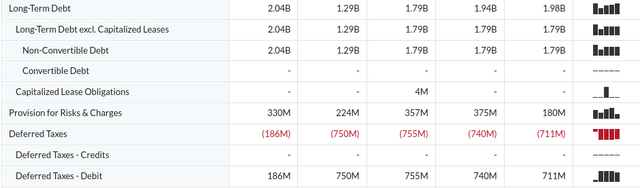

The company also has a stable amount of long-term debt. It has more than enough short-term investments to cover its obligations with a current ratio of 3.03.

KEYS has also seen a consistent growth in its revenue. It has consistently added to its revenues for the last five years apart from one FY in 2020.

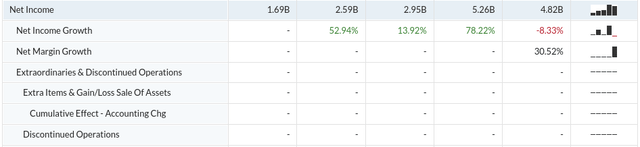

The huge yearly increases in net income are also a very bullish sign for the stock. The business increased its net income 52.94% in 2018 and 78.22% in 2020. KEYS took a small hit in 2021 ending at -8.33%.

Finally, the company’s ROE is 25.55%, representing how it is able to return value to its shareholders. The company’s ROA is 12.31% and has a net profit margin of 18.98%.

MarketWatch

Competitive Analysis

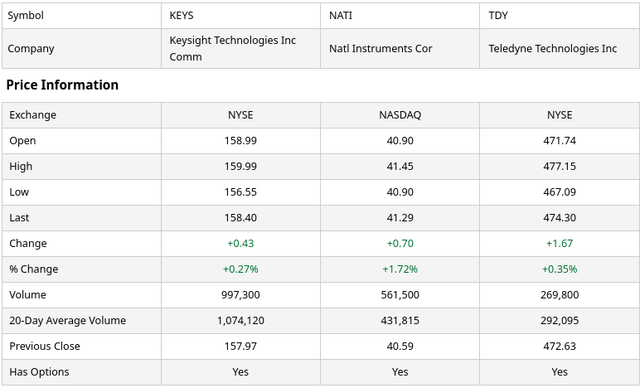

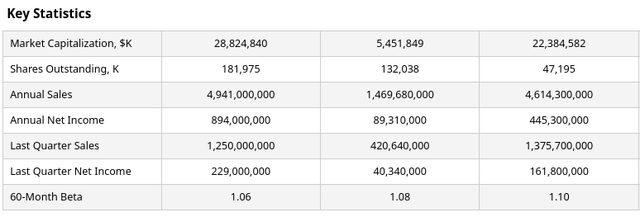

Some of KEYS competitors include Anritsu Corp, National Instruments (NATI), Tektronix (TEK), and Teledyne Technologies Incorporated (TDY).

A major competitive advantage of KEYS is its strategic partnerships and test cases for 5G. For example, the company recently introduced a test plan for 5G in China. Using Keysight’s systems, it will work with 190 vendors of 5G devices to ensure compliance and verification as mandated by Chinese regulators. Another important partnership that was announced in March this year is with IT Ecology. Clients of IT Ecology will be able to make use of KEYS’s network visibility and test solutions to improve their network security.

Another important advantage of KEYS is its development of O-RAN network (open radio access network) software and hardware, which is a critical piece of infrastructure for taking advantage of the 5G supercycle. KEYS recently partnered with Cisco (CSCO) to help migrate the network from traditional 4LTE networks to 5G open access networks.

Valuation

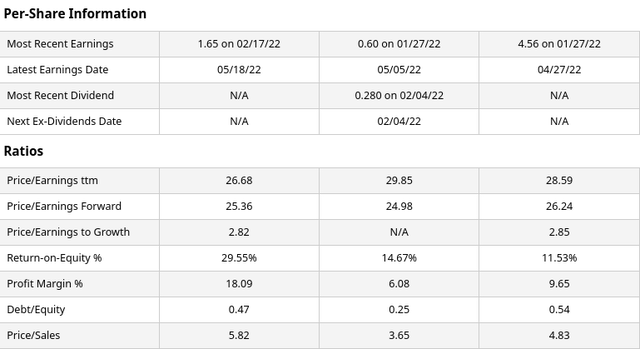

Using two of the company’s largest competitors, KEYS has the highest ROE of 29.55% and the second highest P/E of 26.68. The company also has the highest net income.

KEY’s share price represents the middle ground between TDY and NATI and I believe TDY to be expensive when compared side by side to KEYS with these factors considered while also having a very similar price/earnings ratio.

Risks

I think that KEYS is a strong company, however it may have some execution risks as the world embraces 5G, Ethernet and other technologies that are in a constant state of development. Management will need to ensure that it can keep on top of these latest changes or risk being left behind by its many competitors.

Then there’s the risk that its investment in 5G might not pay off since it is present in both of its earning segments. Forecasting demand for 5G is difficult because it’s still an emerging technology in many parts of the world. Investors may be disappointed if the company is not able to fully capture the perceived value it can provide.

Conclusion

KEYS has more revenue growth avenues to other than simply 5G, despite it being an unquestionable focus of the company. Both of its segments last quarter recorded record orders on top of beating revenue and EPS estimates. For these reasons I am giving this stock a buy recommendation.

Be the first to comment