Helmut Feil/iStock via Getty Images

One of the oldest US-based companies you have likely never heard of is Kennametal (NYSE:KMT). Founded in 1938 as a business that focused on tungsten carbide technology, the company has slowly grown into a roughly $2 billion firm. Over the years, the company has transformed itself, focusing on products that are used by customers across the aerospace, earthworks, energy, general engineering, transportation, and other similar markets. Over the past two years, financial performance for the business has been rather rough because of the COVID-19 pandemic. But results experienced so far for the 2022 fiscal year are encouraging. Given how cheap shares look relative to similar players and the trajectory of the company so far this year, I cannot help but to rate the business a soft ‘buy’ at this time.

A niche business trading on the cheap

The best way to understand Kennametal is to analyze the company based on its two individual segments. First and foremost, we have a segment called Metal Cutting. Through this, the company produces and sells high-performance tooling and metal cutting products. Products here include milling, hole-making, turning, threading, and tool-making systems that are used in the manufacture of airframes, aero engines, trucks, other related automobiles, ships, and even industrial equipment. Brand names that the company sells these under include Kennametal, WIDIA, and more. The company also provides services related to these products, with examples being carbide recycling, the provision of its ToolBOSS Tool Vending Machines, and reconditioning services. During the company’s 2021 fiscal year, this segment accounted for 62.5% of the company’s revenue but for 43.5% of its profits.

The other segment is called Infrastructure. Through this, the company produces engineered tungsten carbide and ceramic components, earth cutting tools, and advanced metallurgical powders. These are typically used for the energy, earthworks, and general engineering end markets. Product examples include nozzles, frac seats, rod blanks, and more. For the most part, these products are sold through a direct sales force and through distributors the company has, all under the Kennametal name. Last year, this segment accounted for 37.5% of the company’s revenue and for an impressive 56.5% of profits. It is worth noting that while the company is based in the US, an impressive 62% of its revenue comes from markets outside of the country, with a major presence in places like Western Europe, China, and India.

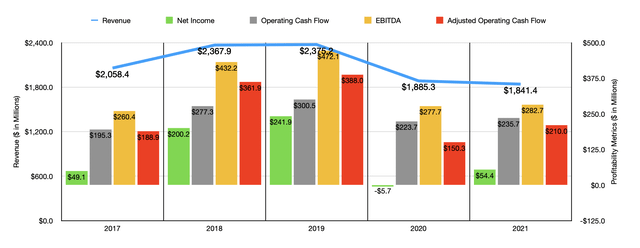

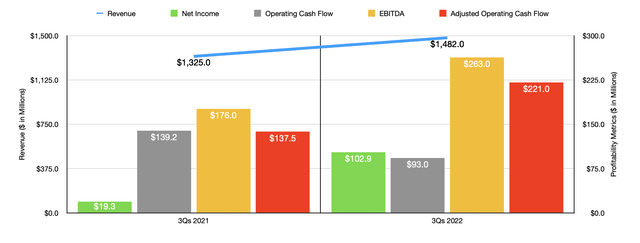

In the years leading up to the COVID-19 pandemic, the management team at Kennametal had done a good job growing the company’s top line. Revenue went from $2.06 billion in 2017 to $2.38 billion in 2019. In 2020, the COVID-19 pandemic caused revenue to plummet to $1.89 billion. And unfortunately, revenue fell further in 2021, dropping to $1.84 billion for the year. The reason for this continued decline is the timing of the company’s fiscal year end. The end of a fiscal year for the company is June 30th of each year, so technically the 2021 fiscal year came to an end as the economy was still just starting to reopen. The good news is that financial performance since then has been positive. In the first three quarters of the company’s 2022 fiscal year, revenue came in at $1.48 billion. That represents an increase of 11.8% over the $1.33 billion generated one year earlier.

On the bottom line, things have been volatile from year to year. After seeing net income skyrocket from $49.1 million in 2017 to $241.9 million in 2019, the company generated a loss of $5.7 million in 2020. Fortunately, the 2021 fiscal year saw something of a recovery, with net income totaling $54.4 million. Other profitability metrics have followed a similar trajectory. After seeing operating cash flow rise from $195.3 million in 2017 to $300.5 million in 2019, it then dropped to $223.7 million in 2020. In 2021, it inched up to $235.7 million. On an adjusted basis, we can see a similar trend. Ultimately, this metric went from $388 million in 2019 to $150.3 million in 2020 before recovering some to $210 million last year. Just as was the case with operating cash flow, EBITDA also saw this kind of trend. The high point for the company was the $472.1 million generated in 2019. This ultimately plunged to $277.7 million in 2020 before inching up to $282.7 million in 2021.

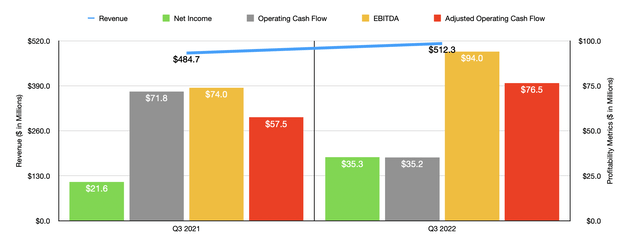

Even though the market is worried about inflationary pressures, Kennametal has done a good job of pushing higher costs onto its customers. We can see this by looking at financial performance achieved so far in 2022. According to management, net income in the first three quarters of the year came in at $102.9 million. That dwarfs the $19.3 million achieved the same time last year. Operating cash flow did worsen, declining from $139.2 million to $93 million. However, if we adjust for changes in working capital, it would have recovered from $137.5 million to $221 million. Meanwhile, EBITDA for the company also improved, rising from $176 million to $263 million.

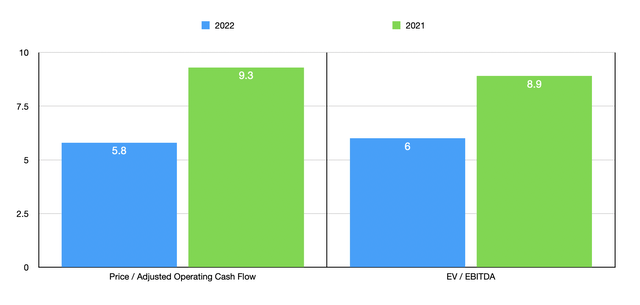

Unfortunately, management has not provided any detailed guidance for the 2022 fiscal year. But if we annualize results experienced so far this year, we should anticipate adjusted operating cash flow of $337.5 million and EBITDA of $422.4 million. This would imply a price to adjusted operating cash flow multiple for the company of 5.8 and an EV to EBITDA multiple of 6. Even if the company were to see results revert back to what they were in 2021, these multiples would still look low at 9.3 and 8.9, respectively. To put the pricing of the company into perspective, I compared it to five similar firms. On a price to operating cash flow basis, four of these companies had positive results, with their multiples ranging from 13 to 20.1. Meanwhile, the EV to EBITDA multiples for the five companies ranged from a low of 12 to a high of 31. In both cases, even if we use our 2021 results, Kennametal was the cheapest of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Kennametal | 5.8 | 6.0 |

| Mueller Water Products (MWA) | 19.9 | 12.0 |

| Hillman Solutions (HLMN) | N/A | 31.0 |

| Kadant (KAI) | 13.0 | 12.4 |

| Helio Technologies (HLIO) | 19.3 | 12.3 |

| ESCO Technologies (ESE) | 20.1 | 14.8 |

Takeaway

Although the recent past for Kennametal was a bit tough, the overall picture of the company looks pretty impressive. The business seems to now be recovering nicely and shares are trading at a low price on an absolute basis and relative to similar firms. Obviously, if we do see some sort of economic slowdown, Kennametal will be hit as well. And that hit, as we saw in 2020, could be rather substantial. In the short run, that could result in some pain for investors. But for those focused only on the long run, now may not be a bad time to consider a stake in the enterprise.

Be the first to comment