Rey Del Rio

Investment Thesis

Kellogg (NYSE:K), a 100-year-old brand is planning to split its business into 3 separate entities to achieve more streamlined business operations across all the entities. This is to make the different business segments leaner and more competitive so as to stay relevant in the current market.

Dividend investors will likely be unaffected since management has made a statement to largely maintain the dividend payout. Growth investors, on the other hand, need to observe the projected trajectory of the different entity’s growth prospects to make an informed investment decision.

The snacking business segment is likely to experience temporary increased costs leading to a reduced bottom line margin in the short term. However, in the long term, it is likely to benefit from a tailwind of a rising global ‘Snack Food’ market.

The Cereal business has experienced stagnation in terms of growth. After the split to an independent entity, the stagnated state of growth is likely to persist.

The plant-based food business is likely to benefit from the macro tailwind of rising popularity among consumers. However, while its popularity is rising in recent years, it is still a very small market. In my opinion, it is unclear whether such popularity can be sustained.

Company Overview:

Kellogg is planning to split into 3 independent entities, and this is expected to be completed by the end of 2023. The result will be the following 3 business units:

- ‘Global Snacking Co’ with US$11.4bn in sales;

- ‘North American Cereal Co’ with $2.4bn in revenue;

- ‘Plant Co’ with around $340m in sales.

Kellogg’s international cereal portfolio will come under the ‘Global Snacking Co’ business unit. This decision was made with the anticipation that it will result in greater flexibility for growth. As CEO Steve Cahillane mentioned:

I think when you have a Kellogg company that is 100% focused on cereal and just its cereal brands, doesn’t have to compete with Pringles or Cheez-It for resources, … I think you’ll see greater innovation, you’ll see more brand building, you’ll see bright days ahead of it

Since investors will eventually value each business separately, it might result in some of these businesses achieving a significantly higher valuation. We will look at some possible outcomes of this split.

Dividend after the Split

Management has committed to continue paying dividends with each individual company assuming responsibility for part of the payout, according to this announcement.

In addition, the Company expects to maintain a strong aggregate dividend and return-on-capital profile across the three businesses. The independent dividend and capital structure policies for each business are expected to be competitive relative to their relevant peer sets.

With this statement from the management, dividend investors can continue to benefit from the dividend received. However, growth investors should consider whether the newly created companies have reasonable prospects for growth before investing in them.

‘Global Snacking Co’

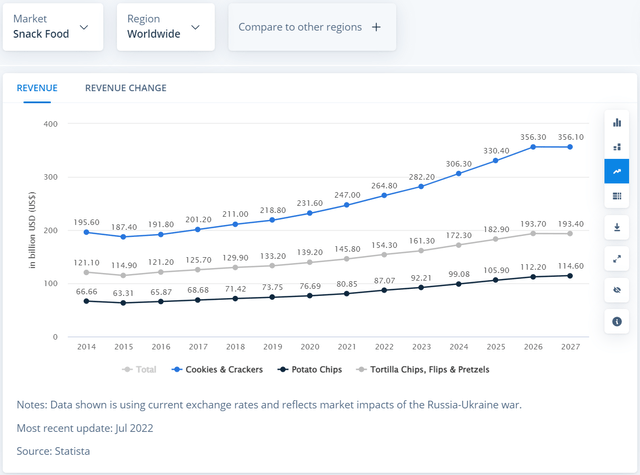

This business unit comprises brands like Pringles, RXBar, and CheezIts. It intends to ride on the tailwind of a rising global ‘Snack Food’ market, with an annual growth of 5.58% (CAGR 2022-2027).

Snack Food Market (Statista)

This new entity of ‘Global Snacking Co’ is expected to sustain higher costs as a result of this split. As noted by this analyst:

While NA Cereal and Plant Co EBITDA margins reflect allocated corporate/overhead costs, the Global Snacking business is likely to face stranded costs following the transaction, which the company will look to offset initially with a Transaction Services Agreement with the spun out entities as well as trimming down overhead expenses.

In my opinion, this means that this business unit is likely to experience lower bottom line margins in the short term. However, assuming the Transaction Services Agreements are executed in a way that allows all benefits to reap the desired benefits, long-term investors are expected to benefit from a leaner business compared to before the split.

‘North American Cereal Co’

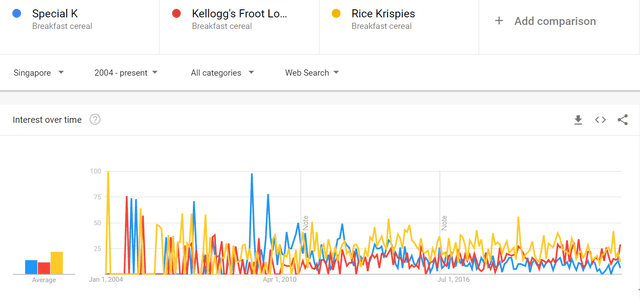

The cereal business is expected to grow modestly at just 2.33% according to Statista. In fact, inferring from this CNBC article, cereal sales were considered to have stagnated in the US. Cereal brands of the company include ‘Special K’, ‘Froot Loops’ and ‘Rice Krispies’. Looking at Google Trends since 2004 which is largely in a consolidation; the search volume is largely flat, attesting to the stagnated popularity of these brands.

Search volume of ‘Special K’, ‘Froot Loops’ and ‘Rice Krispies’ (Google Trends)

‘Plant Co’

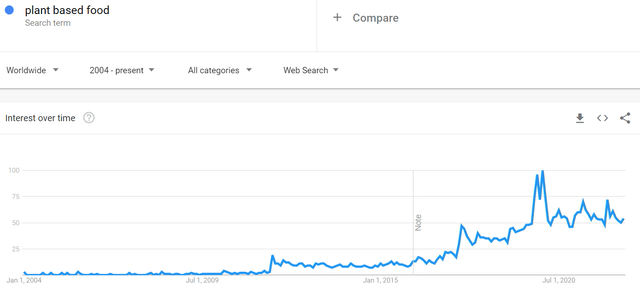

Plant-based food has gained in popularity since 2015, as observed by Google Trends. Generally, the business segment is expected to benefit from this tailwind.

Search Volume of Plant Based Food (Google Trends)

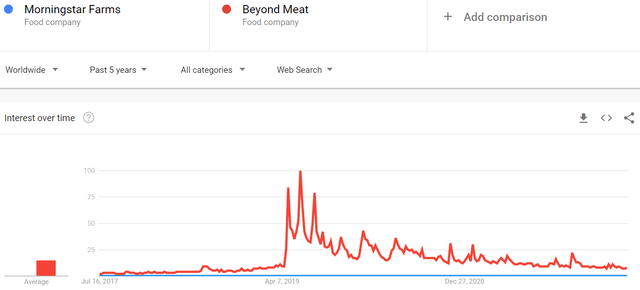

However, the search of ‘MorningStar Farms’ yields almost no results when compared with ‘Beyond Meat’.

Search Volume of Morningstar Farms (Google Trends)

Therefore, it suggests the brand has not established itself among other plant-based food products. I discussed in another article that Oatly (OTLY) is one of the most searched plant-based product brands as inferred from Google Trends when compared to its other similar competing companies. ‘MorningStar Farms’, on the other hand, does not share such a popularity profile when compared with ‘Beyond Meat’.

However, based on this analyst’s observation:

It is worth noting that Kellogg’s plant-based food entity is profitable as compared to the consistent losses marked by peers like Beyond Meat (BYND)

Financially, this can serve as a silver lining for investors who still believe in the growth prospect of ‘MorningStar Farms’.

I described in my earlier cited article on Oatly, I noted that the “plant-based food market is growing but still relatively small”. Therefore, I adopted a neutral stance” on whether plant-based food business in general, including ‘MorningStar Farms’ will eventually dominate the market.

Valuation

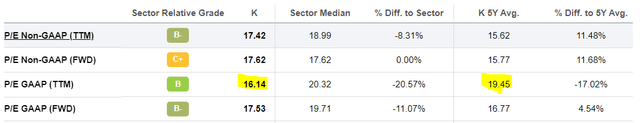

The company is trading with a P/E GAAP (TTM) 16.14:

Valuation of Kellogg (Seeking Alpha)

This is lower than the 5-year average of 19.45 and also lower than Sector Median. As such, it is undervalued. However, as discussed above, investors should wait and see how the different business segments perform after being separated from Kellogg before considering it as an investment.

Risk

The company is undergoing a drastic transformation to sell off or spin off some of its business operations to make each business unit leaner and hopefully create more value for investors in the long run. While management is optimistic about such an approach, investors should monitor closely whether the projected benefits will be materialized in the long run.

Conclusion and Key Takeaway

The Kellogg Company was founded more than 100 years ago. As such, it is an iconic brand for breakfast cereal. Consumer behavior has changed and the company has no choice but to make drastic changes to its business to stay relevant in the market. While the stock appears to be undervalued, the prospects of its growth plans after spinning off its businesses into different entities are still uncertain. As such, investors should adopt a wait-and-see approach until the growth trajectory of their new business entities becomes clear.

Be the first to comment