SDI Productions/E+ via Getty Images

Dear readers,

I’m actually a bit of a language buff – I speak 5 languages fluently. So when a company tells me that they’ve simplified or revolutionized the learning of a language, I’m at the very least somewhat interested in that claim. I still have languages I want to learn. So when a reader contacted me and asked me to take a closer look at Kahoot! (OTCPK:KHOTF), I was at the very least intrigued. I grabbed a morning cup of coffee and went to read.

And I found two things, which I mean to present to you in this article.

What on earth is Kahoot!

Kahoot! (yes, the exclamation mark is part of the company’s actual name), is the name of a company that started after the financial crisis in 2012. It started out as a quiz-based game in order to capture attention in classrooms and make it easier for educators to provide knowledge. Already in a fairly early stage, it was one of the top 3 tools in US education – and that only with 50 employees.

The company launched its first commercial editions back in 2018, and garnered 40,000 paid subs, while also launching apps on iOS and Android, growing the team to around 75+ employees. This was then further advanced to 2019 when it reached 170,000 paid subscriptions, a number which ballooned to over half a million paid subs in 2020, and when it launched its first platform service.

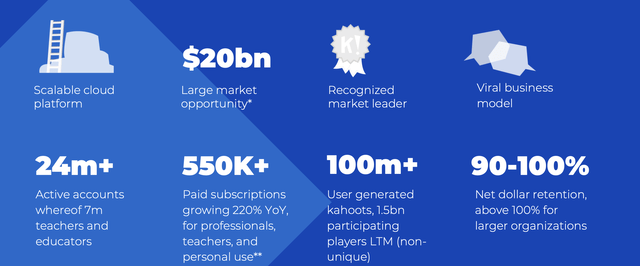

The company has 200+ employees, works with a scalable cloud-based platform, is a recognized and proven market leader, and has very high retention rates – at least insofar as organizations go, and 2021 goes.

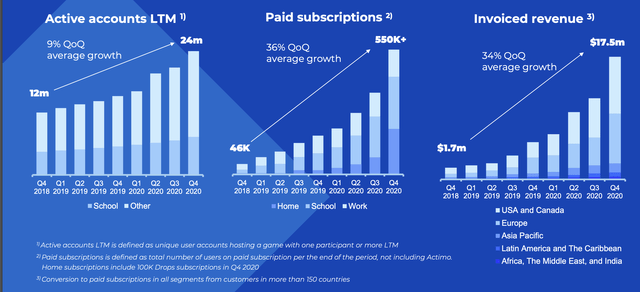

Like any tech-oriented business, the company’s focus is on top-line numbers and accounts, which presents the company with positive stats. Take a look at the way subs, revenue and active accounts have been growing.

Some superb trends here. People are willing to pay, and they’re interested in engaging on the platform. 7,000,000+ teachers across the world use Kahoot! for engagement in classrooms, as well as companies, organisations and families across the world. The company operates a viral distribution model that generates spreading when someone plays Kahoot!. In short, when someone engages with Kahoot!, they’re promoting the game/platform.

Costs for the platform range between $3-$10/ per user per month, depending on what sort of user you are and what volume you use the platform with. This seems to sort of be the set amount that people are willing to pay to a platform like this (even if I personally am not willing to pay that).

The company has some impressive stats and marketing claims, such as this one…

Of course, qualifying that is a different question entirely. What does that mean? That one team leader tried it? That the entire company has integrated it into their workflow? My money is more towards the former than the latter. Still, it can’t be denied that the company has had marketing success in implementing its platform across popular and large companies and institutions of learning – even integrating it into things like Microsoft PowerPoint and Office 360.

The company’s marketing material is a non-stop presentation of the advantages of its platform, its academy, how it’s being used, how many are using it, and similar things. This is neither surprising nor something to hold against the business. That is, of course, how you market a business and make sure that people adopt you. It’s also very much in the time – 2020-2021, when the focus was on this sort of growth and how to build engagement.

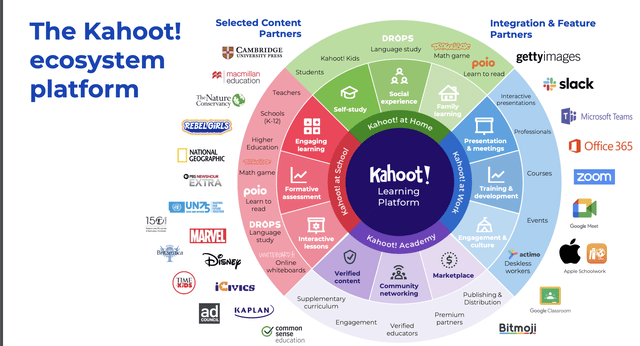

However, from the very start, this always rang very hollowly in my ears. Yes, the Kahoot! Ecosystem is a potentially amazing model…

…and it’s entirely possible the company will continue to grow at amazing rates, while being able to post highlights related to active accounts, sub-growth, revenue growth, and other metrics.

The company also tries to post EBITDA and cash flow numbers, but these are nearly useless because all of them are adjusted. Now, adjusted numbers aren’t the problem.

The problem is that I know what’s included in the adjustments.

We go towards the heart of the Kahoot! problem – the problem as with many other tech companies. Adjusted EBITDA is positive – by around $800,000 for a quarter like 4Q20, when money was free and everyone was frothing about tech – but that’s adjusted for share-based comp, payroll taxes and M&A.

Shall we take a look at what numbers look like when we add this back in?

The company has been operating under negative GAAP numbers for years. It’s, as things stand, an unprofitable company. And the company is not expected to deliver GAAP profit for 2022 either. It had a negative FCF of $344M for 2021, and carries a net debt/EBITDA of close to 4X while trading at a book value of close to 1.2x and managing a 2022 RoE of negative 1.22%.

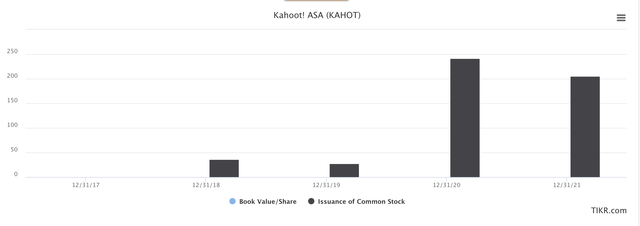

Top-line numbers make sense – they often do in tech businesses. Bottom-line numbers, on the other hand, do not. The company has been issuing massive amounts of common stock over the past few years, all the while net income has stayed firmly negative.

Kahoot! Stock issuance (Tikr.com/S&P Global)

While not as bad as some, SO has risen from 300M in late 2018, to closer to 500M in 2021. if you’ve been investing, you’ve been massively diluted over the past few years. The company has not posted a single year of positive operating income, EBIT, Earnings, net income, or basic EPS.

And now we’re in a rising interest rate environment, which will see the various rates and coupons for the company go up significantly. The company has been boosting its full-time employees to more than twice that in 2020, with 459 LTM employees now on staff.

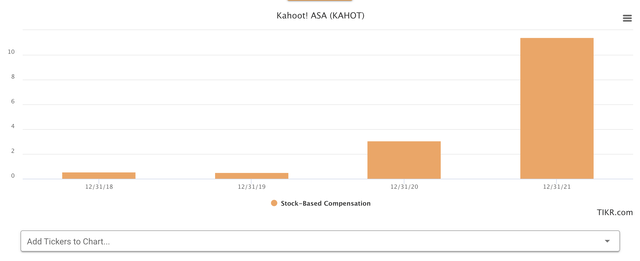

SBC has been skyrocketing, and it’s already almost twice the 2021A level for 2022E at this time – which makes sense – more employees, more SBC.

Kahoot! SBC (TIKR.com/S&P Global)

The problem is, like every tech company, Kahoot! share price has taken a nosedive. To put it in realistic terms and compared to around 2 years ago, it’s being traded like trash, with a nearly 80% negative RoR over 1.9 years.

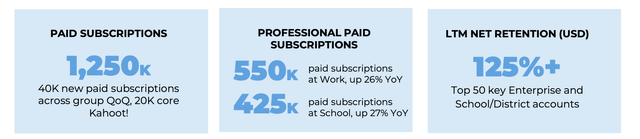

So, trends are not positive. Not in the least. 3Q22 also goes ways to prove or this – the company’s invoiced revenue and subs are, again up (though not as much as previously), with impressive retention numbers. The company is seeing solid demands across all segments and users, with continued important growth in the professional segment, where the company makes much of its money.

However, despite record revenue numbers and record adjusted EBITDA numbers coming in, the company is still expected to generate negative GAAP for the year to those adjusted numbers being less SBC, related payroll taxes M&A expenses and listing costs. So despite everything, the company still isn’t set to generate any positive EBITDA for its shareholders so far.

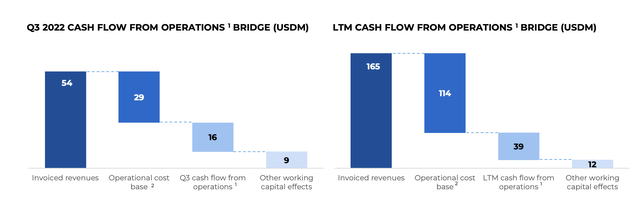

Most of the company’s cash gets consumed by its so-called operational cost base – which by the way, does not include any share-based payment expenses, just as the adjusted EBITDA numbers.

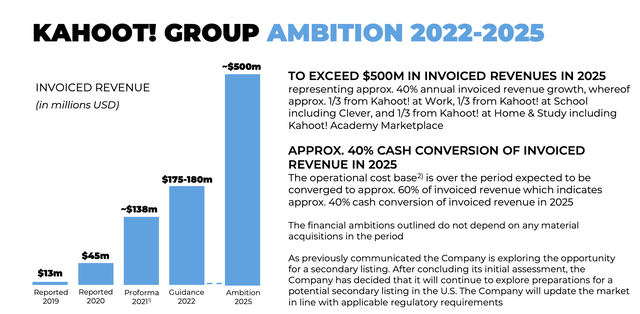

There is a reason why Kahoot! does not provide an unadjusted full-year 2022E outlook for its numbers, such as EBITDA an operating cash flow, but only adjusts them. The unadjusted numbers would take quite a bit of the shine from the company’s operations and results. You also do not find any sort of unadjusted profit ambitions in the company’s 2025E.

Instead, the talk is of secondary listings, better cash conversions, and revenues. These by themselves may result in GAAP profit, but I personally would like better clarity here.

Is it the time to buy a non-profitable tech company, no matter what top-line trends it boasts? I would argue that it is most assuredly not the time to do so.

However, let’s look at what we have.

Kahoot! Valuation

The main question we want to be answered is “When exactly are you guys going to be profitable?”. I’ve always been opposed to eternally unprofitable companies, and I’m against the characterization of companies that have been around for 10+ years as “startups”. A startup is a company that’s in its first 3 years – maybe it’s first 4. After that, I want to see a profit out of the company’s bottom line, or at the very least a visibility of when we can expect such a profit to materialize.

We need to be fair. The current forecasts for the company do actually forecast positive GAAP profit in 2023. But they did the same for 2022, back a year or two ago. This obviously did not materialize – so I’m taking those numbers with a spoonful of salt.

All of the numbers presented that matter on a quarterly basis – EBITDA, expenses, are excluding/adjusted to SBC, payroll taxes, and M&A/expense listing costs. This makes adding these costs back incredibly important to get a fair picture of where the company is. And I have to agree with the market here – it’s not a flattering picture, even if, unlike some other tech-oriented companies, Kahoot! has been able to continue growing significantly.

6 analysts follow the native Kahoot share and give the company an average target of 25-26 NOK for the native share, which denotes an upside of about 15%. However, only one of those analysts has a “BUY” target on the company, which shows you how much confidence these analysts have in their own targets.

Kahoot currently trades at a 6.5x sales multiple – and a lovely negative 99.98x P/E multiple, which should tell you all you need to know about traditional multiple valuations here. They don’t work, simply put. While the company’s revenues and earnings have grown, the company’s BV/share has dropped due to the massive amounts of dilution that SBC and other things are causing to the company. It’s actually stayed flat or negative for over a year at this point.

The most commonly used valuation method for a tech business if I look at my colleagues across various firms, is a multiple of or percentage of revenue. On that logic, we could assign a 50-80% revenue percentage and value Kahoot! on this basis, and say that it’s probably undervalued.

But this is obviously not a method I subscribe to, being a valuation-oriented dividend investor.

Instead, I will say this.

I want visibility for positive, non-SBC-adjusted cash flows and earnings before I invest in a business like this. Contrary to what you might think, I’m not at all against tech businesses – I have an aversion to unprofitable companies though, meaning i never go for a company that’s never been able to post a single dollar of bottom-line, unadjusted profit.

Because that, to me, isn’t an interesting business yet. That isn’t just me saying that by the way – plenty of valuation investors far smarter than me hold the same view. The purpose of your business is to make money. If you do not make money, you’re not a (successful) business.

That is the reason for my extreme aversion here, and why it would be contrary to everything i believe in – the beauty that is capitalism – to invest in this sort of business.

I will give Kahoot! a target – i have to. I’m writing an article about the company.

But for now, that target is a quarter of the current price – 5 NOK. That represents a BV multiple of around 0.5x, and at that valuation, I could be convinced that there is some SOTP-value to what I’m paying – provided that there is continued indication for a positive trajectory for earnings, on an unadjusted basis.

But paying 2x BV or 6.5x sales for an unprofitable business?

Ridiculous – no thank you.

Here is my thesis for Kahoot!.

Thesis

- Kahoot! is an interesting and market-dominating learning and engagement business, with very impressive top-line trends. However, like many tech businesses, it has failed to generate a single cent of positive operating income and net income – which means that I do not view it as a successful or investable business at this price.

- I could be convinced to pay a SOTP-50% value at 5 NOK/share, a quarter of the current share price, provided trajectories continue to show positive momentum.

- For now, though, this company is a “HOLD”, and I would not buy it here.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The company fulfills none of my investment criteria. It’s a “HOLD”, and if I held it, I would “SELL” it.

Be the first to comment