Mongkol Onnuan

While it appears that the Federal Reserve is not yet finished raising interest rates after the better-than-expected jobs report last Friday, December 2, investors may want to consider taking advantage of funds that hold floating rate loans to generate income. Even if the Fed does slow down the pace of interest rate increases as some have suggested, interest rates are likely still going up in 2023. This situation can have the effect of continuing to push down bond prices, which makes them less appealing to investors looking for steady income without further loss of capital.

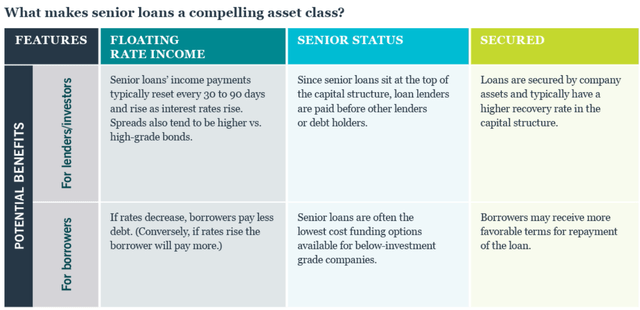

Conversely, some business development companies (“BDCs”) and funds that hold floating rate assets like senior secured loans can actually benefit from the rate increases that are coming down the road. In a September article from Nuveen, the fund manager makes the case for the ongoing opportunity in floating rate senior loan funds.

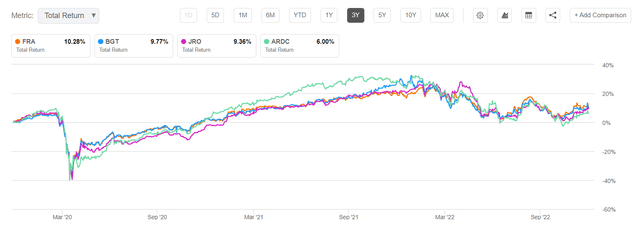

There are several good closed-end funds (“CEFs”) that offer investors a regular income stream from senior loans and other floating rate credit instruments. One such fund that I covered previously is Ares Dynamic Credit Allocation Fund (ARDC), which holds senior loans and some CLOs. BlackRock also offers several floating rate senior loan funds, including two that were recently covered by one of my favorite fellow authors, Nick Ackerman, where he examined BlackRock Floating Rate Income Strategies Fund (FRA) and BlackRock Floating Rate Income Trust (BGT).

Using the fund screener from CEFconnect, I found 27 CEFs that offer senior loans and several of those focus on floating rate loans. One of those funds is an offering from Nuveen and is called the Nuveen Floating Rate Income Opportunity Fund (NYSE:JRO). Comparing each of those 4 funds, ARDC, BGT, FRA, and JRO, I decided that JRO appears to offer near the best YTD total return and potential for best total return going forward given the fund holdings, distribution coverage, and past fund performance. The 4 funds have had nearly identical total returns over the past 3 years, with ARDC lagging slightly.

JRO Overview

Nuveen offers the JRO fund to provide high monthly income, diversified assets for an overall income portfolio, and adjustable dividends that can act as a possible hedge against rising short-term rates. From the fund description:

The Fund invests at least 80% of its managed assets in adjustable rate loans, primarily senior loans, though the loans may include unsecured senior loans and secured and unsecured subordinated loans. At least 65% of the Fund’s managed assets must include adjustable rate senior loans that are secured by specific collateral. The Fund uses leverage.

The fund inception date was July 2004 at an inception NAV of $14.33 and starting share price of $15. As of December 1, the NAV was $9.09, and the share price was $8.40 leading to a discount of -7.6%. The average annual return since inception is 4.9% at NAV and 4.67% based on share price. The YTD total return is -10.44%.

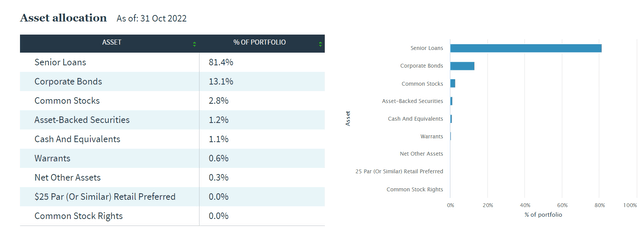

The fund’s holdings include more than 81% senior loans, 13% corporate bonds, and a small amount of common stocks, asset-backed securities, and cash. As of September 30, total managed assets amounted to just under $600 million with 477 total holdings. The fund uses leverage, estimated at 38.7% as of October 31, 2022. Fund fees include 1.28% in management fees plus 0.14% in other expenses, and 1.05% in interest expense for a total of 2.47% as of September 30.

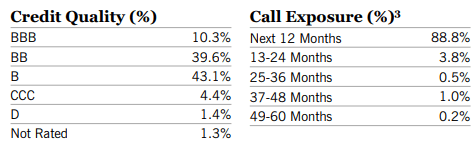

From the fund’s fact sheet, credit quality is mostly below investment grade and the call exposure has nearly 90% of loans callable in the next 12 months.

fund fact sheet

That high call exposure is a strong indicator that the fund will be able to reset the majority of loan holdings at higher interest rates, supporting future potential increases in NII.

Distributions

The fund pays monthly distributions and has varied the distribution rate over the life of the fund, while paying a high yield income stream that currently amounts to 10.5% annually based on the current (as of December) payout of $0.074. The fund has increased the monthly distribution 2 times in 2022, starting with $0.0575 in January, increasing to $0.655 in July, and now $0.074 in December.

For the JRO fund, Nuveen uses a Monthly Level distribution policy, as described in the fund’s literature.

The goal of each fund’s level distribution program is to provide shareholders with stable, but not guaranteed, cash flow, independent of the amount or timing of income earned or capital gains realized by the funds. Each fund intends to distribute all or substantially all of its net investment income through its regular monthly distribution and to distribute realized capital gains at least annually. In any monthly period, in order to maintain its level distribution amount, each fund may pay out more or less than its net investment income during the period. As a result, regular distributions throughout the year are expected to include net investment income and potentially a return of capital and/or capital gains for tax purposes.

The dividend history over the past 5 years is shown on the Dividend History page on SA and is included here for your review. After cutting the distribution in 2020, the monthly amount now exceeds the 2017 dividend payment.

The fund has declared a total of $15.5073 in distributions since inception. The latest 3 months of distributions have consisted of more than 94% NII each month, and just a small amount of ROC according to the 19A filings on the fund website.

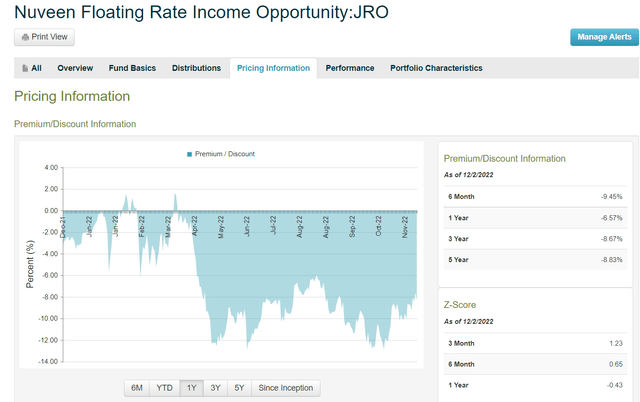

The fund is currently trading near its average 3-year discount of -8.67% as illustrated by CEFconnect, although that discount has been narrowing from its 1-year low discount of -12%.

Risks and 2023 Outlook

Some of the risks associated with investing in JRO (or any leveraged senior loan fund) include senior loan risk, credit risk, interest rate risk, and leverage risk. Of course, all closed-end funds also have risks associated with the market price that can trade at a premium or discount to NAV. Typically, funds that trade at a discount have a better chance of closing that discount, especially when the NAV is rising as is the case currently with JRO.

Senior loan risk is mainly due to loans that may be unrated, are not registered with the SEC, and public information about those loans may not be available. The credit risk with loans that are below investment grade include a possibility of default, difficulty in evaluating credit quality by fund managers who must typically rely on their own analysis using industry data, and potential counterparty credit risk if those counterparties fail to meet their obligations should the fund hold any derivatives for hedging purposes.

Interest rate risk mostly affects fixed income securities such as bonds, preferred, convertible or other debt secured investments. Fortunately, JRO holds very little of those. Leverage risk heightens the volatility of the fund’s NAV and can magnify the impacts of the other risks mentioned above. Different forms of leverage such as swaps, can increase the credit risk and/or interest rate risk, for example. Lastly, leverage can increase the liquidity risk in the fund if the requirement to sell some assets to stay within regulatory leverage limits forces a fund to sell holdings at inopportune times.

Most leveraged loan funds have performed poorly in 2022 due to rising interest rates and fears of a looming recession which could lead to a sudden increase in the default rate, which remains at an historically low level as we near the end of the year. Some forward-looking economists view 2023 as a time to potentially move to more aggressive (i.e., higher credit risk) investments. JRO may be in a sweet spot for this opportunity if it comes to pass as described in this 2023 outlook from Pinebridge.

While the Federal Reserve’s aggressive rate increases threaten to overshoot and engineer a recession, market prices still reflect expectations for a soft landing. Against this backdrop, we believe fixed income investors should maintain a defensive portfolio stance while being prepared to quickly shift to offense should valuation cracks emerge and present attractive opportunities. With an inverted yield curve and yields at or near a cyclical peak, we see no need to play aggressive offense and take undue risks when seeking sufficient yields.

Investment grade debt, especially in the US, looks more attractive given the challenges heading into 2023. That said, our current more risk-off stance, along with the dollar’s supremacy across fixed income markets, could begin to shift in the new year as the Fed finishes its hiking phase and settles in to maintain its restrictive higher terminal rate. This could mean below-investment-grade and emerging market (EM) assets look more attractive again in 2023 and begin to eat into US investment grade’s dominance.

In my opinion and based on my review of JRO and other similar senior loan funds like BGT and ARDC, I believe that now is a good time to start a position in JRO if you do not already own shares. We have likely seen the bottom in terms of market price as investors begin to realize that the NII coverage is good enough to increase the monthly dividend by nearly 14% above the previous level.

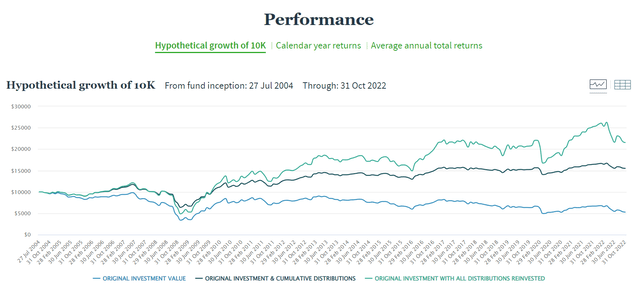

As long as the economy does not actually fall into a deep recession that could impact all market sectors next year, the senior loan investments that benefit from floating rates should do well and offer a strong total return over the next several years as the market recovers. JRO has withstood previous recessions and if an investor had reinvested all monthly distributions paid to date, they would have more than doubled their investment since 2004 as illustrated in this Performance chart from the fund’s website.

For income investors who are interested in a steady monthly income and do not wish to reinvest the monthly distributions, JRO provides a relatively “safe” source of reliable monthly income. I would recommend buying shares of the fund while it still trades at a reasonable discount to NAV, currently around $9. It should be considered a diversified income source in a portfolio that holds other funds that offer steady income using other asset classes such as fixed income, high yield bonds, preferred stock, etc.

I own another Nuveen fund in my income portfolio – the Nuveen Core Plus Impact Fund (NPCT), which is a taxable, multi-sector, fixed income fund that I wrote about in August. I may consider adding JRO to my portfolio for increased diversification and to supplement my other monthly income holdings that offer annual yields exceeding 10% as I prepare for retirement next year, and will be taking the monthly income as cash to supplement my other monthly income sources.

Consider your own investment objectives and risk tolerance before deciding whether to invest in JRO. If your investment horizon is longer than 1 to 2 years and you can withstand some volatility, you may want to investigate JRO further. If you are squeamish about investing in leveraged loan funds, this may not be your cup of tea.

Be the first to comment