yujie chen

Johnson & Johnson (NYSE:JNJ) is expected to report its second quarter earnings before the market opens on July 19. Analysts are expecting the company to report revenue of $23.87 billion and EPS of $2.56. However, it has reported a positive earnings surprise in all of the previous 12 quarters which means it may outperform EPS expectations. On the other hand, revenue surprises have been much more inconsistent and could either miss or beat expectations. In the past year, JNJ has outperformed both the S&P 500 and health care sector due to its strong pharmaceutical segment and COVID-19 vaccine sales. This has caused the stock to rise to high valuation multiples when compared to its peers, possibly leading to a major downside if the company misses future expectations. Therefore, investors may want to wait before jumping into the stock.

What Do Analysts Expect for the Upcoming Quarter?

JNJ is expected to report earnings on July 19 before the market opens. As of writing this article, the consensus analyst expectations report an EPS of $2.56 and revenue of $23.87 billion. This represents a contraction in EPS but a growth in revenue when compared to last quarter. In the first quarter of 2022, JNJ reported an EPS of $2.67 and a revenue of $23.43 billion.

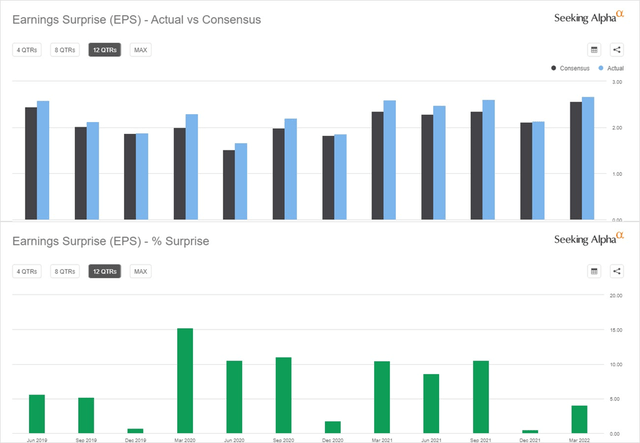

However, it is important to note that JNJ often beats analysts’ expectations for EPS. The company has beaten consensus expectations in every one of the past 12 quarters. The average earnings surprise over this time period calculates to 7.02%. Based off the current expectations for EPS of $2.56, JNJ could see an actual EPS of about $2.74.

JNJ Earnings Surprise Data (Seeking Alpha)

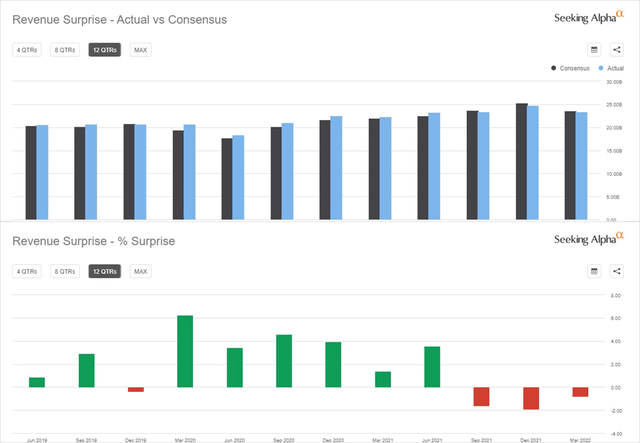

On the other hand, JNJ’s revenue surprises have been inconsistent over the past 12 quarters. In this time period, the company has beaten expectations for revenue 8 times while missing expectations 4 times. The average revenue surprise over the past 12 months calculates to 1.85%. This could mean that JNJ may report an actual revenue of $24.31 billion. However, we must consider the fact that JNJ has missed revenue estimates in the past 3 quarters, reporting an average surprise of -1.44%. This means JNJ could miss expectations for the fourth consecutive quarter and report revenue of $23.53 billion.

JNJ Revenue Surprise Data (Seeking Alpha)

When comparing the current consensus analyst expectations for the upcoming quarter, JNJ is expected to see decent growth. In the second quarter of 2021, the company reported an EPS of $2.48 and revenue of $22.32 billion. The consensus analyst expectations have EPS experiencing a Y/Y growth of 3.23% and revenue experiencing a Y/Y growth of 6.94%.

As for the full fiscal year, management has given guidance that has EPS coming in between $10.15-$10.35 and revenue coming in between $94.8-$95.8 billion. This is lower than previous guidance which had EPS between $10.40-$10.60 and revenue at $98.9-$100.4 billion. The reason for cutting guidance is because of issues with the sale of the COVID-19 vaccine and currency changes. As for analysts, consensus expectations have FY22 EPS reporting at $10.23 and revenue reporting at $96.29 billion.

How Has JNJ Performed in the Past?

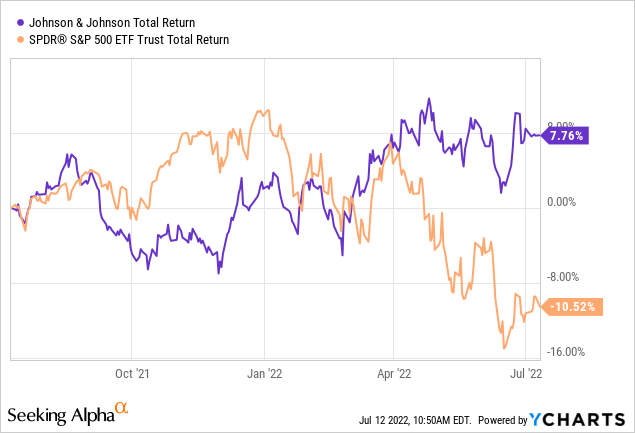

Over the past year, JNJ has outperformed the general market by a large margin. Since July 2021, the stock has given shareholders a return of 7.76%. Meanwhile, the S&P 500 has been dropped by -10.52%. This means shareholders of JNJ have experienced an alpha of 18.28%.

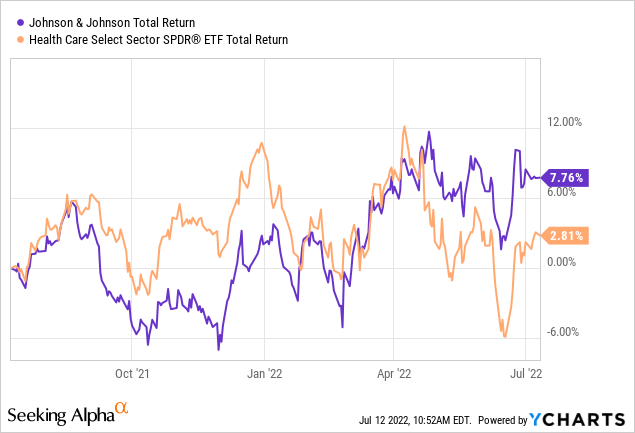

When compared to the general health sector, JNJ has still outperformed but not by as much. Over the past year, the general health care sector has seen a return of 2.81%. This means JNJ has given health care investors an alpha of 4.95% over the sector.

Why Has JNJ Outperformed?

It is important to discuss why JNJ has outperformed the market and its peers by large amounts. Overall, the company’s outperformance is due to its intensely strong pharmaceuticals segment. In FY21, the pharmaceuticals segment grew its revenue by 14.3% to $52.08 billion, accounting for about 55.54% of total revenue. This large growth is mainly due to the segment’s immunology and oncology subsegments amassing large revenue among their blockbuster drugs, as well as the COVID-19 vaccine generating lots of revenue.

As for the immunology and oncology subsegments, Stelara and Darzalex saw huge growth and generated the most revenue of JNJ’s medicines. From 2020-2021, Stelara grew its revenue from $7.71 billion to $9.13 billion, which calculates to a growth of 18.52%. Darzalex outperformed in growth, increasing its revenue from $4.19 billion to $6.02 billion and achieving a growth rate of 43.75%.

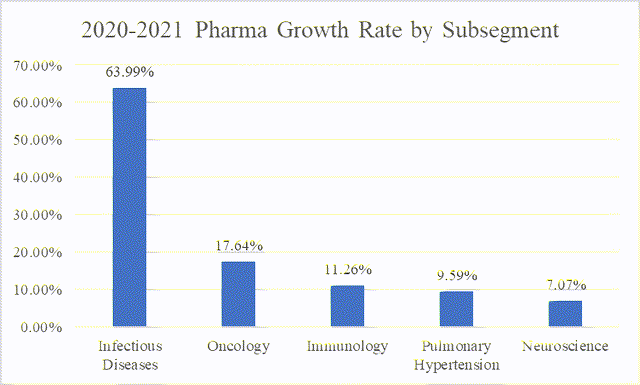

JNJ Pharmaceuticals Segment Growth by Subsegment (Created by Author)

The COVID-19 vaccine also helped JNJ’s Infectious Diseases subsegment grow by nearly 64% from 2020-2021. In 2021, the company’s COVID-19 vaccine generated $2.39 billion in revenue despite it being sold at a not-for-profit price. However, this report came in just short of the forecast of $2.5 billion and is now expected to slow down as the pandemic fades. With this tailwind leaving with the pandemic, JNJ will have to rely further on its pharmaceuticals segment and strong pipeline to generate higher revenue.

How Does JNJ Compare to Its Peers and What Is the Stock Worth?

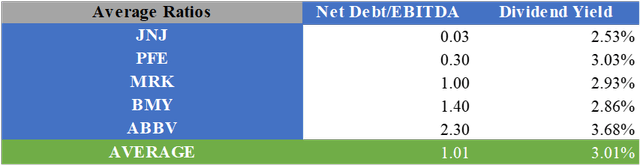

One of JNJ’s strongest fundamental aspects is its incredibly low net debt and strong cash position. Currently, the company has a net debt of about $876 million. The reason for this low net debt is due to the company’s large cash position of $30.39 billion. On top of this low debt, JNJ has a great TTM EBITDA of $32.41 billion, giving it a Net Debt/EBITDA ratio of just 0.03. This is the lowest ratio of any of its competitors, with Pfizer (PFE) being in second at 0.3.

JNJ Debt & Dividend Data (Created by Author)

Even though JNJ has lots of cash, the company does not pay a great dividend compared to its peers. Currently, it has a dividend yield of about 2.53% while the average among its competitors is 3.01%. Instead, it focuses heavily on M&A. In his first earnings call, new CEO Joaquin Duato said the company is going to take an aggressive approach towards M&A in the upcoming future. Specifically, it is going to focus heavily on acquiring companies in the MedTech industry to generate further growth after the pandemic. This is likely a smart decision as JNJ’s MedTech segment has been improving recently due to a fast market recovery post-pandemic. These acquisitions will likely allow the company to see further growth even without COVID-19 vaccine sales.

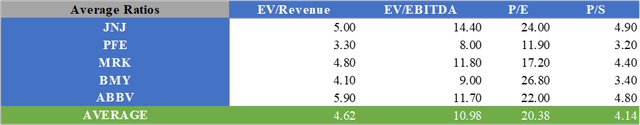

As for the stock’s valuation multiples, JNJ has some of the highest among its peers. Currently, its EV/Revenue, EV/EBITDA, P/E, and P/S multiples are all above the average of its competitors. This is likely due to the stock being highly attractive among investors because of its much lower net debt and high COVID-19 vaccine sales. However, it could also be a potential risk for the stock as it could cause it to fall lower than competitors in the case of a downturn.

JNJ & Competitor Multiples (Created by Author)

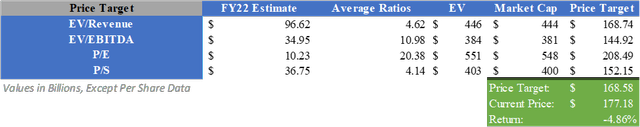

Using these average valuation multiples, a relative valuation can be found. By using the consensus analyst expectations for FY22 mentioned previously and multiplying them by the provided average multiples, a price target of $168.58 can be calculated. This implies a downside of about 4.86%.

Relative Valuation of JNJ (Created by Author)

What Does This Mean for Investors?

JNJ is expected to report upcoming earnings before the market opens on July 19. Current consensus analyst expectations have revenue coming in at $23.87 billion and EPS coming in at $2.56 billion. It is important to note that the company has consistently reported a positive earnings surprise over the past 12 quarters, meaning it may outperform the expected EPS. However, actual revenue has been inconsistent when compared to expectations and could either miss or beat expectations. In the past, JNJ has outperformed the general market and health care sector due to its outperforming pharmaceuticals segment and COVID-19 vaccine sales. These effects have caused the stock to have high valuation multiples and cause it to become overvalued. Due to this, the stock may have major downside if the company misses expectations. Therefore, I will apply a Hold rating at this time.

Be the first to comment