AnVr/E+ via Getty Images

Employment data released today gives some indication the job market is weakening.

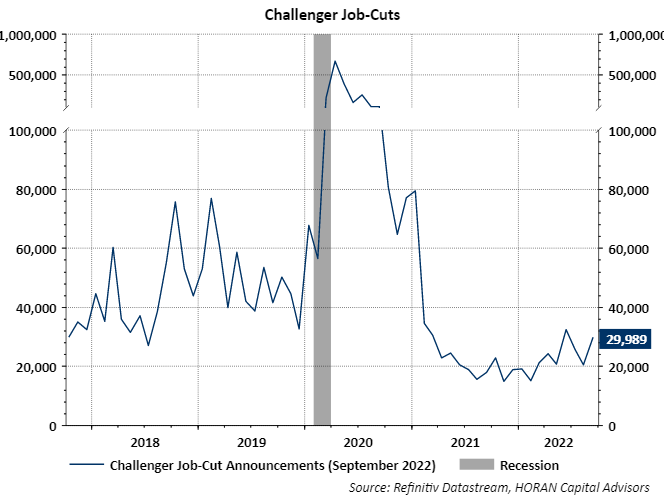

The Challenger Layoff report for September shows job-cuts increased 46% month over month and 68% year over year. Although the report notes the nine-month total for job cuts is lower than the same nine-month period in 2021, the third quarter job-cut total of 76,284 is 45% higher than the third quarter of 2021 when employers planned to cut 52,560 jobs.

Andrew Challenger, Senior Vice President of Challenger, Gray & Christmas, Inc., said, “Some cracks are beginning to appear in the labor market. Hiring is slowing and downsizing events are beginning to occur,”

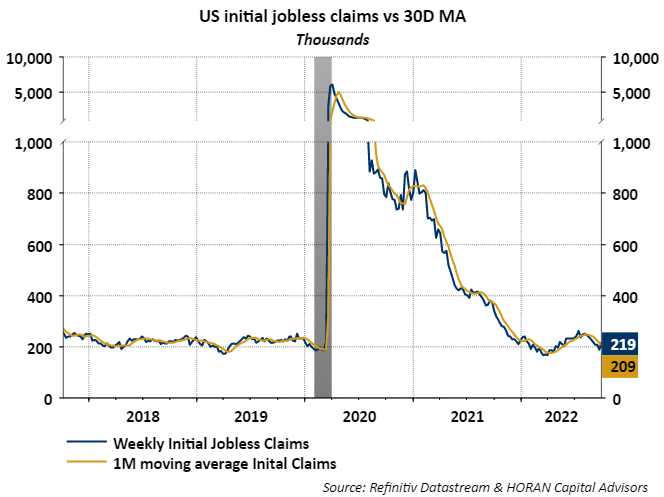

Weekly initial jobless claims exceeded expectations of 203,000 and rose to 219,000 compared to a lower revised 190,000 in the prior week. With today’s report the number of jobless claims again rose above the one-month average of 209,000.

Today’s employment data, along with the Job Openings and Labor Turnover survey I wrote about yesterday, provide some indication the job market may be softening. This is the type of data that would give the Fed justification for slowing the pace of rate increases.

As I noted in yesterday’s post, the magnitude of the rate increases this cycle are far greater than prior Fed tightening cycles. It seems the Fed should see if the tightening to date is resulting in bringing inflation down via a weakening consumer.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment