NicoElNino

A Quick Take On JFrog

JFrog (NASDAQ:FROG) reported its Q3 2022 financial results on November 2, 2022, beating revenue and EPS estimates.

The firm provides DevOps tools to software developers in the enterprise.

Given the company’s high and increasing operating losses in a rising cost of capital environment, I remain on hold for FROG in the near term.

JFrog Overview

Sunnyvale, California-based JFrog was founded to develop an integrated and full-featured system to enable DevOps teams to more quickly and easily develop and deploy new software releases.

Management is headed by Co-founder and Chief Executive Officer, Mr. Shlomi Ben Haim, who was previously at AlphaCSP, a software implementation company acquired by Malam Group.

The company has developed a robust partner program composed of three partner types: Resellers, Technology Partners, and Solutions Partners.

The company’s primary offerings include:

-

Artifactory – Artifact repository

-

Xray – Security and compliance

-

Pipelines – CI/CD automation

-

Distribution – Trusted software releases

-

Mission Control – Platform control panel

-

Connect – Device management

The firm offers a multi-tiered subscription structure, utilizing free trials and open-source offerings to entice businesses to try the integrated service.

Subscription offerings include:

-

JFrog Pro

-

JFrog Pro X

-

JFrog Enterprise

-

JFrog Enterprise Plus

-

JFrog Security

JFrog’s Market & Competition

According to a 2018 market research report by MarketsandMarkets, the global market for DevOps software was an estimated $2.9 billion in 2017 and is expected to reach $10.3 billion by 2023.

This represents a forecasted very strong CAGR of 24.7% from 2018 to 2023.

The main drivers for this expected growth are an increasing need for continuous software release capabilities as organizations seek to gain an edge through their superior software system operation.

Also, organizations are seeking lower cost structures, greater automation, increased agility, and faster application delivery cycles.

While the North American market represents the greatest demand, the Asia Pacific market is expected to grow at the fastest rate of growth during the period.

Major competitive or other industry participants include:

-

IBM (Red Hat)

-

Pivotal Software & VMware

-

GitLab (Microsoft)

-

Sonatype

-

Alphabet

-

Amazon (AWS)

JFrog’s Recent Financial Performance

-

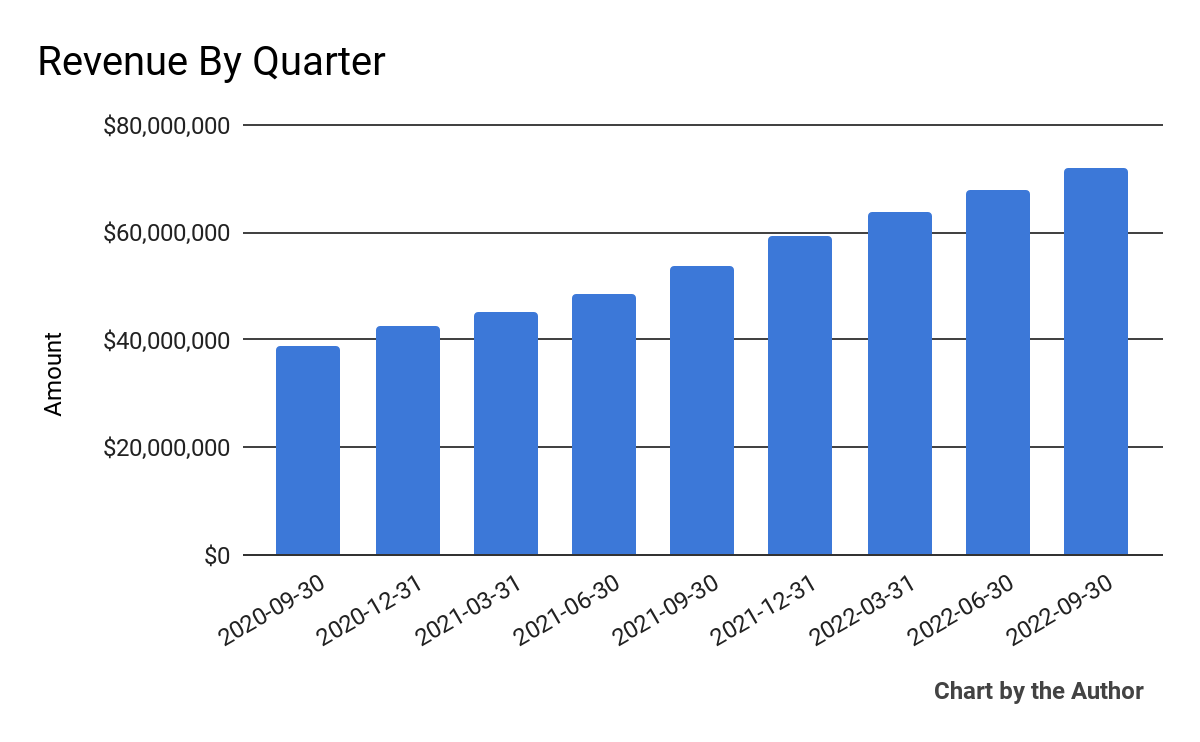

Total revenue by quarter has followed the trajectory shown below:

9 Quarter Total Revenue (Financial Modeling Prep)

-

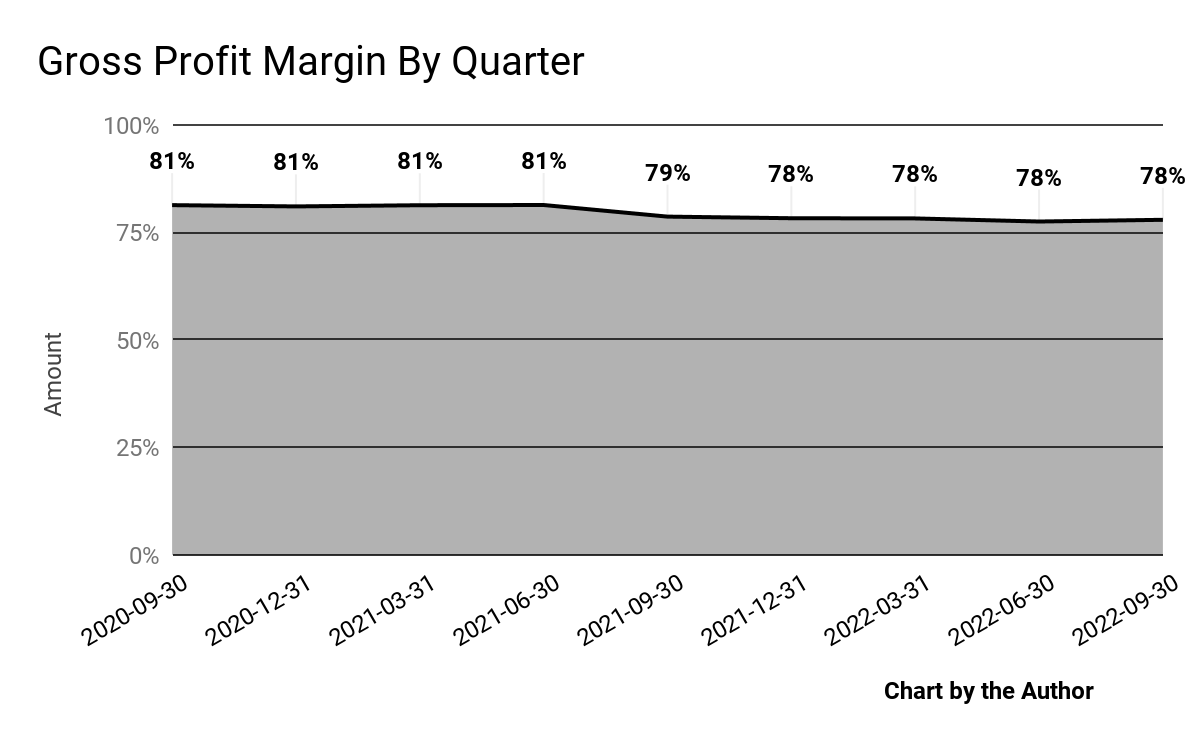

Gross profit margin by quarter has trended lower in recent quarters:

9 Quarter Gross Profit Margin (Financial Modeling Prep)

-

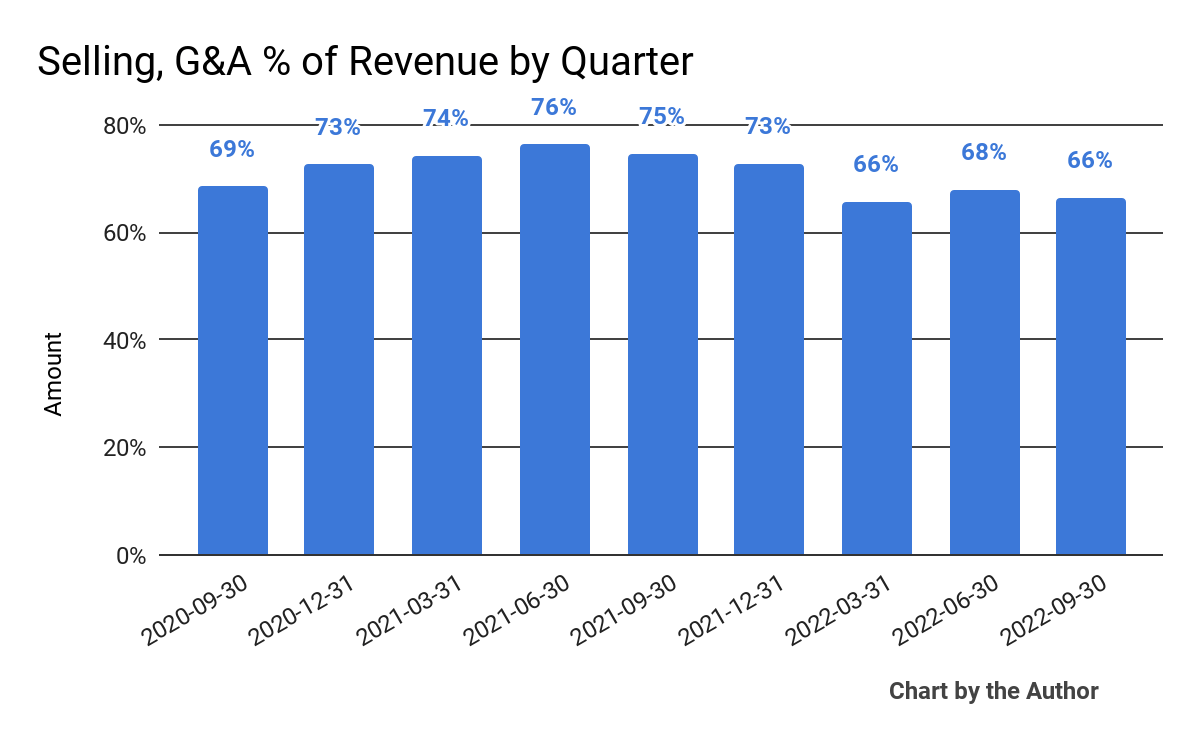

Selling, G&A expenses as a percentage of total revenue by quarter have trended down recently, per the chart below:

9 Quarter Selling, G&A % Of Revenue (Financial Modeling Prep)

-

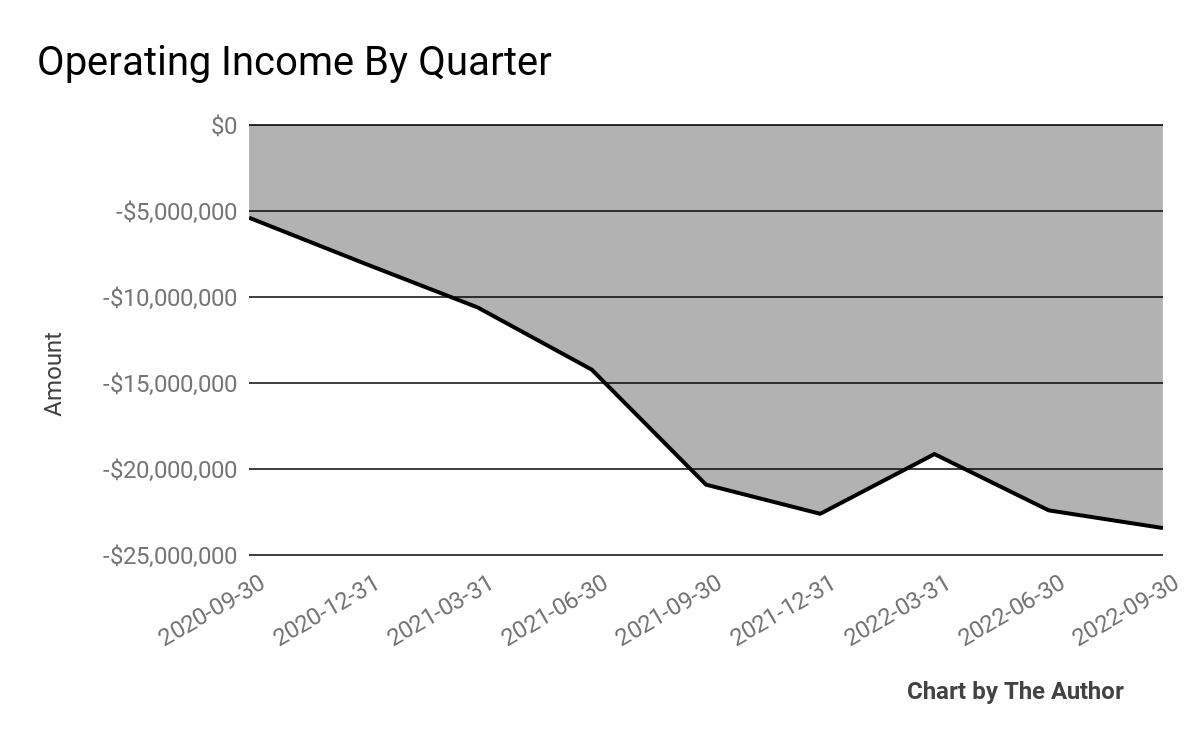

Operating losses by quarter have worsened dramatically in recent quarters:

9 Quarter Operating Income (Financial Modeling Prep)

-

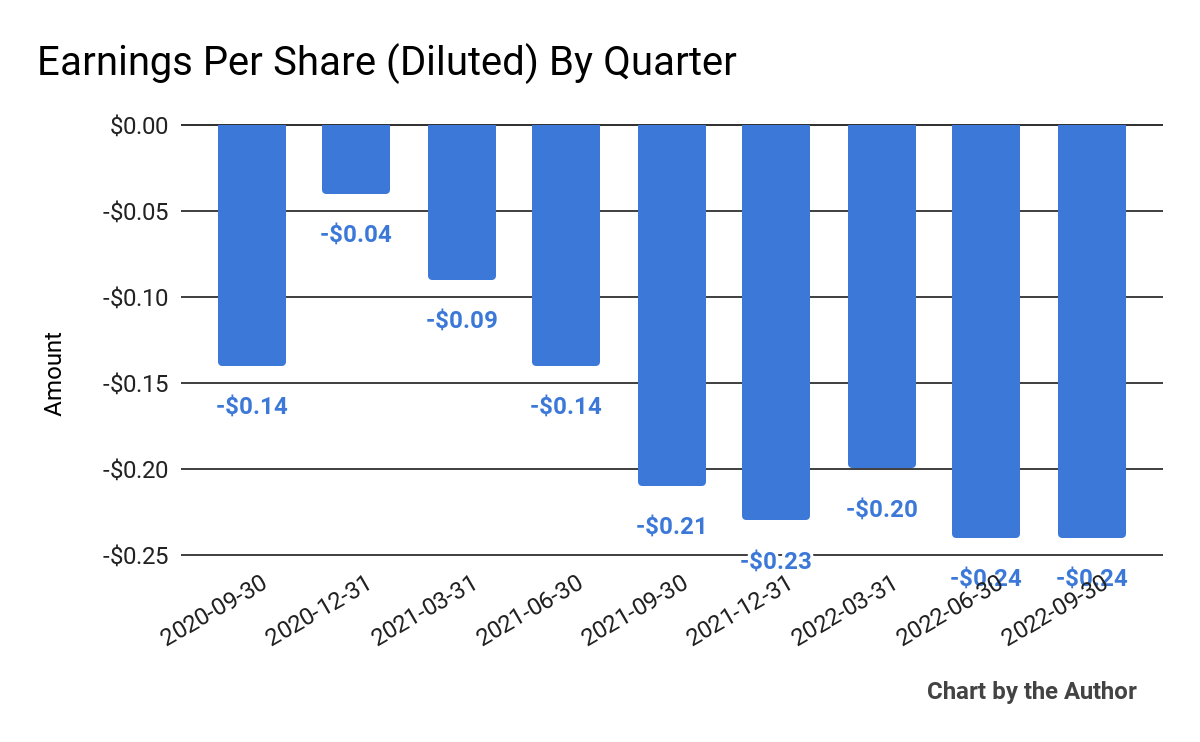

Earnings per share (Diluted) have worsened further into negative territory, as shown here:

9 Quarter Earnings Per Share (Financial Modeling Prep)

(All data in the above charts is GAAP)

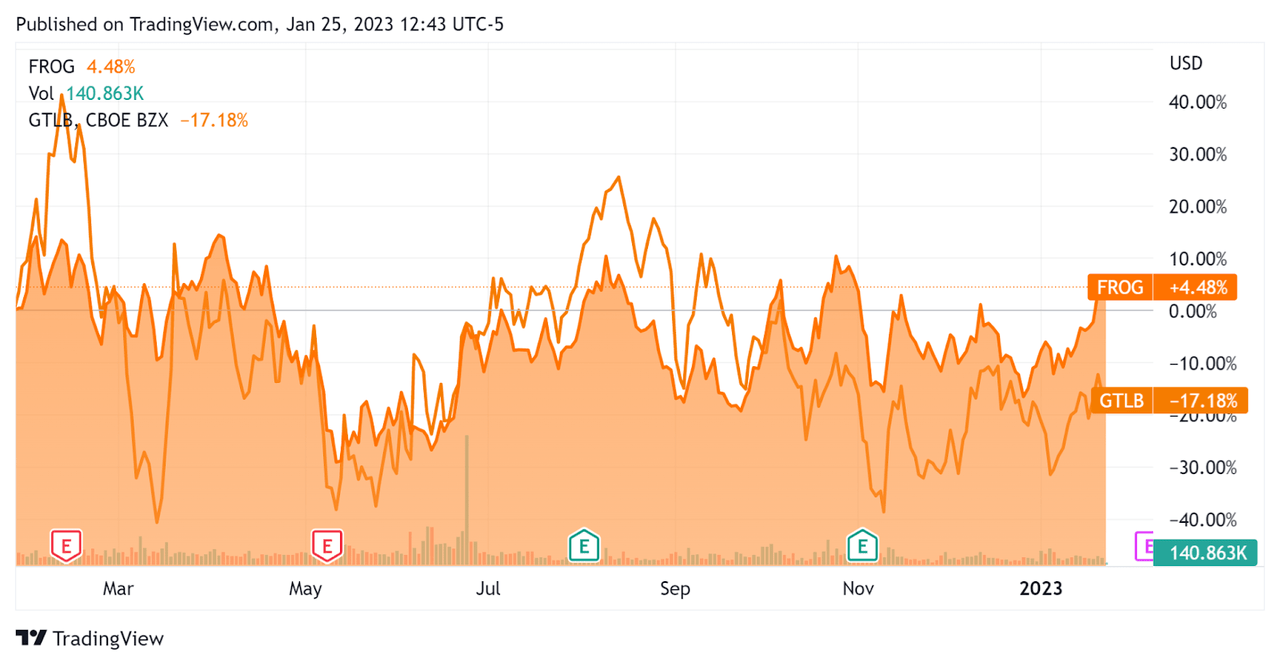

In the past 12 months, FROG’s stock price has risen 4.5% vs. GitLab’s (GTLB) drop of around 17.2%, as the chart below indicates:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For JFrog

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

9.4 |

|

Enterprise Value/EBITDA |

-35.7 |

|

Revenue Growth Rate |

38.2% |

|

Net Income Margin |

-34.2% |

|

GAAP EBITDA % |

-26.2% |

|

Market Capitalization |

$2,508,252,928 |

|

Enterprise Value |

$2,460,394,352 |

|

Operating Cash Flow |

$31,772,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.91 |

(Source – Financial Modeling Prep)

As a reference, a relevant partial public comparable would be GitLab; shown below is a comparison of their primary valuation metrics:

|

Metric (TTM) |

GitLab |

JFrog Ltd. |

Variance |

|

Enterprise Value/Sales |

17.0 |

9.4 |

-44.8% |

|

Revenue Growth Rate |

71.6% |

38.2% |

-46.7% |

|

Net Income Margin |

-47.3% |

-34.2% |

-27.8% |

|

Operating Cash Flow |

-$66,780,000 |

$31,772,000 |

— |

(Source – Seeking Alpha and Financial Modeling Prep)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

FROG’s most recent GAAP Rule of 40 calculation was 12.0% as of Q3 2022, so the firm is in need of improvement in this regard, per the table below:

|

Rule of 40 – GAAP (TTM) |

Calculation |

|

Recent Rev. Growth % |

38.2% |

|

GAAP EBITDA % |

-26.2% |

|

Total |

12.0% |

(Source – Financial Modeling Prep)

Commentary On JFrog

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted the growth of large customers within its customer base, up 29% year-over-year for clients generating annual recurring revenue of over $1 million.

Leadership also noted the growth of its Enterprise Plus subscription plan by large enterprises, confirming its belief in a growing need for ‘mature end-to-end solutions.’

The company also released its Advanced Security product that is focused on securing client binaries.

As to its financial results, topline revenue rose 34% year-over-year, with cloud revenue up 60%.

The company’s trailing four-quarter net dollar retention rate was 130%, indicating strong product/market fit and high sales and marketing efficiency.

The firm’s Rule of 40 results were mediocre, with a strong revenue growth result offset by a negative operating result, contributing to a disappointing figure for this metric.

However, GAAP operating losses continued to worsen, and negative earnings were a dismal ($0.24) per share.

For the balance sheet, the firm finished the quarter with $434 million in cash, equivalents and short-term investments and no debt.

Over the trailing twelve months, free cash flow was $27.3 million, of which capital expenditures accounted for only $4.5 million. The company paid a hefty $62.6 million in stock-based compensation.

Looking ahead, for full-year 2022, management expected revenue to be $280.5 million at the midpoint of the range and non-GAAP operating income of $1.5 at the midpoint.

Note that non-GAAP operating income does not include stock-based compensation, which has been quite high, as mentioned above.

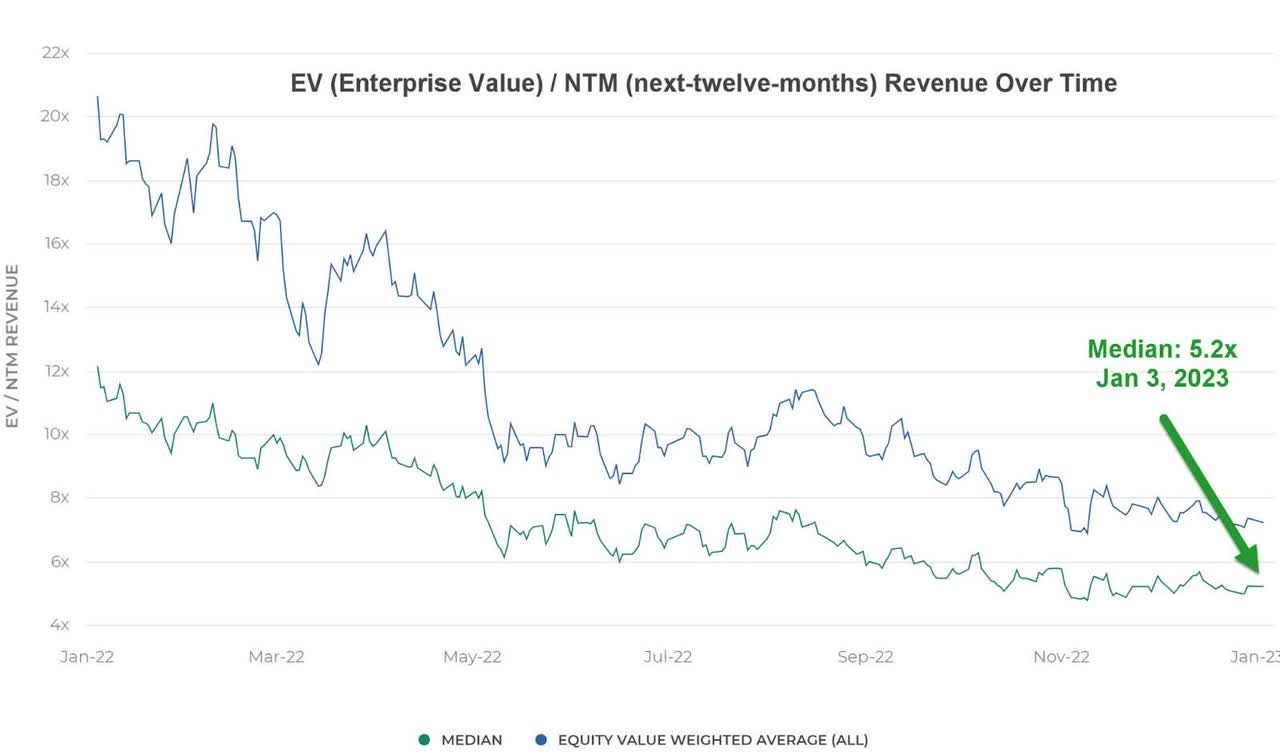

Regarding valuation, the market is valuing FROG at an EV/Sales multiple of around 9.4x.

The Meritech Capital Index of publicly-held SaaS software companies showed an average forward EV/Revenue multiple of around 5.2x on January 3, 2023, as the chart shows here:

EV/Forward Revenue Multiple Index (Meritech Capital)

So, by comparison, FROG is currently valued by the market at a significant premium to the broader Meritech Capital Index, at least as of January 3, 2023.

The primary risk to the company’s outlook is a likely macroeconomic slowdown, which may accelerate new customer discounting, produce slower sales cycles, and reduce its revenue growth trajectory.

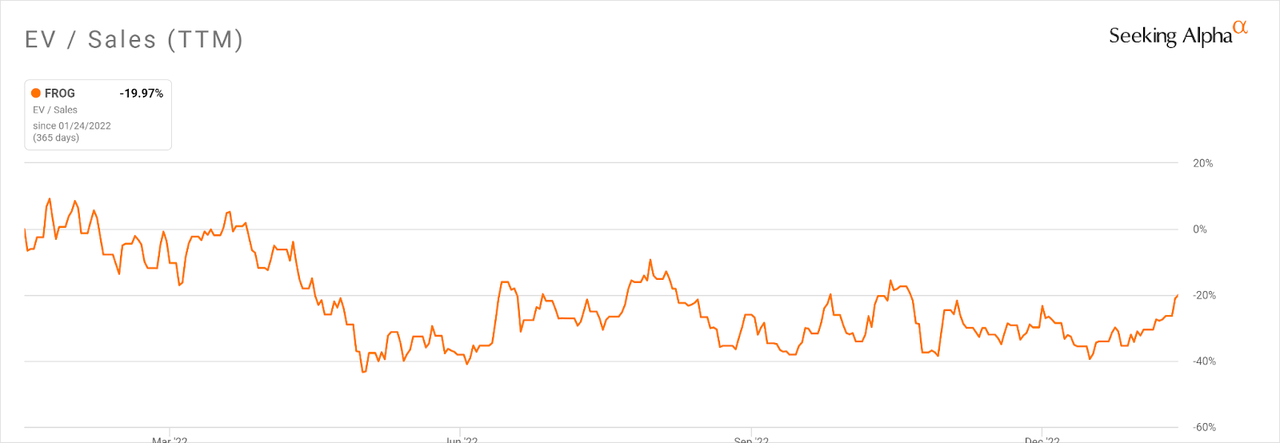

Notably, FROG’s EV/Sales multiple has compressed by 20% in the past twelve months, although it has risen from a low of 40% several weeks ago, as the chart shows below:

Enterprise Value/Sales Multiple History (Seeking Alpha)

A potential upside catalyst to the stock could include a ‘short and shallow’ downturn offset by China’s reopening effects.

However, given the firm’s increasing operating losses in a rising cost of capital environment, I remain on hold for FROG in the near term.

Be the first to comment