FangXiaNuo/iStock Unreleased via Getty Images

This article is contributed by Jun Hao from our Superstocks Seekers team.

Overview

JD.com (NASDAQ:JD) is a Chinese e-commerce company operating one of the largest logistic network infrastructures in China. Through scaled economics shared, JD has been reinvesting its margins to provide low-cost and high-quality goods to its consumers.

JD had recently announced its 1Q22 results. In this article, we will be covering some of the business updates, and also sharing our takes on this quarter. Importantly, we want to assess whether JD’s fundamentals are still intact. If you have not read our previous article, we highly encourage you to do so before proceeding.

So, let us dive right into it.

JD Retail

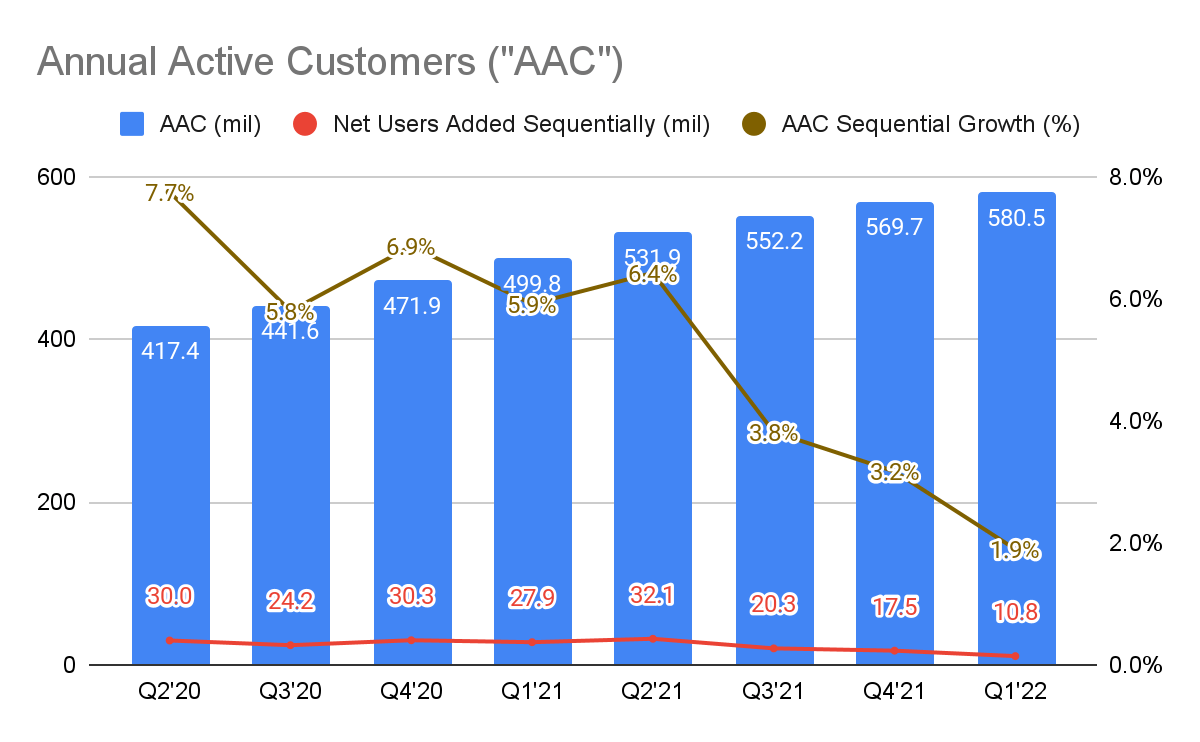

(Source: JD IR)

In our last article, we expressed our concern over the slowdown in JD’s annual active customer (“AAC”) growth, and we continue to see that in this quarter as only 10.8 million new users were added. This is a relatively big slowdown if you compare it to 1Q21 (a year ago), and against the previous quarters.

This is a worrying sign for us as JD could be losing momentum in terms of gaining market share.

This could also possibly hint that we are heading into normalization.

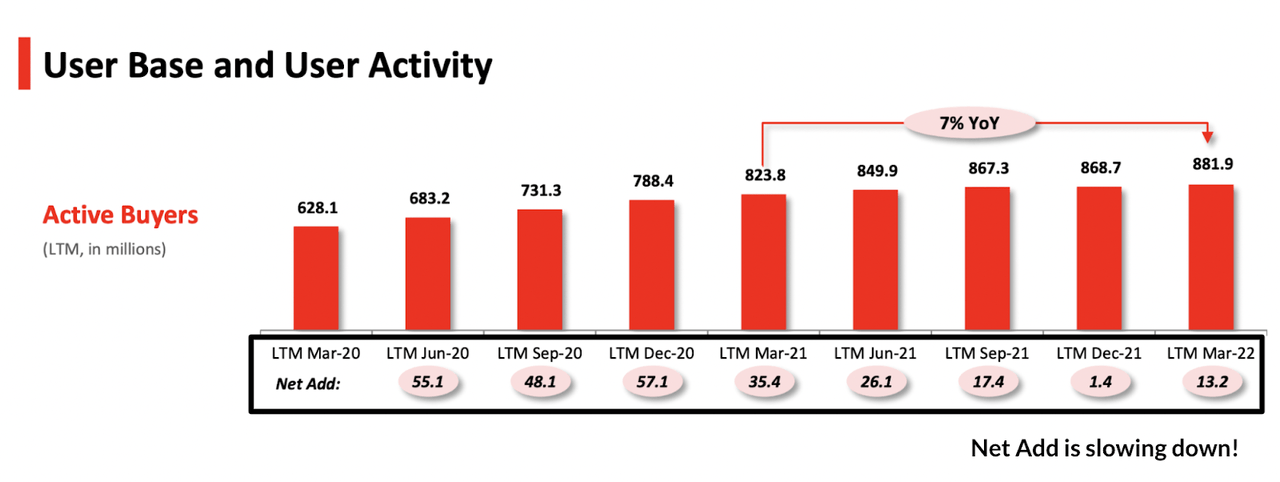

(Source: PDD IR)

One way for us to cross-check if it’s a fundamental issue with JD, or a broad-based slowdown, is to compare it with their competitors. If we look at Pinduoduo’s (NASDAQ:PDD) active user base, the pace they are adding new users has been slowing down since FY21. Likely because lots of demand was pulled forward into FY21 due to COVID.

However, since 2H22 is a seasonally better half for JD due to holiday seasons, we expect to see stronger growth in new users added.

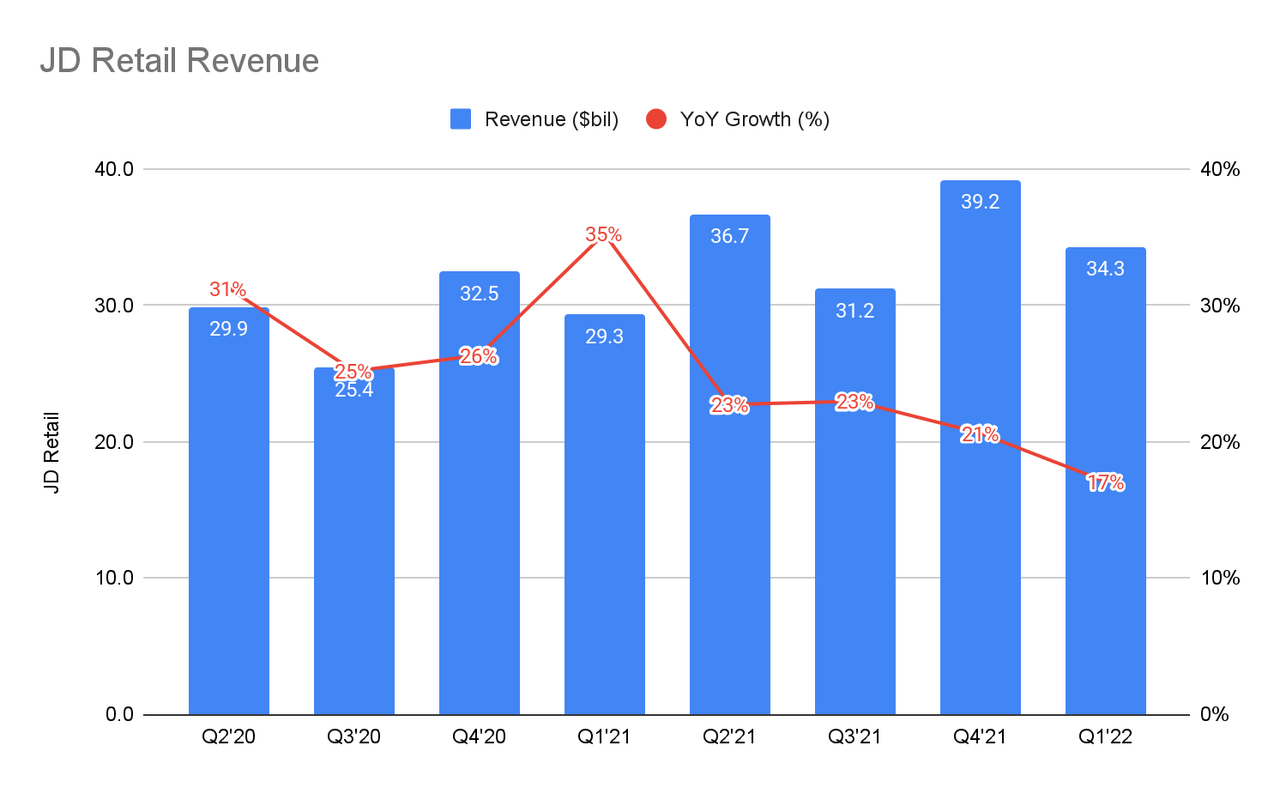

(Source: JD IR)

Despite the growth of AAC tapering, JD Retail revenue grew relatively well at 17% YoY.

The reason was that the COVID resurgence in China has largely shifted consumers’ demand from non-essential items like apparel & mobiles to essential items like supermarkets & healthcare, where user purchasing frequency and Average Revenue Per User (“ARPU”) reached record-highs during the quarter. Consumers are likely to be stocking up on foods as they are confined at home, due to the fear of food shortages and price surges.

This slowdown in AAC was offset by the near-term pent-up demand for essential items, but we prefer the number of new users to grow instead to provide a more sustainable revenue growth.

And while COVID lockdown used to be a pure catalyst for JD, this doesn’t seem to be the case now.

According to Bloomberg:

China’s economy is paying the price for the nation’s COVID Zero policy, with industrial output and consumer spending sliding to the worst levels since the pandemic began…The zero-tolerance approach has prompted criticism from businesses, fueled public frustration…Sunday normal life and production will only fully resume by mid- to late-June.

When workers are forced to stay at home, people are not able to work. This means lower income and lower production volume. This doesn’t sound good as not only are consumers cutting back on discretionary spending but they are running on limited supply.

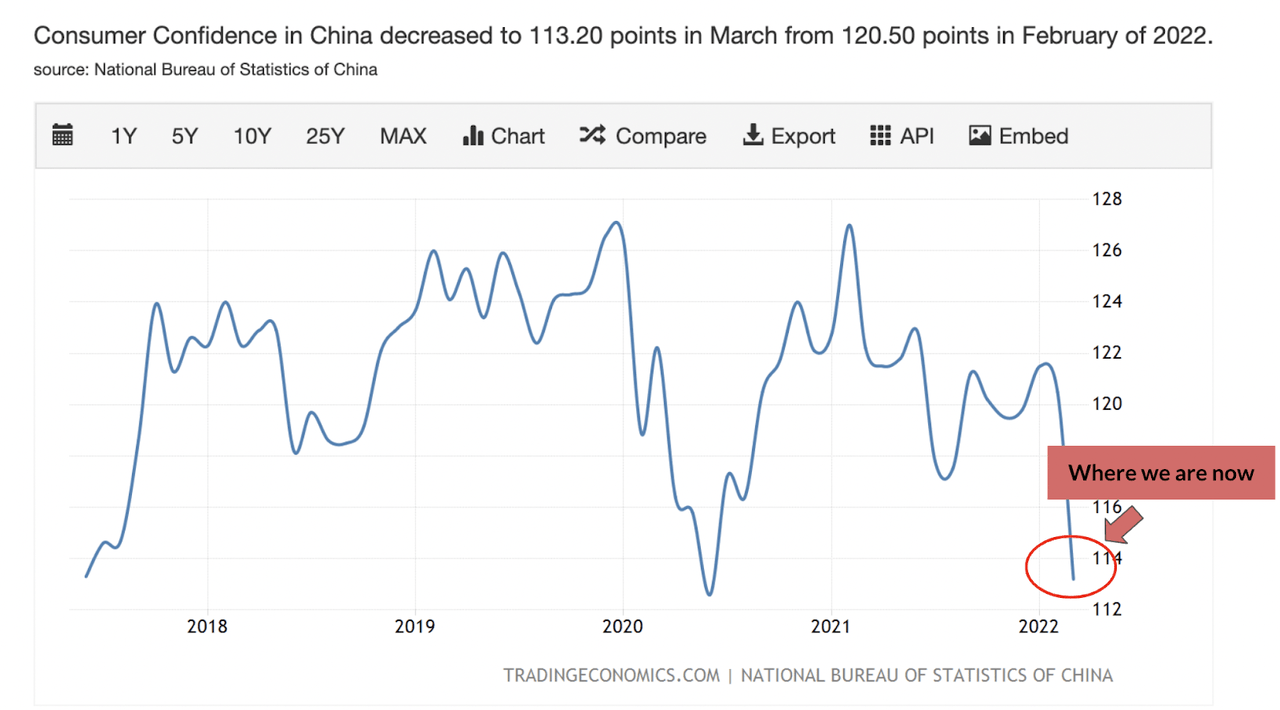

(Source: Tradingeconomics)

To grasp the impact of the current situation, if we look at the China consumers’ sentiment over 5 years, you’ll see that it is currently near the low. According to Investopedia, this is a survey that measures how optimistic or pessimistic consumers are regarding their expected financial situation.

This is essentially a double whammy to JD’s growth with the pace of new users slowing down, and consumers’ spending power weakening.

However, Beijing seeks to ease the regulatory crackdown on tech companies to revitalize the sluggish economy:

Beijing is enlisting the technology industry…to revitalize an economy struggling with rolling urban lockdowns hitting consumption and causing supply-chain bottlenecks…Liu vowed in March to stabilize battered financial markets, promising to ease a regulatory onslaught that started with the dramatic cancellation of Ant Group Co.’s record IPO before snowballing into an assault on every corner of China’s technosphere.

In our view, this is great for several reasons:

-

JD offers a wide variety of essential items that consumers depend on.

-

JD Logistics (“JDL”) operates a nationwide logistics network that businesses rely on for delivering goods reliably and efficiently to consumers. In times where supply chain disruption is felt across the economy, having a reliable logistic partner is critical. E.g. JD helped to supply and deliver COVID-19-related equipment to the Healthline workers.

We strongly believe JD will play a crucial role in helping to alleviate the impact of the zero-COVID policy, just like how they did during the COVID-19. Moreover, they have always maintained a healthy relationship with the Chinese Communist Party (“CCP”) and we expect the CCP to work closely with JD.

However, we could argue that as long as the zero-tolerance approach stays, the extent to which it can affect consumers’ confidence and thus JD’s near-term growth is still unclear.

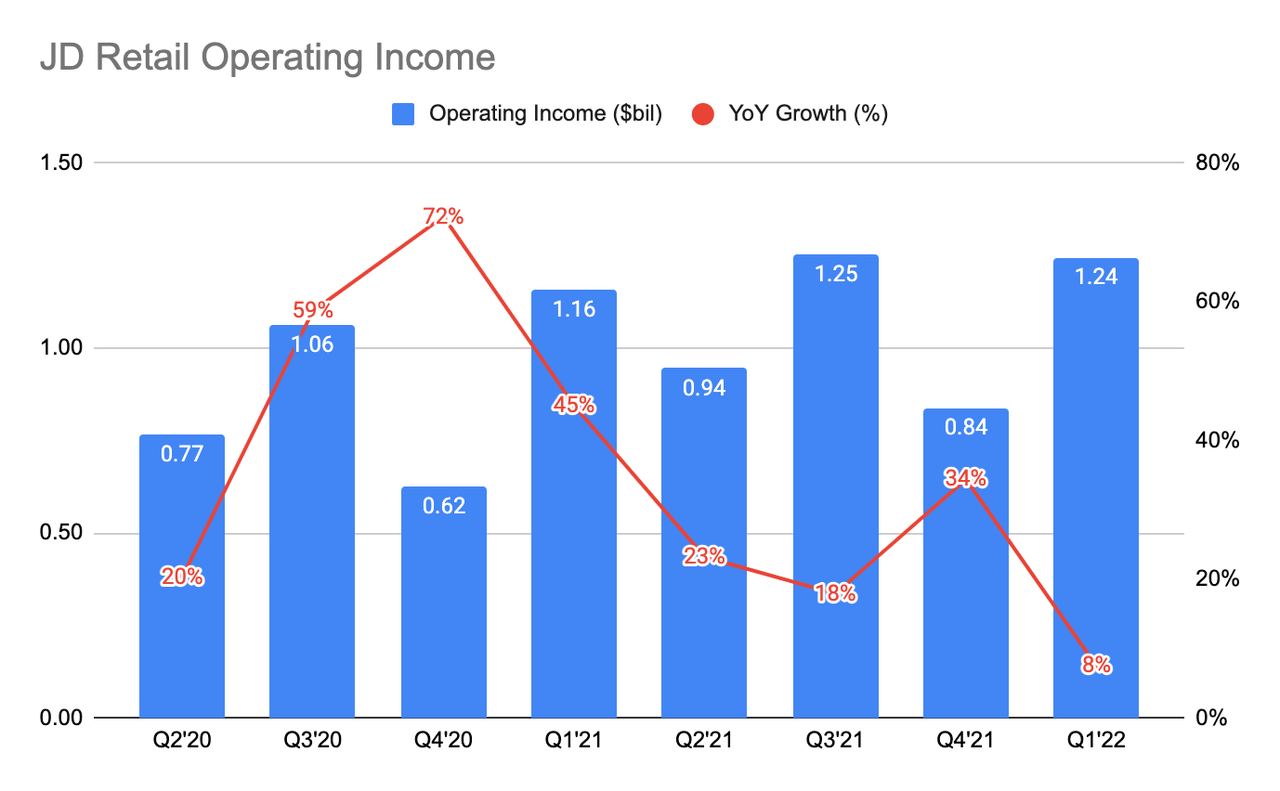

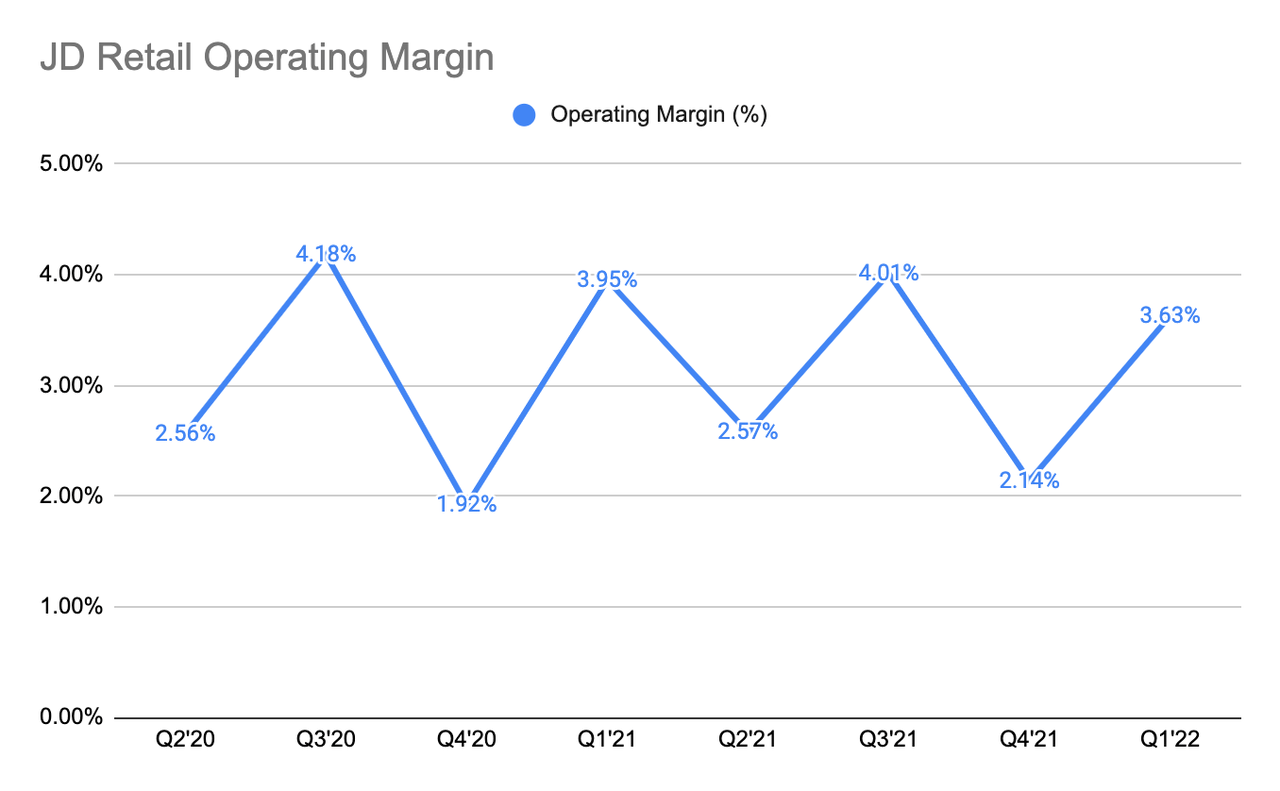

(Source: JD IR) (Source: JD IR)

This quarter, JDR’s operating profit did not grow as quickly as it only grew by a mere 8% Y/Y. This led to a lower operating margin of 3.63% from a year ago.

As investors, should we be concerned?

According to JD’s management, this is largely due to the increase in one-off marketing expenses related to the Spring Festival Gala Partnership in which JD will be giving out virtual red packets in the form of cash to grab consumers’ mindshare. As a result, JD’s marketing expenses make up 3.3% of its total revenue as compared to 3.6% in 1Q21.

Margins in the near-term are expected to fluctuate as well:

That said, we expect to see additional COVID-related costs and expenses, particularly in fulfillment, as well as margin impact caused by product mix shift due to the uneven performance of our different product categories in the short term.

Therefore, this isn’t due to JD’s inability to extract operating leverage.

Its margin expansion is also dependent on its ability to grow its user base, which is what we’re going to be monitoring over the quarters.

The Lack Of Profitability For JD’s New Businesses

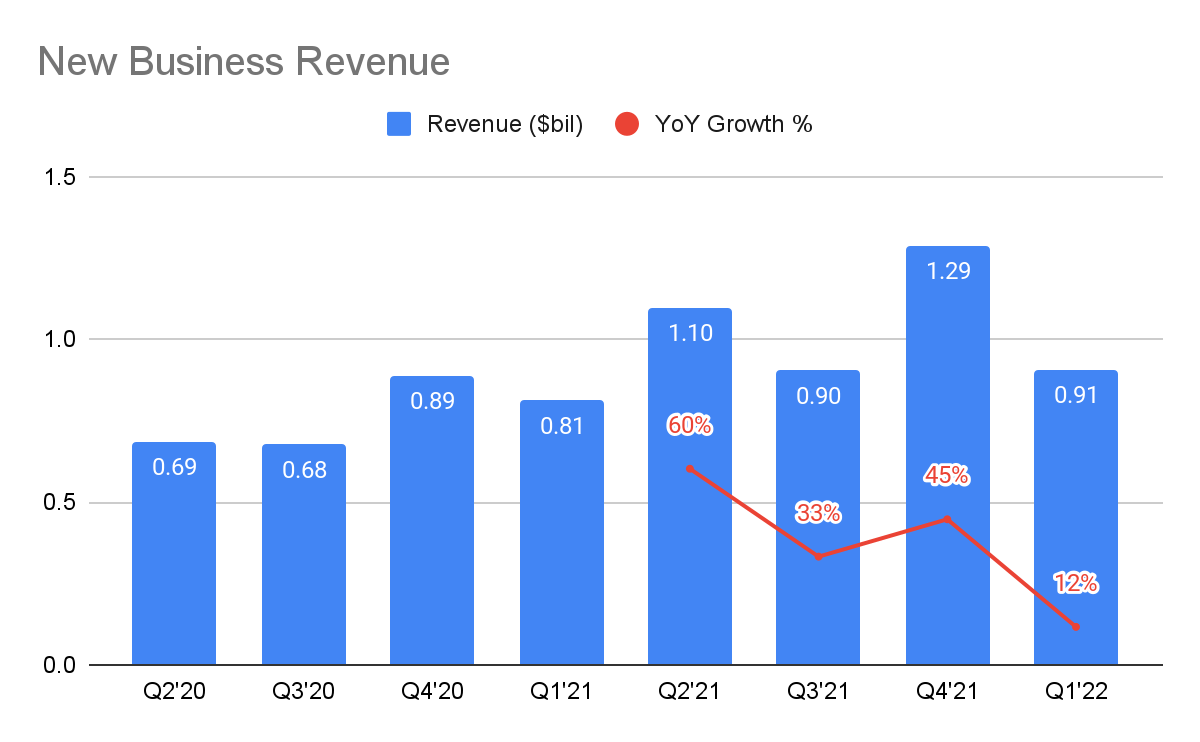

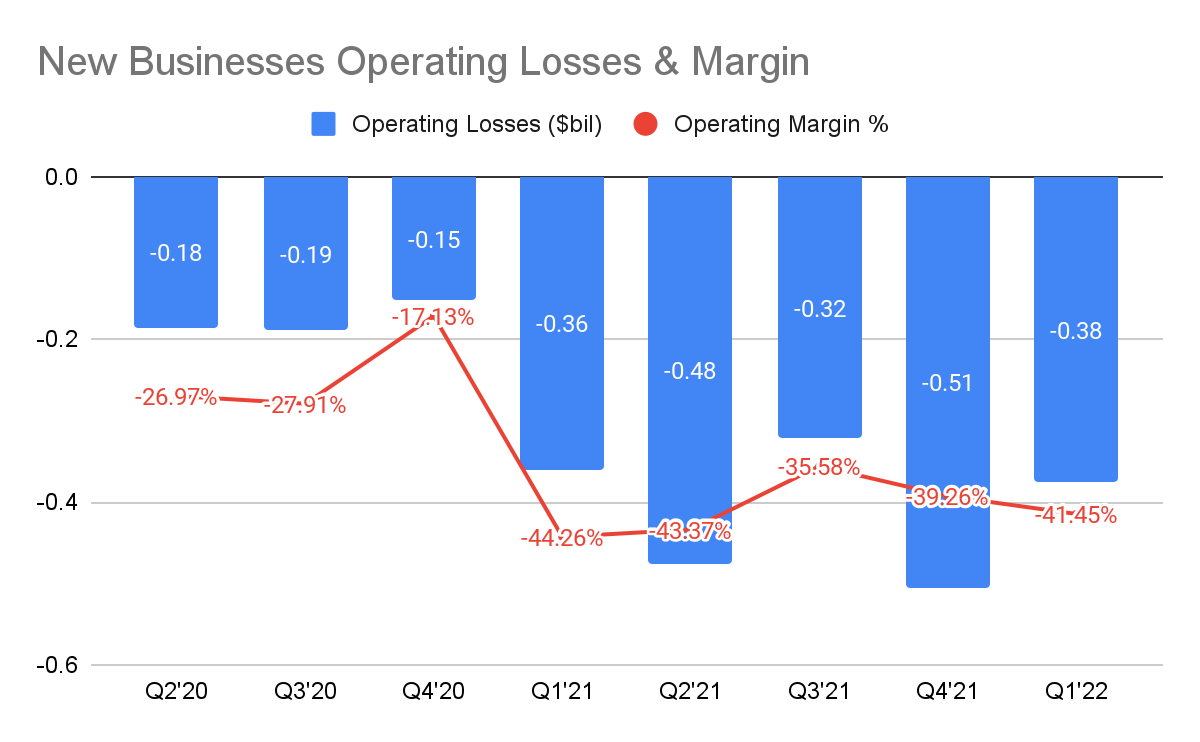

(Source: JD IR) (Source: JD IR)

This is JD’s new business segment, which consists of various business units like Jingxi, a marketplace for price-sensitive consumers to tackle the less-developed region/lower-tier cities.

It is worth reiterating that as the market in tier 1 & 2 cities matures, JD has to step up its investments in the less-developed region where its market share is still relatively low. This requires heavy investments of 5 to 10 years for the company to build out the logistic infrastructure.

However, what’s concerning us today is the lack of meaningful revenue growth with improving unit economics (“UE”) & profitability.

Here, you can see that since 4Q20, its operating losses and margins have widened with increasing revenue. This quarter, its revenue grew by 12% Y/Y while operating losses increased by 5% Y/Y. Worst of all, its operating margin is at -42%, hardly an improvement from previous quarters!

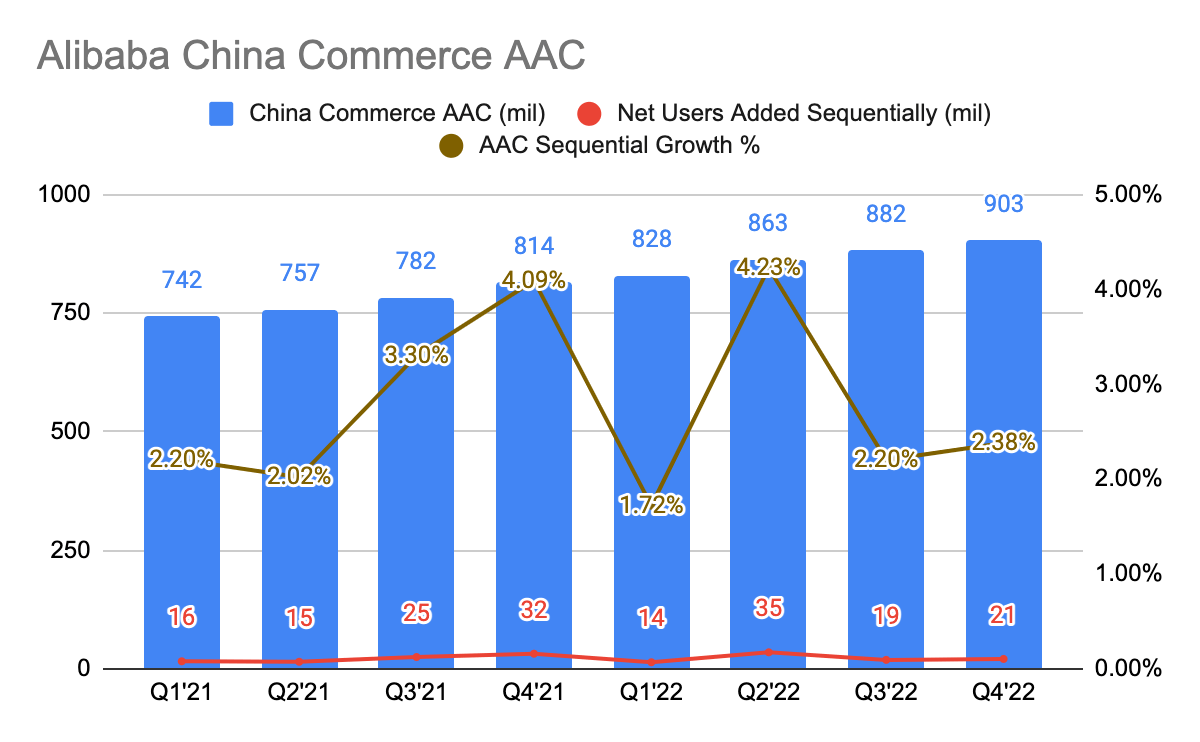

(Source: BABA IR)

Let’s take a moment here to compare this with Alibaba (NYSE:BABA).

Unlike Pinduoduo and JD, Alibaba’s pace of adding new users does not seem to be slowing down. And earlier, we alluded to the China economy slowing down and consumers’ confidence hitting a near low. During Alibaba’s 4Q22 earnings call, Taobao Deals and Taocaicai are showing continuous improvement in UE, while successfully acquiring new users in the lower-tier cities. More importantly, losses are narrowing.

This is something that we do not see in JD yet.

This tells us a few things – (1) JD is having a hard time gaining consumers’ mindshare which explains the slowdown in new users added, (2) lack of operating efficiency, and (3) the lower-tier cities are a tough market to crack. In the near term, this raised questions about JD’s ability to execute and pursue market share.

Since this is an important market, this could hurt JD’s long-term growth.

JD Logistics

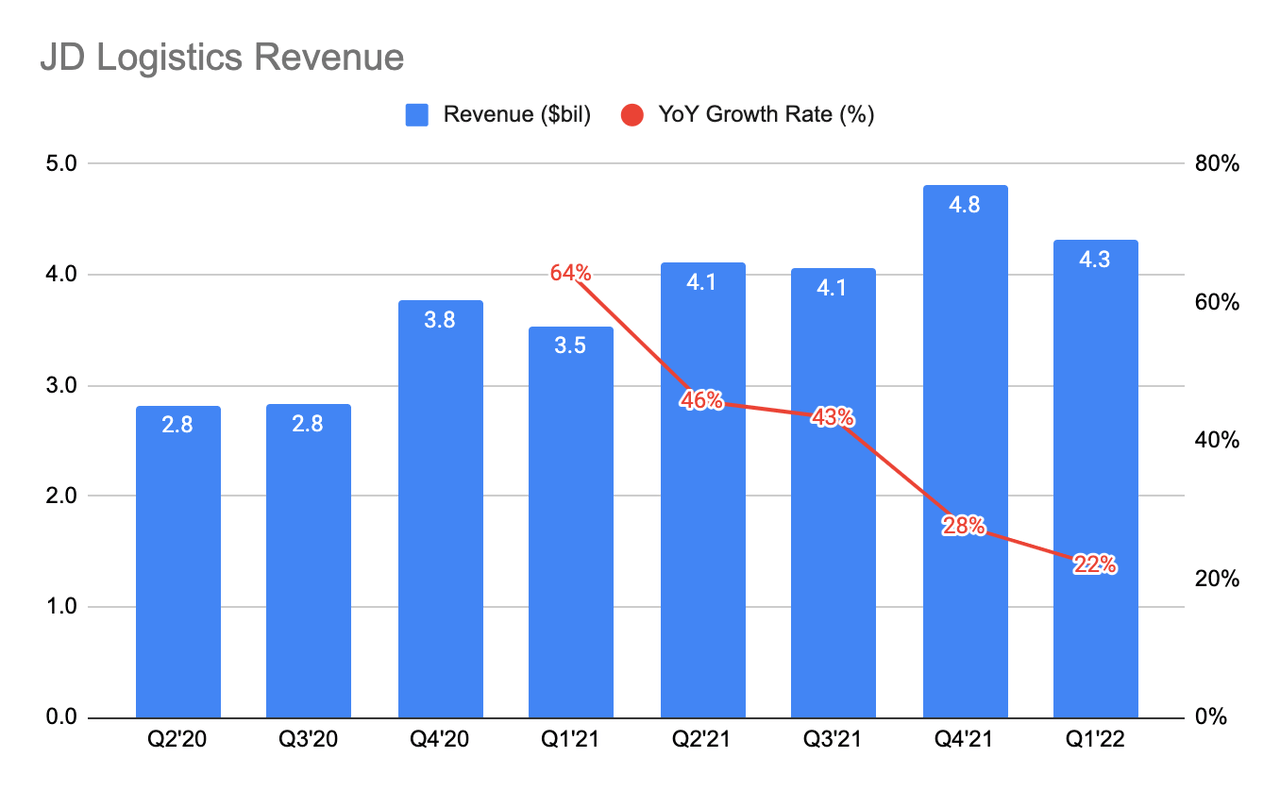

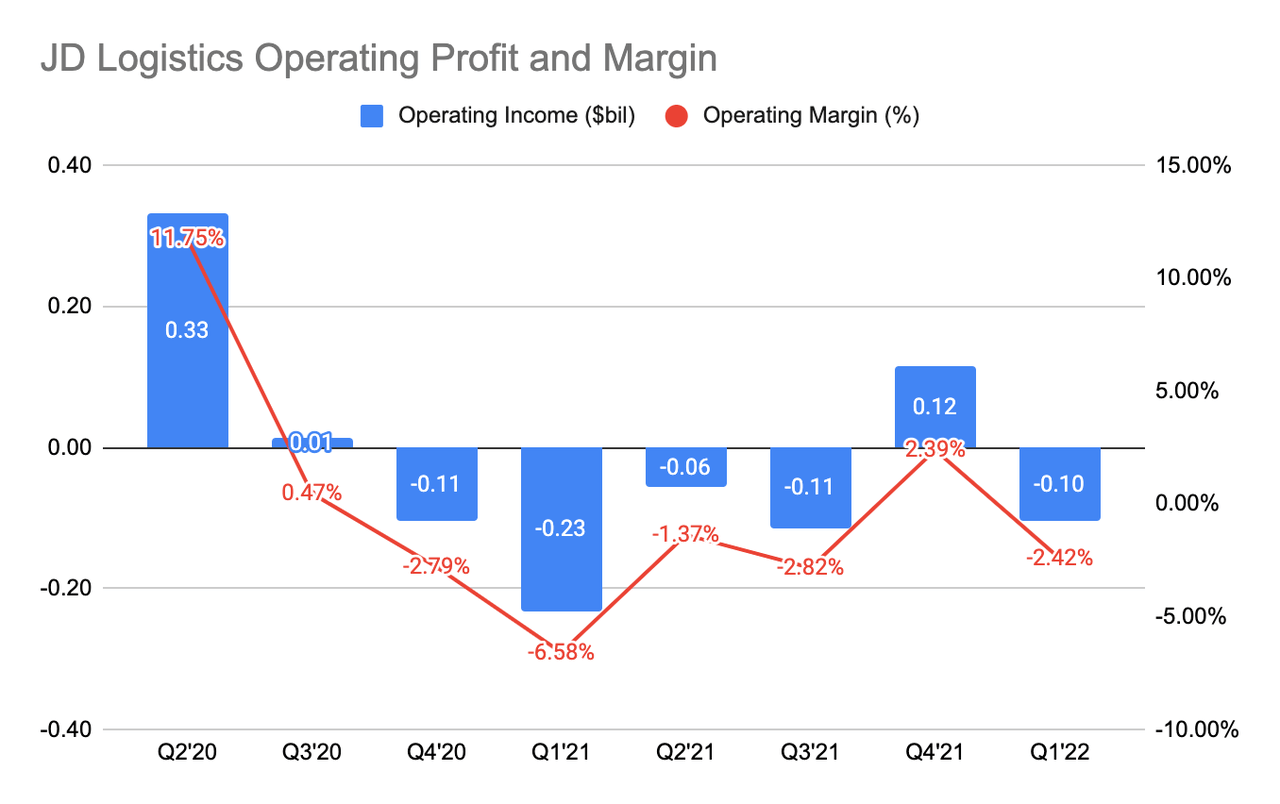

(Source: JD IR)

JDL revenue continues to grow strongly at 22% Y/Y.

This was largely driven by the increasing number of external customers as well as the increasing Average Revenue Per Customer (“ARPC”). Some of these new customers include Douyin/Tiktok, Muji (a Japanese retailer), and Viomi Technology (NASDAQ:VIOT).

Here’s what the management is saying during this quarter’s earnings call:

…we have better control across our entire business process and supply chain…JD has also introduced a series of new and existent initiatives for merchants and SMBs that have suffered from the epidemic in order to lower their operating costs and help them gradually resume function…also helps business partners to generate higher efficiency and more profitability without external disruption. As such, we have gained recognition from our business partners during the epidemic.

In this time where the impact of supply chain disruption is real, customers are increasingly realizing the importance of having a reliable logistic partner, and this COVID lockdown has only further accelerated the demand for its logistic services. And because JD in its early days has invested in its logistic infrastructure, this makes them and its partners more resilient amid the supply chain disruption.

More than that, we believe this helps to promote goodwill and establish a stickier relationship between them and their partners.

JDL is also increasingly selective of the customers they’re partnering with. Quoting from JDL 1Q22 earnings call:

…we have also been monitoring our customer mix and the business conditions of each customer, essentially conducting a health check…customers’ business development and cash flow status are key factors for us to decide whether to extend the scope of our cooperation; we have made timely adjustments to certain business segments that are exposed to potential credit risk…

This is great to see as this ensures lesser churn, more sustainable, and growing revenue (from both existing and new customers) going ahead.

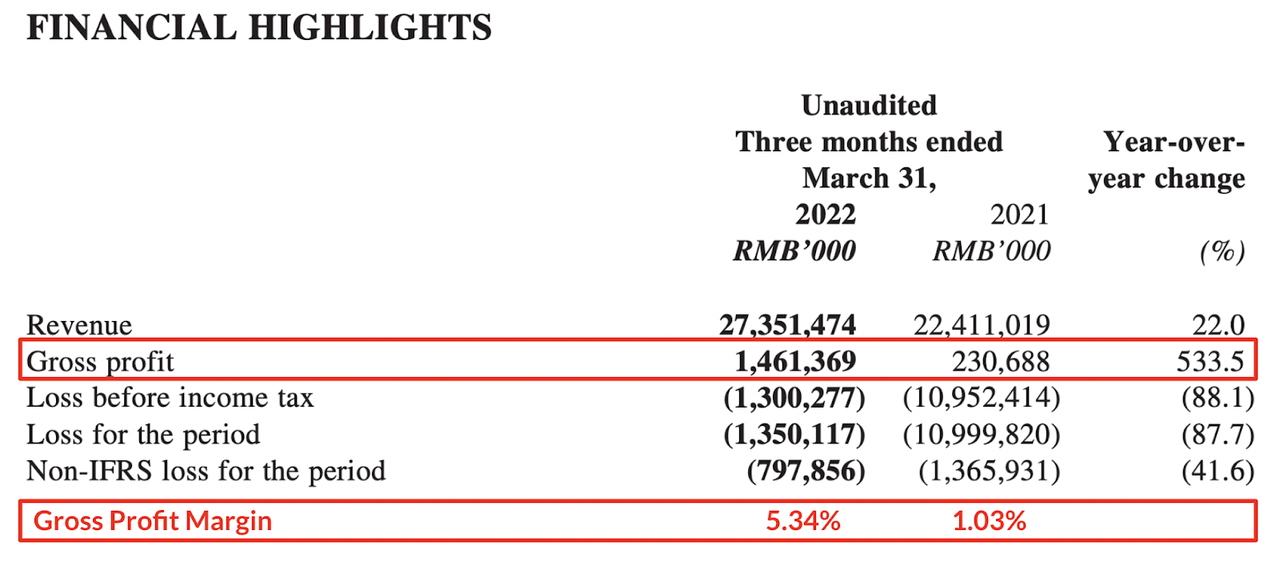

(Source: JD IR) (Source: JD IR)

Due to its strong revenue growth, it has resulted in a gross margin expansion from 1.03% in 1Q21 to 5.34% in this quarter. This is highly impressive.

According to the management:

The increase in the gross profit margin was primarily due to (i) refined cost control measures, (ii) effective restructuring of customer portfolio, and (iii) economies of scale as our revenue grew rapidly, driving efficiency gains in most of our cost components.

As a result, its operating losses improved by 55% Y/Y and its operating margin fell to -2.42% from -6.58% a year ago. This is an inherent strong operating leverage and this speaks of JDL’s highly efficient business model.

However, our concerns remain as part of this growth was driven by COVID, as well as the recent lockdown in China. And the question that bugged us is, how would the revenue fare as we head to normalization? Could we experience a quick decline in growth?

Concluding Thoughts

Overall, we find this to be a decent quarter for JD.

Since its 4Q21 quarter, we have cited our concern over the slowdown of the JD Retail user base, and this has continued in 1Q22. It makes us wonder if JD is facing challenges in terms of acquiring new users in the lower-tier cities, which its closest competitor, Alibaba seems to be gaining momentum in currently. Furthermore, its lack of revenue growth and poor unit economics in its New Businesses segment is something that we will be keeping track of closely in the upcoming quarters.

JD Logistics, on the other hand, has performed well, showing strong topline growth and increased profitability. Owning this logistic infrastructure has bode well as more customers are increasingly flocking to JDL for its reliability and highly efficient end-to-end logistic services. Not to mention, they are also spending more. This makes JD and its partners incredibly resilient in the face of supply chain disruption.

To sum things up, JD continues to face a slowdown in users’ growth, and readers should properly monitor this over time, particularly in how they would fare in the lower-tier cities. And JDL should continue to perform well given the demand for logistic services.

Be the first to comment