FangXiaNuo

Thesis

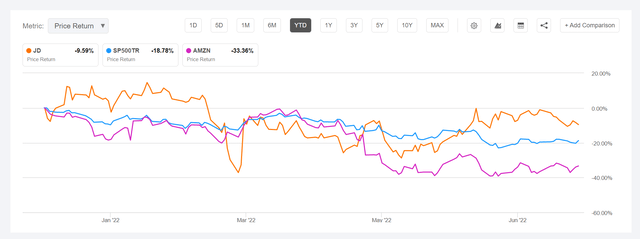

I am very excited about JD.com (NASDAQ:JD) stock. For price levels below $70/share, I believe the company is deeply undervalued as compared to fundamentals. Moreover, most of the headwinds that pushed the stock down in 2021 are easing: China’s regulatory crackdown on tech/internet firms is coming to an end and ADR delisting fears do not seem to bother investors anymore. That said, JD stock has already outperformed US-based peer Amazon (AMZN) YTD, and the US-market in general. I expect this trend to continue.

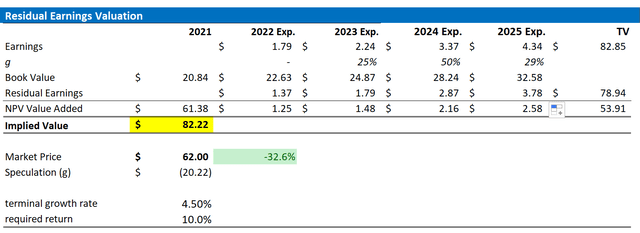

I value JD stock based on a residual earnings framework, anchored on analyst EPS consensus estimates, and see about 30% upside. My target price is $82.22/share. Buy.

About JD.com

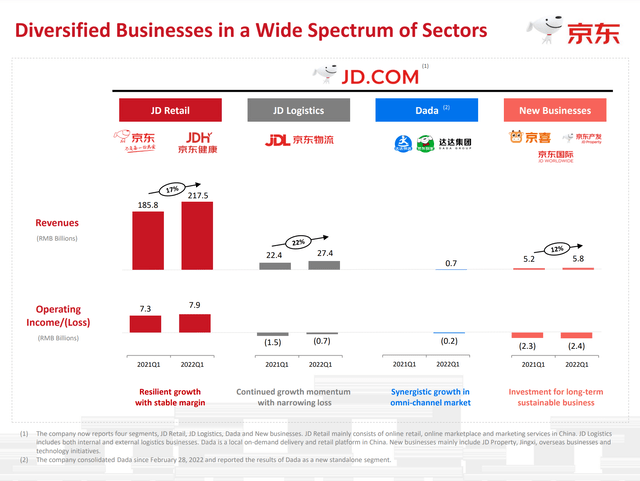

JD.com is a leading internet/technology company based in China, at par with giants such as Tencent (OTCPK:TCEHY), Alibaba (BABA) and Baidu (BIDU). JD is mostly known as a leading e-commerce retailer with about 550 million monthly active users. However, the company also operates multiple other business ventures, including an online healthcare platform known as JD Health, a leading logistic company known as JD Logistics, a real estate arm known as JD Property and a fintech company known as JD Digits.

Most notable is JD’s enormous logistic and fulfillment network, which is ranked as the largest of any e-commerce company in the world with more than 1,300 warehouses.

A View On JD’s Recent Past

Riding the tailwind of the Chinese internet/technology boom, JD has enjoyed enormous growth in the past few years. Notably, from 2016 to 2021, revenues jumped from $37.2 billion to $149.7 billion, reflecting a 5-year CAGR of more than 30%. This is about x10 of the nominal global GDP growth for the same time-period. Respectively, gross-profit jumped from $2.7 billion to $11.0 billion (40% CAGR).

The stock price, however, does not reflect JD’s high growth history and potential – which has only returned about 10% CAGR since 2016. That said, JD’s share price performance was pressured by a few significant headwinds in 2021, which scared investors. Firstly, JD and other internet peers in China suffered from significant regulatory crackdown, which started with the cancellation of the Ant Group IPO in November 2020 and was followed by multiple anti-trust fines, streaming regulations and even price-caps for certain food-delivery services. Secondly, sentiment towards China based equity was hit hard by ADR delisting fears. Finally, JD’s business suffered from a general slowdown of the Chinese economy. Given the real-estate crisis, Covid-19 lockdowns in multiple key cities and rising commodity cost, China has had one of the worst cyclically adjusted growth periods since many years.

However, the general macro/regulatory-situation for JD appears to improve and investor-sentiment is slowly improving as well. The CCP has tried to assure investors that the government is supporting a healthy growth of the country’s internet/platform economy. Even Ant Group is rumored to reboot IPO ambitions. Moreover, China has pushed multiple infrastructure investment programs to support the country’s economy. That said, JD and many other China-based companies have outperformed the US market YTD.

JD’s Financials

It is worth noting that JD continued to perform even despite China’s economic slowdown. For the trailing 12 months, JD generated $155 billion of total revenues, which reflects an approximate 15% increase as compared to the prior period. Although JD’s accounting profit appears low: -1.8 billion for the trailing 12 months, $7.31 billion of operating cash flow strongly indicates a healthy business. Investors should consider that JD has expensed $2.55 billion of R&D investments and an additional approximately $1.5 billion to build the logistic network. Moreover, investors should consider JD’s strong and negatively levered balance sheet. As of Q1 2022, JD recorded $28.5 billion of cash and short-term investments and only $8.4 billion of total debt. This implies that JD is a net creditor for approximately 20% of the company’s market capitalization.

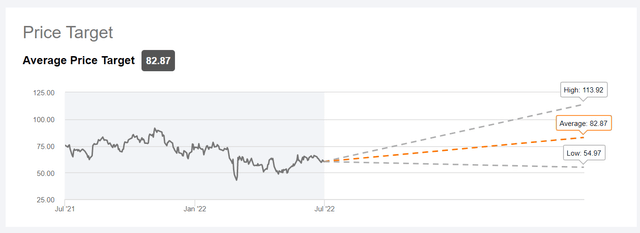

Going forward, analyst consensus expects JD to continue to grow. As available on the Bloomberg Terminal on July 16th, consensus sees JD’s revenues in 2022, 2023 and 2024 at $159.31 billion, $189.46 billion, and $223.76 billion – reflecting a CAGR of approximately 20%. For the same period, EPS are estimated at $1.79, $2.64, and $3.37. Respectively, the share-price targets imply significant upside, with the average target being $82.87/share.

Residual Earnings Valuation

So, if analyst consensus is right about JD’s business forecast, what could be a fair per-share value for the company’s stock? To answer the question, I have constructed a Residual Earnings framework and anchor on the following assumptions:

- To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise.

- To estimate the cost of capital, I use the WACC framework. I model a three-year regression against the S&P 500 to find the stock’s beta. For the risk-free rate, I used the U.S. 10-year treasury yield as of July 16, 2022. My calculation indicates a fair WACC of 10%.

- To derive JD’s tax rate, I extrapolate the 3-year average effective tax-rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply expected nominal GDP growth plus one percentage point to reflect a favorable growth outlook for China’s e-commerce potential.

- I do not model any share buyback further supporting a conservative valuation.

Based on the above assumptions, my calculation returns a base-case target price for JD of $82.22/share, implying material upside of about 30%.

Analyst Consensus EPS, Author’s Calculation

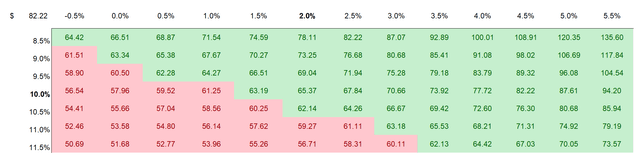

I understand that investors might have different assumptions with regards to JD’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Analyst Consensus EPS, Author’s Calculation

Downside Risks

Investors should be aware of the following downside risks that might cause JD stock to materially deviate from my base-case target price of $82.22/share: First, the economy in China is currently pressured by multiple headwinds including inflation, real-estate crisis and COVID-19 lockdowns. If the Chinese economy would slow more than what is expected and priced in, investors should adjust expectations for JD’s short/mid-term business monetization accordingly. Secondly, China’s internet/tech companies in general, and gaming companies in particular, are strongly exposed to regulatory risk. While the worst seems to be behind us, the elevated risk exposure persists. Third, much of JD’s share price volatility is currently driven by investor sentiment towards Chinese ADRs and risk assets. Thus, JD stock price might show strong price volatility even though the company’s business fundamentals remain unchanged.

Conclusion

JD stock is undervalued, I argue. While the stock has significantly underperformed the US market in 2021, given multiple macro/regulatory headwinds, the performance trend is poised to reverse. I see about 30% upside for JD stock, based on a residual earnings valuation framework and assign a Buy recommendation.

Be the first to comment