josefkubes

We have a good grip on the tobacco businesses. Philip Morris International’s publication was one of the most remarkable analyses in our history and is still one of the most important investments within our portfolio. As we recognize when we miss it, we acknowledge when we get it right. We had good timing with Japan Tobacco follow-up notes and we hope you follow our advice (OTCPK:JAPAF; OTCPK:JAPAY).

Japan Tobacco: It Just Gets Worse

Last time, we concluded that the company was already late with RRP investments. With profit in constant decline and its biggest market outside Japan being down (i.e. Russia), we were not very optimistic about Japan Tobacco’s future development.

2022 Second Quarter Results

Before analyzing the quarterly numbers, let’s start with Russia’s activities. In the press release, the management explained that “while we continue to manufacture and distribute our products in full compliance with national and international sanctions, the operating environment is becoming increasingly complex. Under these circumstances, the JT Group continues to evaluate various options for its Russia business, including potentially transferring its ownership“. As a reminder, Japan Tobacco operates in Russia with a 36.7% of market share thanks to four industrial plants (both for traditional cigarette production and also RRP manufacturing process), employing more than 4,000 people. Looking at the quarterly performance, Russia was down in volume (up in RPP products and down in combustible cigarettes) but price hikes and currency development were very favourable for JP. In numbers, Russia’s revenue and adj. EBIT represents 9% and 17%, respectively, of Japan Tobacco’s total business.

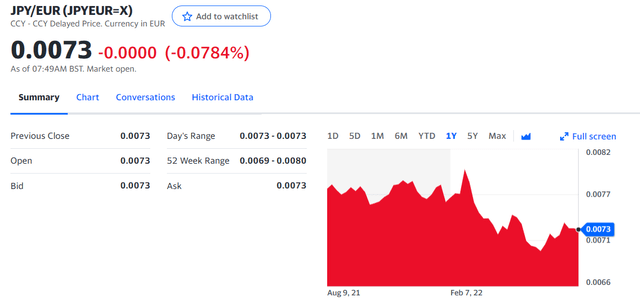

As a whole, the Japanese cigarette company delivered a good quarter with leading indicators up not only on a quarterly basis but also in yearly comparison. Japan Tobacco’s main driver was a favorable currency environment sustained by a weak Japanese Yen that positively supported its sales exports.

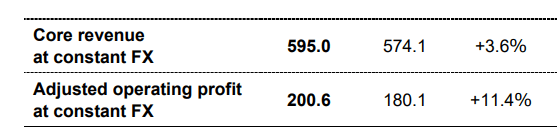

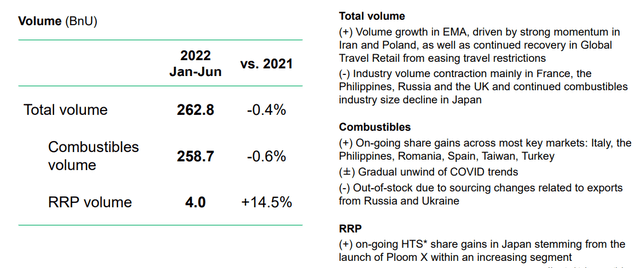

Excluding currency effects in Q2, revenue, adjusted operating profit and net income increased by 3.6%, 11.4% and 20%, respectively (Fig. 1). Looking at the specifics, we should report that the group’s net income was negatively impacted by higher financing expenses. These positive performances were supported against the usual secular decline in the traditional cigarette volumes partially offset by the RRP positive development (Fig. 2).

Japan Tobacco financial snap (Fig. 1)

Japan Tobacco volumes (Fig. 2)

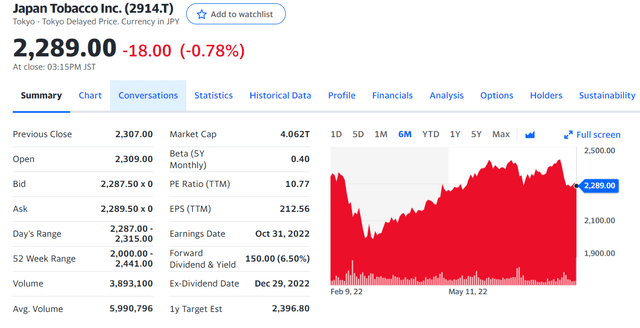

Conclusion and Valuation

At the constant exchange rate, the company downgraded its 2022 outlook. This was due to supply chain constraints and inflationary pressure from raw materials. These past two quarters were positively influenced by currency development but we should not base our forecast on a weak yen development. Almost 20% of JP’s total EBIT is coming from Russia with high execution risk “related to the availability of raw materials exists”. Once again, rolling forward our model and based on a constant P/E of 10x, we derive a neutral valuation. Within the sector, we prefer Philip Morris International and British American Tobacco.

Be the first to comment