Adam Smigielski

As mostly a small cap value and special situation analyst, I’m proud to have identified a number of unknown and/or long forgotten businesses that have gone onto produce exceptional returns. Perhaps, one of most famous research calls was when I interviewed Steve ‘Woody’ Woodward, the CEO of Kirkland’s, Inc. (KIRK), during late June 2020. As it turns out, Captain KIRK, as I love to call the stock, leapt from the low $2s to an apex of $34, in April 2021.

And speaking of captains, today, I write to share an update on another stock I call ‘captain’, Captain JAKK, or JAKKS Pacific, Inc. (NASDAQ:JAKK).

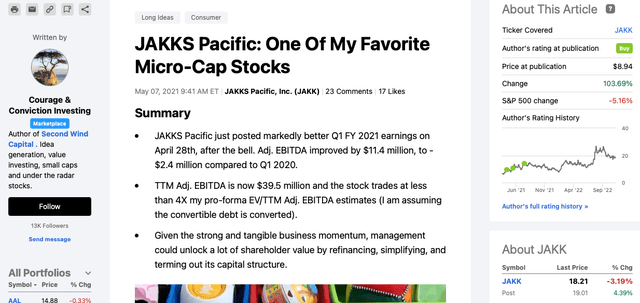

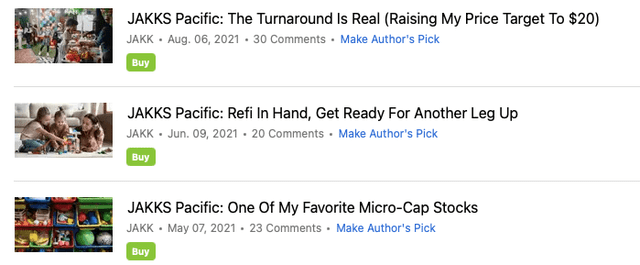

For perspective, I worked out JAKK’s turnaround, in the $8s, in early May 2021. I spoke with the company, figured out the pro-forma balance sheet, and a mapped out a realistic and plausible business recovery pathway. Importantly, I worked this out well ahead of the street. And as I always eat my own cooking, hence the name ‘Courage and Conviction’, JAKK was the largest contributor to my FY 2021 overall performance.

As you can see, enclosed below, please note the first article was published on May 7, 2021.

See here:

Also, for perspective, on SA’s free site and in 2021, I wrote two other articles on JAKK.

Now that we took our little trip down memory lane, let’s focus on the present and the current opportunity, in JAKK shares.

The Setup

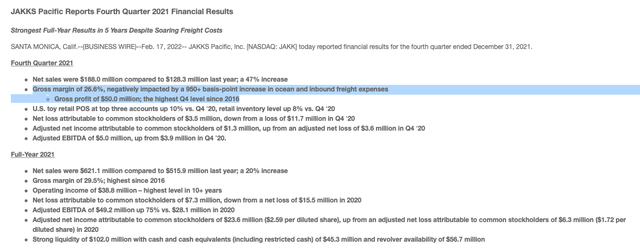

Captain JAKK, the actual business, has performed exceptionally well since May 2021. In fact, JAKK’s Q3 FY 2021 got marred by $40 million of orders getting pushed from September 2021 to October 2021 and its Q4 FY 2021 quarter was great, but marred by container costs.

Enclosed below, as you can see, and to jog readers’ memories, ocean and inbound freight was a 950+ Basis Point headwind to Q4 FY 2021 margins (in other words, $188 million x 9.5%, was diverted to paying usury ocean container and inbound freight, in excess of Q4 FY 2020).

JAKKS Pacific Q4 FY 2021 Earnings Release

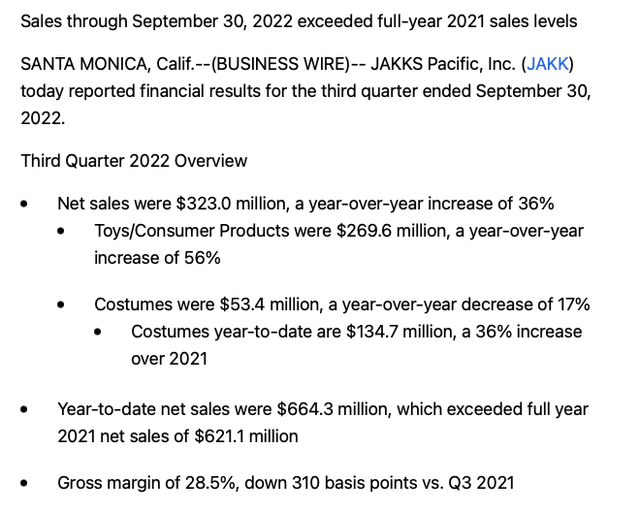

Q3 FY 2022 Results And Q4 FY 2022 Guidance

On October 27, 2022, JAKK reported its Q3 FY 2022 results. Q3 FY 2022 numbers were great, but Q4 FY 2022 guidance was light. On a blended basis, though, if you add Q3 FY 2022 actuals with Q4 FY 2022 guidance, second half FY 2022 results came in ahead of consensus estimates. However, the big Q3 FY 2022 beat and light Q4 FY 2022 guide caused a lot of confusion.

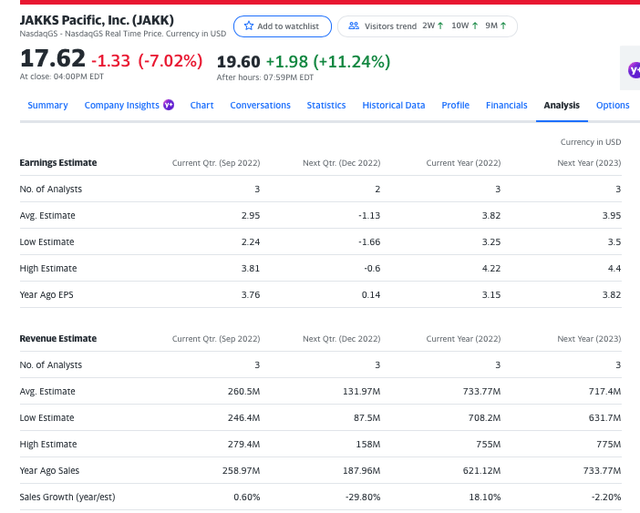

Enclosed below, and as you can see, as of October 27, 2022, full year consensus estimates for FY 2022 were $3.82 in EPS and $733.8 million in revenue.

Consensus Estimates (as of October 27, 2022)

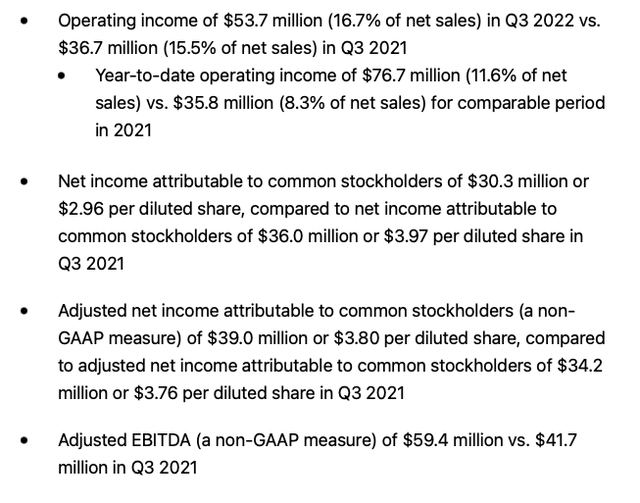

In Q3 FY 2022, JAKK generated $323 million in revenue and $59.4 million in Adj. EBITDA.

However, and equally as importantly, management stated that they are experiencing very strong sell throughs, at retail, and therefore expecting FY 2022 revenue growth of 20%.

As a result, our customers are ready for the holiday season with a great range of product and promotional plans. We are on track to deliver full-year 2022 revenue growth around 20% vs. prior year for the second year in a row, which are exceptional results that the team and I are very proud of.

(Source: JAKKS Pacific Q3 FY 2022 earnings press release)

Let’s Do Some Math Against Consensus Estimates

JAKK posted $664.3 million of revenue during the first nine month of FY 2022. And last year, they generated $621.1 million of full year revenue. So, if you take $621.1 million and multiple by 120%, you arrive at $745.3 million.

If you then take $745.3 million of revenue and subtract $664.3 million of revenue, that translates to only $81 million of revenue. However, and as I showed via 2nd half consensus estimates, a $745.3 million figure is still ahead of $733.8 million in FY 2022 consensus estimates.

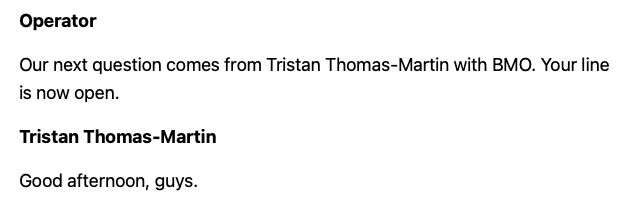

On the Q3 FY 2022 conference call and specifically during the Q&A section, a question was asked by the BMO analyst about Q4 revenue.

Here is how Stephen answered.

JAKKS’ Q3 FY 2022 Conference Call JAKKS Pacific Q3 FY 2022 Conference Call

In other words, JAKK’s Q3 FY 2021 quarter got dinged by the supply chain and crazy ocean freight costs chewed up tens of million of dollars of would be profit, on great FY 2021 revenue results. Therefore, this year, the team at JAKKS planned ahead and got that product out the door and shipped earlier, averting some of the higher ocean freight and risks associated with last year’s supply chain gridlock. As a result, in a pre Covid world, perhaps some of the would’ve shipped product would gone out during Q4 FY 2022, and instead, it got pulled forward to Q3 FY 2022.

Again, though, on a blended 2nd half basis, revenue is ahead of consensus and EPS is by a wide margin!

Also, since we are in the weeds, like any good analyst, JAKK has generated so much profit, during its business turnaround that its NOLs are utilized. Therefore, the YTD EPS of $5.68 is relatively understated, both by a higher share count and higher taxes compared FY 2021 (when they were in a use NOL position).

See here:

Consistent with our bottom-line improvements, strong results compounded with seasonality changes have created a lot of volatility and our expectations for the income tax provision. We now anticipate exhausting any net operating loss carryforwards we have available to us this year on the federal and state levels, which will result in higher tax expense compared to previous years.

Our Q3 tax provision of $11.6 million brings our year-to-date provision to $13.3 million or 20% of year-to-date pre-tax net income. Earlier this year, we began a number of analyses to ensure we’re taking advantage of all readily available deductions to mitigate our tax expense.

(Source: JAKKS Pacific Q3 FY 2022 Conference Call)

See here:

Net of those impacts are adjusted diluted EPS for the quarter is $3.80, an improvement of $0.04 from Q3 2021. The increase in our year-over-year tax provision is an unfavorable $1.10 per share as a noteworthy year-over-year change.

Year-to-date adjusted diluted EPS is $5.68 Compared to $3.15. For the first nine months of 2021. Quarterly EPS is calculated based on a diluted share count of 10,259,789 shares. Year-to-date, EPS is calculated based on a diluted share count of 10,111,475 shares.

(Source: JAKKS Pacific Q3 FY 2022 Conference Call)

The Q3 FY 2022 Conference Call

I elected to listen to the Q3 FY 2022 as opposed to reading the transcript. I wanted to hear the subtext of Stephen Berman’s voice to gauge his confidence level of the business and get a sense what FY 2023 would look like.

If you listen to the replay and audio, it is easy to work out Stephen is upbeat, flying high even, about the business, its momentum, and the drivers of FY 2023!

I will share a few excerpts, but if you have the time and intellectual curiosity, feel free to listen or read the Q3 FY 2022 call.

Highlights Pointing To A Strong FY 2022

1) Strong sell throughs in October 2022

Consumers began to think more about the holiday shopping season, we are seeing some good numbers in October as well across all of our major product lines. A special shout out to our Target Toy Shopping Cart with our perfectly cute range. It’s a tremendous item that the team worked on with Target, a bull’s eye top toy pick, it has been flying off the shelf as soon as it appeared in this quarter.

2) Disguise (its costume business doing very well)

As you know, Q3 is when we get most excited about our market leading costume business. According to the NPD Group, we are the U.S. market leader for the most recent five weeks, with over 20% market share as we were last year.

Through the end of September from dollar perspective, we had 33 of the top 50 Selling items per the same report. With 135 million shipped through September, we’re having our biggest year with the Sky since JAKKS acquired Sky back in 2008.

3) Supply Chain is much better, but not yet back to pre-covid.

From an order of magnitude perspective, as we sit here in late October, we feel we’re in a much better place as it relates to supply chain issues than a year ago. But just because container rates are down, I want to be clear that there’s still work to be done before we can remotely say it’s business as usual on this front.

And Specifically……

So, we shipped those businesses to keep the shelf space, so we could go into 2023 with better initiatives and with cost of container rates dropping materially, from $12,000 to $15,000 in the early part of the year to $3,000 to $2,000, where they’re coming in now and even lower, that will look to grow, but all the other areas of businesses are Disney core business, our style collection, our role-play of everyday princesses have all had great growth.

4) The Business Has Momentum

See here:

We’re selling a broader product lineup into our customer base, and they’re increasing the number of places consumers can find and engage with our ranges. It’s that type of momentum that will help us sustain a portion of our recent growth heading into 2023 despite putting up such great results this year and last.

We’ve also had success this year working fast to secure a high volume of opportunities, and working slightly less fast, but still quicker than most to achieve lower volume, but nonetheless, relevant growth dollars.

See here:

The other nice thing about success is how it tends to open up the doors and create new opportunities, which not be available when things are trending poorly. Good news seems too often lead to more good news and we have other initiatives underway for 2023 that I’m also really excited about, but too soon to start talking about them in this forum.

5) 2023 Catalysts To Propel Velocity And Momentum

A) Sonic launching on Netflix

The action figure team has been working to support a couple of new entertainment initiatives in 2023. To name just one, following up on the excitement of Sonic the movie earlier this year, Sega and Netflix are launching a new series called Sonic Prime during the winter season 2022. We have a full lineup of figures placed at plush, ready to go to support the show in the New Year, which should continue the brand excitement we’ve been seeing since the first film back in 2020.

B) JAKKS has a great relationship with Disney (new content and exclusive set for FY 2023)

2023 is also another huge year for Walt Disney Studios theatrical releases. Releasing in May 2023, the live action musical film The Little Mermaid premieres on the big screen. JAKKS will bring this film to the toy aisle with inspired dresses, large doll, role-play toys and more.

Moving into the fall, Disney will be releasing an all new animated feature Wish that explores how the iconic wishing star upon so many Disney animation characters have wished came to be. Wish releases November 23rd and JAKKS will have a wide array of toys.

We are also participating in a Disney 100-year of Wonder with a range of products including for a limited time a collection of Disney Simpson figures. These are highly collectible molded figures that come in three unique sizes for staking fun. JAKKS will be launching figures over 100 unique characters reflected the past 100 years of consumers’ favorite Disney stories and caricatures.

Putting It All Together

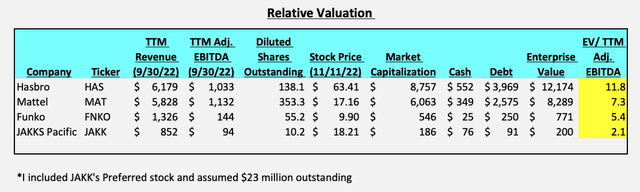

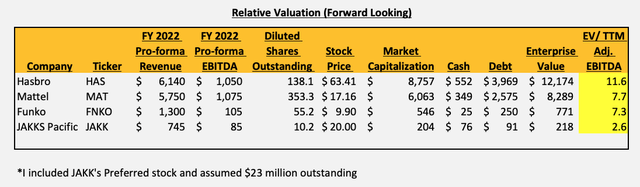

This chart says it all.

That said, the second chart is more important, as it includes updated Q4 FY 2022 guidance, to arrive at a peer comparison valuation, for FY 2022.

In the case of JAKK, I’m projecting a Q4 FY 2022 Adj. EBITDA loss of $4 million (from a $5 million gain, in Q4 FY 2021). And for Hasbro (HAS), Mattel (MAT), and Funko (FNKO), I used their updated FY 2022 EBITDA guidance ranges.

As you can clearly see, JAKK trades silly cheap. We are talking about a business that has been completely transformed, that has a clean balance sheet, that is firing on all cylinders, despite the much tougher FY 2022 macro back drop, and that has clear momentum, headed into FY 2023, including defined catalysts and drivers of future business success.

Stephen’s commentary here says it all:

The other nice thing about success is how it tends to open up the doors and create new opportunities, which not be available when things are trending poorly. Good news seems too often lead to more good news and we have other initiatives underway for 2023 that I’m also really excited about, but too soon to start talking about them in this forum.

In closing, please show me another business that has grown its revenue 20% per year, in back to back years, that has transformed its balance sheet, that has generated robust operating cash flow, and that trades at less than 3X EV/ Adj. EBITDA whereas its peer group trades at 7X to 12X.

If you are looking for small cap value, Captain JAKK should be at or near the top of your list.

Finally, if we place a 3.5 multiple on $85 million of FY 2022 Adj. EBITDA, we arrive at a $30 twelve month price target.

Appendix

Exhibit A – Q3 FY 2022 Highlights

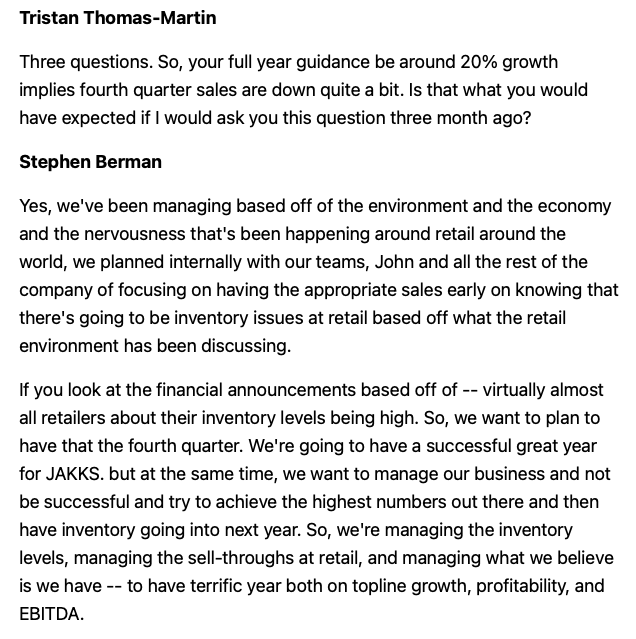

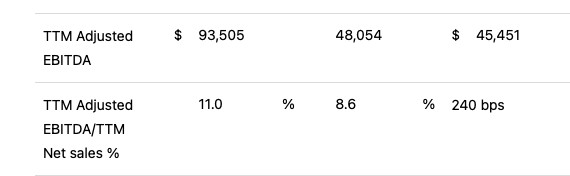

Exhibit B – TTM Adj. EBITDA (through Q3, September 30, 2022)

Seeking Alpha Seeking Alpha

Be the first to comment