Juan Jose Napuri

Just over a year ago, I wrote on Jaguar Mining (OTCQX:JAGGF), noting that inflationary pressures were weighing on the investment thesis considerably. While this wasn’t a company-specific issue with all producers dealing with higher costs, Jaguar was likely to suffer more, given that it was a small producer without the benefits of economies of scale operating in a country where inflation was skyrocketing (Brazil). Since then, the stock has slid over 50% from a draw-down standpoint vs. a mere 8% decline in the gold price (GLD).

Unfortunately, we haven’t seen any real improvement in the thesis over the past year. Due to rising oil prices, inflation has worsened since August 2021, and Jaguar will likely miss guidance again this year. This has set the company up for considerable margin compression for the second consecutive year, exacerbated by the declining gold price. Some investors might note that Jaguar is cheap, which presents an opportunity. However, provided a setup where dozens of names are cheap, it makes sense to focus on the best, not marginal producers in Tier-2 ranked jurisdictions.

Jaguar Mining Operations (Company Presentation)

All figures are in US Dollars unless otherwise noted.

Q3 Production & Sales

Jaguar Mining released its preliminary Q3 results last week, reporting quarterly production of ~21,200 ounces, a 6% decline from the year-ago period. This was related to lower tonnes processed and lower grades at both operations, with ~216,000 tonnes processed vs. ~224,000 tonnes in the year-ago period. From a sales standpoint, the company sold ~22,100 ounces of gold vs. ~23,200 in the year-ago period, with revenue likely to be flat or down in the period with a similar average realized gold price (Q3 2021: $1,753/oz) but lower volume sold. Let’s take a closer look at the results below:

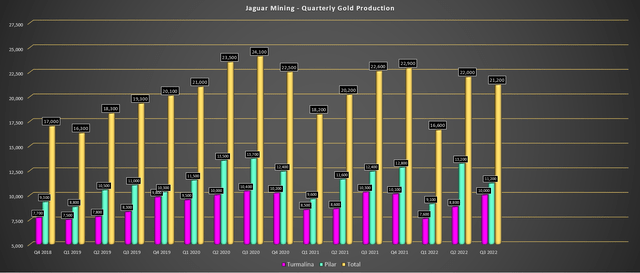

Jaguar Mining – Quarterly Production per Mine (Company Filings, Author’s Chart)

As shown in the chart above, Jaguar’s Turmalina and Pilar mines saw quarterly production decline by 3% and 9% year-over-year, respectively, with the production of ~10,000 and ~11,200 ounces. The lower production at Turmalina was related to lower grades and recovery rates (87% vs. 89%), offset by a slight increase in processed tonnes. Meanwhile, at Pilar, the company processed fewer tonnes at 6% lower grades, leading to a 9% decline in production in the period. The silver lining was that development meters were up substantially in the period to 3,000, a 15% increase year-over-year.

Jaguar’s management noted that this was one of the best quarters since 2021 for Turmalina, with the mine showing consistency in stoping and development, with further improvement expected in Q4 2022. Unfortunately, this was offset by cycling issues which were related to backfilling some higher-grade stoping blocks at Pilar, but production should rebound in Q4 2022. While it’s encouraging to hear both assets should deliver a better Q4, the company is tracking miles behind its FY2022 guidance (86,000 to 94,000 ounces), with just 59,800 ounces produced year-to-date. Even if we assume a 23,000+ ounce quarter in Q4, the company would miss the low end of its range by a wide margin.

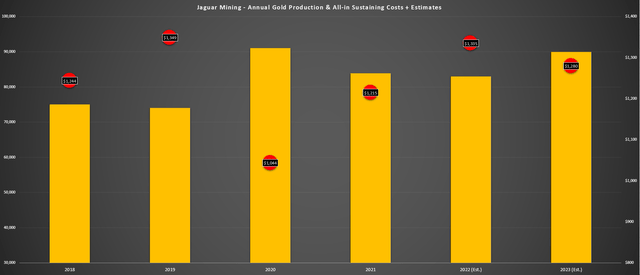

Jaguar Mining – Annual Production & Costs + Forward Estimates (Company Filings, Author’s Chart)

Based on the weaker-than-expected year-to-date results partially offset by the strengthening of the US Dollar (UUP) vs. the Brazilian Real, I would expect Jaguar’s FY2022 all-in sustaining costs to come in above $1,385/oz, a nearly 15% increase. These would mark the highest costs for the company in the past several years, and while we could see some improvement in costs next year if oil prices remain below $90.00/barrel, I would be surprised to see costs fall back below $1,300/oz in FY2023. This does not paint a very attractive picture, given that the company’s all-in costs are nearly $300/oz higher than its AISC, translating to razor-thin margins at current gold prices.

Recent Developments

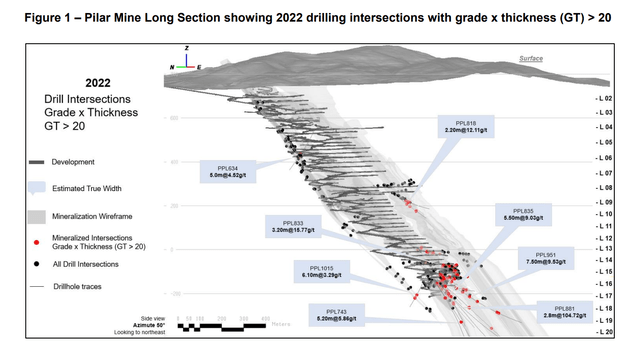

Fortunately, there was some good news in the quarter. Jaguar had success drilling at Pilar and Turmalina. At Pilar, the company continues to report solid drill results at depth, potentially increasing its ounces per vertical meter on level 15 vs. the level 12 mineral resource. In addition, the company is encouraged by drilling results it received below 15, with intercepts like 2.8 meters at 104.72 grams per tonne of gold and 5.20 meters at 5.86 grams per tonne of gold. This suggests the mine could add considerable resources at depth if drilling success continues, and these intercepts are over reasonable true widths.

Pilar Mine Long Section (Company News Release)

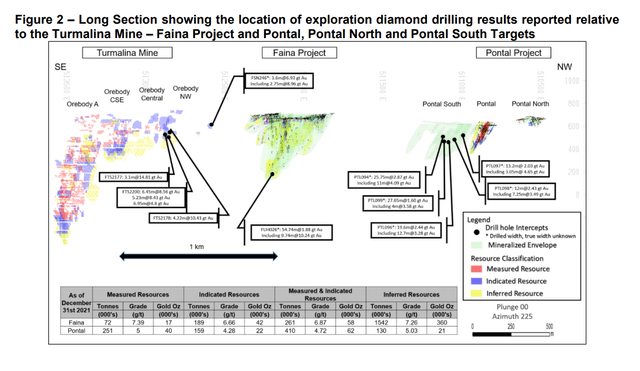

Meanwhile, Project Northwest continues progressing at Turmalina and is advancing at planned rates, now accessing new mineralized structures with new stoping blocks. This will provide new ounces and an opportunity to expand resources on its way to accessing the Faina Project. In addition, the company received encouraging results from the Pontal Project, with several thick intercepts of decent grades intersected. While true widths are not yet available, this suggests that the company could have a three-kilometer length trend available to build on its resource base near its Turmalina Mine, which certainly provides a positive base for resource/reserve growth at this asset as well.

Turmalina Mine, Faina, and Pontal – Long Section (Company News Release)

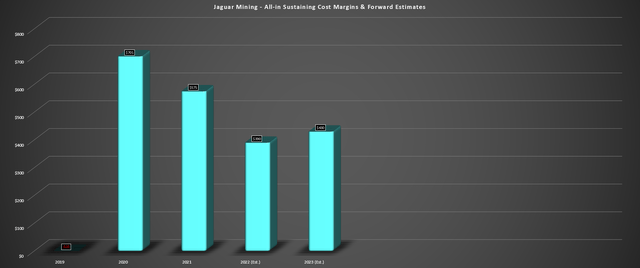

On the negative side, prices of precious metals have been pummeled over the past few months, and Jaguar is set to see another significant decline in AISC margins this year. As shown in the chart below, Jaguar’s AISC margins fell 18% in FY2021 to $575/oz but could slide below $400/oz in FY2022 with the combination of much higher costs (inflationary pressures, stronger Brazilian Real) and a weaker gold price. Assuming all-in-sustaining costs of $1,385/oz in FY2022 and an average realized gold price of $1,775/oz, AISC margins come in at $390/oz. Meanwhile, Jaguar currently has no margins from an all-in cost basis, with its FY2022 all-in costs likely to come in above $1,775/oz vs. a current gold price of $1,650/oz.

Jaguar Mining – All-in Sustaining Cost Margins & Forward Estimates (Company Filings, Author’s Chart)

So, while it’s certainly positive to see that Jaguar is having exploration success and should be able to extend its mine lives, the bigger issue here is that the business looks much different post-COVID-19 with the impact of inflationary pressures. The reason is that AISC has soared from sub $1,100/oz to a new normal of $1,300/oz+, and even if costs do improve to $1,300/oz next year (FY2022 estimates: $1,385/oz), margins won’t recover much unless we can see a rebound in the gold price. To summarize, Jaguar offers considerable leverage to the gold price, but there’s a very high risk of a dividend cut if the gold price falls further, which is one of the few redeeming qualities here.

Valuation & Technical Picture

Based on ~74.3 million shares and a share price of US$2.10, Jaguar trades at a market cap of $156 million, which is a reasonable valuation for a junior producer in a Tier-2 ranked jurisdiction. However, with falling gold prices that have pinched margins of most producers, stock selection is key, and the names that are the most attractive in the current environment are those with considerable production growth on deck. This is because these names will be able to buck the trend and grow revenue and cash flow per share even if the metals price decline continues or if we don’t see an immediate rebound.

In Jaguar’s case, the company appears to be confident in growing production, but this looks like a post-2025 opportunity that doesn’t help investors looking for companies able to buck the trend in 2023/2024. In my view, this makes Jaguar less attractive, given that it’s already difficult to justify owning junior producers, which are a dime a dozen, but especially one without a special story (significant margin expansion or significant production growth near-term, or a top-10 exploration story sector-wide). Therefore, from a valuation standpoint, I continue to see far better opportunities elsewhere in the sector, and in a bear market, when investors can take their pick – it only makes sense to focus on the best.

Summary

Jaguar Mining had another mediocre quarter in Q3 from a production/sales standpoint,. While the exploration success is noteworthy and should help the company to increase its reserve base, I don’t see this as significant enough of a development to favor it over other names. Besides, in terms of Q3 and FY2022, the company is set for another year of significant margin compression, which could keep pressure on the stock. Finally, while not a huge risk, there is some election risk for Jaguar Mining, which relies on only one jurisdiction for its production.

While I wouldn’t expect Presidential candidate Lula (if elected) to be nearly as harsh on the industry as the new Colombian President, Petro, there is some discussion of the potential for new mining royalties in Brazil if Lula is elected. Overall, I wouldn’t expect any new royalties to be too severe, given that there would be strong pushback on anything too burdening. However, any uncertainty related to this (assuming Lula wins) could make Jaguar even less attractive vs. other junior producers in Tier-1 jurisdiction. So, while Jaguar is undoubtedly cheap, I think investors can do far better, with Osisko Gold Royalties (OR) trading for just ~0.80x P/NAV with ~90% cash margins and considerable growth on deck.

Be the first to comment