Eoneren/E+ via Getty Images

Investment Statement

Jackson Financial Inc. (NYSE:JXN) has been growing in double-digits, has an investment-grade balance sheet, and is undervalued based on a peer-to-peer valuation.

The Business

Jackson Financial is the largest annuities provider in the United States with an AUM of 359 Billion. They are retirement specialists who deal only in annuities. A brief definition of an annuity is a financial instrument that makes a series of payments of interest and principal at fixed intervals and has a specified end. The three primary types of annuities are fixed-rate, variable-rate, and index-linked. It’s not necessary for the following analysis to get into the different features of each, just keep in mind that annuities are safe-haven assets.

The Set-Up

Jackson was spun out of Prudential (PRU) on August 27, 2021, at a rate of 1 share of Jackson for every 40 shares of Prudential. Shares began trading on the NYSE on September 20, 2021, at $25. Prudential kept a 19.9% stake in the spin-off. Prudential decided to spin out Jackson as low-interest rates were creating a drag on annuities, and new accounting rules may create unwanted earnings volatility.

Annuities Businesses have been getting bought up since the 2008 financial crisis recent transactions include the sale of the AIG (AIG) Annuities line to Mass Mutual, KKR (KKR) buying Goldman Sachs’ (GS) insurance arm Global Atlantic, and Warren Buffet buying up Alleghany (Y). The multiples that these companies and divisions are being sold at have been very cheap, with Alleghany being bought at 1.26 book, 3x EV/Sales, and 0.97 Price to sales. This was a classic Buffett deal, buying a company at extremely low valuations with the expectation that he expects the business to see significant appreciation in the coming years.

Why Jackson is Attractive

First, I want to point out that Jackson’s peers are not perfect comparisons, as they are all diversified into other products other than Annuities. Jackson’s only products are annuities.

Profitability

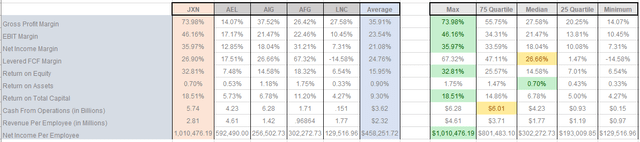

Profitability Peer Comparisons (Information From Seeking Alpha, Compiled and Formatted by Author)

When performing the peer-to-peer valuation (see chart above), I labeled all of Jackson’s matching data in the quartile in green, with the inexact data in yellow as it is generally close to that number. Upon examination, you’ll see that Jackson is the leader in profitability in almost every category except for Return on Assets and Levered FCF Margin. Both of these categories still have respectable numbers sitting close to the median. Jackson leads the industry in profitability with close to 20% better margins than the median values of the industry.

Growth

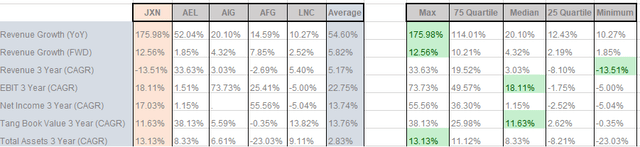

Peer Growth Comparison (Data from Seeking Alpha, Compiled and Formatted by Author)

Jackson has been growing in the double digits using every metric except revenue in the last three years. This is impressive as a low-interest-rate environment is unfavorable for annuity companies. Jacksons’ ability to continue to grow its profitability, assets, and book value over the past three years during this period, speaks to the quality of its investment decisions. A more favorable market is expected as the Federal Reserve has indicated they will raise interest rates. This should drive further growth for the insurance industry and Jackson Financial.

Valuation

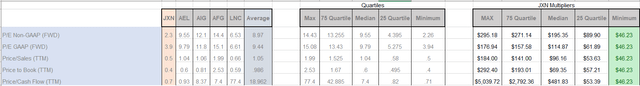

Peer Valuation Comparisons (Data form Seeking Alpha, Formatted and Compiled by Author)

When looking at the valuation tables you can see that Jackson is at the bottom in every metric. Jackson has managed to increase book value at a CAGR of 11.63% over the past 3 years. However, Jackson only trades at 0.4 of its book value.

As Jackson is a mature company, I would expect Jackson to at least be trading in line with its book value. Since the company has higher margins and growth that is either on par or better than the industry, I would expect the company to be at least be trading in line with its peer group. This leads me to believe that Jackson will re-rate higher over time to trade in line with its peer group.

Catalysts

Rising Rates

Annuities companies generally perform better in a rising rates environment as their products will generate a higher yield for customers, thus making them more attractive. At the same time, annuities are often preferred over bonds as they do not go down in price as bonds do in a rising rate environment. As the central banks across the Western world are raising the overnight rate were seeing the yield on annuities rise, this should result in further inflows to annuities

Geopolitical Uncertainty

Further demand is being created by market instability and geopolitical uncertainty as investors look for safe havens. Annuities are on par with a life insurance policy in terms of safety. For many investors who desire income from their portfolio, an annuity makes more sense than a life insurance policy. An annuity also tends to hold its value better than bonds. These factors are appealing to investors and savers with low-risk tolerances.

Headwinds

Inflation

Inflation effectively works as a tax on your capital, diminishing your total return. Realizing this may make an annuity investment significantly less attractive, as, in real terms at least, many investors will be booking in a real loss. It makes them even less attractive to the bulk of individuals buying annuities who are retirees that will use the payments to live on and may need their investment to extend for a long time. Jackson does specialize in this type of investment and has multiple risk management techniques to mitigate these risks, but the basic inflation risk will remain in many investors’ minds.

To Conclude

Jackson Financial valuations are extremely low compared to its peers. With its high growth rate and low valuations, investors should be able to see gains for years to come. A rising interest rate environment and global instability are bullish for safe-haven income assets such as annuities which should push further growth.

Large investors and private equity have been buying annuity and insurance companies over the past years, which is a bullish signal. Inflation is a headwind but due to the many factors, many investors will prefer a safe haven such as an annuity over other safe-haven assets. Jackson Financial looks to have years of continued growth and is substantially mispriced, making this company a strong buy.

Be the first to comment