blackdovfx

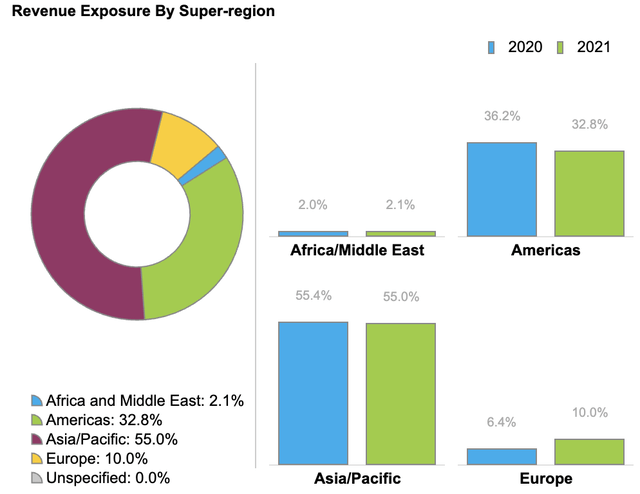

Jabil’s (NYSE:JBL) efforts to build faster-growing businesses could see high single-digit revenue growth over the medium term. Despite the continued near-term supply chain and logistical problems, the increasing popularity of Electric Vehicles and 5G may serve as important key driving forces to facilitate the next growth stage. Growth may also be supported by the continued demand for Jabil’s healthcare products and also due to continual secular growth within its cloud business. While Jabil’s heavy dependence on a small number of customers may be cause for worry, the company’s exposure to emerging markets, such as electric vehicles, may help to mitigate this risk.

EV Growth

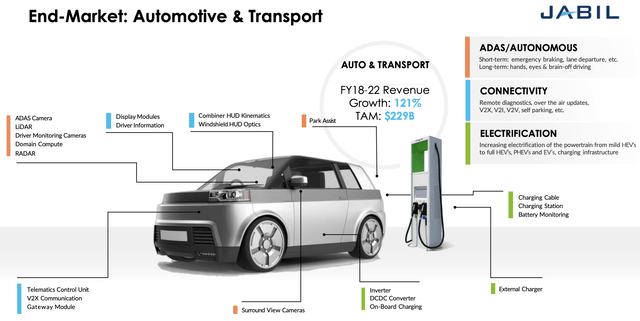

As global automakers increase EV manufacturing, Jabil may continue to see yearly growth in sales at levels over 15%. As authorities across the globe push for low-emission transportation, the company’s EV offerings may become instrumental in the continued growth of Jabil. As evident below, JBL is positioned to grow through all verticals within the EV industry.

Along with the government’s ongoing push towards EV’s, via customer incentives, almost every carmaker has stated completion goals for EVs within the next decade. JBL is in a unique position due to the fact that, despite the sentiment that there may be an imminent recession over the horizon, which may limit growth for the short term, the secular tailwinds of the economic, political, and social environments will likely improve sales growth.

In the EV market, the company’s concentrated client base poses a serious threat from rivals (more on this below). In addition to making progress in building relationships with ‘EV-Only’ manufacturers like Tesla (TSLA), established automakers like VW and Ford (F) have identified this market as a key consumer base.

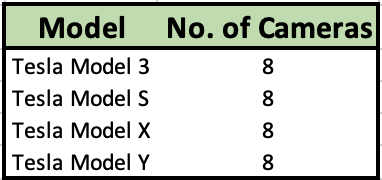

It is possible that Jabil’s strong client base and the transition to EVs would allow its EV revenue to grow at a rate of 15%, thanks to the company’s expertise in vehicle electrification and sophisticated driver-assistance system components. Increased demand for its camera modules, may arise in the future as autonomous vehicles become more common as seen below.

Evspeedy.

Jabil’s top clients, which include companies like Volkswagen and Ford, are intending to increase EV-related sales to over 30% of their total by 2026, up from less than 10% in 2021. Since Jabil’s automotive client base accounted for around 30% of worldwide automobile unit sales in 2021, this might help open up new prospects for its EV powertrain-related goods.

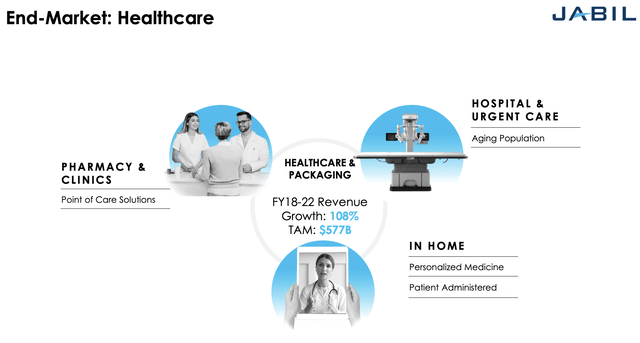

Health: Recession Proof?

As the general population becomes more health conscious and the need for elective procedures increases, Jabil may see double-digit growth in medical device sales in the medium term. Jabil may rapidly acquire knowledge and facilities to build its healthcare offering via acquisitions and strategic alliances, therefore boosting revenue growth and margin expansion.

Jabil’s credibility in the healthcare space has positioned us well to take advantage of this outsourcing of manufacturing trend. Should we enter an economic slowdown, it is our view that OEMs would in fact look to accelerate this outsourcing trend. A recession-resistant end market with long product lifecycles and accretive margins and stable cash flows is why healthcare continues to be such an important component of our diversified portfolio.

Jabil’s medical-device sales may improve over the next cycle as the need for individualized medical solutions grows. Sales of elective surgery-related equipment and digital healthcare gadgets are expected to increase again as the effects of Covid-19 subside and social mobility rises. There may be a movement in consumer expenditure away from electronics and towards wearable medical devices like fitness trackers as a result of falling demand for at-home entertainment and remote work and increased health awareness among the general population.

Increased manufacturing capacity in Jabil’s higher-margin health-care segment may help the company’s bottom line. With the help of strategic alliances with companies like Johnson & Johnson (JNJ), Jabil will be able to access a greater variety of medical devices and capitalize on the trend toward product innovation and platform development. Jabil’s planned factory expansion in the Caribbean may increase economies of scale and reduce production costs.

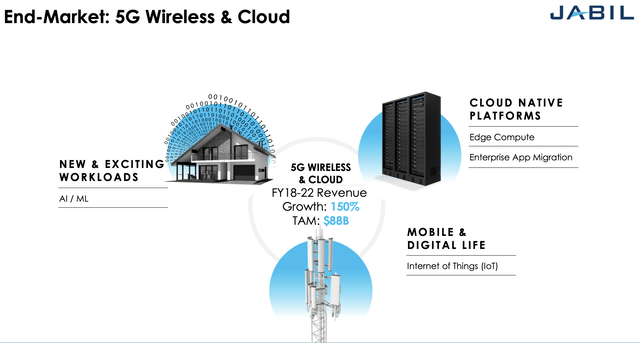

5G & Cloud: The Secular Story

Management expects that the ramp-up of 5G deployment and cloud computing will propel the company’s EMS sector forwards. It’s possible that, if these new divisions continue to grow and expand, they will provide larger profit margins for the firm overall as these are lucrative segments.

As wireless carriers and cloud service providers increase their expenditures, 5G and the cloud are projected to be significant revenue drivers in fiscal 2022 and for many years. Jabil’s EMS revenue growth may also be aided by the retail sector’s revival in the wake of the digital change that followed the pandemic.

Since fiscal ‘18, our 5G wireless and cloud business has nearly tripled in spite of the asset-light nature of the cloud model as our Design-to-Dust value proposition resonates with existing and new customers.

According to a survey conducted by Jabil, more than 90% of stores have acknowledged that investments in automation or efficiency-enhancing technology are vital for continued growth. According to IDC, global expenditure on telecom equipment is expected to increase to $69 billion in 2023 from $64 billion in 2020, which is good news for Jabil as the company hopes that the continuous upgrading to 5G infrastructure throughout the globe will continue to boost its sales.

The need for base stations and other radio access-node equipment, as well as edge computing and other hardware required for next-generation wireless infrastructure, might be a boost for Jabil’s 5G wireless and cloud operations under its EMS sector. 18.2% of Jabil’s fiscal 2021 revenues came from 5G wireless and cloud, which I believe has the potential to continue to grow to 20% in the medium term.

Spending on cloud data centers is expected to expand quickly over the next decade, which allows Jabil’s cloud business to be perfectly positioned to capitalize on this trend, as global organizations continue to migrate to cloud-based settings from on-premise infrastructure. IDC predicts that by 2025, cloud service providers’ infrastructure services would generate spending of $1.3 Trillion, representing a CAGR of 16.9%.

Given that the cloud industry is “asset light” and more design-focused than others, further expansion in this area of Jabil’s business may continue to be a profit driver for its EMS division.

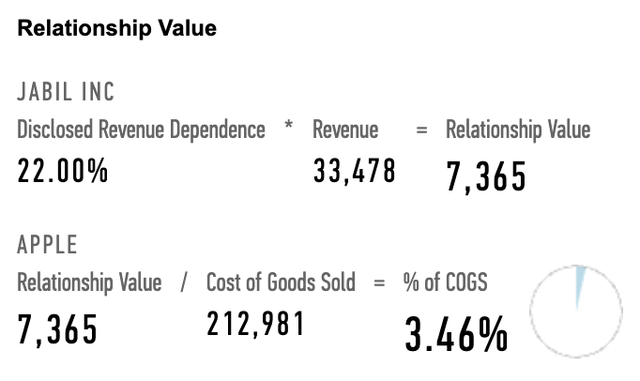

Concentration

As the increase in consumer electronics demand caused by the pandemic begins to wane, Jabil’s considerable dependence on IT giants like Apple (AAPL) and HP (HPQ) may add instability to its profits and cash-flow growth. The concentration has been noted by management and is the focus of the expansion into new verticals such as healthcare and EVs.

Diversification away from Apple as a dependable revenue stream is vital, as Apple is known to eventually take all production in-house and is therefore posting an existential threat to Jabil. Despite Jabil’s best attempts to diversify its sales mix, the iPhone maker’s proportion to Jabil’s revenues increased to 22% in fiscal 2021 ended August, up from 20% a year earlier. In fiscal year 2021, the company’s top five clients accounted for 40% of total sales.

Exposure to Apple’s growth and revenue will be further scrutinized, as Apple made headlines yesterday due to slowing demand for iPhone sales.

Apple Inc. is backing off plans to increase production of its new iPhones this year after an anticipated surge in demand failed to materialize, according to people familiar with the matter.

Jabil, along with Foxconn Technology, is an iPhone case supplier; in 2021, Apple added Lens Technology of China as another vendor, which might dilute Jabil’s market share.

Financials

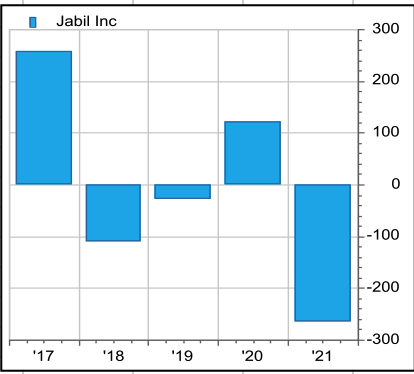

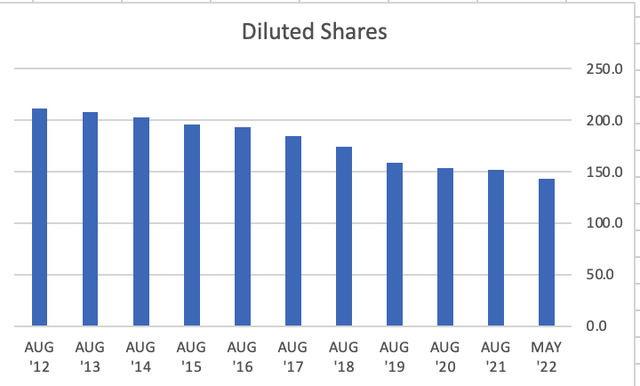

It is possible that Jabil’s free cash flow will become even stronger in fiscal 2023-24 as a result of the company’s increasing operational profits, its prudent capital expenditures, and the reduction in its working capital needs. The company’s strong cash position may allow it to speed up the rate of share repurchases and provide the financial backing to continue its buyback program into 2023.

FactSet; Changes in Working Capital

Secular trends such as the increasing popularity of hybrid and electric vehicles, individualized healthcare, and cloud computing might all contribute to a sustained increase in sales. With growing revenue contributions from margin-accretive business sectors, the company’s core operating margin may likewise increase gradually. As chip shortages subside and the supply-chain scenario improves, inventory challenges might abate in fiscal 2023, compared to previous years. It would also reduce working capital requirements, allowing for greater cash flow.

Jabil is in the midst of its biggest share buyback program yet, totaling $1 billion over the course of two years. Since Jabil has approved a fresh repurchase program until 2023, share buybacks may pick up speed in the coming years. Its strong operational performance has generated substantial cash flow, which might be used to fund a fresh round of repurchases.

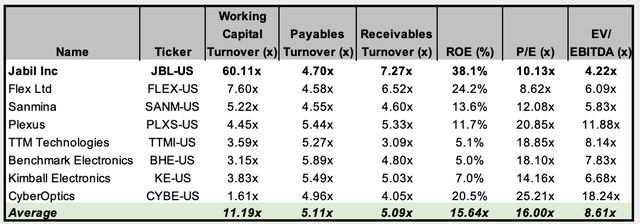

Jabil’s expanding presence in the EV, healthcare, and 5G/cloud markets might reduce the company’s dependence on consumer electronics and boost its stock price. The company is trading at a discount to its peer group, with a current P/E of 10.13 vs the peer average of 16x. The rising contribution of margin-accretive businesses like electric vehicles (EVs), healthcare, and 5G/cloud should help grow earnings and offer a potential tailwind to its valuation, despite the fact that ongoing global inflation could continue to add pressure to Jabil’s consumer electronics exposure and the company’s high concentration in a number of key customers.

Final Thoughts

Jabil’s management will have much of its work cut out for them as the continual secular growth of JBL’s segments will allow their expansion. If management is able to deliver on their goal of diluting the customer base on which they are dependent, this could prove to be vital for JBL’s growth.

Be the first to comment