With the pandemic keeping many consumers home for what is going on weeks in some areas, companies that sell grocery items have seen a surge in business. The rush for consumers to stock their kitchen pantries has generated a large boost in traffic across the consumer staples sector. Retail giant Walmart (WMT) reported a 20% jump in sales for March. Meanwhile, The Kraft Heinz Company (KHC) reported its most recent quarter and blew past analyst sales estimates. It’s becoming clear that many food stocks (and the companies that people buy food from) are going to see a large uptick in activity throughout this unique event. This likely includes The J.M. Smucker Company (SJM), whose shares are rising into the higher end of the stock’s 52-week range. While the company will surely see a boost from these macroeconomic trends, investors cannot forget the consistent mediocre performance of the past several quarters. Any boost from consumers panic-buying groceries will likely be a temporary bump, and the company’s most recent quarter better tells the “big picture” story. The stock remains cheap compared to historical multiples, but we would not be chasing shares as they rise. The company needs to prove itself without a sector-wide rising tide.

The Most Recent Quarter Tells A Bigger Story

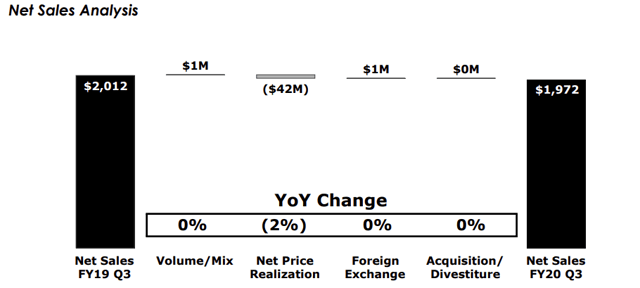

While Smucker will no doubt see a boost in sales due to its essential offerings for consumer cupboards (including pet food, peanut butters, spreads, and coffee), there is no evidence that any sales boost will sustain itself outside of the few months that consumers are mandated to shelter at home. The company reported its most recent three months (ending January 31st), and organic sales were down -2%. This wasn’t an outlier. If we go back multiple quarters, sales have struggled.

The below chart details the past three quarters of comparable sales growth Y/Y since the acquisition of Ainsworth was fully mixed in. In other words, how the company is performing once acquisitions are no longer influencing comparable data.

Comparable Net Sales Growth In 2020

| 2020 Q1 | 2020 Q2 | 2020 Q3 |

| -4% | -1% | -2% |

Sales have long struggled, and the core business of J.M. Smucker was barely growing before the move to acquire Ainsworth Pet Nutrition (an upscale pet food brand). A while back, we questioned whether Smucker still had a viable “moat” (competitive advantage). The company levered up its balance sheet by making blockbuster deals for Big Heart Pet Brands (and Ainsworth later on) to position itself in the pet food industry.

That analysis can be found in more detail here.

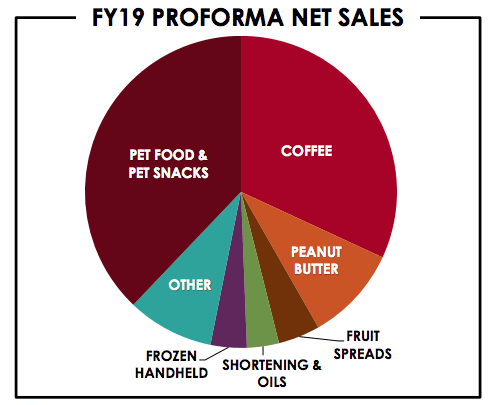

(Source: The J.M. Smucker Company)

The basic premise was that Smucker has concentrated its portfolio around pet food and coffee, obviously placing big bets in anticipation of growth. However, the company’s operating results thus far indicate that it miscalculated these moves. It turns out that these two product categories are both extremely competitive, as well as sensitive to margin pressure from input costs.

(Source: The J.M. Smucker Company)

When both volumes are struggling and pricing pressures create additional headwinds, it’s difficult to argue that your business has a very strong “moat”. The company was much more diversified in the past, which we find to have been a strength that management arguably pivoted away from.

Momentum Carrying Shares Away From A Margin Of Safety

With a fundamental problem that Smucker has yet to prove solved, valuation has become increasingly important for investors. A steep discount on shares would provide a margin of safety in what is still a good business (approaching Dividend Champion status with 22 straight payout increases) – despite the flaws we are discussing.

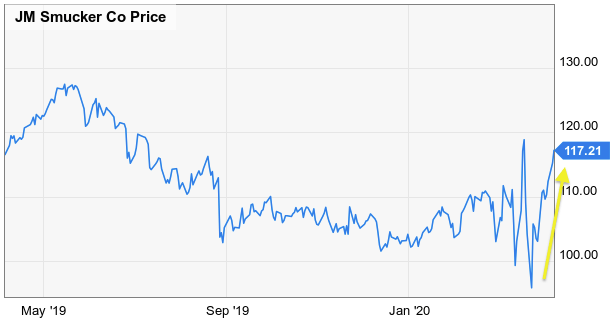

However, the further that the rotation into consumer staple stocks progresses, the less safety there is for investors. The stock now trades at $114 per share, and it is creeping towards the high end of its 52-week range.

(Source: YCharts)

Management is currently guiding full-year earnings at a midpoint of $8.20 per share. This puts a multiple of 13.9X on the stock. The stock’s 10-year median P/E ratio is 19.4X, so there is obviously still a cushion between the current multiple and historical norms. However, investors have to consider the company’s missteps in recent years. If we say that 15X earnings is a more reasonable multiple given the company’s recent performance, the current share price leaves little to no margin of safety for investors.

Even though Smucker has struggled since restructuring its portfolio, the company still generates strong cash flows, converting 10% of its revenue into FCF. Smucker can still right its ship over the long term, and can evaluate the long-term direction of the company as the balance sheet deleverages further in quarters to come. We simply believe that a margin of safety is needed to protect any investment in the meantime. At a 12X earnings multiple, the stock would more effectively price in these operational struggles. This places shares at a potential target price of $98 per share based on management’s guidance for the full 2020 year. Given the ongoing volatility in the markets, investors shouldn’t be quick to dismiss the possibility that shares head lower in the markets once again.

If you enjoyed this article and wish to receive updates on our latest research, click “Follow” next to my name at the top of this article.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment