krblokhin/iStock Editorial via Getty Images

It’s been just about three months since I put out my “the stock is not worth the price” article on J.B Hunt Transport Services Inc. (NASDAQ:JBHT), and in that time the shares are down about 14% against a loss of about 3.75% for the S&P 500. This price action is dangerously gratifying to my already unhealthily large ego, so in some sense it’s probably mentally unhealthy of me to revisit this name, but I’m willing to endanger my already frayed sanity in order to see if there’s now good value here. After all, a stock trading at $174 is, by definition, less risky as an investment than the same stock when it traded at $202. I’ll make this determination by looking at the updated financial history here, and by looking at the stock as a thing distinct from the underlying business. Also, I recommended selling put options in the latest article, so I need to look at that trade also.

Welcome to the ubiquitous “thesis statement” paragraph of the article, dear readers. It’s here where I give you the essence of my thinking about a given stock in a single, pithy, paragraph. I do this so you can avoid subjecting yourselves to the more tiresome elements of my, uh, “rhetorical stylings.” I’m of the view that J.B. Hunt is in many ways a fine business that obviously had a great 2021. My views about the sustainability of the dividend haven’t changed since I last wrote about the business. The problem is the valuation, and that problem is compounded by the fact that management chose to spend over $180 million of owner wealth on what I consider to be overpriced shares. Because the valuation is stretched, I recommend continuing to eschew the stock. That said, the puts I recommended selling last time are even more attractively priced now, so, once again I recommend selling the August puts with a strike of $125. I consider these “win-win” trades for reasons I get into later in the article.

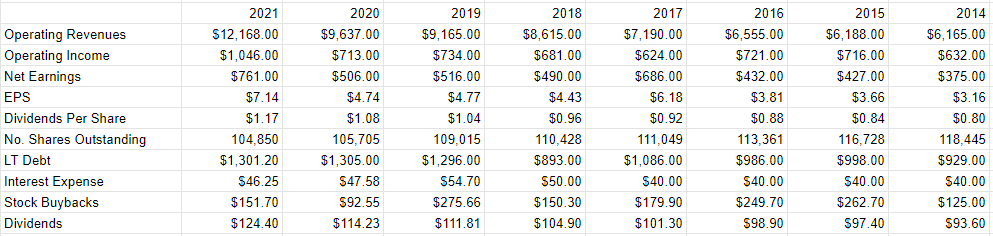

Financial Snapshot

The most recent year has been quite good for the company in my estimation, with the top line up by 26%, and net earnings up by a whopping 50.5% relative to 2020. At the same time, the company has managed to clean up the capital structure a little bit, as evidenced by the fact that long term debt is now about 0.3% lower than it was at the end of FY 2020. The company rewarded shareholders handsomely in my estimation, by increasing the dividend payments by just under 9% relative to 2020.

In case you’re worried that 2021 only looks good relative to an anemic 2020, fret no longer, dear reader. The performance was also good relative to 2019. In particular, revenue was ~33% greater in 2021 than it was in 2019, and net income was about 48% higher. In other words, it seems that in 2021 the company was better than ever.

The Buyback

It’s not all sunshine and lollipops at J.B. Hunt, though. In particular, I think it’s worth writing about the buyback. To those who have the unhealthy habit of following my stuff regularly, it’s no secret that I’ve been of the view that the stock has been overpriced for some time, so when I read that the company bought back shares, I became curious.

Here are the relevant facts:

- On February 16, 2021, there were 105,705,006 shares outstanding.

- On February 15, 2022, there were 104,850,002 shares outstanding.

- Using one of the skills I learned in Primary School I was able to work out that the company retired 855,004 shares.

- The company spent $151,720,000 on retiring treasury stock in 2021 and an additional $28,471,000 on stock repurchased for payroll taxes and other.

So, given the above, the company spent an average of $215.43 on each retired share. I’m of the view that it’s short sighted to decide whether this purchase was good or bad based on the current stock price, because the entire premise behind this enterprise is that the stock price is often “incorrect.” I’ll judge the quality of this decision based on the valuation the company paid. So, put a pin in these numbers for now, and we’ll return to them when I write about the stock.

J.B. Hunt Financials (J.B. Hunt investor relations.)

The Stock

It’s all well and good for me to characterise the performance in 2021 as “quite good.” The fact is that a company that has just posted “quite good” results can be a poor investment at the wrong price. This is because the stock is affected by dynamics that don’t have much to do with the business. In my view, the stock is governed by the mood of the crowd, and its changing perspectives on the very long term future for a given company. The crowd is very volatile, and this adds greatly to the risk of stock market investing in my view. I’ll drive this point home by using J.B. Hunt as an example.

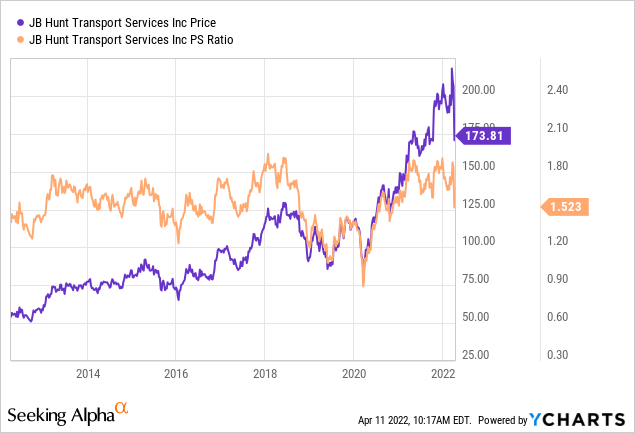

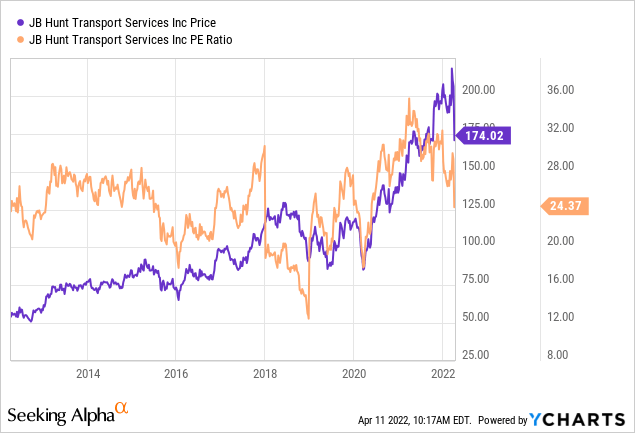

The company reported its latest earnings on February 25th. Had someone bought that day, they’re down about 13% since. Had they waited until March 16th when the market got giddy on the news that J.B. Hunt had entered into a deal with Burlington Northern Santa Fe. They’re down about 21.5% since. In my view, this offers two “teaching moments.” First, the returns on a stock are almost entirely a function of the price paid for that stock. Second, it’s often a very bad idea to trade based on good news that is likely quite “stale” by the time it is announced. Anyway, the investment was “bad” or “very bad” depending entirely on when you happened to buy during a 3-week window, and that people who bought more cheaply did “less bad.” This is why I only ever want to buy stocks that are cheap relative to their own history and to the overall market. In my previous missive about this stock, I threw a virtual hissy fit when I complained that the price to sales had hit 1.9 times, and the PE was around 32. I noted that each of these was very near a decade high. We see from the below that these are now 21% and 23% cheaper, per the following:

Source: YCharts

Source: YCharts

While the shares are more attractively priced now, I don’t think they’re yet cheap enough to get me excited, and for that reason I’m going to continue to recommend eschewing the shares.

Reviewing the Buyback

So, the company bought back shares at a price of $215 per share. Holding all else constant, that works out to a price to sales ratio at a decade higher of 1.88 times. That PE was very near a multi year high of 30 times. Based on this, I think management did shareholders no favours with the buyback activity in 2021. I think a special dividend would have been welcome, or, better yet, debt reduction.

Options As Alternative

In my previous missive, I reminded investors that just because this was a terrible investment at $202 didn’t mean there was no value here. I was quite happy to buy the stock if it got to $125, which is why I sold five of the August puts with a strike of $125 for $0.55 each. Now that the shares have dropped in price, and a few more sands have flown through the hourglass of time, these are now bid at $1.70.

I’m still comfortable buying the stock at this level, and, now that the premium is even higher, I’ll sell another five of these because I consider this to be a “win-win” trade. If the shares don’t fall another 28.5% from current levels, I’ll simply pocket the premium and move on. If the shares do drop below $125, I’ll be obliged to buy, but will do so at a price that lines up with a dividend yield of 1.3%, and a PE of 17, which would put my purchase on the cheap side by historical standards. I’m comfortable with either outcome, hence “win-win.”

Now, in case you’re the sort of person to take the word of a stranger on the internet about “win-win” trades, I have a moral obligation to mute your enthusiasm a little bit by writing about risk. After all, it’s all well and good for me to characterize these things as “win-win” trades as I frequently do, but everything comes with some measure of risk, and short puts are no exception. I’m starting to divide the risks here between the economic and the emotional. Let’s review these in turn.

Starting with the economic risks, I’d say that the short puts I advocate are a small subset of the total number of put options out there. I’m only ever willing to sell puts on companies I’d be willing to buy, and at prices I’d be willing to pay. For instance, the premia on offer for the $200-strike J.B. Hunt puts was quite good a few months ago. Had I sold these, I may have picked up a few extra dollars in premium, but I’d be facing a fairly massive loss on the options. So, the first and most important rule when trading puts is to only ever sell puts on companies you want to own at (strike) prices you’d be willing to pay.

The two other risks associated with my short-put strategy are both emotional in nature. The first involves the emotional pain some people feel from missing out on upside. To use this trade as an example, let’s assume that the market really likes what’s happening at J.B. Hunt, and the shares blow past their 52-week high of $213.85. Since the short put only offers you the option premium, your returns will be muted and this can be emotionally painful for many.

Secondly, I can say from many years of painful experience that it is emotionally painful when the shares crash below your strike price. While these trades have worked out well in the medium to long terms, largely because my strike prices are usually “screaming buys”, it is emotionally painful in the short term. So, I can make a reasonable argument that J.B. Hunt shares are a steal at $125, but if they drop to $100 because of a market meltdown, that will take an emotional toll. I think people who sell puts should be aware of these emotional risks before selling.

Conclusion

Although they’re much closer now than they were when I last reviewed this stock, the shares of J.B. Hunt are hardly cheap in my estimation. The company has had a great year, and in spite of that the shares fell in price. Also, I don’t like the fact that management paid a premium price for buybacks. In my view, this destroyed shareholder wealth. Just because there isn’t value at current prices doesn’t mean this is an irredeemably bad investment, though. This is a very compelling business at $125, and for that reason I’ll be selling five more of the puts I wrote a few months ago. If you’re comfortable with short puts, I’d recommend this or a similar trade. If you’re not, I’d recommend holding until the price falls to more closely line up with value.

Be the first to comment