Scott Olson

The iShares Russell 1000 Value ETF (NYSEARCA:IWD) is a solid one that has a lot of exposure that should stay pretty static or see incremental improvement in the current financial environment. We aren’t making a value case here, but just having places to park money nowadays is already a big ask, especially for larger, more mature portfolios that need to retain value. The sectoral exposures are rather attractive, and the multiple is rather low. IWD is a good spot in equity markets.

IWD Breakdown

This is a very big ETF. There are 857 holdings. Not quite the 1,000 in the name, but close enough. It’s not uniformly weighted. A couple of the top holdings are Berkshire Hathaway (BRK.A) (BRK.B), Johnson & Johnson (JNJ) and Exxon Mobil (XOM). Real US classic value blue-chips. They also give a pretty good view of the sectoral exposures we’re getting in this ETF.

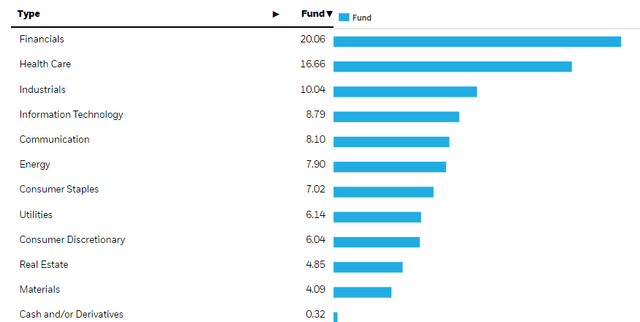

Sectoral Breakdown (iShares.com)

Financials are at the head. We haven’t been quiet about our love of financials in the current environment. BRK adds quite a lot of insurance exposure, and indeed other parts of the portfolio contribute to insurance exposures as well. They all benefit from rising rates on their reserve portfolios, which by pretty consistent mandate are allocated into short term fixed income instruments. Banks are also a solid pick as savings rates lag in the rate-hike environment while lending rates grow.

There are quite a few full-service banks in the portfolio too. Bank of America (BAC) and JPMorgan (JPM) are a couple of the relevant full-service bank exposures. On one hand, we have little hope for the ECM, DCM and M&A advisory businesses within, but where these banks have that as a negative, they often have trading divisions which almost universally benefit from volatility, like a toll on panic and stupidity. The countercyclicality there is something we like, especially as markets are likely to trade sideways for a couple of years now, with intermittent volatility as the Fed plays the multivariate inflation game with the liquidity handles on which markets so heavily rely. Overall, the financial exposures are solid and well received.

Conclusions

There are other points of resilience. We like the heavy healthcare allocation at 17% to financials’ 20%. Healthcare exposures are primarily biopharma, but there’s also some implicit financial exposure with health plans, which benefit similarly to rate hikes as insurance more generally does. There’s also some lab tech and medtech exposures within. All of these are going to be solid in the event that unemployment eventually hit on Fed’s credit throttling efforts, or at the very least that purchasing power continues to decline on inflation. Necessities are always a good addition to the portfolio.

In addition to sectoral resilience, the earnings yield here isn’t too bad. The 14x PE multiple implies a decent 7% earnings yield. To be fair, rates are coming up quickly on that, and in general we have a problem with equity valuation in the US especially, but that’s a better earnings yield than your typical US value-weighted portfolio. There are better things out there, but for US investors looking for something familiar but not trash, IWD looks like a decent exposure.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment