hocus-focus

Expedia Group, Inc. (NASDAQ:EXPE) is one of the leading companies in the travel industry. They offer essential assistance and convenience to clients during their booking process. EXPE posted some recovery from the peak of the pandemic, and actually benefited from their cost-savings initiatives. In fact, EXPE posted a 30% adjusted EBITDA margin in Q3 ’22, up from its 20% recorded in Q2 ’22 and up from its 10% in FY ’21.

Furthermore, despite the fact that the company’s top line has not yet fully recovered from the pandemic, EXPE has managed to deleverage, which improves its solvency. Despite a probable downturn in travel demand, Expedia Group, Inc. is fundamentally appealing and a good buy amid today’s weakness.

Company Overview

EXPE outperformed analysts’ estimates for its total revenue and ended its Q3 ’22 with $3,619 million, up $2,962 million recorded in Q3 ‘ 21 and up from its $3,558 million recorded in Q3 ’19. This growth comes from the improving gross bookings. As of this writing, EXPE has a trailing gross bookings of $92,001 million, up from its $72,245 million recorded in FY ’21, but remains below its $107,873 million recorded in FY ’19. Additionally, management continued to forecast a positive demand environment despite the current high inflationary environment.

Overall, we are pleased to see strong demand extended to the fourth quarter as consumers continue to prioritize travel spending over other discretionary spending. Source: Q3 ’22 Earnings Call Transcript

One of Expedia’s notable growth areas comes from revenue derived from outside the U.S., which grew 61% on a comparable quarterly basis. This growth outperforms Booking Holdings Inc. (BKNG), whose revenue outside the U.S. increased by 28.7% year-on-year in Q3 ’22. This calls into question the notion that EXPE is actually losing market share as a result of a more cautious marketing strategy.

Actually, management has stated clearly that they are on track to reap long-term advantages from their present marketing spending, as quoted below.

In terms of our marketing mix, we have been shifting towards longer term channels including app downloads and other methods to capture traveler intent outside of classic performance channels. These longer term marketing investments, including loyalty and brand, are helping us build a larger base of long-term high value customers. But as important as marketing is, we are ultimately marketing a product and the product has to be great. So most of our energy is going into product innovation to build the best customer experience we can with the most customer benefits to drive loyalty and consumer love.

Among our recent successes, we have introduced exciting new products features including price tracking, trip boards, and smart shopping, all of which are designed to engage customers, to inform customers and to ensure they’re finding the right product at the right time, at the right price. So just to remind you, our flight – excuse me, our flight price tracking feature, which we launched earlier this year, has been a great engagement tool. Since launch, we have seen exceptionally high notification open rates, which demonstrate the value that our customers see in this tool. This feature’s currently live on our app in the U.S. and is on track for global rollout in the first quarter of 2023. Source: Q3 ’22 Earnings Call Transcript

This is one of the reasons why the company’s operating margin is improving. As of this writing, EXPE has a trailing operating margin of 10.99%, up from 3.05% recorded in FY ’21 and 7.96% in FY ’19.

Share Buybacks and Deleverage BS

Another value-adding catalyst for EXPE is its improving liquidity. In fact, the company received a stable outlook from Moody’s and Fitch ratings. The firm is focused to reduce its total debt and currently has trailing total debt amounts to $6,552 million, down from its $8,887 million reported in FY ’21 but remains greater than its $5,589 million. However, looking at its trailing free cash flow of $3,279 million, up from $3,075 million in FY ’21 and up from its $1,607 million in FY’19, makes the company attractive at today’s lows. Finally, Expedia has been buying its own shares and still has 21.8 million shares remaining under its share repurchase authorizations.

Priced Attractively

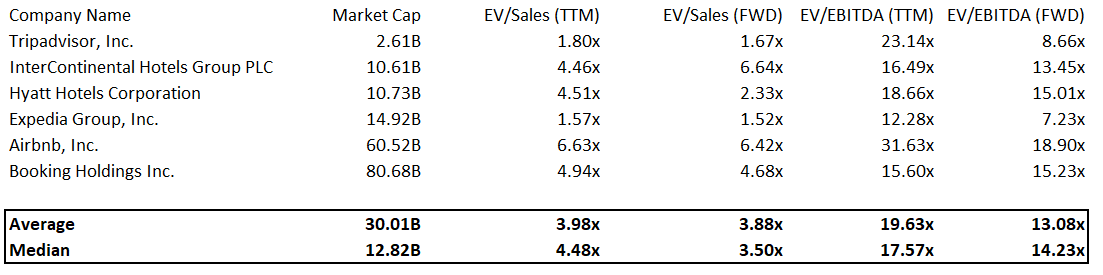

EXPE: Relative Valuation (Source: Data from Seeking Alpha. Prepared by the Author)

Expedia peers are: InterContinental Hotels Group (NYSE:IHG), Hyatt Hotels Corporation (NYSE:H), Tripadvisor, Inc. (NASDAQ:TRIP), Airbnb, Inc. (NASDAQ:ABNB)

As you can see, EXPE trades relatively cheaper than its peers. The company only trades at a trailing EV/EBITDA of 12.28x compared to its peers median of 17.57x. It has a better forward EV/EBITDA of 7.23x than its peer’s figure of 14.23x and compared its 50.44x 5-year average. Looking at the normalized P/E, EXPE is expected to improve further with forward P/E of 13.71x, and has a positive forecast of $7.15 normalized earnings per share with 333.08% YoY growth from analysts. The company produced a positive trailing normalized diluted EPS of $3.68, better from -$0.48 reported in FY ’21 and -$7.15 in FY ’20. Finally, looking at EXPE’s forward EV/Sales of 1.52x reveals a considerable discount compared to its peer’s median. Overall, EXPE is trading attractively at today’s bearish environment.

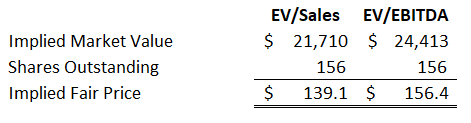

EXPE: Relative Valuation (Source: Prepared by the Author)

Using a conservative implied EV/Sales of 1.84x, an EV/EBITDA of 9.86x, an estimated $11.74 billion total revenue and $2,462 million EBITDA in FY ’22, we can arrive at an average fair price of $147 or a 57% potential upside as of this writing.

Trading Near its $90 Support

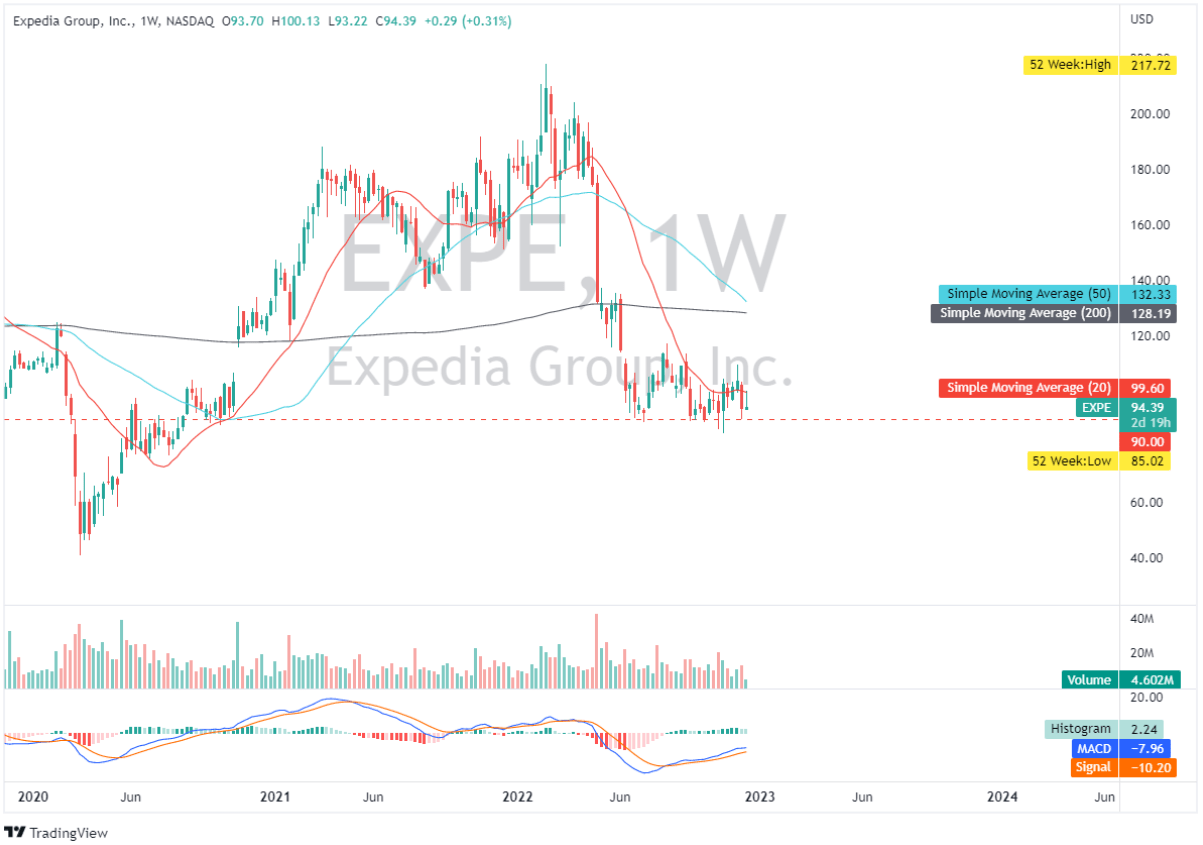

EXPE: Weekly Chart (Source: Author’s TradingView)

EXPE is stabilizing above $90, which acts as support. Another positive catalyst to monitor would be a break and consolidation above its 20-day simple moving average. Finally, even if the MACD indicator is still below the zero line, a positive bullish crossover has been printed, which might induce future buying pressure.

Travel Demand

One of Expedia’s key risks is the level of travel demand in the U.S., which, according to Wolfe Research, will be lower next year as a result of the expected global recession. If this occurs, it will have an impact on the company’s top line and may influence my current valuation.

A cooler consumer price index reading in November, on the other hand, may support the idea of a milder-than-expected recession next year. Additionally, EXPE’s sales outside the U.S. may thrive, particularly in the ASIA region, where analysts anticipate a continuing travel demand recovery supporting positively the overall company’s total sales.

Final Key Takeaway

Despite global travel demand uncertainty, EXPE stays stable and is now more efficient in client acquisition. This resulted in a higher operating margin, which snowballed into a $589.3 million trailing normalized net income, the highest figure over the previous three calendar years. Expedia Group, Inc. is a buy at today’s weakness.

Thank you for reading and good luck everyone!

Be the first to comment