CHUNYIP WONG/E+ via Getty Images

Investment thesis

In my article in June this year on Blackrock’s iShares MSCI Hong Kong ETF (NYSEARCA:EWH), I downgraded it from a Buy to a Hold based on my concern that Hong Kong’s economy will suffer from the Government’s strict approach to the pandemic.

Another reason was that when I went through the top 10 holdings in EWH’s portfolio, which constitutes 65% of their total portfolio, I could only come up with one buy stance and nine that I would rate as a hold or simply not invest in.

All markets have gone down further since June.

EWH versus other Index based market indexes (SA)

A validation of this is that the difference in the fall in the Hang Seng Index and the S&P 500, is only about 3%.

Since all the top 10 companies have delivered their first half of 2022 results after my last article we should look at their fundamentals.

Do their results deserve a drop of this magnitude?

Here they are:

Financial development of the leading companies in EWH

1. AIA Group Ltd.

AIA is well-known to many investors. Market capitalization is HKD 791 billion.

Their operating profit after tax (OPAT) for the first half of 2022 was up 4% to USD 3.22 billion, which equals HKD 25.28 billion. Their EPS was HKD 2.10 for this interim period. The trailing 12-month EPS was HKD 4.83.

The share price has gone down from HKD 80.40 in June to HKD 66.65 as of 12 October, which gives us a P/E of 13.78

They paid out an interim dividend of HK cents 40.28 which was up from 38 HK cents the year before.

After taking into account the final dividend of HKD 1.08 from last year, we get a total dividend based on TTM of HKD 1.483 which gives investors a low yield of just 2.23%. That is, in my opinion, too low bearing in mind what risk-free returns are on Treasury bills.

The net book value is only HKD 38.97, so it trades at a price/book value of 1.71 which is considered quite high compared to other similar companies.

I still believe that the insurance landscape in Asia is getting quite competitive with strong competition coming from Chinese insurers, such as China Life Insurance, and also HSBC.

It is still a Hold in my opinion.

2. Hong Kong Exchanges and Clearing (HKXCF)

It has a market capitalization of HKD 327 billion. In my last article, I pointed out that if they ever were to merge the Shenzhen stock exchange with the Hong Kong stock exchange it would then become the third largest in the world, after NYSE and Nasdaq.

The profit attributable to shareholders in the first half of 2022 was HKD 4.84 billion. This was 27% lower than what they delivered in the same period last year. This meant that the EPS went down from HKD 5.22 to HKD 3.82.

TTM EPS was HKD 8.51 and with a current price of HKD 258.40 we get a P/E of 30.36.

As a result of lower earnings, the interim dividend got cut from HKD 4.69 to HKD 3.45. This brings the total dividend, on 12-month trailing basis to HKD 7.63.

A yield of 2.95% is still not much to get excited about.

Last time around, when the share traded at HKD 358.40, I concluded that HK Exchange was too expensive based on fundamentals and my stance was that of a Sell. Even though we have seen a 27.9% drop in the price to HKD 258.40, I think this only reflects the lower earnings we have seen so I would continue to Sell.

3. Link REIT (LKREF)

Link REIT is Asia’s largest REIT by capitalization. With 151 properties, predominantly in retail, located in Hong Kong and some in China, the value of their real estate portfolio is HKD 228 billion.

It started out purely with retail and car parks, as these properties originally were owned by the Hong Kong government. Diversification, both in terms of segments and geography is taking place.

68.4% is in the retail segment, 17.6% is in car parks and related business, 12.7% is in office space and the remaining 1.3% is in logistics. Geographically it now has 74.8% of Hong Kong, 17,4% in mainland China and a balance of 7.8% are located in Australia and the U.K.

Their 12-month trailing DPU is HKD 3.0567 and as such, the yield has improved somewhat since June when it was 4.82% to a more favorable 5.87%.

Their share price is currently HKD 52.05.

The net book value per share is HKD 77.10 per share leaving investors with a low price to net book value of only 0.67.

Their gearing is still a comfortable 22%, and their credit rating is A.

Since their IPO back in 2005, they have delivered quite a remarkable 15% compounded annual total.

This month, they came out with a business update, like most REITs that do not provide a quarterly updates with financials. It does give us an idea of things like occupancy and other business development. We know that Hong Kong has suffered from the pandemic and it is especially the retail sector that got affected badly as the tourists, especially from China, have been missing.

However, things are gradually improving. An open border to China is more important than the rest of the world.

Link REIT – Retail properties (Link REIT – October 2022 update)

Furthermore, I have been communicating with another Hong Kong REIT called Hui Xian REIT, in which I have a long position. My request to them was to stop issuing new units in lieu of payments of distribution and management fees now that their share price has become severely depressed.

Fortunately, it appears they have listened. I went one step further and told them that since they have a stellar balance sheet with plenty of cash, they should be buying back their own shares. It is a company that trades for 22 cents on the dollar. Where can they get prime properties at such discounts?

They have so far not taken me up on this sensible suggestion.

It was interesting to note that Link REIT in fact has bought back and canceled more than the announced HK$150M worth of units. I hope others follow suit.

I change my stance from a Hold to a Buy.

4. CK Hutchison Holdings (CKHUY)

I regularly cover CK Hutchison Holdings. My last article was published on the 10th of August with an update on their first half of 2022 performance.

As with most other companies, their share price keeps going down. For CK Hutchison, it is down 19% since Medio June. It is presently HKD 42.50.

Contrary to a lower share price, the company actually delivered profits attributable to shareholders that were up 4% from the year before, with HKD 19.09 billion in profits. The EPS came in at HKD 4.98 in the first half of 2022.

The trailing 12-month EPS is HKD 8.93. As such, the P/E is a tantalizingly low 4.8.

Their price to net book value is just 0.32 so you get to buy a dollar for just 32 cents.

On top of that, you get paid 6.4% in dividends while waiting for the value to potentially be realized.

All this is a value investor’s dream.

I had a Hold stance in April, and this was maintained in my August article. This some readers may understandably question, as the fundamentals are very good. I would not argue with that. When the Hong Kong market turns a tide, a large conglomerate like CK Hutchison, with its good fundamentals will also follow that tide.

My hold stance is most likely biased since I own a part of some of their subsidiaries and they have destroyed shareholders’ value over the last 10 years in my opinion. These companies have lost roughly 70% of their value over the years. I do not know why Li Ka-Shing’s companies trade at such large discounts and if it is a valid discount. All I know is that it is what it is. I am reluctant to put more funds into any of their companies, unless I am convinced that they in fact treat all shareholders the same way.

5. Sun Hung Kai Properties (SUHJY)

Another company that I cover is this real estate giant. In my recent article from last month, I had a Hold stance on it. This is an interesting company so I recommend that you read my last update.

Their accounting year ends on the 30th of June each year, so we shall just focus on the latest financial report available which is the Annual Result for 2021/2022. The net profit attributable to shareholders was HKD 25.56 billion. This was 4% lower than the 26.67 billion it made the year before. EPS was HKD 8.82, down from HKD 9.21 last year.

Based on the present share price of HKD 90.60 we get a P/E of 10.27.

With a net book value per share as high as HKD 204.91 we get a low price to net book value of just 0.44.

They paid out HKD 4.95 in dividends for the year, giving it a yield of 5.5%.

I would still sleep well if I owned Sun Hung Kai. Especially in view of solid earnings and excellent balance sheet.

Their share price has not fallen much since June. It was HKD 91.50 and is now HKD 90.60.

I maintain a Hold, but might buy the shares if we see a further decline in the price.

6. CLP Holdings

China Light & Power, has a market capitalization of HKD 138.8 billion and is one of two utilities in Hong Kong. These two operate in a duopoly with favorable terms from the government of Hong Kong which basically guarantees them a given return on their investment where they simply can pass on the cost to their consumers.

However, as I mentioned in June, things were not going well with their Australian operation. As a result of unfavorable forward contracts, the Group recorded a consolidated loss of HKD 4.86 billion for the last six months. It was their largest loss ever, and it was a stark contrast to the HKD 4.62 billion they made in profit from FH in 2021.

This resulted in a loss per share of HKD 1.92 in the first half of 2022.

The share price has dropped from around HKD 66 in June to HKD 54.90.

They do pay out quarterly dividends, which on an annualized basis is HKD 3.1.

It presently gives a yield of 5.65%.

My stance on CLP is a Hold.

7. Techtronic Industries (TTNDY)

They have a market capitalization of HKD 141 billion. It is a large manufacturer of tools with well-known brands such as Milwaukee Tools and Ryobi.

They delivered EPS of HKD2.48 in the first half this year and have a 12-month trailing EPS of HKD 4.95.

Based on its present price of HKD 76.90 per share, it means its P/E is 15.53.

As a value investor, I just don’t get excited about a company that can be bought at a price to net book value of 3.8 and a dividend yield is 2.50%.

I own no company that operates in the manufacturing sector. As such I still pass on such investments.

8. Bank of China Hong Kong

As I pointed out in my last article, this is not the same as Bank of China, which is listed in Hong Kong under ticker code 3988.HK. It is their local business unit which to the best of my knowledge restricts their business to lending and deposits within the Hong Kong market, which does give it a somewhat different risk profile than their main bank in mainland China. Their market capitalization is HKD 273 billion.

BOC HK had EPS in the FH of this year of HKD 1.27 and a 12-month trailing EPS of HKD 2.25 and the present share price of HKD 25.80 it gives us a reasonable P/E of 11.46.

Their dividend yield is quite comparable with many other banks in Asia as it is 4.38%.

Last time around I compared it with that of Bank of China (HK.3988) which now gives its shareholders a dividend yield as high as 10.08%, one can see the difference in risk reflecting the large gap in yield. The spread in yield has widened slightly from 5.1% to 5.7%.

My take on BOC HK is that of a Hold.

9. CK Asset Holdings (CHKGF)

More details about the history of this company can be found by reading my last EWH article.

Their EPS for FH 2022 was up 58% to HKD 3.55. Their 12-month trailing EPS is HKD 7.08.

Based on the latest share price of HKD 45.70, their P/E is attractive at just 6.45.

The same goes for their price to net book value as the book value per share is HKD 101.89 which means the P/NBV is only 0.45.

The dividend yield is 4.86%.

The fundamentals are indeed very solid. However, my conclusion in June was that CK Asset was less interesting to me as the company has steered away from a pure real estate company to something that looks more like a conglomerate.

This remains the same. I maintain my stance of Hold.

10. Hang Seng Bank (HSNGY)

This local Hong Kong bank is 62% owned by HSBC (HSBC). It has a market capitalization of HKD 224 billion.

In the first half of 2022 EPS was down almost 50% from HKD 4,44 to HKD 2.31. This gives us a 12-month trailing EPS of only HKD 4.83 which based on a share price of HKD 117.40 gives us a P/E of 24.30.

The net book value per share is also down from HKD 96.42 to HKD 90.27.

I am long HSBC and prefer that instead of owning Hang Seng Bank.

Economic development of Hong Kong

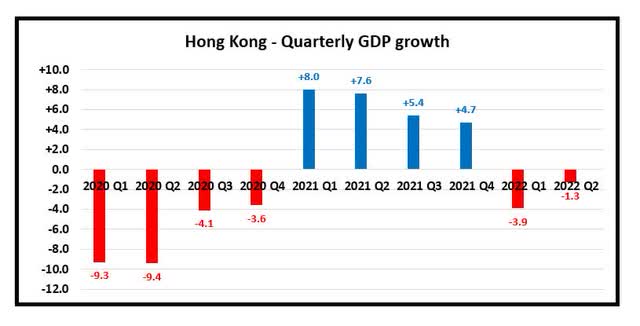

Hong Kong’s economy shrank 1.3% in the second quarter of this year, following a 3.9% contraction in the first three-month period of 2022.

Hong Kong quarterly GDP growth in percentages (Data from HK Census and Statistics department. Graph by author)

The tide does seem to have turned, and I would not be surprised to see positive growth in Q3 and onwards.

The bigger picture is of course what will Hong Kong’s role be in the future.

It has thrived as an intermediary between China and the rest of the world. This was undeniably a result of it being a British colony with British law and language and attractive taxes and a large contingency of international businesses located there.

The last couple of years has not only seen the departure of many well-educated Hong Kong people, but also the departure of multinational companies.

Their reasons are linked to changes in how Hong Kong is being managed.

A recent study conducted by the Hong Kong General Chamber of Commerce which has about 4,000 corporate members, found that about 30% of large firms reported they were considering leaving Hong Kong or had already departed in the first half of the year, while 10% had left for good.

It is not only the draconian curbs on traveling due to the pandemic that is holding it back.

The Chamber also called for the Hong Kong government to lower the thresholds for talent schemes to avoid losing out to Singapore. Once companies have relocated, they may not return in the short term.

The former Chief Executive of Hong Kong C.Y. Leung recently visited Japan and South Korea in a bid to attract more companies to set up shop in Hong Kong. He pointed out that in order to attract overseas companies to Hong Kong again, ‘0+0’ and ‘0+3’ are important factors, but not the only factors. Hong Kong also needs to resolve their misconceptions about the city’s political situation, including ‘one country, two systems’, ‘high degree of autonomy’ and judicial independence”.

That could be harder to achieve.

Conclusion

What happens in China matters a lot to what will happen in Hong Kong.

The difference between the two is becoming increasingly blurred each year. One day, it will, in my opinion, be just another city in China.

In my recent contrarian pick, which was investing in BlackRock’s iShares MSCI China A Shares ETF (CNYA), one of my followers here on SA shared his frustration about his Hong Kong portfolio with this message;

Comments to article on ETF CNYA (SA)

I have sympathy and share some of his frustration. It would be better if companies there were valued more “fairly” in relation to their earnings, solid balance sheets, and low price-to-book values.

But it is what it is. As a value investor, you really need patience. At least you get paid quite well with many of these companies while you wait.

With regard to my stance on EWH at this moment, I maintain a Hold as I would like to see the border opening up between Hong Kong and China and to see what comes out of the 20th National Congress of the Chinese Communist Party which starts on the 16th of October in Beijing

Be the first to comment