byakkaya/E+ via Getty Images

iShares Core MSCI Total International Stock ETF (NASDAQ:IXUS) is an exchange-traded fund that provides investors with exposure to international developed and emerging market companies. The fund is designed to track the performance of its benchmark, the MSCI ACWI ex USA IMI Index.

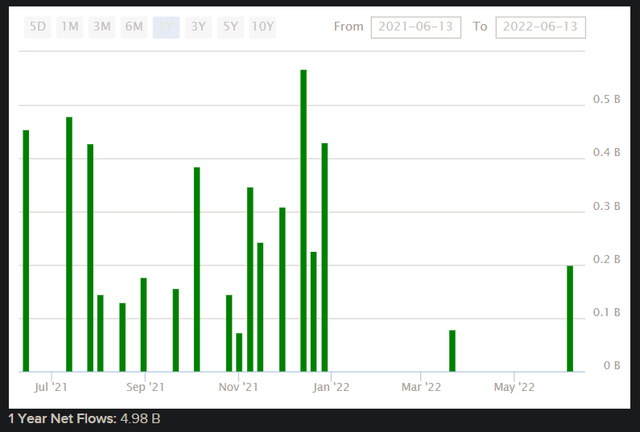

The broader a fund’s strategy, the lower the chance the fund will be capable of generating alpha; IXUS had 4,348 holdings as of June 13, 2022, making it exceptionally diversified. Assets under management were $26.72 billion as of June 13, 2022, which would also make the fund very popular. IXUS has been the beneficiary of circa $5 billion of flows at the fund level over the past year.

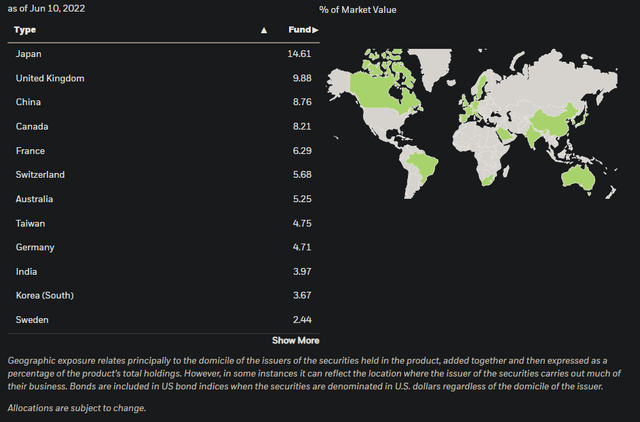

No matter how large IXUS’s fund flows are, they are unlikely to affect the price of fund’s underlying allocations, given there are well over 4,000 open positions across several geographies and exchanges: Japan is interestingly the largest geographical allocation (15%), followed by the United Kingdom (10%), China (9%), Canada (8%), France (6%) and Switzerland (6%), among many others.

The fund’s benchmark has constituents in small-, mid- and large-cap stocks, across 22 of 23 “Developed Markets” countries, excluding the United States, and across 24 “Emerging Markets”. IXUS follows this strategy, although presumably for practical and economic reasons, its number of holdings does not match the number of its benchmark’s constituents (the latter being 6,639). In any case, IXUS is basically a bet on non-U.S. global equities, and it is market-cap weighted (larger companies earn larger positions in the portfolio).

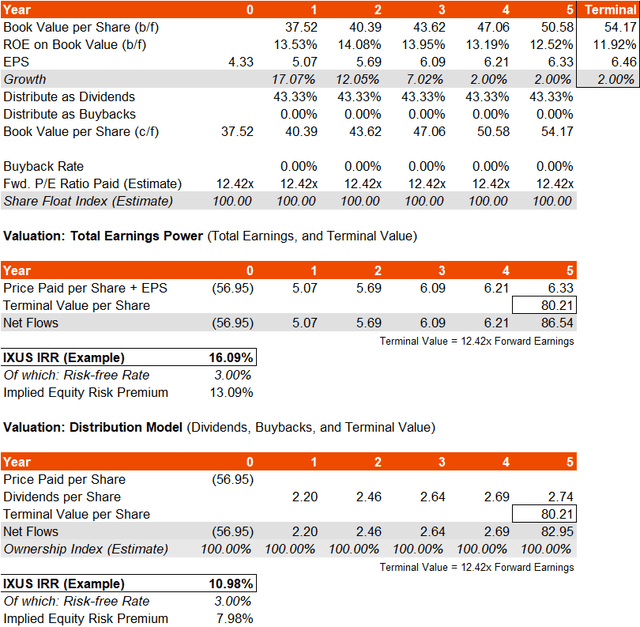

A recent factsheet for IXUS’s benchmark index (as a proxy for IXUS itself) reveals trailing and forward price/earnings ratios of 14.54x and 12.42x, respectively, with a price/book ratio of 1.68x (all as of May 31, 2022). The dividend yield was just under 3%. The data implies a forward return on equity of 13.53% and a distribution rate of earnings into dividends of about 43%. That return on equity is not high, but it is reasonable. Lower-return nations like Japan bring the average down (Japan especially given its weighting in the IXUS portfolio).

Assuming no buybacks for the moment, and keeping the rest of the data constant, but also assuming a 3% notional risk-free rate (I calculate the fund’s country-weighted 10-year government bond yield as being 2.80% at the time of writing, but we can assume circa 3%), and a roughly stable return on equity (changing based on a fairly quickly maturing earnings growth rate), I generate the IRR gauge below.

This generates an IRR estimate of about 11-16%. My three-year and five-year average earnings growth rates are 7.87% and 11.97%, respectively; Morningstar currently estimate a three- to five-year average earnings growth rate of 10.37%. So, my midpoint is about in line with that estimate. Still, in spite of the forecasted jump in earnings over the next year of 17% (by MSCI), if we assume 2% earnings growth “only” thereafter, the IRR is still 7.80-12.68% depending on the model used (if we were to assume buybacks, that would increase the lower-bound IRR, but the upper-bound would remain constant). Since IXUS is a low-beta fund, and global interest rates are low, this suggests an implied equity risk premium of circa 4.80-9.68% in the latter case, and 7.98-13.09% in the original gauge.

Long-term equity risk premiums are usually in the 3.2% (globally after accounting for survivorship bias) to 4.2-5.0% for mature markets that have happened to do well over the long run (like the United States). If we assume an equity risk premium globally of 5%, my IRR gauges in the more conservative version above suggest that IXUS is at worst probably fairly valued, and at best possibly due for 59% upside (that is, comparing an IRR of 12.68% with an implied ERP of 9.68%, to a “fair” 8% cost of equity with a 5% equity risk premium; in each case, assuming a 3% risk-free rate).

This also assumes a stable earnings multiple. Even on 0% long-term earnings growth, a healthy 5% equity risk premium and a long-term risk-free rate of 3% would generate a forward multiple of 12.5x (1 divided by the sum of those two components being 8%). The current multiple is 12.42x. So, in a sense, IXUS is valued as if there will be no long-term earnings growth. Perhaps more likely, it is pricing in positive but low long-term earnings rates, and an elevated equity risk premium. This would suggest that IXUS is probably generally undervalued.

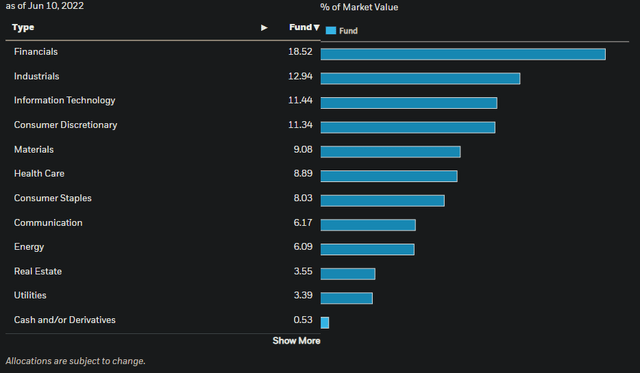

I wouldn’t necessarily expect rapid earnings growth from IXUS, especially with Financials being the largest sector allocation (18.5%) followed by Industrials (12.9%). Nevertheless, the fund does look like it is being underestimated.

Markets have sold off globally recently, and arguably international markets have suffered unduly. Even the U.S. equity market is starting to look inexpensive (or at least much less expensive than before, if we assume low interest rates in the long run). I would be generally bullish on IXUS at the moment. Lower prices often imply elevated equity risk premia, and if you can hold through the volatility, that means higher returns. In this case, IXUS is backed by a decent underlying total earnings power, and it is highly diversified, so provided you buy in at a time when valuations are lower, it is difficult to go wrong in the long run.

Be the first to comment