ansonmiao/E+ via Getty Images

Main Thesis / Background

The purpose of this article is to discuss the iShares China Large-Cap ETF (NYSEARCA:FXI) as an investment option at its current market price. I typically don’t invest directly in individual emerging market indices, preferring instead a diversified approach through the Schwab Emerging Markets ETF (SCHE). However, rather than add to that current holding, I am considering branching out into FXI because I see the potential for strong returns from China in particular in the months (and hopefully years) ahead.

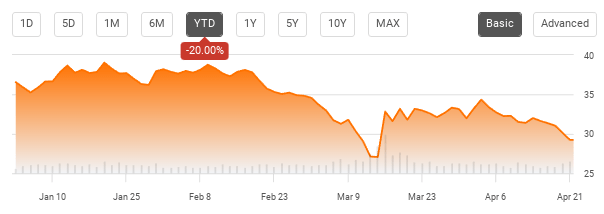

This is due to a number of factors. Some of the major headwinds facing Chinese equities have pressured FXI, and other country-specific ETFs, into deep negative territory this year. This has been due to regulatory concerns, geo-political concerns, and a strict lockdown policy. While these remain headwinds, I think the current weakness has baked a lot of this in already:

Fund Performance YTD (Seeking Alpha)

As you can see, FXI has hit exact bear market territory since January 1. Whenever I see this for any stock, fund, or sector, I am immediately drawn to the potential contrarian play. With respect to China, I see some value here now that equities are so deep in the red. There are a number of reasons for this bullishness, which I will get to in the following paragraphs. However, I will add the caveat that this investment is not for the risk averse. Chinese equities are very likely to see enhanced volatility in the near-term, and investors should only undertake this investment idea if they can withstand short-term losses without panicking.

FXI Is Performing Poorly – What Gives?

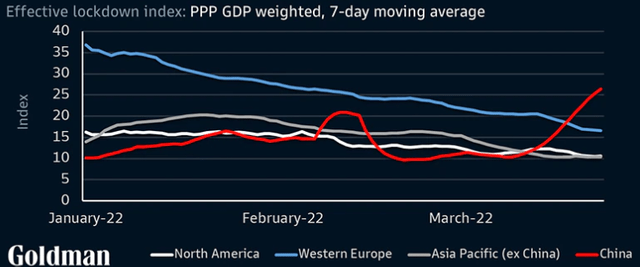

To begin, I want to talk about some of the reasons behind recent Chinese weakness, including FXI. After all, knowing the why behind these poor returns is important when evaluating if there is value here, or if it is a value trap. To be fair, there are a number of reasons for FXI’s decline recently, but one of the biggest points is the strict Covid-policy the government has been enacting. Taking a “zero Covid” approach has meant increasing lockdown measures, restricting travel, and other forced quarantine measures. While this is not necessarily new for the Chinese government, it has come at a time when most of the world is actually opening back up, especially in developed markets. Countries in North America and Europe have been working to get back to normal, so China’s approach differs in a distinct way.

In fact, if we take a look at Goldman Sachs “lockdown index” (which measures official restrictions and mobility data), we see a marked difference between North America, Western Europe, and the rest of the Asia Pacific, compared against China:

Lockdown Index (Goldman Sachs)

This, of course, makes investing difficult for most of the country and most of the underlying sectors. In particular, however, I see it damaging to consumer-oriented names as this dampens confidence and impairs supply-chains. If consumers cannot get out to shop, or can’t get the items they buy online delivered timely, spending is going to suffer.

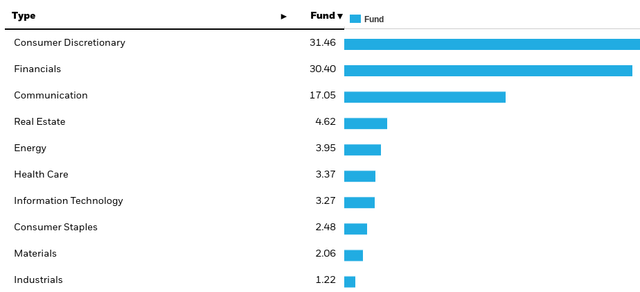

When looking at FXI, as well as other large-cap Chinese equity funds, this plays a paramount role. This is because the Consumer Discretionary sector is actually has the largest weighting within FXI. Further, once we add in Consumer Staples, we see that direct consumer-oriented plays account for one-third of total fund assets:

FXI Sector Allocations (iShares)

I bring this up because FXI has seen some weakness for very valid reasons. While some Chinese Tech stocks were getting caught up with the regulatory uncertainty from Beijing, that has not been as much of an issue for FXI since the fund has only 3% Tech exposure. Other areas, like Consumer Discretionary / Staples and Financials have come under more pressure from the Covid-lockdowns and the ensuing hit to the broader economy.

Personally, I believe the lockdowns will be coming to an end soon, but that is not an immediate prediction. FXI is not going to just bounce back immediately, because the Chinese government will have to wean off some of these restrictions. But I expect that to happen in the coming months, and see this as a nice way to play that rebound.

China Is Unloved – Contrarian Delight

Another reason for the under-performance in FXI and Chinese equities is that investors have chosen to flee the space. As regulatory and geo-political risks mount, investors have taken a less risk-on approach. This has benefited North American equities, as well as other developed market indicates, such as the United Kingdom, that are isolated from the developments in Eastern Europe. Investors began to reduce exposure to countries closer to the conflict, as well as themes, like emerging markets, that are seen as less stable given the ongoing uncertainty of what the end result is going to be. With respect to China, some investors have hypothesized that Russia’s aggression could be the spark of wider global unrest – with nations like China seeking territorial change in places like Taiwan and Hong Kong. The net result to this point, has been an exodus of investment dollars out of Chinese stocks:

Fund Flows (China) (Yahoo Finance)

Again, this sentiment is not without merit. There is plenty of risk in emerging markets right now – China or otherwise. Global geo-political pressures seem to be mounting, and a strengthening U.S. dollar is weighing on foreign currencies.

But there-in lies the opportunity. The flight out of Chinese equities, while valid to some degree, may be getting a bit overdone. We see that history suggests positive flows into Chinese equities is the norm, and continuous outflows are probably not going to last. Furthermore, this unwillingness to invest in China has pushed down valuations to levels that seem very compelling. In fact, Chinese equities have not looked this cheap compared to global equities in almost a decade:

CSI 300 Index Valuation Gap (Bloomberg)

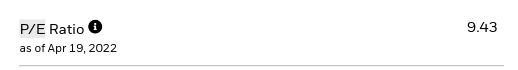

My takeaway is this means investors are being properly compensated for taking on the risk. Yes, risks abound, but we are paying a cheap price for that exposure at current levels. Nowhere is this more evident that FXI, which has a current P/E under 10, less than half the S&P 500’s P/E of 22:

FXI P/E Ratio (iShares)

To be very clear, I am not saying this is a “sure thing”, or even that FXI is going to see positive returns in the near term. Do I think it will? Yes. And I am planning on starting a position on that basis. The headline risks concern me, but the price seems to be adequately reflecting it. I see this as a scenario where the market has baked in so much bad news and such a negative forward outlook that any progress that is forthcoming will have a disproportionately positive impact. Whether I will be proved right remains to be seen, but the buy-in price is temping enough for me to take the gamble.

China Is Not Russia

I want to dive in now to some of the geo-political risk I have mentioned already. As readers probably know, the conflict in Ukraine has prompted many investors to take a risk-off approach to equities. In particular, investors are worried that Russia’s action could spark similar aggression by other nations around the world. The concern for equities is that Western nations will respond in-kind as they have in Russia – shutting down businesses, cutting off trade, divesting, calls for boycotts, etc. Thus, if one expects China to show aggression towards its neighbors – whether Taiwan, Hong Kong, or any other smaller nation in the Asia Pacific, the world will respond similarly. This could mean massive divestment from China, and major pressure of corporate revenues and profits at a time when the government is trying to jump-start an already struggling economy.

In fairness, this is a plausible outlook, but it is not one that I buy for a few reasons. This is important, because it is part of my thesis that Chinese equities (and FXI) are oversold because investors are overstating the risk. The problem I have with the outlook described in the preceding paragraph is it rests on a number of assumptions. One, it assumes China will act in a hostile or aggressive manner towards its neighbors in the short-term. Assuming the market is forward looking, to see prices declining now means that some type of military action would occur in the next 6-12 months. Could that happen? Sure. But I don’t think it will and we haven’t seen a strong indication that it will at this point. Two, if said military action did happen, I don’t buy the assumption the world will respond in the same manner as they have with Russia.

This is critical, and stems from the fact that the Chinese economy is simply more important globally than Russia’s is. The West – whether the U.S. or Western Europe – will have a much more difficult time shutting China off from the financial system or from trade. And that assumes the political will exists to undertake that endeavor, which is another assumption I don’t believe is accurate when we have seen how American and European governments have treated with China in the past.

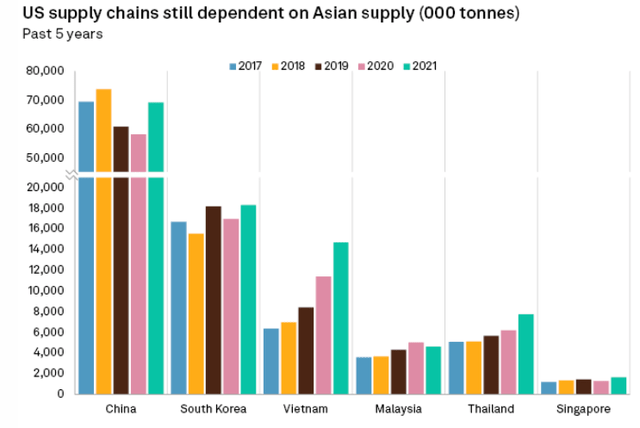

To understand why I feel this way, let us remember that the U.S. and Chinese economies are heavily inter-twined. We certainly have a policy mindset to become more supply-chain independent on the backdrop of the Covid pandemic, but the reality is that has not happened yet. While America’s trade with Russia is not a game-changer, our trade with China is. Our country’s reliance on China is almost as high as it was five years ago and, importantly, our supply-chain is more reliant on other Asian Pacific nations as well – more so than they used to be:

US Reliance on Asia (S&P Global)

The conclusion I draw here is that America can’t really afford a Russian-type response to Chinese aggression even if we want to. Supply-chains will be crippled, inflation will soar, and consumer outrage will outweigh the outrage Americans will feel towards potential aggression halfway around the world.

I really this sounds pessimistic, but it is steeped in realism. America and the West cannot cut ties with China even if they say they want to. We are decades away from that possibility. While the world’s condemnation of Russia’s action is a welcome sign on a humanitarian level, I don’t expect such a united response in retaliation towards anything the Chinese government does. This suggests to me the sell-off on Chinese equities on those types of fears is overblown, and represents a buying opportunity.

Good News On The Regulatory Front

So far in this review I have discussed the bad news out of China and why I don’t think it is as bad as it seems. But I want to end on some good news because we want to see that too. If the story was all negative, it would indeed be difficult to come up with a buy thesis, no matter how cheap stocks are.

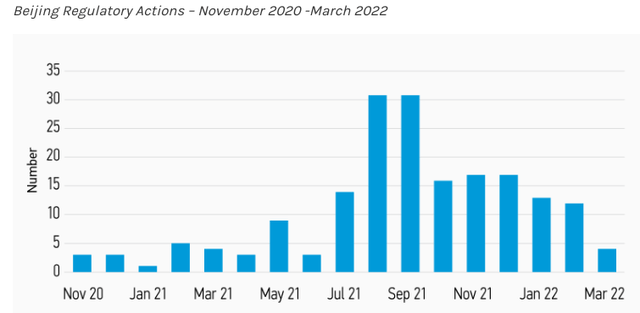

On this front, we should remember that another reason for the pressure in FXI is that Chinese regulators had gotten increasingly aggressive starting mid-2021. There was a crackdown on money laundering, tax evasion, capital flight, “monopolistic” behavior (which was loosely defined), and a number of other areas that softened sentiment across the board. While some of these actions may have been good for the longer term, they have pressured short-term stock action. The good news on this front is that since the regulatory-induced volatility spiked in the last few quarters, there are signs Beijing is toning down its rhetoric and regulatory ambitions. Looking back at monthly regulatory actions, we have seen a sharp drop-off recently:

Beijing Regulatory Actions (Per Month) (Morgan Stanley)

I find the implication behind this graphic encouraging. The Chinese government seems to have backed off a bit, probably in part because of the market pressure the country is facing. While the regulatory scrutiny is only one reason behind the negative returns, it is also the one Beijing has the most control over. By scaling back on regulatory actions, China is taking key step towards restoring investor confidence in the country.

Bottom-line

Chinese equities do not seem to inspire much confidence, but that is precisely why I am interested. FXI is a reasonable way to play the space, it focuses on large-cap holdings which I prefer to manage some of the risk I am taking by diving into this arena. Plenty of headline risk does remain, but I find this fund, and Chinese equities in general, to be priced in a way that mitigates those risks. On the bright side, Chinese regulators have taken a step back.

Also, I find fears of a Russian-type response to any future Chinese aggression to be too pessimistic. China, and the Asia Pacific as a whole, are more critical to U.S. supply chains than Russia is. This should prevent the decoupling that some are suggesting could happen if China makes territorial claims on its neighbors. This doesn’t make it “right”, but I won’t shy away from investing in Asia on fears of something I don’t believe will happen. As a result, I will be looking to build a position in FXI, and I encourage readers to give this idea some consideration at this time.

Be the first to comment