vinhdav/iStock via Getty Images

iShares MSCI Frontier and Select EM ETF (NYSEARCA:FM) is a passively managed investment vehicle offering exposure to a vast and versatile equity basket of a few EM and frontier markets, with Vietnam (~27.2%), Nigeria (~8.9%), and Romania (~6%) being the top allocations.

Since its inception in September 2012, the fund has amassed net assets of around $371 million but with recent AUM trends being rather sluggish. Fees of 79 bps are on the expensive side due to the inherent complexity of its riskier, less liquid markets-focused investment strategy. But please bear in mind that burdensome fees erode returns.

Investors seeking exposure to stocks uncorrelated with the U.S. market might find this vehicle appealing, especially considering the bearish forces have been raging closer home, trimming generous valuations in the face of persistent inflation and the gnawing interest rates question.

Speaking of co-dependence, the YTD correlation coefficient of FM and the iShares Core S&P 500 ETF (IVV) is only 0.59, while the iShares MSCI World ETF (URTH), which is at times used by investors to meet their diversification goals, has its coefficient at 0.99, which is indicative that the U.S. bellwether fund and URTH are moving nearly in tandem, and this ETF investors are not capturing even a measly alpha overseas, while also being exposed to the prolonged softness in New York should the hawks bolster bearish forces.

I appreciate FM’s inherent cheapness manifested in a 9.44x P/E as of the iShares data stemming from the size and country risk discounts, though I do not think this is sufficient enough to assign the vehicle a Buy rating at this juncture despite me touting the value factor this year, and the fact that FM’s price has slipped by ~21% YTD does not guarantee the frontier and select emerging markets equity basket has already bottomed.

In addition, I dislike its rather bleak 2.4% standardized yield, which comes as a surprise as anecdotal evidence suggests emerging and frontier markets are top destinations for risk-tolerant investors seeking bumper yields; this is certainly has something to do with the high expenses of the fund, though with them stripped off, the TTM dividend yield is still not alluring enough for such a risky play.

Nevertheless, I am positive about FM since Vietnamese stocks, principally those from the financial sector, account for the bulk of its net assets in the wake of the deep changes its basket underwent in recent years. The reasons which are shoring up my optimism include a rosy GDP growth outlook and exceedingly low inflation (by the current standards) together with the healthy structural trends. However, these factors are supposed to play out in the longer term, while less distant issues can still eat into the ETF’s returns this year. Hence, while seeing no strong reason for a bullish view and also not being a committed bear, I opt for a Hold rating this time.

Thorough strategy changes render past returns irrelevant

Last year, FM underwent a thorough strategy recalibration, with the underlying index replaced with the MSCI Frontier and Emerging Markets Select Index on March 1. Before that, it tracked the MSCI Frontier Markets 100 Index.

Previously, before Argentina was upgraded to an emerging market status in 2019 (later, in 2021, it lost its place in the cohort, being downgraded to a standalone market principally due to “the prolonged severity of the capital controls,” as explained by MSCI), the country was one of FM’s top allocations, with a 14.4% weight as of May 17, 2019, as illustrated by the iShares page saved by the Wayback Machine.

Also, the fund had gradually reduced its exposure to Kuwait. As the saved webpage saved shows, in May 2021, around 19.5% of the net assets were allocated to the country. The figure fell to single digits in October 2021. The page from January 20, 2022, shows no Kuwaiti stocks.

All these resulted in a tectonic shift in the regional exposure and markedly altered the risk/return profile, including lower dependence on the oil price dynamics in the wake of the Kuwaiti stocks’ removal.

That said, I am skeptical that past returns of FM are indicative of future potential given such sweeping changes.

Delving deeper into the portfolio

In the wake of the index change, the portfolio’s depth and breadth of exposure have expanded, from approximately 100 holdings in the pre-recalibration versions (e.g., 114 as of January 2021) to 175 now.

Sectors occupying the three key positions are financials (over 37%), real estate (~11.7%), and materials (~11.2%). Such a large footprint in financials is barely a coincidence: the bank industry and the like are in many ways key beneficiaries (and also facilitators) of long-term economic progress, especially in the frontier countries that are yet to achieve even an emerging status. The largest play (~4.7%) from the sector and also the fund’s key investment is Kuwait-quoted, KWD-denominated shares in Ahli United Bank located in Bahrain, as of the June 13 holdings dataset.

It is worth remarking that investors who are on the lookout for substantial exposure to commodities, especially oil, should take notice that FM has allocated only ~7% to the energy sector, with Kazakh, Colombian, and Romanian companies having the largest share of the net assets. Besides, the top play from the sector with a ~1.5% weight in the London-quoted is NAC Kazatomprom JSC, the world’s most significant producer of uranium, and is, in essence, a bet on nuclear energy, not hydrocarbons. That being said, my point here is that the single-digit allocation is insufficient to meaningfully benefit from the Brent crude price’s steady performance should petroleum supply/demand imbalances persist.

In the current iteration of the portfolio, the following countries are represented: Bahrain, Bangladesh, Colombia, Egypt, Estonia, Jordan, Kazakhstan, Kenia, Lithuania, Morocco, Nigeria, Oman, Pakistan, Peru, the Philippines, Romania, Slovenia, Sri Lanka, and Vietnam. Please note that according to the most recent MSCI classification, Colombia, Peru, Egypt, and the Philippines are EMs.

Vietnamese companies dominate the portfolio, followed by Nigerian and Romanian. Meanwhile, we see just a trace amount of Lithuanian, Sri Lankan, and Slovenian names.

As I highlighted above, I view the fund’s large exposure to this Southeast Asian nation as a longer-term positive. Specifically, what I especially like about the Vietnamese economy is that inflation has been kept at bay, with consumer prices up just 2.25% in the first five months, in sharp contrast even to the heavyweight developed markets. Besides, the nation has survived 2020, the toughest year of the pandemic, almost unscathed, delivering 2.9% real GDP growth, and is on track to expand by 6% this year, per the IMF’s most recent outlook.

Performance: no illustrative long-term data, sluggish shorter-term returns

In essence, a few deep changes effectively rendered past performance irrelevant. Truly so, if we extrapolate the returns FM delivered while being grossly overweight in Argentinian and Kuwaiti stocks, we would arrive at misleading conclusions, for example, failing to cut off the oil price factor which weighed on the Kuwaiti holdings during the two crises of the previous decade, or the economic woes Argentina addressed.

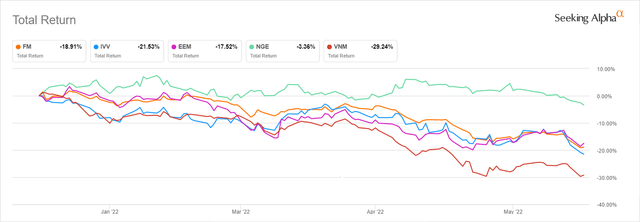

That is to say, I would prefer briefly assessing only its YTD returns. The chart below compares its total return to IVV, VanEck Vietnam ETF (VNM), Global X MSCI Nigeria ETF (NGE), and iShares MSCI Emerging Markets ETF (EEM).

As you can see, the only ETF that has seen its price declining only modestly is NGE, mostly thanks to the nation’s oil-heavy exports. Anyway, this had a limited positive impact on FM, principally because of the Vietnam stocks selling off despite the country’s healthy economy.

Final thoughts

Bargain-hunters may point to the fund having just a 9.44x Price/Earnings ratio, indicating that FM is trading in the value territory, with no growth premium at all, and, hence, it can be used as a contrarian safe haven while the storm is raging in the expensive U.S. equity echelon. This is especially inviting given the low correlation with the S&P 500 ETF flagged above.

The problem is that this view is a shortsighted one, missing an essential factor: the risk and liquidity discounts. Additionally, investors riposting that the Vietnam-heavy portfolio is an appealing allocation in a high inflation environment should not forget that Romania is fighting with mid-double-digit inflation, with that also being the case for Nigeria. Overall, less developed markets are as a rule the most vulnerable to the repercussions of elevated prices. In sum, FM is a Hold.

Be the first to comment