GoranQ/E+ via Getty Images

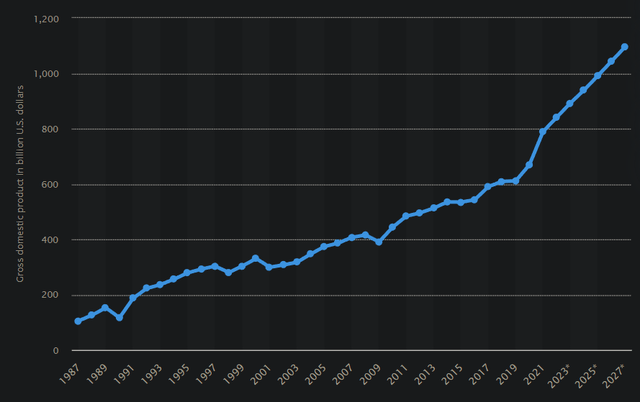

iShares MSCI Taiwan Capped ETF (NYSEARCA:EWT) is an exchange-traded fund that enables investors to gain exposure to Taiwanese equities. Taiwan’s GDP has grown at a rapid clip over the past couple of decades (illustrated in the chart below, with projections out to 2027).

Still, with $789.51 billion in GDP in 2021, Taiwan’s economy is much smaller than other major economies; the United States’ GDP was about $23 trillion in that same year. That doesn’t mean Taiwan’s economy is not sophisticated though. Per the OEC’s website, the country ranked third (on this website, it is referred to as “Chinese Taipei”) for economic complexity, just behind Japan and Switzerland. The United States ranks ninth. One of the most important exports of Taiwan is semiconductors; the most significant company in this domestic (and indeed international) industry is Taiwan Semiconductor Manufacturing Company (TSM). That company remains the largest position in the EWT fund, at 22.05% as of June 16, 2022.

The fund had 88 holdings as of June 16, 2022, with assets under management of $4.77 billion (June 17, 2022). The fund includes large-cap stocks like TSMC as well as mid-caps. EWT seeks to track the performance of its benchmark index, the MSCI Taiwan 25/50 Index, which has a capping methodology to prevent holdings from becoming more than 25% of the overall fund. So, given that TSMC itself has performed so well, EWT has sort of trailed behind TSMC somewhat, while also benefiting from its rise.

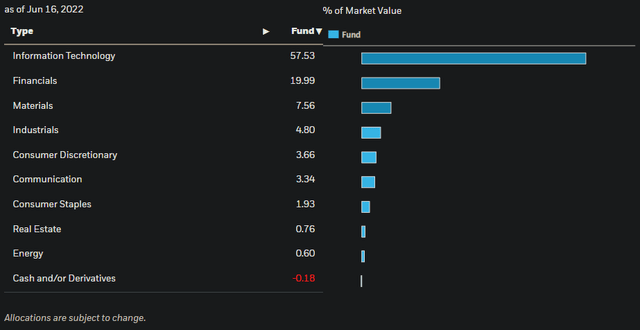

More broadly, EWT is exposed to Taiwan’s domestic Financials sector (20%), Materials sector (8%), Industrials sector (5%), and other sectors include Consumer Discretionary (4%), Communication (3%), Staples (2%), Real Estate (1%), and Energy (1%).

Clearly, however, Information Technology is the most important part of the portfolio at 58%, with a big chunk of this owing to TSMC stock.

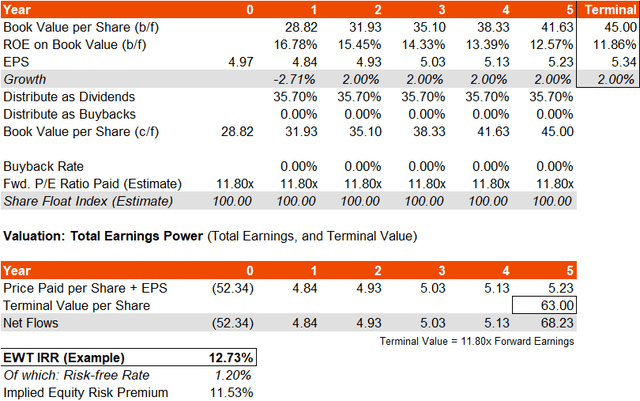

Fortunately MSCI produce basic financial data that we can use to help gauge the return potential of EWT. A recent factsheet for EWT’s benchmark index, a good proxy for EWT itself, tells us that the trailing and forward price/earnings ratios of the fund as of May 31, 2022 were 11.48x and 11.80x, respectively.

Given the forward price/earning ratio is higher than the trailing ratio, this implies a drop in earnings of almost 3% in the first year. Conversely, Morningstar have set an average forecasted three- to five-year earnings growth rate at 17.82%. Regional growth is slowing, while the semiconductor demand boom through the pandemic was a probable one-off. And the EWT portfolio more broadly contains some fairly important industries (besides semiconductors) that are not likely to disappear (such as Financials, Materials, and Industrials). In spite of a near-term dip in earnings, it seems fair to assume that the return on equity of EWT’s portfolio will roughly hold up. Nevertheless, I will choose to be conservative in estimating the future.

On a forward basis, EWT’s benchmark index, with a price/book ratio as of May 31, 2022 of 1.98x, offers a return on equity of 16.78%. The indicative dividend yield was 3.11% as of the same date, on a trailing basis, which roughly (against the trailing price/earnings ratio) implies a distribution rate of earnings into dividends of 36.7%. Using this data and holding most of the inputs constant, including the forward earnings multiple, gives us the following IRR gauge. Bear in mind I have been much more conservative than Morningstar, and kept the slight dip in earnings on a forward basis (estimated by MSCI), and then assumed an earnings growth rate of just 2% thereafter. For context, Taiwan’s core inflation rate has been around 1-1.5% per year over the past 10 years, so it assumes very little in the way of real earnings growth.

This is based on total underlying earnings power. The Taiwanese 10-year bond currently yields only about 1.2%, which means that local risk-free rates pale in comparison to the local equity market’s potential returns of over 12% (again, on a total earnings basis). If you assume zero buybacks and only value EWT on dividend distribution potential, plus the terminal value, the IRR would still be 6.97%, which is much greater than the risk-free rate, and implies an equity risk premium of 5.77%. EWT also carries a lower beta.

However, there is country risk, and there are growing concerns that Taiwan may be invaded by China over the next few years. As reported in the FT, “Phil Davidson, former US Indo-Pacific Commander, believes the threat of a Chinese attack on Taiwan will manifest by 2027”. Some are more concerned than others, of course nobody truly knows, and perhaps the lack of success of Russia invading Ukraine so far has reduced the chance that China might try for Taiwan, which would likely be a far more complex operation (for one, because Taiwan is an island). In any event, the risk is likely being priced into EWT.

Political risk is important, perhaps the most important form of risk when it comes to investing. It is akin to “picking up pennies in front of a steamroller”; take for example Russia’s escalation of the Russo-Ukrainian War this year. Russian equities were crushed, and Russian equity ETFs were delisted. Taiwanese equities could be similarly hammered, as could Chinese equities, were a war to break out between the two countries.

Given the economic importance of Taiwan, and its strong portfolio, and low local risk-free rates, I think EWT is likely fundamentally inexpensive. Therefore, I would take a bullish stance on the economy, as I think semiconductor manufacture (especially at the level of complexity and engineering that TSMC is operating at, as a global leader) will remain a globally critical industry for the foreseeable future. The capping methodology of the EWT fund, and the rest of the portfolio, together help to reduce the concentration risk in TSMC too.

On the other hand, Taiwan carries a heavy weight in terms of political risk, and therefore I would not expect the forward price/earnings multiple to expand until some much later date; perhaps in several years time if it appears that the risk of an invasion by China has fallen substantially. I would take a bullish stance but not recommend a large position in Taiwanese stocks.

Be the first to comment