iYok_photo/iStock via Getty Images

Main Thesis & Background

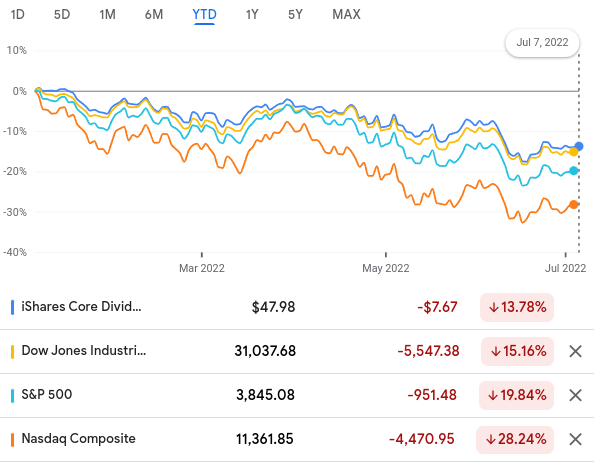

The purpose of this article is to evaluate the iShares Core Dividend Growth ETF (NYSEARCA:DGRO) as an investment option. The fund is managed by BlackRock (BLK) and its objective is to “track the investment results of an index composed of U.S. equities with a history of consistently growing dividends.” This has been a long-term holding of me, and one that I have recommended many times. However, it has been a while since I last covered it, as this ticker already gets quite a bit of coverage on Seeking Alpha. Yet, as one of my three core dividend ETFs, I thought it was timely to give readers an update on my thoughts given how poorly it has performed in 2022:

YTD Performance (Seeking Alpha)

While this chart is probably unnerving, it is important to note this return is stronger than the S&P 500, so there has been some relative out-performance here. Further, rather than fear this weakness, I personally see it as a reason to add to my position. It is not often DRGO falls into correction territory, so I want to make the most of it by putting some cash to work here. While there are plenty of macro-headwinds to be concerned about, I see enough positives to warrant buying now. I will discuss these in detail below.

The Trend Has “Worked”, Follow The Trend

My first take is to look at the dividend-paying space more broadly. As my readers know, I have a biased take on dividend payers (whether stocks or ETFs). I simply love dividends, especially those that have been raised recently. As a growth dividend ETF, it should be no surprise DGRO is one of my core holdings. However, this does not always protect investors from losses, as 2022 has shown us. Still, when we consider the divergence between DGRO and the major U.S. indices, it is not hard to see why I am drawn to it:

YTD Performance (Google Finance)

Of course, a loss near 12% (after accounting for dividends) is not really indicative of an amazing play. But we have to consider most sectors are in the red this year, with Energy being a notable exception. We can’t expect positions to be in the green all the time, so the fact DGRO is beating the market provides some level of comfort.

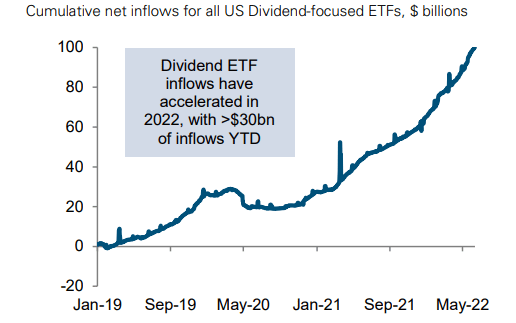

Beyond that, followers and investors in dividend paying securities would probably be happy to know that the trend is on their side. Retail investors as a whole have been piling into this strategy for years. Importantly, this trend has accelerated in 2022, helping explain why funds like DGRO have held up better than the S&P:

Retail Investor Inflows To Dividend ETFs (Federal Reserve)

I view this positively because this means dividend ETF investors are in good company and could benefit from this momentum if it continues.

Of course, I put “worked” in quotes for the title of this paragraph for a reason. These inflows have not been enough to pump out a positive return, so we have to be realistic about how great this strategy is. This is not a risk-free investment plan, nor is it a sure thing. Markets could continue to fall and DGRO could follow right along with the herd. While the relative out-performance and retail interest could soften the blow in the second half of the year as it has in the first, readers need to remain cognizant of the risks facing the U.S. and global economy. If conditions materially deteriorate, funds like DGRO will only “work” so well.

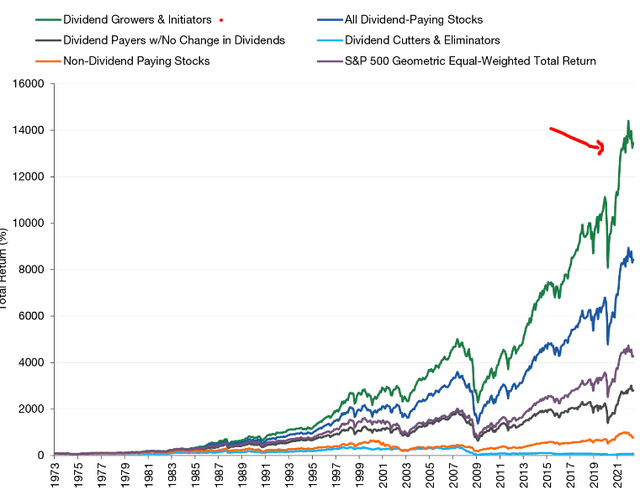

So, Why Buy? History Supports It

Expanding on to why investors may want to buy DGRO at this moment, I would refer them to the long-term trend that dividend paying stocks enjoy. As I showed above, DGRO has had a bit of an edge over the market in 2022. But this is not an anomaly. If we look back for the past fifty years, we see that companies who either initiate a dividend or grow their dividend will out-perform those that do not. With DGRO’s dividend growth focus, this is a great attribute supporting this buy thesis:

Total Return by Dividend Policy (Lord Abbett)

The takeaway here is a simple one. Dividend growers (and initiators) have proven their merit over the past fifty years with flying colors. While other flashier and trendy investments will certainly perform better at times, I like this steady, long-term alpha-generation to help me sleep well at night.

Some Things America Has Going For It

I now want to shift the focus to U.S. stocks more broadly. As noted, even if dividend payers perform reasonably well compared to the market, that can still mean losses. So it isn’t necessarily wise to start loading up on DGRO even the market is going to decline further. While the performance may be “better”, losses can be painful even if they are smaller than the S&P.

On this note, there is plenty of be concerned about. Globally, the economy is on fragile footing, with Europe in crisis, inflation raging, and supply-chains remaining challenged. But we have to remember we want to invest during times of strife. Once you wait for the dust to settle, it can be too late. Naturally, there could be more pain to come, but there are some positives out there that I believe will limit equity losses in the second half of the year.

For starters, I like the idea of building positions in developed markets away from eastern Europe. With the war on-going there and the chance of de-escalation in the short-term fading, I would focus more on North America and Australia. This is precisely why I have built on to my dividend-paying positions that are U.S.-based, such as DGRO, as well as the iShares MSCI Canada ETF (EWC). America, Australia, Canada, and even Britain and Japan all benefit from being far away from the frontlines of the Russia-Ukraine conflict. This makes these areas more investable for me at this time.

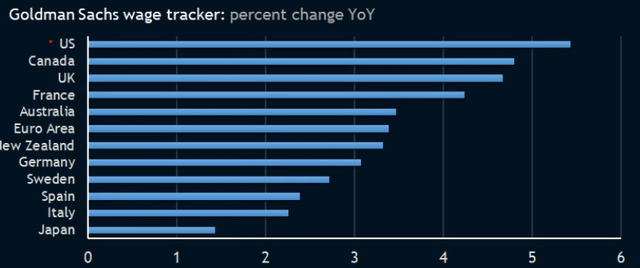

In addition, the U.S. still leads the developed world in worker productivity, which is great news for the companies that are domiciled here. Fortunately, U.S. workers are also capturing a larger slice of the pie. Wages are rising domestically, and at a pace much faster than the rest of the developed world:

Wage Increases (YOY) (Goldman Sachs)

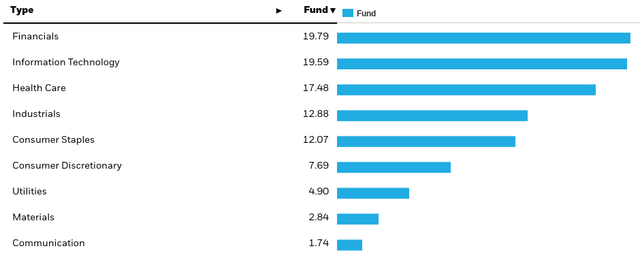

This helps lend support to consumer-oriented sectors within the U.S., which is a mixed area right now given how challenging inflation has been. With wage rises have not matched inflation rates yet, this is still healthy growth that is at least helping keep U.S. workers above water. Given that DGRO has roughly one-fifth of its assets in Consumer sectors, this is a good sign:

DGRO Sector Weightings (iShares)

Ultimately, I don’t want to come off sounding too optimistic here. I do like the idea of using the market correction to add to DGRO, so I stand by my “buy” call. But we have to manage expectations. The market is in a tough spot, so are corporations, so are American households. We are not likely to see a straight shot higher in equity markets any time soon. Rather, use weakness to buy in, and keep a patience, long-term outlook. DGRO will be a winner over time, I am confident in that, but it may be a bumpy ride for the remainder of 2022.

Financials Fading Due To Recession Risk

Digging deeper in to DGRO specifically, readers should note in the prior chart that the Financials sector makes up 20% of fund assets. As the largest individual sector in the fund, this is an important consideration before deciding whether or not to buy in. Personally, I view this positively, as large banks should benefit from a rising rate environment over time. However, this has not played out in 2022 so far, despite the Fed raising rates and having plans to keep on doing so. This begs the question – why is that?

The primary culprit is recession fears. While rising rates can be good, in that they typically lead to a greater margin spread for lenders, there is downside risk to consider. Chief among them is that rates rise too fast and slow down the economy too aggressively. This can lead to a recession. The implication for banks is that lending will dry up, and loans will go delinquent. If so, the losses from missed opportunities of lower lending levels and missed loan payments offsets the tailwind of higher rates on the loans. In today’s market, investors seem to be focused on the latter scenario, and banking stocks have suffered.

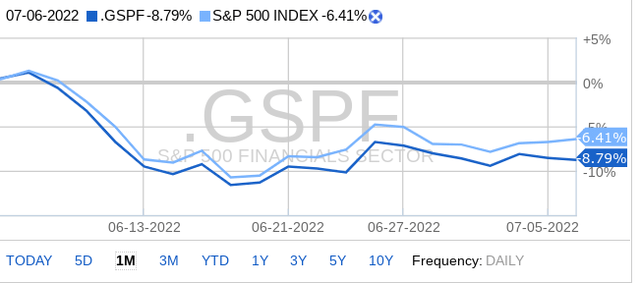

In fact, over the past month the Financials sector has under-performed the S&P 500, despite interest rates rising during that same time period:

Relative Performance (1-Month) (Fidelity)

The conclusion I draw here is I like DGRO’s inclusion of Financials because I am getting a beaten down sector that has tailwinds on the horizon (in the form of higher interest rates). But readers should evaluate their own outlook here. If they are forecasting an economic backdrop worse than a mild recession, going long a fund with this cyclical exposure may not end well. The market is clearly selling off banking stocks at the moment, which I view as a contrarian opportunity. But the pain could only be starting if global conditions worsen, so please do your own due diligence here.

Bottom-line

DGRO is a well-rounded, dividend-focused fund that has served me well over time. While the current year hasn’t been pretty, the below-average loss gives me some comfort. At a 2% yield, some investors may shy away from it, but remember this objective is not “high” yield, but growth. DGRO’s underlying holdings have proven their ability to grow their dividend streams, including during periods of market stress. If we do see dividend increases in the second half of the year, that helps to offset inflationary effects to some degree.

Beyond that, DGRO holds large-cap U.S. names that I find attractive in this environment. The market sell-off gives us discounted prices, and I like that America is sheltered from some of the bigger geo-political risks right now – including war in Ukraine and supply disruptions in Europe. While the spillover from this conflict is impacting the globe as a whole, North America is fortunate to be less impacted than Europe. Finally, I think the sell-off in the Financials sector has been a bit overblown, and like the idea of using DGRO as a way to buy in to that weakness as a contrarian play. As a result, I will be adding to my position in the coming weeks and months ahead, and suggest readers give this fund some consideration at this time.

Be the first to comment