Justin Sullivan/Getty Images News

Elevator Pitch

I downgrade my investment rating for Wells Fargo & Company’s (NYSE:WFC) shares from a Buy to a Hold. In my article published almost a year ago on April 28, 2021, I compared WFC against Bank of America Corporation (NYSE:BAC) and determined that Wells Fargo was the more attractive stock of the two based on outlook and valuations.

As highlighted in my current article, Wells Fargo is now the most expensive banking stock among the “Big 4” and lower-than-expected fee income could possibly lead to WFC’s Q1 2022 bottom line falling short of market expectations. Considering these factors, I view Wells Fargo as a Hold now before its Q1 2022 earnings.

WFC Stock Key Metrics

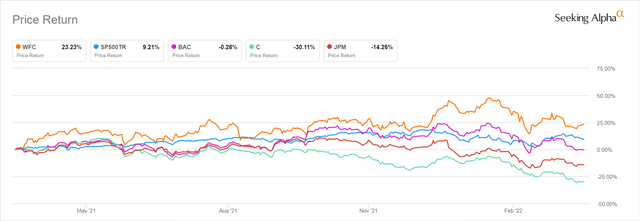

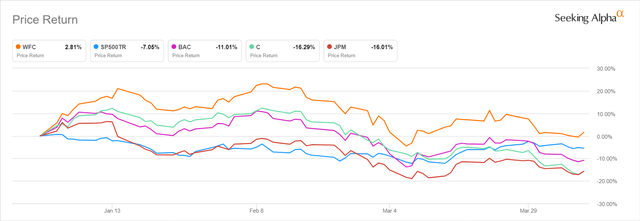

Wells Fargo has outperformed its key banking peers and the broader market (the S&P 500 as a proxy) in the past one year (+23%) and in 2022 year-to-date (+3%) as per the chart below. I have chosen the other three “Big 4” banks, Bank of America, Citigroup Inc. (C), and JPMorgan Chase & Co. (JPM), as the peer comparables for WFC.

Wells Fargo’s Share Price Performance In The Last One Year

Seeking Alpha

WFC’s 2022 Year-to-Date Stock Price Performance

Seeking Alpha

It is easy to understand Wells Fargo’s outperformance when one assesses the key metrics relating to the bank’s Q4 2021 financial performance and 2022 guidance.

WFC’s earnings per share or EPS expanded by +18% QoQ and +109% YoY to $1.38 in the fourth quarter of 2021, as highlighted in its Q4 earnings press release dated January 14, 2022. Wells Fargo’s Q4 2021 EPS also beat the Wall Street’s consensus bottom line estimate of $1.13 per share by +22%. This was also the eighth straight quarter that WFC’s EPS was ahead of the sell-side analysts’ expectations. Even if one excludes for the asset sale gains amounting to $0.18 per share, Wells Fargo’s adjusted EPS of $1.20 for Q4 2021 would still have been equivalent to a +82% YoY growth and exceeded consensus EPS forecasts by +6%.

Wells Fargo’s FY 2022 guidance issued in mid-January (in tandem with its Q4 2021 results release) is even more encouraging. In the company’s Q4 2021 earnings presentation slides, WFC guided that its net interest income could potentially increase by +8% in fiscal 2022. The +8% net interest income growth guidance is comprised of a +3% increase mainly driven by “loan growth” and changes in “balance sheet mix” and a +5% growth relating to expectations of “three 25 basis point rate increases” starting in May.

Separately, Wells Fargo has managed to cut the bank’s staff strength by -6% last year through various cost restructuring initiatives, and there is room for further cost savings this year. Specifically, WFC sees the company’s cost base reduced from $52.3 billion (adjusted based on divestments and other non-recurring items) in fiscal 2021 to $51.5 billion in FY 2022.

WFC’s upcoming Q1 2022 earnings will give investors an indication of whether the bank is able to live up to its earlier management guidance, and this will in turn have an impact on Wells Fargo’s near-term share price performance.

When Does Wells Fargo Report Earnings?

Last week on April 7, 2022, Wells Fargo made an announcement disclosing that the bank will be reporting its earnings for the first quarter of the year on April 14, 2022.

What To Expect From Earnings

Wells Fargo’s Q1 2022 earnings could potentially disappoint on the downside, and all eyes are on WFC’s mortgage business.

A recent April 5, 2022 Seeking Alpha News article highlighted that the “30-year fixed rate mortgage” crossed the 5% mark which is the “highest since 2013”, and noted that this “is making it even more expensive for consumers to buy homes.” It is inevitable that higher rates translate into lower demand for mortgages which is negative for Walls Fargo and other mortgage lenders.

When Wells Fargo was questioned about the outlook for fee income in Q1 2022 and FY 2022 at the bank’s Q4 2021 results briefing on January 14, 2022, it also acknowledged that “we all expect the mortgage market to be down with refinancing really driving that.”

Management’s comments about the expectations of a substantial drop in mortgage refinancing has been validated by recent industry data. A CNBC article published on March 30, 2022 noted that mortgage refinancing applications volume for the prior week dropped by -60% YoY.

WFC also mentioned “investment advisory and other asset-based fees” at its fourth-quarter investor call, which it referred to as “one of the biggest fee lines” and “a function of our client assets and what the equity market is doing primarily.” There is also room for disappointment here. MSCI World Index, one of the proxies for global equity performance, declined by -5.15% in the first quarter of 2022, which pales in comparison with +21.82% gain the index registered in 2021.

In summary, Wells Fargo’s 1Q 2022 earnings might not meet market expectations on lower-than-expected fee income.

What Is Wells Fargo’s Forecast?

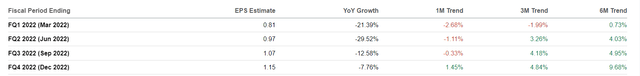

Wells Fargo’s consensus EPS forecast for Q1 2022 is $0.81, representing a -21% YoY decline.

The worry here is that the sell-side analysts might not have sufficiently reduced their earnings estimates for WFC in view of rising mortgage rates and the lackluster performance of global equities.

Revisions To Quarterly EPS Forecasts For WFC In Recent Months

Seeking Alpha

In the chart presented above, it is apparent that the Wall Street analysts have not made significant changes to their respective earnings estimates for Wells Fargo in recent months. This supports my view that Wells Fargo is at risk of an earnings miss when it reports its Q1 financial results this week.

Is WFC Stock Overvalued Now?

WFC stock is at best fairly valued now, if not slightly overvalued.

Based on the stock’s last traded share price of $49.33 as of April 11, 2022, Wells Fargo is now valued by the market at 12.4 times consensus forward FY 2022 P/E as per financial data sourced from S&P Capital IQ. This makes WFC the most expensive stock among the “Big 4” banks. BAC, JPM, and C currently boast relatively lower consensus forward FY 2022 P/E multiples of 12.2 times, 12.0 times, and 7.8 times, respectively.

Also, Wells Fargo’s forward P/E of 12.4 times appears to be rather fair in comparison with its 10% RoTCE target (Return on Average Tangible Common Shareholders’ Equity) for 2022 and 15% RoTCE long-term goal as outlined at the bank’s Q4 2021 earnings briefing.

Is WFC Stock A Buy, Sell, or Hold?

WFC stock is a Hold. Wells Fargo’s forward P/E in the low-teens seems well aligned with the bank’s short-term and long-run RoTCE targets. Also, the company’s FY 2022 guidance is good, but there is a risk of an earnings miss for the upcoming quarterly results release.

Be the first to comment