brightstars/E+ via Getty Images

Unity (NYSE:U) is a stock that I did not think would crash to these levels. Its association with the trending metaverse sent the stock soaring for much of its life as a public company, but the past year has seen such bubbles pop in dramatic fashion. There is a saying that periods of irrational exuberance are followed by periods of irrational pessimism. That appears to be the case here, as the market is not looking beyond the near term headwinds facing the company in 2022. The future remains bright both for the company – and shareholders.

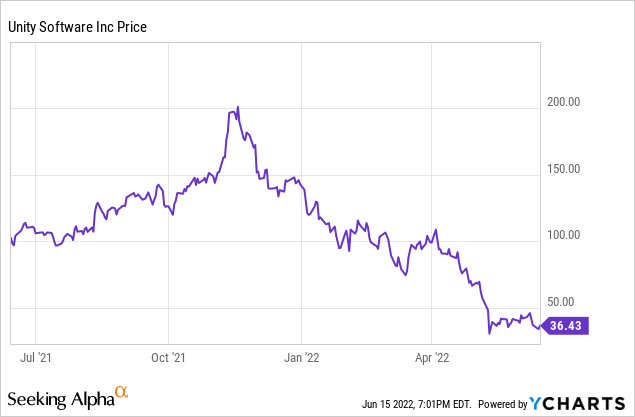

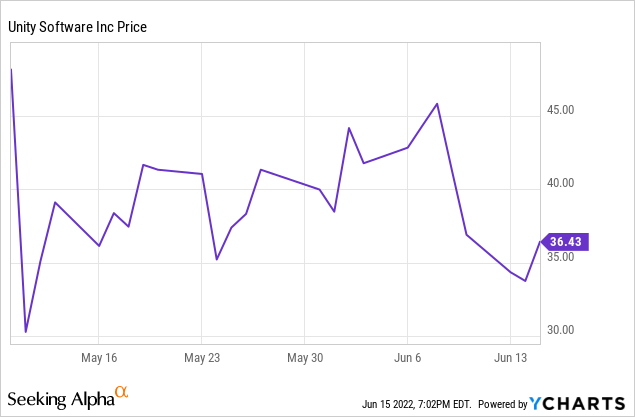

U Stock Price

U priced its IPO in late 2020 at $52 per share and peaked around $210 per share. The stock has since crashed around 80%.

I last covered the stock in March when I called it buyable, but noted better opportunities in the tech sector. I am now upgrading my rating and have purchased a stake myself.

U Stock Key Metrics

Recall that Unity is a real-time development platform, enabling 3D, AR, and VR development. Its software is used largely in modern games, but is also used across many other industries.

Unity

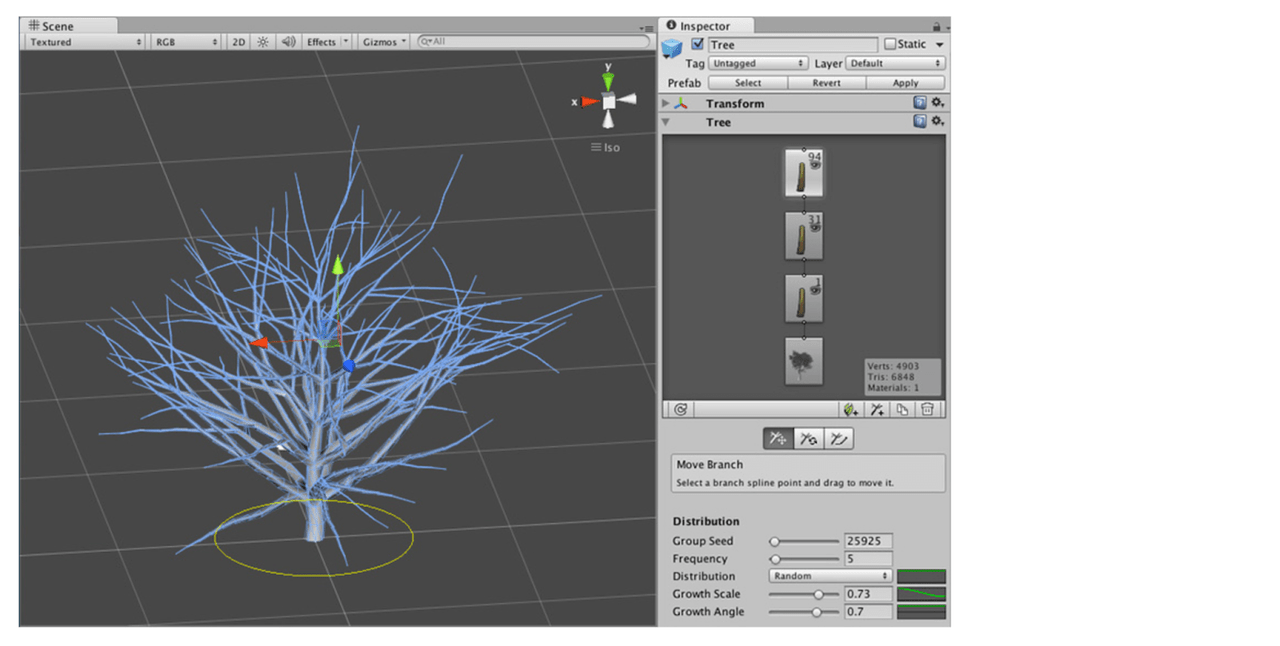

We can see what the software looks like below – customers can use Unity software to visualize anything. There is a reason why Unity is so commonly associated with the metaverse – without Unity there is no metaverse.

Unity

In the quarter, U generated 36% revenue growth to $320.1 million. That growth was largely driven by 65% growth in Create Solutions revenue, which refers to the revenues earned for using the software. Operate Solutions revenue grew by only 26% – this refers to the revenue share agreements it has with its customers. U stated that this was due to monetization issues that hit the company in February and March. The company was not profitable in the quarter, losing $171.2 million on a GAAP basis and $23 million on a non-GAAP basis (excludes equity-based compensation).

Why Did Unity Stock Drop In Early May?

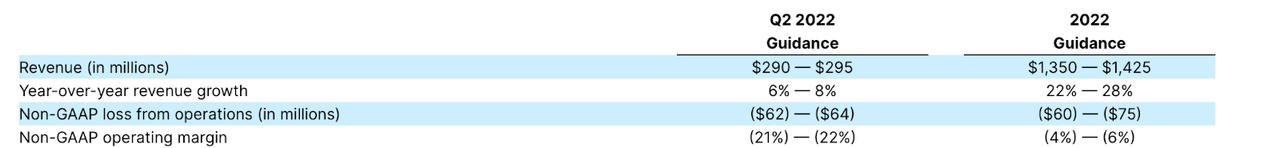

U gave the following guidance, which showed minimal growth in the second quarter and also lowered full-year guidance from $1.505 billion to only $1.425 billion in revenues.

2022 Q1 Press Release

That spooked Wall Street, as the stock crashed sharply after the earnings release.

The reduction in guidance was blamed on the aforementioned monetization issues. On the conference call, management stated that it expects roughly $110 million of net impact this year with 60% of that impact falling in the second quarter. Management also stated that they expect to be profitable in fiscal 2023, but that was not enough to prevent the brutal action in the stock price.

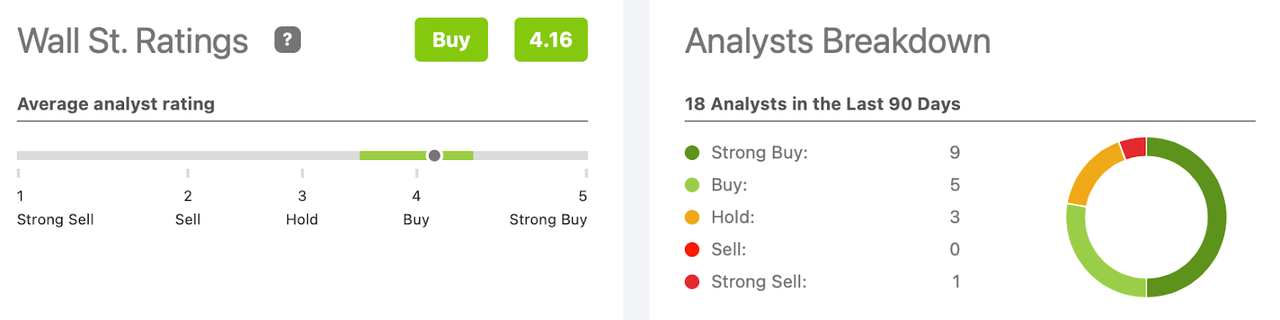

Is U Stock Expected To Keep Rising?

Wall Street analysts have remained bullish in spite of the near term headwinds. The average rating is 4.16 out of 5.

Seeking Alpha

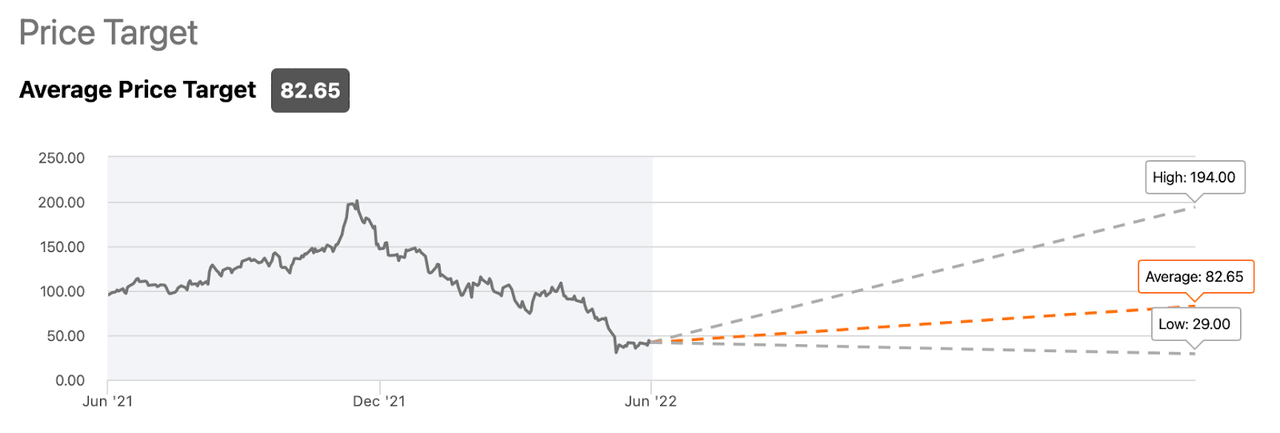

Price targets have come down since the quarter but the average price target of $82.65 still represents around 127% upside.

Seeking Alpha

It is interesting to see price targets decline so dramatically as the tech sector falls. I expect price targets to rise once the tech sector rebounds.

Is U Stock A Buy During This Dip?

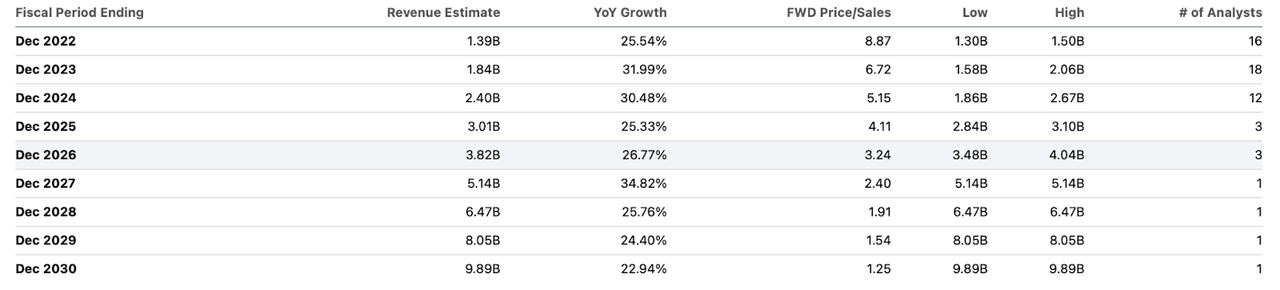

My view is that the current price weakness is a gift for long-term oriented investors. Management is quite confident that they can fix their monetization issues and bring advertisers back to their platform – my view is that they deserve the benefit of the doubt considering U’s place on the totem pole. For game developers, U is very much like the Apple (AAPL) app store in that it has tremendous leverage. On the call, management reiterated its expectation to sustain revenue growth “at or above 30% per year over the long term even as we gain scale.” With that in mind, the stock looks quite cheap here at 9x forward sales. The company does not have a material net cash position because it had spent $1 billion to acquire Weta Digital late last year. 9x sales might not sound so cheap, but the company’s ability to sustain a 30% growth rate for many years makes the valuation cheap when looking several years out. We can see consensus estimates for the next decade:

Seeking Alpha

The stock is priced at just 3.2x 2026e sales. I could see U sustaining at least 30% long term net margins as its business model has inherent operating leverage. Based on a conservative 1.5x price to earnings growth ratio (‘PEG ratio’), I could see U trading at 13.5x sales in 2026. That suggests 322% upside or 36% annualized over the next 4.5 years. This is a name which I expect to gain a steep premium relative to tech peers, with the main driving catalyst being a recovery in its monetization efforts. That means much of those returns could be front loaded as this is arguably one of the higher quality growth stories in the market today. The key risks here are twofold. First, it is possible that the company is unable to fix its monetization issues. I find such an event unlikely, but the possibility must be stated. Second, it is possible that its products lose relevance. Perhaps the metaverse does not meet expectations for growth – perhaps people stop using their smartphones so much. The bullish thesis is largely dependent on the long term growth rate, and that is predicated on the metaverse being an ever-growing secular story. I rate the stock a strong buy – this isn’t the cheapest name in the tech sector, but it has one of the higher quality growth stories around. I expect a quick rebound and strong returns over the long term. This is a name I have been buying for the Best of Breed portfolio.

Be the first to comment