MOZCO Mateusz Szymanski

Uber Technologies, Inc. (NYSE:UBER) stock is down 36% this year, which had a lot to do with the broad market negativity. Tech stocks in general have had a bad year as investors began to shift to more stable and long-term value plays. Despite mobility restrictions, Uber thrived during the pandemic as the company focused on its food delivery business, Uber Eats, which helped Uber stay afloat. However, investors are concerned that with the economic reopening, demand for online food orders would slowdown materially in the future. Uber’s mobility business came to a halt in 2020 and struggled in the first half of 2021 due to lockdowns and social restrictions but has now recovered fully thanks to stellar demand in the post-pandemic era.

While the lifting of pandemic-related restrictions was a positive sign because it returned cities to normalcy with people constantly getting on the move, investors are concerned that the rising regional Covid-19 cases would take a toll on car rental and ridesharing companies. However, Uber’s third-quarter results show that the company’s mobility business is back on track and continues to benefit from increased travel and changes in consumer spending. Despite concerns about inflation, rising interest rates, and Europe’s economic situation, investors rewarded Uber after the company reported better-than-expected third-quarter revenue.

The objective of this analysis is to determine whether Uber stock is an appealing investment at a time when revenue is trending in the right trajectory.

What Is Uber’s Revenue?

The company reported $8.34 billion in revenue for the third quarter, up 72% YoY aided by a strong recovery in the mobility business. As mentioned earlier, Uber relied heavily on its delivery business during the pandemic to stay afloat, but its mobility segment has surpassed food delivery revenue in all three quarters this year as riders began to take more trips. The company’s mobility segment reported $3.8 billion in revenue, an increase of 73% YoY. The increase in revenue is also due to a change in Uber’s UK mobility business model, which resulted in a $1.1 billion gain.

The food delivery segment generated $2.77 billion in revenue, a 24% increase year on year. With $1.75 billion in revenue, Uber’s freight business, which is currently the smallest segment, grew 336%. However, Uber’s revenue growth in 2022 was significantly boosted by Uber Freight’s acquisition of Transplace, which was completed in November 2021, and a change to its U.K. Mobility business in December. The change in its business model transformed it into an official transportation services provider, requiring the company to report all of its bookings as revenue.

Total gross bookings were $29.1 billion in Q3, up 26% YoY with mobility gross bookings increasing 45% and delivery gross bookings increasing 13%. Delivery Gross Bookings were up 19% in the United States and Canada, while the rest of the markets were up 8% in constant currency.

The number of monthly active platform consumers (MAPCs) reached an all-time high of 124 million in the third quarter, up 14% YoY, with 1.95 billion trips completed on the platform during the period, averaging twenty-one million trips per day. The company’s take rate, or the percentage of bookings that Uber keeps as revenue, also increased year over year. The mobility take rate was 27.9%, while the delivery take rate was 20.2%.

Uber’s gross bookings growth has slowed over the last year due to currency headwinds and business changes. The company expects the slowdown to continue, with gross bookings increasing by 23% to 27% (in constant currency) in Q4. Currency headwinds are expected to impact bookings by about 7%.

Is Uber Profitable?

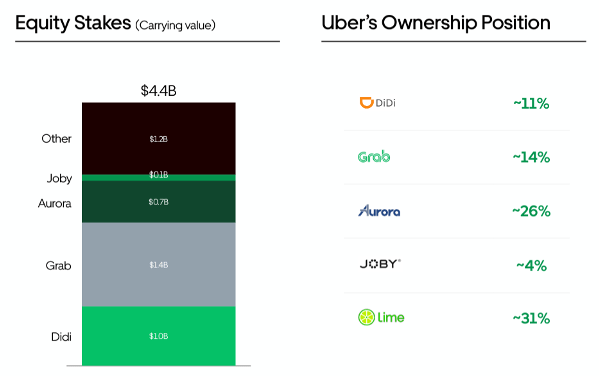

Uber reported a $1.2 billion net loss for the third quarter, which is half of its $2.42 billion net loss in Q3 2021. However, only $212 million of the loss was attributable to its core operations, with the rest coming from a revaluation of its equity investments in Grab, Aurora, and Zomato, as well as stock-based compensation expenses. In August, the company sold its entire equity stake in Zomato for net proceeds of approximately $376 million. The company’s adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) increased from $8 million in 2019 to $516 million this quarter, marking Q3 Uber’s fifth consecutive quarter of EBITDA positivity.

Exhibit 1: Uber’s equity stakes

Earnings presentation

Source: Earnings presentation

Despite the loss, Uber is making a concerted effort to turn a profit and has reported positive cash flows since the second quarter. The company has divested itself of its less profitable non-core businesses, and the refocus on its core businesses may soon generate consistent earnings. The company is on the right track and has successfully onboarded more customers who are willing to spend more money on its platform.

Furthermore, Uber is getting into the advertising business, having launched ‘Uber Journey Ads’ earlier this year, which are in-vehicle advertisements that entertain and engage customers with video advertisements while they are riding. In addition, the company provides ‘Sponsored Listings’ across Uber and Uber Eats, allowing brands to capture consumers’ attention and promote offers. Despite the slowdown in ad spending, active advertising merchants surpassed 250,000 during the quarter. These developments provide reasons to be bullish on the company.

What Is The Business Outlook?

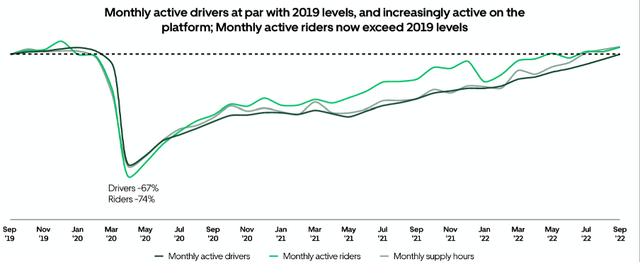

With recovering travel demand and an improvement in labor shortages, Uber continues to see strength across all business segments. According to CNBC, the company has recovered 80% in terms of drivers returning to the service, with 72% of drivers in the United States citing inflation as one of the factors in their decision to drive for Uber. Drivers and couriers earned a total of $10.8 billion (excluding tips) during the quarter, a 25% increase YoY.

Exhibit 2: Mobility active drivers

Earnings presentation

Source: Earnings presentation

Although Uber’s gross bookings growth is slowing, this is not surprising given the company’s robust post-pandemic recovery through 2021. On the other hand, the company’s losses are shrinking, and its take rates are improving. Uber anticipates $600 million to $630 million in adjusted EBITDA in Q4 and has reiterated its goal of $5 billion in adjusted EBITDA by 2024. Although investor focus should be on profits in terms of positive net income – not EBITDA – the continued increase in cash flows is a sign that the company is moving in the right direction to achieve profitability in the coming years while continuing to invest in the business.

Uber anticipates the growth of the advertising business will benefit the mobility and delivery segments. The company is also working toward becoming a zero-emission platform by 2030. To accomplish this, Uber announced a partnership with Moove, a mobility fintech startup, to bring 10,000 electric vehicles to London by 2025, as well as partnerships with Stellantis and Free2Move in France and BP Pulse in the United Kingdom. In October, the company announced a partnership with Splend, an Australian company that provides cars, training, and data analytics to drivers, to bring 500 premium EVs to driver-partners in NSW, with the majority planning to be delivered before the end of the year and the remainder arriving in early 2023. These sustainability efforts – although will not have a direct impact on profitability – could help attract a new generation of investors in the coming years.

Is Uber Stock A Buy, Sell, or Hold?

Given the positive cash flow trends and improving profitability, Uber appears to be delivering on its promises. However, because of the unpredictability of regulatory headwinds related to the Labor Department’s recent proposal to reclassify gig workers as employees may increase the company’s costs in the future. The company is experiencing strong growth but lacks profits, making it a risky bet in the short term due to the challenging environment. However, given the recovery of the mobility business, continued growth in the delivery segment, and opportunities in the freight business, Uber stock seems to be a great long-term opportunity at these discounted prices.

Be the first to comment