Massimo Giachetti/iStock Editorial via Getty Images

Article Thesis

The Invesco QQQ ETF (NASDAQ:QQQ) is one of the most important tech ETFs investors can put into their portfolios. Its strong capital appreciation in recent years has made the ETF a good investment, but with interest rates continuing to climb, “growthy”, expensive names will likely not outperform in the coming years. Since QQQ does not offer an especially attractive income stream, other tech investments could be better ideas for an income investor’s portfolio.

What Is The Average Return For QQQ?

Over the last twelve months, the Invesco QQQ ETF has delivered a return of 9%. That’s very solid in absolute terms, but other ETFs, such as the S&P 500-replicating SPY (SPY) have performed better, as SPY is up 11% over the last year. When we take a longer-term view, QQQ has outperformed the broad market, however.

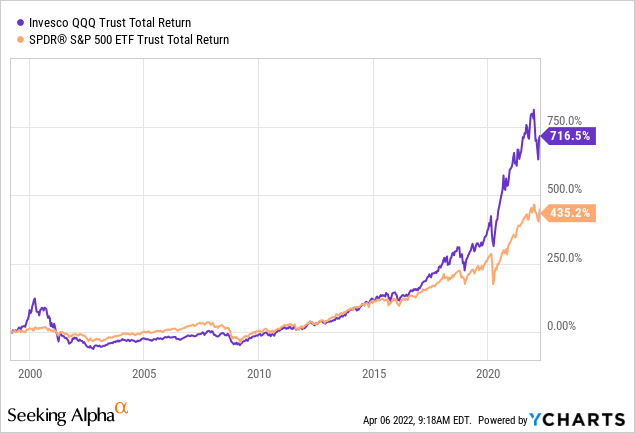

Since its inception in the late 1990s, the Invesco QQQ ETF has delivered a total return of more than 700%, or about 10% a year. The S&P 500 has delivered a return of more than 400% over the same time frame, for an annual return of 7%. When we consider that both the tech industry as well as the broad market as a whole were relatively pricey in the late 1990s, the returns for both ETFs are solid, with the tech-heavy QQQ outperforming meaningfully. In the above chart, we also see that this outperformance was not constant over time, however. Instead, the QQQ trailed the broader market at times. Up to ~2010, the QQQ performed worse than the SPY on a since-inception basis. Up to around 2015, the QQQ and SPY performed relatively on par. Since 2015, however, the Invesco QQQ ETF clearly decoupled from the broad market.

The outperformance over the last couple of years was driven by ultra-loose monetary policy that benefitted growth names, the pandemic and its impact on e-commerce, work-from-home picks such as Zoom Video (ZM), and by the strong results by many large tech stocks, including Alphabet (GOOG)(GOOGL), Amazon (AMZN), Apple (AAPL), etc. Multiple expansion in formerly inexpensive tech mega-caps such as Apple or Microsoft (MSFT) also played a role in QQQ’s outperformance.

Since its inception, QQQ has thus outperformed the broad market with a ~10% annual return. But it seems questionable whether the recent trends that benefitted QQQ will remain in place forever. With a more restrictive monetary policy in 2022 and beyond, and with pandemic tailwinds fading, growth names will likely not outperform forever. The performance between inception and 2015, when QQQ and SPY delivered comparable returns, might thus be a better predictor for the future.

How Much Of A Dividend Does QQQ Pay?

Many tech names, including highly profitable ones such as Alphabet or Meta Platforms (FB), do not make any dividend payments. Even those tech mega-caps that do pay dividends oftentimes offer below-average yields, such as Apple and Microsoft, with dividend yields of just 0.5% and 0.8%, respectively.

All in all, these factors result in a pretty low dividend yield of just 0.5% for the Invesco QQQ ETF, based on an annualized payout of $1.74 and a share price of $353.

QQQ Key Metrics

QQQ’s returns have primarily consisted of share price appreciation in the past, as the dividend yield was not large enough to have a significant impact over the years. That being said, the dividend growth rate has been quite solid for the ETF. Seeking Alpha reports that the dividend growth rate was 13% over the last decade, and 7% over the last five years. When we factor in the pretty slim yield, QQQ nevertheless isn’t a great income choice, though. If QQQ were to grow its dividend by 7% a year in the future, too, it would take until 2032 for investors to get a dividend yield on cost of 1% if they bought at current prices.

For ETF investors, a couple of other metrics are important as well. The first one is the expense ratio, which shows how much money investors are paying to the company that manages the ETF. In QQQ’s case, that’s Invesco (IVZ), which takes 0.2% of the ETF’s assets under management per year. That’s a higher expense ratio compared to even larger ETFs such as the SPY, where the expense ratio stands at just 0.09%. That being said, the expense ratio is still pretty small compared to what investors are paying when investing in mutual funds and similar vehicles, where expense ratios are oftentimes in the 1%-2% range.

QQQ’s investments are distributed over the 100 stocks that make up the NASDAQ 100 index. Naturally, there’s a heavy weight on mega-caps such as Apple, Microsoft, etc. Due to how the underlying index is constructed, there are some stocks in the index and the ETF that are not really “techy”. Examples include soft drink players Keurig Dr. Pepper Inc. (KDP) and PepsiCo (PEP), retailers Costco (COST) and Walgreens Boots Alliance (WBA), and even CSX (CSX), which is a railroad company. That being said, the emphasis clearly is on tech stocks, which also make up all of the biggest ETF investments.

Is QQQ A Good Investment For Dividend Portfolios?

From a pure income perspective, QQQ isn’t a good choice for dividend portfolios. The yield is just too low, and even the solid dividend growth rate will not turn QQQ into a meaningful income machine in the foreseeable future.

On the other hand, one can argue that income investors might want some exposure to higher-growth themes in their portfolios. In that case, QQQ might be a worthy addition, although I do not believe that this must necessarily be the case. First, the factors that have led to QQQ’s recent outperformance versus the broad market will likely not remain in place going forward. Quantitative tightening and rising interest rates will hurt growth stocks and should therefore have a meaningful impact on the growth-heavy NASDAQ index.

Fading pandemic tailwinds for tech names (e.g. e-commerce) are another factor that might lead to underperformance for QQQ going forward. With the pandemic easing, travel names, entertainment, brick-and-mortar retailers, etc. could benefit, and those are generally not included in QQQ. Instead, investors can get access to these industries via a broad-market ETF such as the SPY. Since the SPY also offers a significantly higher dividend yield than QQQ, at 1.3%, it might be a better choice for broad equity exposure.

Investors that want to own income investments in the tech space could be better off looking for individual stocks. Many tech stocks don’t pay (meaningful) dividends, but there are some that are quite attractive income investments.

Texas Instruments (TXN), for example, offers a dividend yield of 2.6% and has raised its dividend by 19% annually over the last five years. The semiconductor stock thus offers a way higher yield and faster dividend growth compared to QQQ. TXN also trades at only 19x net profits, which isn’t expensive for a company with a compelling growth track record.

Broadcom (AVGO) is another semiconductor company with a strong dividend growth profile. Its dividend yield stands at 2.7%, while its 5-year dividend growth rate is at an incredibly high level of 38%. That will slow down over the years, of course, but AVGO clearly is a company that puts a lot of focus on sharing its growing profits with the company’s owners. AVGO does trade at 17x this year’s net profits, which isn’t an expensive valuation, I believe.

Connectivity hardware player Cisco (CSCO), which offers switches, routers, etc. to its customers is another tech pick with an above-average dividend yield. Its dividend yields 2.8% today, and the company has raised the payout by 7% annually over the last five years. That growth rate is not as high as that of TXN or AVGO, but in combination with a yield of close to 3% and a low valuation (the P/E ratio is just 15.5), Cisco could nevertheless be a solid tech income pick.

Takeaway

Traditional income stocks are oftentimes active in industries such as healthcare, consumer staples, real estate, energy, utilities, and so on. Tech generally isn’t a great place to look for income stocks, as companies oftentimes prioritize growth spending over shareholder returns.

QQQ thus isn’t a great choice for income portfolios. The yield is pretty meager, and it is far from guaranteed that share price appreciation will make up for that in the future. QQQ had a great run over the last couple of years, but there is no guarantee that history will repeat. Investors looking for income from tech investments might be better off investing in individual stocks, such as TXN, AVGO, or CSCO.

Be the first to comment