Brandon Bell

Perhaps there is no bigger winner from the recent energy boom than the stock of Occidental Petroleum (NYSE:OXY). OXY, once written off as a victim of the pandemic, has suddenly seen its acquisition of Anadarko Petroleum fully validated as the company is generating sizable cash flows. One of the main bearish arguments has been its large debt load, but the current cash flows make it seem like just a matter of time before the company regains its investment grade ratings. I discuss my outlook for the stock as we potentially move beyond the high commodity prices.

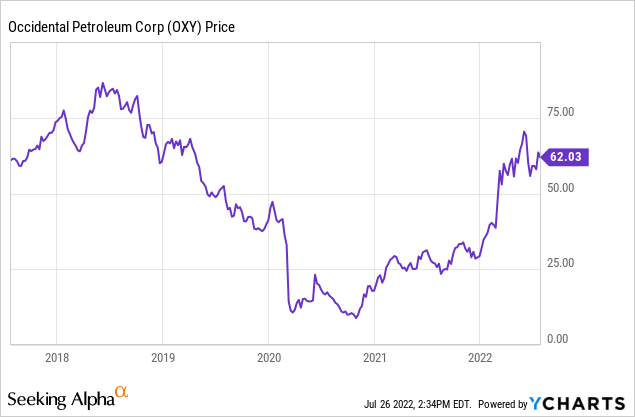

OXY Stock Price

OXY saw its stock drop to the high single digits during the pandemic but has since been a monstrous winner as commodity prices soared.

Now trading around $60 per share, OXY still trades lower than it did prior to the pandemic in spite of commodity prices being substantially higher.

OXY Stock Key Metrics

Given the high oil prices, it is no surprise that OXY has been performing strongly. That may be an understatement – the company has been essentially printing money. After adjusting for $2.5 billion of non-cash tax benefits related to post-Anadarko acquisition costs, OXY earned $2.1 billion of adjusted net income – a huge jump from the $136 million net loss of the prior year’s first quarter. What drove the jump? It can be summed up in two words: operating leverage. Production volumes were slightly down over the prior year and commodity prices were up around 70%. That led to revenues jumping by 56% to $8.5 billion. The key though is that almost all of those excess revenues were able to flow directly to the bottom line as the company simply operated with the same assets. It was business as usual, except the company earned a greater return on production. The operating leverage shows in mathematical terms why energy companies can shift from burning cash to printing cash based solely on fluctuations in commodity prices.

OXY used that cash flow boom to pay down debt – the company paid down $3.3 billion of debt and ended the quarter with $26 billion of debt.

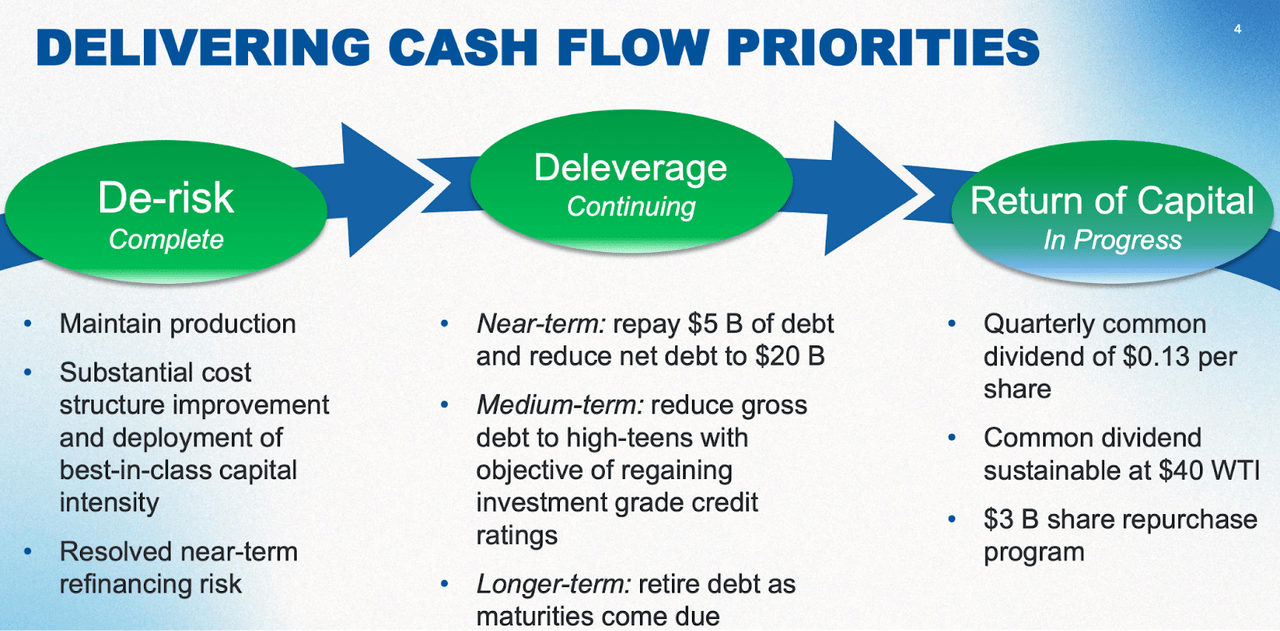

OXY has indicated its desire to pay down another $5 billion of debt to bring its net debt position to $20 billion. The company believes that when its gross debt position falls to the high-teens it will be able to regain investment grade-credit ratings. I find that assumption to be reasonable considering a similar note from Moody’s (MCO).

2022 Q1 Presentation

After OXY completes its debt paydown plans, investors are bullish on prospects for an increase in returns of capital to shareholders through dividends and share repurchases. While OXY has a $3 billion share repurchase program, but management stated on the conference call that paying down $5 billion in debt will be its priority.

How Much OXY Stock Does Berkshire Hathaway Own?

Investors may be interested in OXY stock due to the fact that Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) has been buying shares. As recently reported by Seeking Alpha, Berkshire has increased its stake to 19.4% in the company. In addition to that $10.9 billion stake, Berkshire also owns $10 billion of preferred stock and warrants to purchase an additional 83.9 million shares.

What Is The Outlook For Occidental Petroleum?

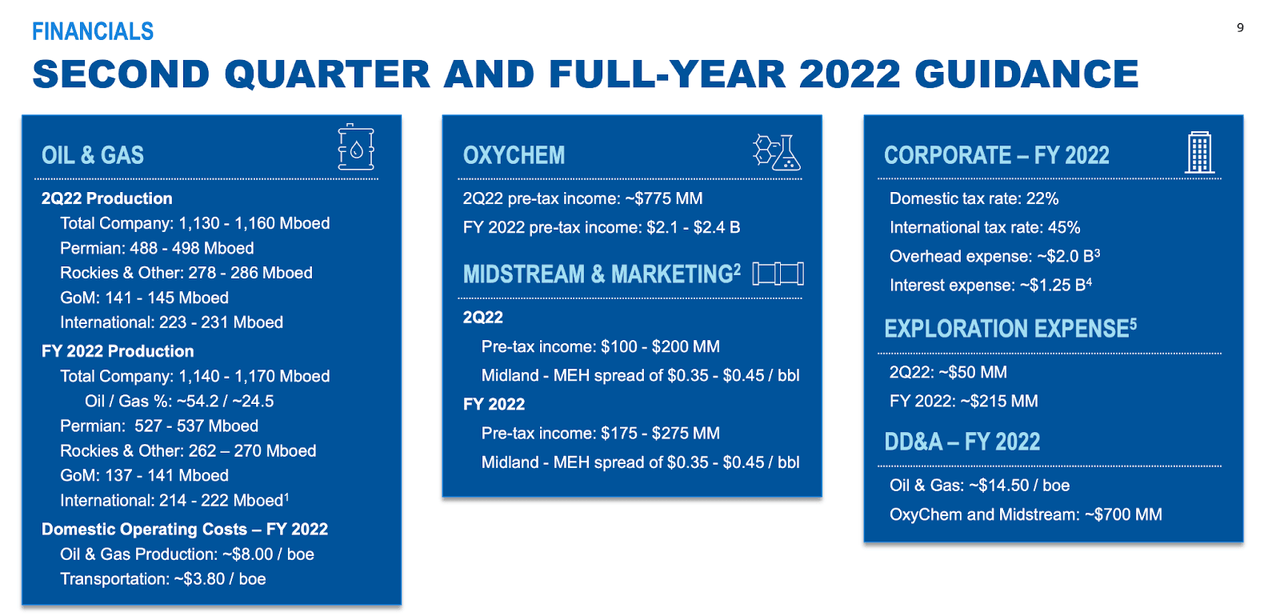

OXY has guided for volumes to pick up for the rest of the year, which should lead to a boom in fundamentals.

2022 Q1 Presentation

Consensus estimates call for $37 billion in revenues, representing 38% YOY growth.

Seeking Alpha

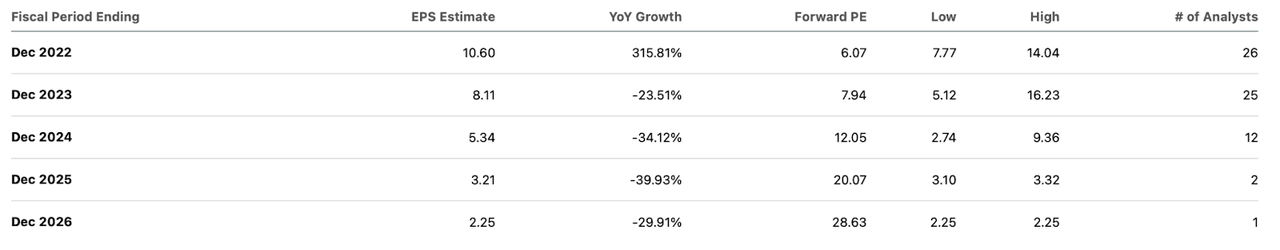

Consensus estimates also call for $10.60 in earnings per share, which would place the stock at 6x earnings.

Seeking Alpha

Is OXY A Good Long-Term Investment?

As OXY makes progress towards its de-leveraging goals, it may experience accelerating momentum. Based on its current run-rate, I can see OXY reaching its sub $20 billion net debt goal within two quarters at the most. At that point it is expected to embark on its $3 billion share repurchase program, but I am more excited about the prospects for additional de-leveraging. As Seeking Alpha contributor Open Square Capital wrote, OXY may be able to begin redeeming the preferred stock at a 10% premium after its share repurchase program is underway. That would be significant because the preferred stock yields 8% and costs the company $800 million annually.

While OXY might not be the most exciting or innovative investment, it has a very clear path towards creating shareholder value through de-leveraging, which may in turn eventually lead to multiple expansion.

Is OXY Stock A Buy, Sell, or Hold?

I suspect that many investors are tempted to buy OXY stock solely due to Warren Buffett’s involvement. I do not argue against the possibility that Buffett seeks to eventually acquire OXY in full at some premium to the current price, but I caution against investing solely based on the actions or beliefs of others. In particular, consensus estimates are calling for OXY to see earnings decline rapidly over the coming years – the stock is trading at 20x consensus 2025 estimates of $3.21 in earnings per share. That multiple is not obviously cheap. Of course, it is possible that high commodity prices persist for longer than expected, which would lead to sustained earnings power and further deleveraging. But investors must understand that OXY’s current 6x earnings multiple is highly dependent on prevailing commodity prices. The bull case seems to revolve around the possibility that the United States becomes a greater exporter as the world moves away from Russian sources. While that case is plausible, I can also see the world resuming “business as usual.” If oil prices were to decline back to around $55 per barrel as they stood in the first quarter of 2021, then I estimate that OXY can produce around $200 million of quarterly net income (assuming deleveraging) and around $1 billion of quarterly free cash flow. The stock is trading around 15x free cash flow based on those assumptions. The longer these high commodity prices persist, the more cash is generated which helps the valuations. However, OXY still has a sizable debt load and its shareholder yield might stand at only 5% assuming its $3 billion share repurchase program takes place, as debt paydown is likely to remain the priority over the medium term. I could see the stock trading sharply lower if oil prices collapse which might occur in several years. Perhaps the stock can trade at 8x to 10x free cash flow – that presents almost 50% downside. The 5% shareholder yield may do little to offset that downside. While the free cash flow generated right now may seem exciting, I expect other companies in the sector to offer superior returns, especially those that entered the boom with low leverage and are thus able to return the majority of cash to shareholders. I suspect that OXY’s stock price has been bid up to reflect a Warren Buffett premium – a distinction that may feel good to own but may not lead to the best shareholder returns. I rate shares a hold as the current valuation appears to be already pricing in bullish scenarios.

Be the first to comment