David Becker/Getty Images News

About ten months ago I took a deep dive into NVIDIA’s (NASDAQ:NVDA) share price and laid out my thesis on why investors should be less concerned about the company’s business fundamentals and laser focused on its momentum exposure.

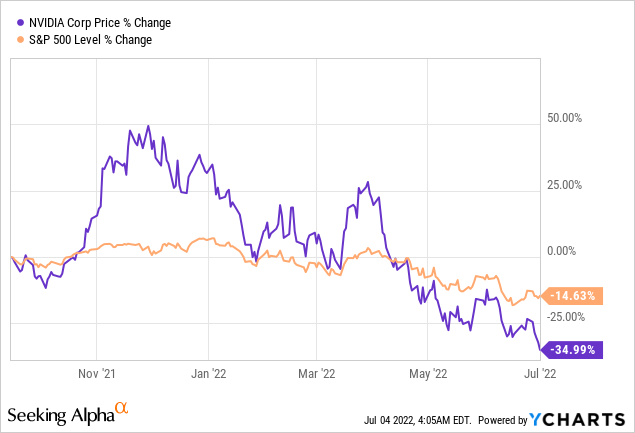

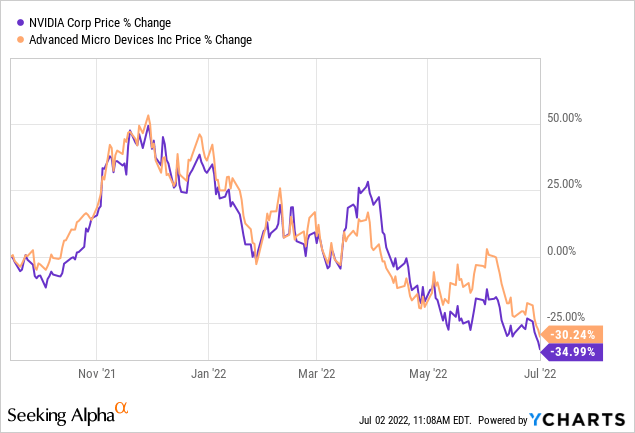

Although this might sound counterintuitive, since sooner or later fundamentals matter, Nvidia is still at the mercy of factors that have little to do with the company’s actual performance. That is why, since September of last year, the company lost nearly 35% of its value, while at the same time the S&P 500 fell by slightly less than 15%.

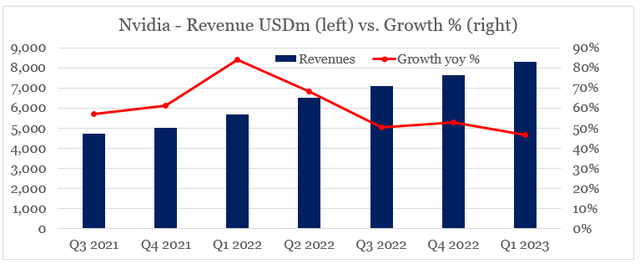

Such a large drop relative to the broader market was disappointing even when adjusting for Nvidia’s high beta of 1.6. Contrary to this abysmal share price performance, however, the company continued to grow its quarterly sales numbers at a nearly 50% rate.

prepared by the author, using data from Seeking Alpha

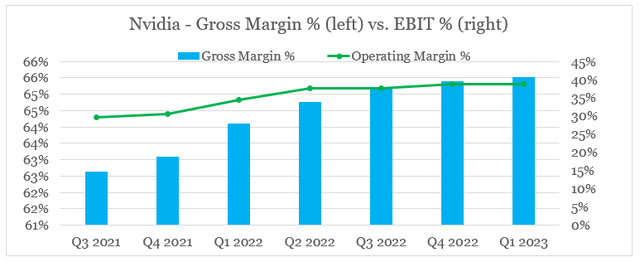

Not only that, but both gross and operating margins continued to improve over the past few quarters since I covered the company.

prepared by the author, using data from Seeking Alpha

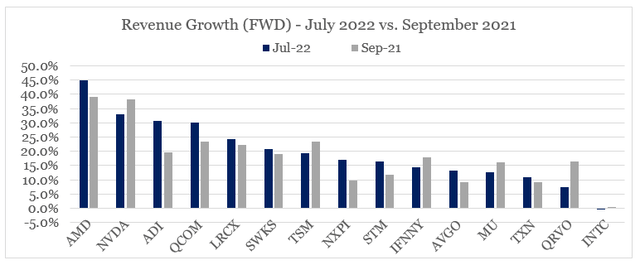

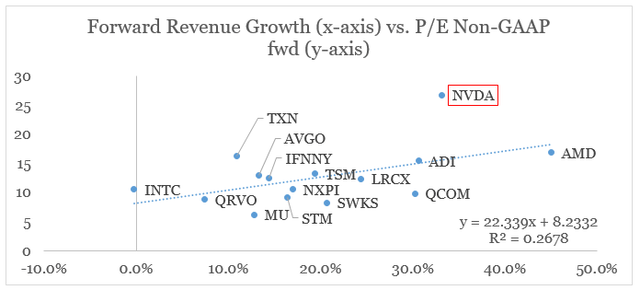

A somehow slowing topline growth rate could be partially to blame, however, Nvidia’s revenue forward growth rate is not very different now from what it was back in September of 2021.

prepared by the author, using data from Seeking Alpha

As a matter of fact, AMD (AMD) forward revenue growth rate is much higher now than it was back then and yet the company’s share price performed remarkably similar to that of Nvidia, thus also significantly underperforming the S&P 500 even on a risk adjusted basis.

So what happened?

To put it briefly, the risk that I highlighted in September materialized. Although I will not go into the details again in this article, I will highlight that momentum exposure of Nvidia combined with the monetary tightening (or at least the expectations of it) were the main factors for the company’s poor performance during the past 10-month period.

I also explained how the whole process works in my thought piece called ‘The Cloud Space In Numbers: What Matters The Most‘, where I did a case study based on another high-growth sector.

Monetary tightening has a profound impact on high duration stocks and unfortunately, Nvidia is still one of the most heavily exposed companies to rising interest rates in the semiconductor space.

prepared by the author, using data from Seeking Alpha

Even though the relationship between forward revenue growth rate and forward P/E ratios has weakened significantly since September of last year, the flattening of the slope of the trend line above was what caused the companies at the top right-hand corner to perform so poorly even as their business fundamentals improved.

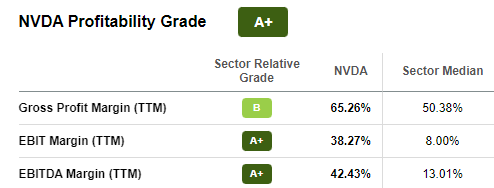

One of the reasons why Nvidia is still so far above the trend line above, is that in addition to its industry-leading growth rate, it also has one of the highest margins within the broader semiconductors peer group. The premium pricing of Nvidia’s GPUs also sets it apart from AMD, which is valued at much lower multiples.

Is Nvidia stock a bargain?

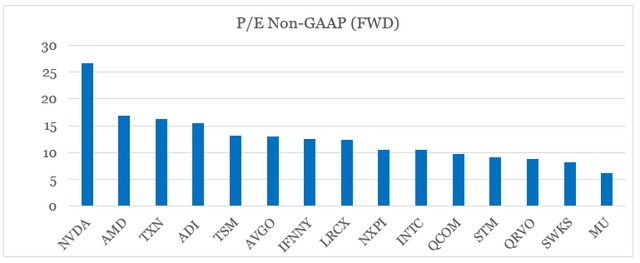

Nvidia is arguably one of the highest quality semiconductor companies, with enormous growth opportunities in data centers and the automotive sector. However, it now trades at more than twice the industry average forward P/E ratio.

prepared by the author, using data from Seeking Alpha

Moreover, recent developments in the GPU market, resulted in never before seen premiums for Nvidia’s products on the back of robust demand from consumers, data centers and cryptocurrency miners. All that propelled margins to levels far above its historical results and the sector median estimates.

Seeking Alpha

This, however, does not mean that Nvidia is suddenly a bargain, simply because a high growth and highly profitable company is trading at forward Non-GAAP P/E ratio of below 30x.

The main reason why the absolute value of its forward P/E ratio could be misleading is that the semiconductor industry is highly cyclical. Therefore, during cycle peaks, P/E ratios tend to be low due to high profits and share prices reflecting the risk of slower future sales growth.

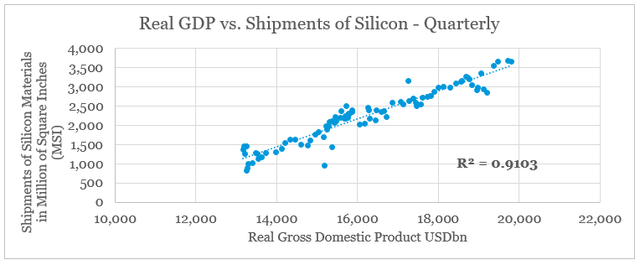

Although, the recent push towards digitalization has somehow dispelled the risk of semiconductors being cyclical, the industry remains closely related to the business cycle (see below).

Source: prepared by the author, using data from FRED and semi.org

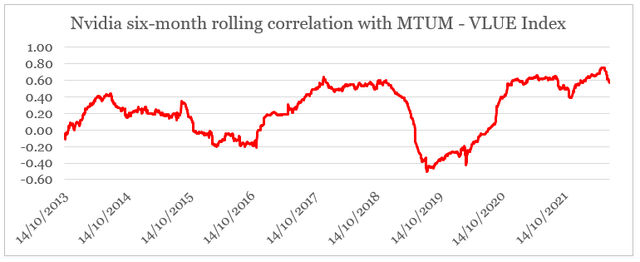

More importantly for Nvidia’s share price, however, is the fact that it still exhibits high correlation with the MTUM less VLUE index – an index that takes a long position in iShares Edge MSCI USA Momentum Factor ETF (MTUM) and a short position in iShares Edge MSCI USA Value Factor ETF (VLUE).

prepared by the author, using data from Seeking Alpha

As a result, Nvidia’s share price will continue to be highly sensitive to the momentum trade and more specifically to the overall liquidity in the equity market. Having said that, should the current monetary tightening cycle continue, Nvidia will likely continue to underperform even in the case of the company’s fundamentals remaining strong.

On the contrary, should the Federal Reserve reverse course and embark on yet another monetary loosening journey, then Nvidia could potentially return to its 2021’s highs. Although such a scenario should not be ruled out, it remains highly uncertain. Moreover, if it does not occur, then it will take many years before Nvidia returns to its all-time highs, all that provided that the company retains its industry leadership.

Conclusion

In the past couple of months since I first covered Nvidia, the company’s share price has turned from a shining star in the technology sector to a significant underperformer, both on an absolute and risk-adjusted basis. While this has convinced many commentators that Nvidia is now suddenly a bargain and that the market does not understand the future opportunities of the company, in reality Nvidia could continue to disappoint. Even if management continues to execute on the strong roadmap and demand remains robust for years, Nvidia’s share price is still at the mercy of the monetary conditions and available liquidity.

Be the first to comment