chrupka/iStock via Getty Images

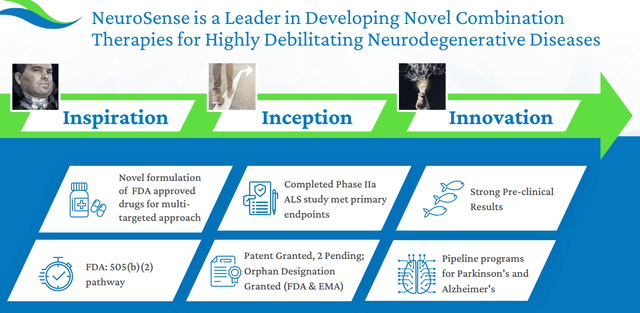

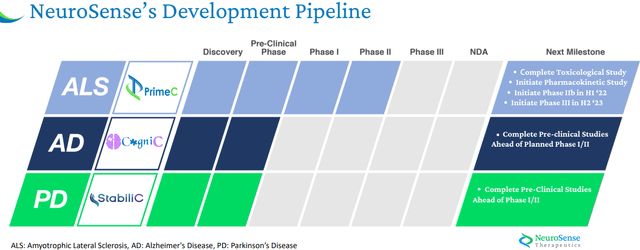

NeuroSense Therapeutics Ltd. (NASDAQ:NRSN) is focused on developing treatments for neurodegenerative diseases. The company’s flagship drug candidate known as “PrimeC” is intended to improve motor functions and the lifespan of Amyotrophic Lateral Sclerosis “ALS” patients which is recognized as a debilitating disease with over 5,000 people diagnosed each year in the U.S. Considering only a limited number of FDA approved ALS treatments, the attraction in NRSN is the potential that PrimeC ultimately moves towards commercialization and can capture a significant market opportunity. Furthermore, the company is also developing a therapeutic for Parkinson’s and Alzheimer’s utilizing a similar mechanism of action. Recognizing the inherent risks associated with clinical-stage biotechs, we believe NRSN looks interesting with several expected catalysts for the rest of 2022.

Company IR

Why Did NeuroSense Stock Go Up In March?

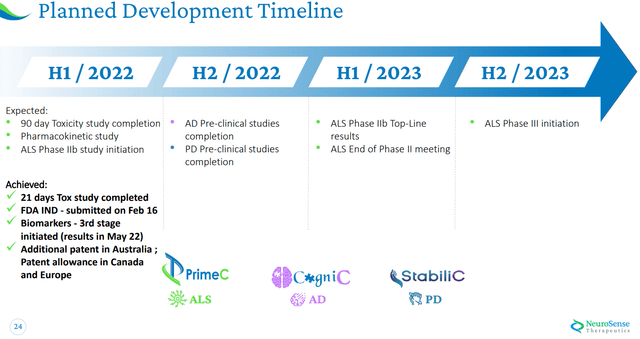

NeuroSense popped up on our radar following a spectacular 300% surge on March 21st, which was the result of a company announcement that the FDA had cleared a pharmacokinetic study for PrimeC in healthy adult subjects. In these types of tests, the purpose is to study how people handle the drug through blood tests over time and how it reacts with food. Simply put, it’s an important part of the drug development process and highlights NeuroSense making progress. The positive news translated into the stock price rally.

Seeking Alpha

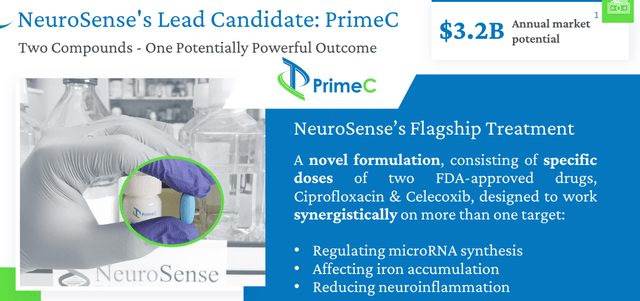

A key point about PrimeC is that it’s based on a novel formulation consisting of specific doses of two currently FDA-approved drugs, “Ciprofloxacin” and “Celecoxib”. The idea here is that it can target multiple pathways in ALS as a highly complex disease and generate efficacy improvements compared to existing medications. Specifically, the drug is intended to regulate microRNA synthesis, interact with iron accumulation in cells, and reduce neuroinflammation in patients.

There is a thought that since the underlying compounds have already been found to be safe in the FDA-approved versions, PrimeC has a good chance of also passing toxicological benchmarks. The completed phase 2a trial for PrimeC was able to show a reduced rate of locomotive and respiratory deterioration. Specific ALS-related biomarkers showed significant changes while the treatment was seen as well tolerated with no serious adverse reactions.

Company IR

NeuroSense Expected To Rise?

Investors can look forward to several milestones still this year across the ALS drug along with Alzheimer’s and Parkinson’s disease program. We mentioned the go-ahead for the pharmacokinetic study for PrimeC and the expectation is that this will lead to an initiation of a Phase 2b trial still in Q2. With StabiliC and CogniC, the company expects to complete pre-clinical studies for both in the second half of this year.

Company IR

Overall, we believe further updates and press releases in regards to the development pipeline can be positive for the stock. Following NeuroSense’s December 2021 IPO, the company received approximately $10 million in net proceeds which it believes is sufficient through the Phase 2b study completion in Q2 2023. On this point, NRSN remains relatively unknown and the ability of management to attend industry investor conferences to share the market opportunity can also help the stock price with some greater visibility.

Company IR

Is NRSN Stock Overvalued?

With a market cap of just ~$40 million, the valuation for NRSN is modest considering the opportunity if PrimeC reaches commercialization. The company sees a potential annual market of +$3.0 billion considering +80,000 ALS patients and over 5,000 people diagnosed each year. In other words, if PrimeC is found to provide even a marginal clinical improvement compared to existing ALS therapies, it’s fair to say the stock is undervalued at the current level.

Even among clinical-stage biotechs, there are many examples of companies with market caps above $1 billion that are in the same positions as NeuroSense with no current revenue. For this reason, we believe the NRSN stands out as a unique “nano-cap” opportunity with an attractive setup. The potential that the pipeline moves forward would likely draw a lot more attention to the stock and allow the company’s equity value to reprice higher. Progress in CogniC and StabiliC will also be important for the stock.

On the other hand, the understanding is that the timeline here is still several years away. Even with the planned initiation of an ALS Phase 3 trial in the second half of 2023, the earliest realistic possibility of a new drug application would only come in 2025. Even with the best of intentions, it’s common to see delays in these studies meaning investors buying NRSN today need to recognize this stock will remain speculative for the foreseeable future.

Is NRSN Stock A Buy, Sell, or Hold?

The call we are making is that NRSN can rally alongside the broader biotech sector. The small-caps and more speculative names in the group have been under significant pressure over the last several months but we sense that the momentum is turning into the more recent market rally. For context, the SPDR S&P Biotech ETF (XBI) is down over 35% from its highs in 2021 but has now climbed nearly 20% from its March low. While NRSN is not part of the underlying index, our point is that it should benefit from the improved sentiment in this market segment.

We rate shares as a buy with a price target of $5.50 for the year ahead, implying a market cap around ~$50 million. The key here is going to be the updates on the development timeline which can work as positive catalysts for the stock. Longer-term, the sky is the limit for the company if there is confirmation PrimeC will move towards approval.

Biotech and clinical trial names are among the riskiest types of stocks in the market. Investors have to expect continued volatility and be prepared for the worst. The main risk would be a setback in the approval process. Significant delays in the trials could add to liquidity concerns over the next few years. The strategy to own the stock is only to trade a small position in the context of a diversified portfolio.

Be the first to comment