hapabapa/iStock Editorial via Getty Images

Netflix, Inc (NASDAQ:NFLX) has been a growth investor’s dream. Over the last decade, the stock’s price has increased by nearly 2,200%.

Unfortunately for investors, that trend changed markedly following Q4 2021 results. Even though NFLX beat on the top and bottom line, and reported an 8.9% year over year increase in paid subscribers, the shares tumbled.

Following the earnings call, NFLX sank by 18% in after hours trading. Year-to-date, the stock has tumbled by well over 40%.

The short answer to the cause of the collapse is the relatively anemic guidance during the earnings call for subscriber growth. Management forecasts 2.5 million new customers to be added in the first quarter. If those numbers prove accurate, Q1 2022 will mark the slowest start to a year since 2011.

A more comprehensive assessment would include concerns regarding a pull forward in subscriber growth during lockdowns, increased competition, the relaxation of pandemic restrictions leading to reduced demand for streaming services, and questions ranging from the size of the firm’s debt to prospects for an increase in free cash flow.

Headwinds And Red Flags

“There’s more competition than there’s ever been.”

Reed Hastings, CEO, NFLX

From 2011 through the end of 2021, Netflix grew its subscriber count from 26.3 million to 221.8 million. In that same time frame, annual revenue increased from $226 million to $5.1 billion.

While increases in subscriber growth have been routinely robust, the pandemic related lockdowns are credited with turbocharging the company’s growth. In 2020, Netflix added more than 36 million new subs.

Unfortunately for owners of the stock, there is a flipside to that coin. As COVID restrictions wane, folks are opting for entertainment outside their homes. Furthermore, it is reasonable to assume that much of the subscriber growth was pulled forward. Consequently, growth could be muted over the short to mid term.

A second concern is a marked increase in competition over the last three years. In 2019 Apple TV+ and Disney+ debuted. In the following year, HBO and Peacock were rolled out. Added to that list of new rivals is a more aggressive Amazon Prime Video.

Furthermore, it isn’t just the number of streamers vying for viewers’ attention, it is the financial force that some bring to the table: Amazon (AMZN) and Apple (AAPL) are noted for having deep pockets.

Consider this: in 2021, Amazon devoted over $61 billion to capex. Apple budgeted over $11 billion.

Netflix spent $17.7 billion on content in 2021.

Amazon’s cash and marketable securities totaled $96.1 billion at the end of 2021.

At the end of 1Q22, Apple’s cash and short and long-term investments totaled $205.6 billion. That exceeds the market cap for NFLX.

At the end of 2021, NFLX held $6 billion in cash and equivalents and had $15.4 billion in total debt.

Apple authorized $100 billion for share repurchases in 2018, $75 billion in 2019, $50 billion in 2020, and budgeted $90 billion in 2021 for stock buybacks. By simply paring back on stock repurchases, Apple could fund content at a level well above that of NFLX.

Aside from the cash on rival’s balance sheets, NFLX has a significantly lower debt profile. Although S&P bumped its rating for the company to BBB/stable, Moody’s rating remains Ba/1 positive, a notch below investment grade.

Do not mistake my intent. I am by no means claiming that Amazon or Apple can or will devote the bulk of their resources towards streaming services. My goal is to highlight that in terms of financial prowess, NFLX is in a fight that is tantamount to Sugar Ray Leonard brawling the Klitschko brothers.

Another example of the forces arrayed against NFLX lies in Disney’s move to up its content budget. Netflix spent $17.7 billion on content in 2021. Disney plans to increase its streaming content budget to $33 billion over its next fiscal year.

We are nearly doubling the amount of original content from our marquee brands, Disney, Marvel, Pixar, Star Wars and National Geographic coming to Disney+ in fiscal year 2022, with the majority of our highly anticipated titles arriving July through September.

Bob Chapek, CEO, Disney

Disney’s investment in streaming is driving growth outpacing that of NFLX. Disney added 17.4 million streaming customers in its last quarter, with 11.8 million added by Disney+. In contrast, NFLX added 8.3 million subscribers.

Another concern is the profitability, or lack thereof, associated with streaming services. Despite the success of Disney+, management recently pushed the period when the service will reach its peak operating losses to FY22,versus an original forecast of FY21. The company has repeated that Disney+ will not be profitable until FY24.

This segues well into the fact that NFLX has lost money for most of its existence. The company burned through $850 million in 2015 with the losses increasing each year to a peak of $3.3 billion in 2019. However, management expects the company to become free cash flow positive for the full year 2022 and beyond.

NFLX: Many Manifest Strengths

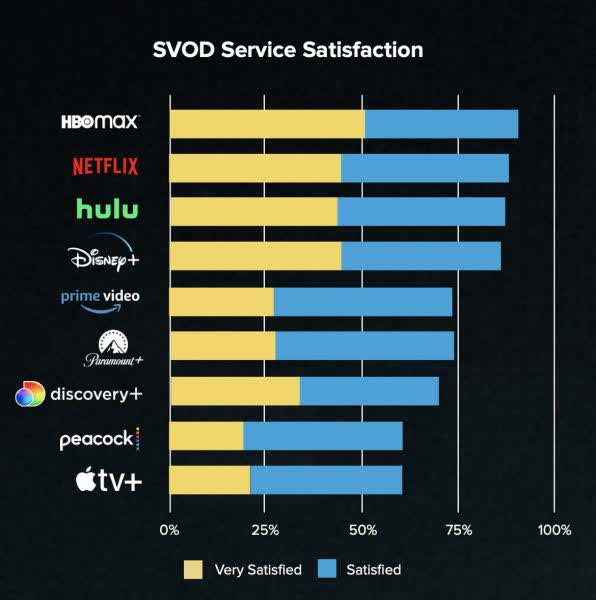

Multiple surveys indicate the average US home subscribes to four or five streaming services. Considering Netflix holds a preeminent position, it is reasonable to assume it will maintain its spot, considering consumers preference for multiple streaming services.

Furthermore, a recent survey by AudienceProject determined that in the US, NFLX commands a durable advantage over rivals: 90% of respondents stated they subscribe to Netflix, and 50% of that group listed the company as their favored streaming service.

Observer

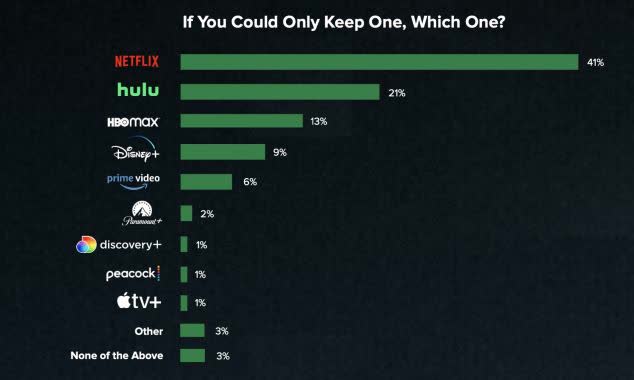

A survey by data firm Antenna asked consumers which streaming service they would keep if they could only retain one. Netflix was the hands down winner with 41% of respondents, nearly double that of the runner up (at 21%), Hulu.

Oberver

In 2021, Netflix received the most Emmy and Oscar awards and nominations.

At the end of 2020, Netflix had nine of the top ten acquired series and seven of the top ten original series. According to Nielson, NFLX broadcast six of the top 10 original movies.

This is of particular importance as studies indicate 92% of consumers give great weight to a streamers portfolio of series and films when choosing a service. Furthermore, 78% of those surveyed ranked the amount of original content as very important or important.

With nearly 100 million more subscribers than Disney, the next largest rival, NFLX has a decided scale advantage. With more viewers on its platform, the company harnesses the power of artificial intelligence to provide insights into consumer interaction and preferences. In turn, this improves content acquisition and production decisions.

The second scale advantage is that the cost of producing a particular piece of content remains the same whether a company has ten million subscribers or two hundred million. Costs related to additional subscribers are minimal. There is a point where additional subs increase profit margin markedly.

The growth in the company’s profitability over the years illustrates this strength: in 2016, NFLX posted an operating margin of 4.3%. In 2021, that metric had grown to 20.9%.

While Netflix has likely reached a point in North America where anything above an incremental increase in subscribers is unlikely, the streamer has a potentially long growth runway overseas, especially in Asia. In 2021, 16.9 million of the company’s 18.2 million new subscribers came from outside the US and Canada.

Management forecasts 500 million subscribers as the company expands in India and other global markets.

…there’s probably 1 billion connected TVs around the world. And you can see our penetration in the U.S. that you kind of do that math, we’re roughly 60% penetrated today. So, that pretty quickly gets us to business that’s over 0.5 billion members.

Spence Neumann, CFO, NFLX

Early this year, Netflix raised prices in the U.S. and Canada. The basic plan increased $1 to $10 per month, the standard plan increased by $1.50 to $14.49 per month, and the premium plan by $2 to $20 per month.

Unfortunately, increasing prices could prove deleterious. Recent surveys show 85% of respondents believe streaming services are too expensive, and that 32% of those surveyed canceled a streamer in the last year to cut costs.

Recent Developments

Late last year, Netflix slashed prices for its services in India. Monthly bills for subscribers will fall up to 60%. The standard plan, previously priced at the US equivalent of $6.55, will fall to $2.61.

While India is seen as a pivotal growth path for Netflix, the company is trailing competitors in the subcontinent. Disney+ Hotstar and Amazon Prime have 46 million and 19 million Indian subscribers respectively. NFLX has 5 million subs in that country.

India, we are still figuring things out. And so that investment takes some guts and belief forward-looking.

Reed Hastings, Co-CEO

While the situation in India may prove problematic, Netflix launched an initiative that could presage another revenue stream for the company. Last November, NFLX debuted Netflix games.

A subscription to NFLX provides immediate access to the gaming platform. Members will be able to play games on multiple mobile devices using Android or iOS. The games are available in many of the languages NFLX offers with its streaming service.

Netflix bolstered the new gaming division by acquiring Oxenfree2, Finnish mobile game maker Next Games, and Boss Media Entertainment, the developer of the popular strategy role-playing game Dungeon Boss.

Here is Spence Neumann’s response to a question regarding the future of the gaming initiative.

Well, again, it’s still super early days. So this is something that, as I mentioned, I think earlier, I hope it’s a big part of our business in a decade. It’s not going to be a big part of our business in the next 12 months, but we’re very pleased with what we’re learning so far.

If we are to take Mr. Neumann at his word, then investors should not expect an abrupt change in the company’s fortunes due to gaming. Count me as one that believes Microsoft (MSFT) is on a path to dominate gaming. I doubt NFLX will be able to compete at the highest level; however, I do see the addition of gaming to the company’s streaming services as a means to differentiate it from rivals and to add “stickiness” to its offerings.

What To Expect From Earnings

Netflix is scheduled to report its first-quarter earnings on April 19. The most closely watched metric will be the company’s net paid subscriber additions. Management guided for just 2.5 million net new paid subs in the first quarter. This is well below the 4.0 million the company added in the comparable quarter of 2021. However, this should be kept in context, as consumers were flocking to streaming services due to COVID lockdowns.

Of course, the company’s guidance for subscriber growth in the second quarter of 2022 will be of great importance. It is reasonable to assume the recent drop in NFLX shares was sparked by management’s guidance for net paid subscriber additions last quarter.

Of course, the period marked by the pandemic draws tough comparisons. However, for NFLX to match Q2 22 subscriber levels with pre-COVID levels, Netflix must guide for roughly 2.7 million new subscribers.

The company’s planned content budget, as well as forecasts related to free cash flow and other profit metrics, will be closely monitored.

Average revenue per subscriber increased by 7.6% in 2021, and analysts forecast that growth rate will nearly double to 15% in Q1 due to recent price changes in North America.

EPS is forecast to hit $2.92, and revenue is expected to land at $7.95 billion.

It is important to note that over the last ninety days there have been thirteen downward revisions for EPS versus one upward revision.

It will also be interesting to peruse management’s commentary regarding competition with rivals.

Is NFLX Stock Overvalued Now?

Netflix currently trades for $341.13 per share. The average 12-month price target of the 36 analysts covering the company is $534.71. The price target of the 28 analysts that rated the company since the last earning report is $655.60.

NFLX has a forward P/E of 30.54x versus its 5-year average P/E of 91.47x. The company’s 5-year PEG, according to Seeking Alpha, is 1.00x. Yahoo estimates the 5-year PEG at 1.67x. Both estimates are well below its average PEG of 2.27x.

Is NFLX Stock A Buy, Sell, or Hold?

I fear that to compete effectively, Netflix will be forced to increase its content budget markedly. Peruse the following exchange between an analyst and management during the third quarter earnings call:

…do you look at your current $17 billion of cash spend and say, well, it’s easy to imagine that being 2x or 3x, that level to achieve what we want to achieve.

..you’re definitely thinking too small. Now it will take a couple of decades to get there, it’s not overnight.

Pundits see streaming as having an enormous addressable market. However, NFLX has harvested most of the low-hanging fruit, and during much of its existence, the company had little competition.

Increased competition is seldom a positive for any company. In the case of Netflix, rivals are emerging from many quarters, including some of the largest corporations in the world, and that is having its effect.

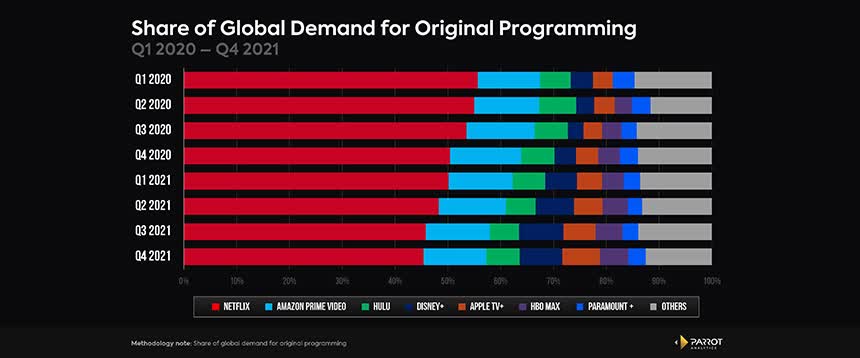

Global demand share for Netflix dropped from 55% in Q2 2020 to 45.4% in Q4 2021.

Senal News

Nonetheless, NFLX has a number of advantages, one of which is the company’s sheer scale. This leads to markedly larger profit margins once a streamer reaches a certain size. Additionally, as noted in this article, NFLX has a distinct content advantage over rivals.

Although Netflix is still priced as a growth stock, the P/E and PEG levels are far below the company’s 5-year averages. Analysts forecast revenue to grow by 12.4% in 2022, although full-year earnings will remain near $11 per share. In 2023, earnings are expected to hit over $14.

Consequently, I rate NFLX as a BUY.

However, NFLX is not a SWAN investment. I suggest investors pay close attention to developments surrounding the streaming wars.

Be the first to comment