gremlin/E+ via Getty Images

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

May Be A Long Haul, But May Prove Worth The Wait

As longtime technology investors here, we believe that the Metaverse will indeed come to pass. It probably won’t be called the Metaverse when it does. Probably that will be a discarded and laughed-at term. But that doesn’t mean that the internet won’t move to its next stage of immersion, being, more 3-D, more real-time, and generally further displacing reality as the location in which stuff happens. This we believe is a tectonic shift no less disruptive than the last – being the mass commercialization and general move to “oh look it actually does work now” that characterized Internet 2.0 from around 2010 onwards. And the drivers of change will, we think, be (1) supply side driven – chip companies need to sell ever more complex and expensive chips, software companies more software, hardware companies more hardware, and unless there is a true reason for retail and corporate customers to undertake a refresh cycle, they won’t do so with any gusto – and (2) demand driven – the desire to do things better, faster, more online is well established now.

Sentiment around the Metaverse now is a lot like sentiment was around something called m-commerce in about 2002. M-commerce was a principally European term that sprang up as the early third-generation cellular telephony licenses were being auctioned by European governments. E-commerce – buying stuff on your computer – was a thing by then but m-commerce – buying stuff on your phone – not so much.

But that’s because this is the sort of phone that people had around that time, and that’s if you were cutting-edge!

Nokia 7110 WAP Phone (DeviantArt.com – https://www.deviantart.com/redfield-1982/art/Nokia-7110-523045144)

So whilst everyone was busy talking up m-commerce and how exciting it was going to be, it didn’t actually happen until the Apple and Google App Stores got going and were accessible on mobile devices that actually enabled you to buy stuff worth buying. And that was a good few years after those 3G licences scooped the big money for governments.

We see the Metaverse in a similar way. Is this really the killer app for the next generation Internet?

Weird (New York Times (https://www.nytimes.com/2021/11/02/arts/mark-zuckerberg-meta.html))

Probably not. Does anyone know what the killer Metaverse apps are? We doubt it. Did anyone foresee the hugely enormous success of the Apple and Google app stores in 2002? They did not. At least not in any way that was sufficiently specific to be actionable.

Sometimes tectonic shifts in technology just take time, and you have to let them play out. You can invest too early, and/or invest in the wrong names, these are all venture capital type risks that you are taking on if you are going long the Metaverse in any kind of specific way now (as opposed to say owning Nvidia (NVDA) stock which is a more diffuse way to play the theme).

And with that in mind, let’s turn to Matterport (NASDAQ:MTTR) and consider what investors should know about it.

What Should Investors Know About Matterport?

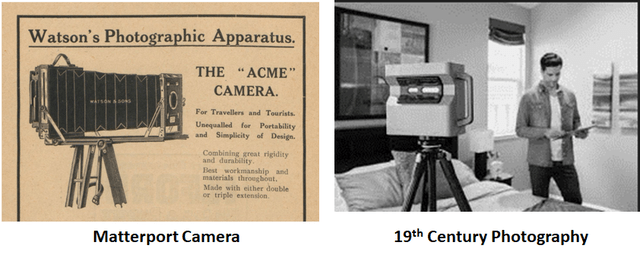

Today, Matterport, Inc offers a clunky integrated hardware and software system used by realtors near you to capture, digitize and 3D model whatever piece of real estate they are presently hawking to the unsuspecting punter.

It uses cameras resembling those last seen in Charlie Chaplin’s day and software that probably needs an AS/400 to run. But the output is pretty impressive – you’ve almost certainly seen the output as a 3D model of any home or premises you’ve doomscrolled lately.

The economics are poor today reflecting both the integrated model and the fact that the revenue model is the old Larry Ellison license/services/maintenance model, now deeply unfashionable on account of its predilection for unreliable outcomes, earnings misses and so forth.

Excited so far? Us neither.

But let’s paint a picture of the future.

Where the real estate opportunity persists and MTTR continues its quasi-monopolistic presence; and where the Metaverse has started to come together and uses MTTR applications to extract, transform and load physical domain real estate into the digital domain. That’s where the company’s product is headed, using iPhones too, not the giant gross-margin-negative devices employed today.

Opposite Day (Matterport website, Met Museum (https://www.metmuseum.org/art/libraries-and-research-centers/watson-digital-collections/rare-materials-in-the-met-libraries/pictorialist-photography-exhibition-catalogs-1891-1914))

So we now have two risks to consider, which is that the company is in Transition (urgh) to the Metaverse (urgh).

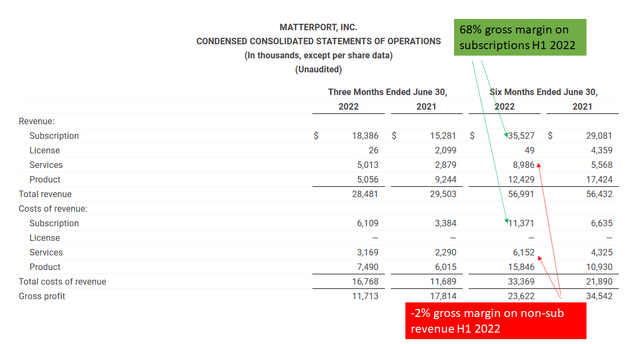

Now, as regards moving from the perpetual license to the subscription model, the company is doing rather well, as you can see from their Q2 earnings release, below.

MTTR Gross Margin Transition (Matterport Q2 Earnings Release)

All told, the future might be bright. But it’s not bright yet.

Is Matterport Fairly Valued?

MTTR is valued on the basis of its potential, not its present reality. Here are the numbers.

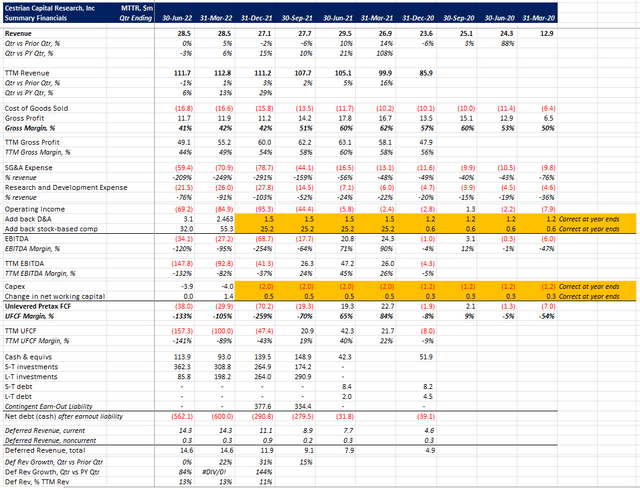

(Note, due to the spotty reporting of new-to-market stocks we don’t yet have perfect data for historic quarterly depreciation & amortization or stock-based comp charges – the orange-highlighted numbers are averaged out over the quarters. The last two quarters’ numbers are as per the company’s SEC filings and the variations in those averages don’t change the story as far as we are concerned. We’ll be updating for actuals as and when that data becomes available.)

MTTR Financials (Company SEC Filings, YCharts.com, Cestrian Analysis)

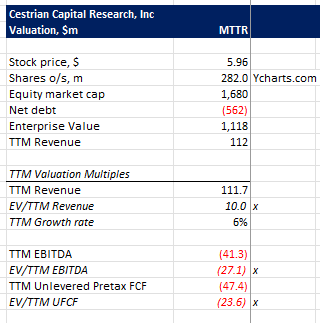

The stock is presently valued at 10x TTM revenue in exchange for 6% revenue growth – which isn’t sensible.

MTTR Valuation (Company SEC Filings, YCharts.com, Cestrian Analysis)

We conclude that investors are looking through the headline growth towards the underlying subscription growth and, again, towards the positioning to come in the Metaverse not the positioning today in vertically-integrated property tech.

Is Matterport’s Outlook Positive For 2022?

We think the outlook is positive. We think that the stock, beaten up along with other speculative names since Q4 last year, is evidencing possible institutional accumulation. The volumes traded at these lows are the highest of any price in the stock’s history. (You can open a full page version of this chart, here).

MTTR Chart (TradingView, Cestrian Analysis)

We believe this alone augurs well for the future.

Is MTTR Stock A Buy, Sell Or Hold?

We believe MTTR is a stock that can be bought with some confidence if (1) you have a very long term perspective and can wear the inevitable volatility that will follow, (2) apply suitable risk management techniques – notably position size given the difficulty of finding any specific hedge for the name, and in addition consider using stop-losses in the region we identify above. Further, we think the stock can be bought with this in mind in that green range we show above – which is to say in the same price range that volumes are being acquired in right now. If this does prove to be a time of institutional accumulation – we cannot know, we can only try to infer from the volume profile – then owning the stock at an institutional price then holding for some years is likely to mimic how Big Money is, we think, playing this name – and that’s usually a good approach to long term investing.

We rate MTTR at Accumulate on that basis. It’s such an early stage stock that with no fundamental or technical tools can we project a sensible price target – we think it can achieve multiples of the current price if held for say 3-5 years. Only you can decide if that’s a good use of your capital or not.

Cestrian Capital Research, Inc – 15 August 2022.

Be the first to comment