Alan Staats/Getty Images News

Kinder Morgan (NYSE:KMI) is a popular dividend stock in the midstream sector due to its high yield and lack of K-1 tax form requirements (unlike many midstream peers, KMI is a corporation not a limited partnership). Unfortunately, I am of the view that the lack of K-1 tax forms has caused the stock to trade at an undeserved premium relative to potentially higher quality midstream peers. While the 6.6% dividend yield is significantly higher than typically seen in today’s market, it is arguably not enough for a company that has made minimal financial progress over the past several years.

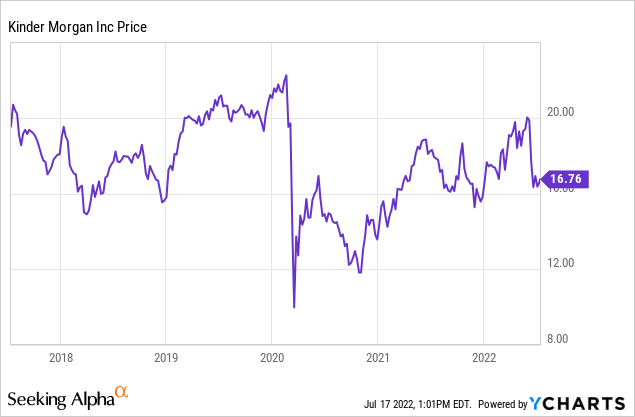

KMI Stock Price

Like many midstream peers, KMI still trades at a discount to pre-pandemic levels.

Interestingly, KMI’s stock price appears to not have benefited from the surge in energy prices, at least not nearly to the same extent as midstream peers. I last wrote about KMI in December of last year, where I called the 7% yield a long term value trap due to my fears of tail-end risk. Since then, I have actually walked back my bearish thesis regarding midstream stocks, of note upgrading my rating of Enterprise Products Partners (EPD) to buy even though that stock had increased in value since my previously neutral call. That upgrade was due to my view that US energy companies will benefit from an infusion of cash (due to the high prices) and potentially benefit from longer term growth if the US begins taking a bigger role of the global energy supply. That thesis does apply to KMI as well, but there are some key issues. In addition to still trading at a notable premium, I am concerned regarding the fundamental performance over the past several years.

KMI Stock Key Metrics

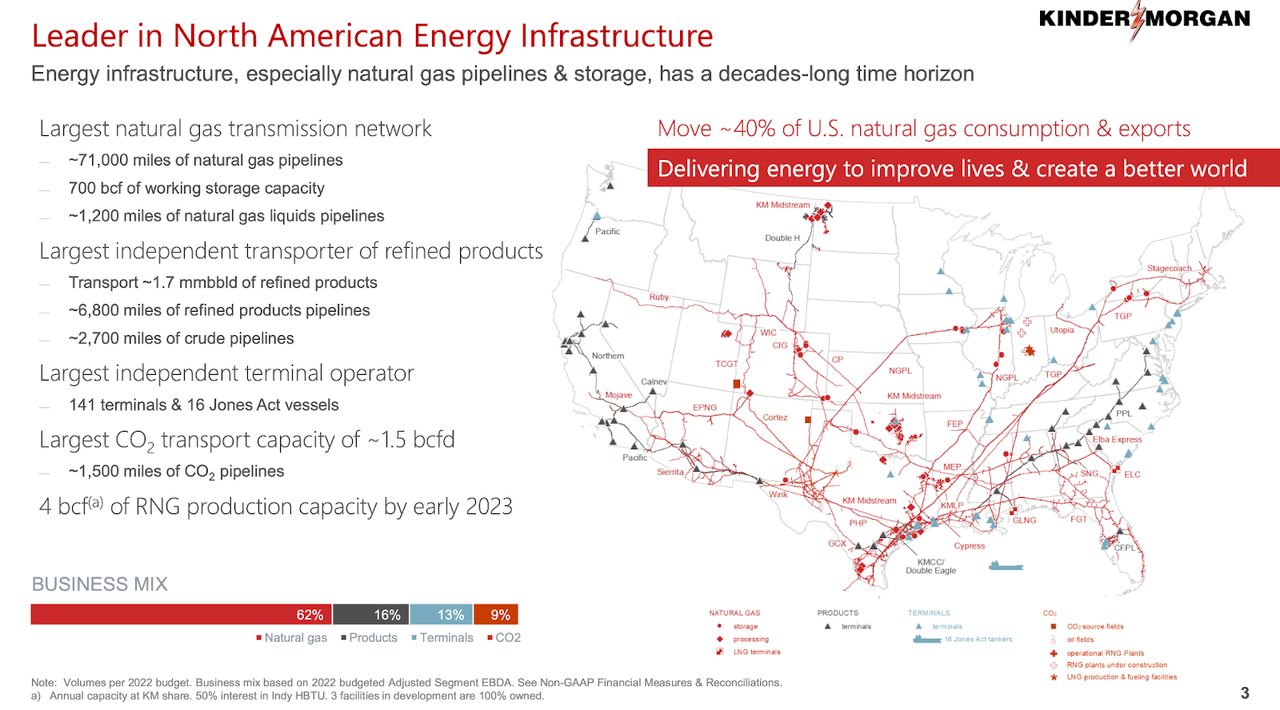

KMI owns one of the largest transportation networks of natural gas in the country. In short, its customers pay fees to transport energy-related commodity products in its pipelines.

June 2022 Presentation

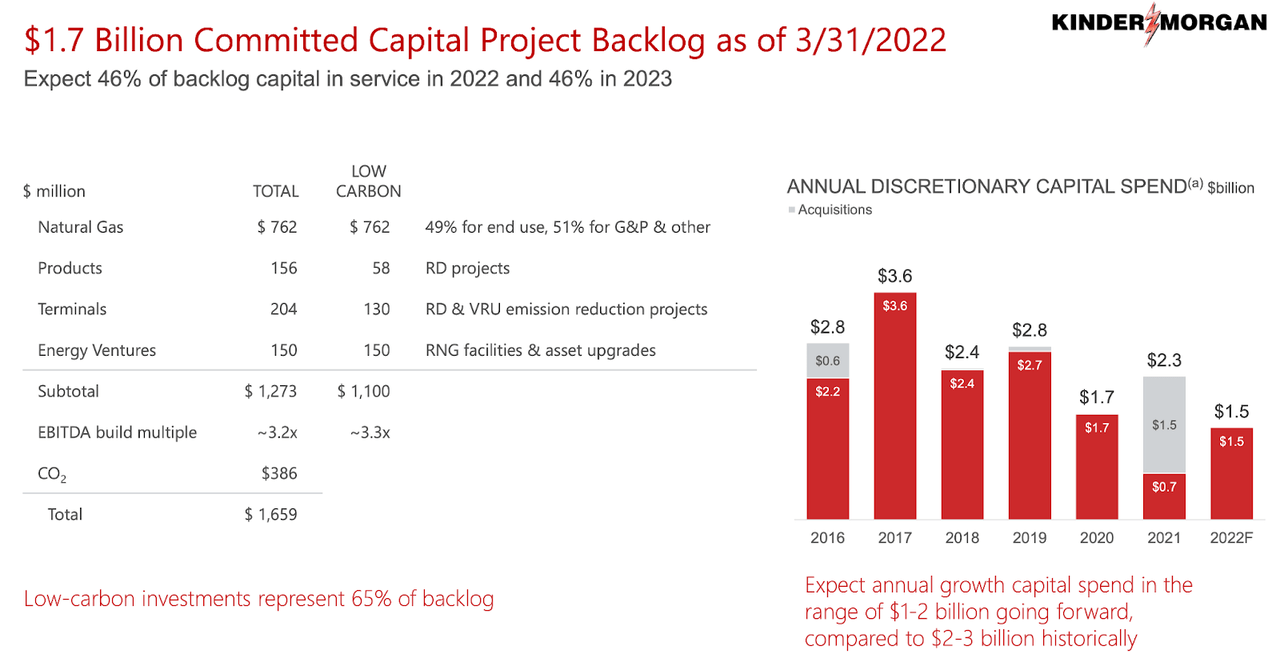

Like many midstream peers, KMI has significantly reduced its growth capital spending ambitions, as it is guiding for up to $2 billion in annual growth capital moving forward as opposed to the $3 billion it has typically spent.

June 2022 Presentation

The excess cash flows appear earmarked for either more aggressive dividend increases, debt paydown, or share repurchases. The company paid down roughly $865 million of debt in the latest quarter.

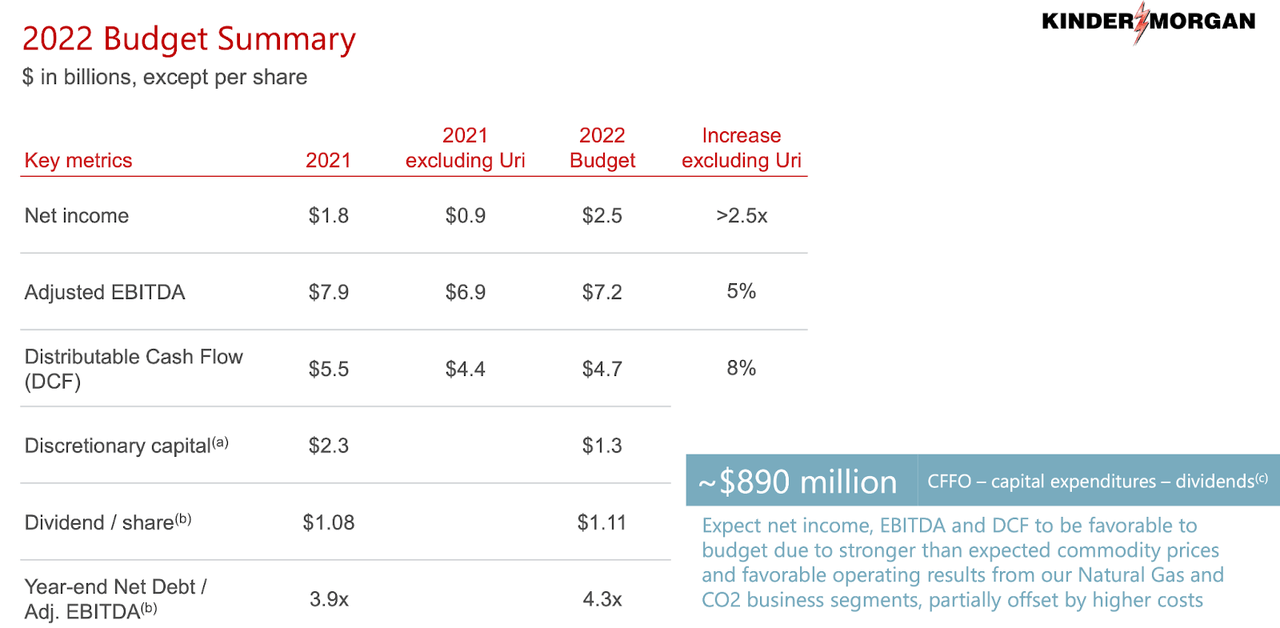

For the year, KMI expects cash flows to increase year over year (after excluding financial performance related to the Uri storm) which in conjunction with a reduction in growth capital spending should lead to a 62% increase in free cash flow.

June 2022 Presentation

Based on projected free cash flow of around $3.4 billion, KMI’s dividend would be covered by 1.4x. That makes KMI one of the few midstream operators which are producing DCF that fully covers both the distribution and growth investments. Leverage is expected to decline slightly to 4.3x debt to EBITDA (excluding Uri, debt to EBITDA in 2021 was around 4.46x).

When Does Kinder Morgan Report Earnings?

KMI is expected to report earnings on Wednesday July 20th after the market close.

What To Expect From Earnings

Due to 95% of its revenues coming from fee-based sources, investors should not be expecting significant upside based on the sustained strength in energy prices. That said, I will be focused on management’s commentary regarding capital allocation – given the strong energy pricing, will they shift gears on their plan to reduce capital spending? Or will management finally aggressively lean into share repurchases to take advantage of the cheaply valued shares? Or perhaps will management aggressively pay down debt to earn a higher multiple?

Is KMI A Good Stock To Buy Long-Term?

Unlike my assessment of EPD, I unfortunately do not have a positive view of the fundamental results at KMI. This is due to issues regarding the two most critical financial metrics for midstream companies: distributable cash flows (‘DCF’) and leverage. KMI is guiding for $4.7 billion of distributable cash flows this year. For reference, DCF stood at $4.6 billion in 2020, $5 billion in 2019, $4.7 billion in 2018, and $4.5 billion in 2017. The lack of growth in DCF absolutely should concern investors because during this time period, KMI has invested $11.1 billion in capital expenditures and acquisitions (the company has sold off $7 billion of assets during the same time period). In comparison, EPD has increased its DCF by around 50% since 2017.

Moving on to leverage. Debt to EBITDA stood at 4.5x in 2018. KMI is guiding for debt to EBITDA of 4.3x this year. This is in spite of reducing net debt by over $5 billion. In comparison, EPD has maintained a low debt to EBITDA ratio around 3.4x. While many midstream operators are paying outsized dividend yields, not all operators are created equal.

Is KMI Stock A Buy, Sell, or Hold?

KMI is priced at an outsized 6.5% yield and at only 8x DCF. Due to the poor execution on growing DCF over the years, I recommend focusing less on DCF and more on free cash flow. This is because KMI has seemingly invested heavily in growth projects with the net result of sustaining cash flows. KMI trades at 11.2x FCF. That isn’t necessarily expensive, but it also is not obviously cheap for a company that has struggled with sustainable growth. Further, it is difficult to see the justification for multiple expansion, considering that there will always be fears regarding the threat from renewable energy. Perhaps one can see KMI trading up to a 5.5% yield – that represents 15% upside. Due to the higher leverage, KMI has significantly higher risk than lower leveraged peers like EPD. Sure, there’s no K-1 tax form, but the increased convenience has no correlation with superior stockholder returns – at least on a fundamental basis. In the midstream sector, I greatly prefer operators with less debt and better execution like EPD, as well as operators who have fully embraced share repurchases like Magellan Midstream Partners (MMP). KMI is not a short here, but it is difficult to recommend buying the stock when peers with stronger fundamentals are trading at lower valuations. My view will turn positive if KMI starts to show sustainable growth and shows a greater willingness to direct free cash flow towards paying down debt and buying back stock.

Be the first to comment