Drew Angerer/Getty Images News

Over the past few years, Beyond Meat (NASDAQ:BYND) is one of the original bubble stocks that have since given birth to so-called “meme stocks.” I remember when in 2019 BYND priced its IPO at $25 per share before closing its first day of trading just under $66 per share. But BYND then soared to nearly $240 per share with everyone in town talking about the stock. Incredibly, the stock now trades lower than its first day of trading, but unlike many years prior, much of the hype regarding alternative meat has vanished. While I am bullish the outlook for alternative meat, I explain why I am not bullish on BYND’s stock. It comes down to valuation and more importantly, the taste.

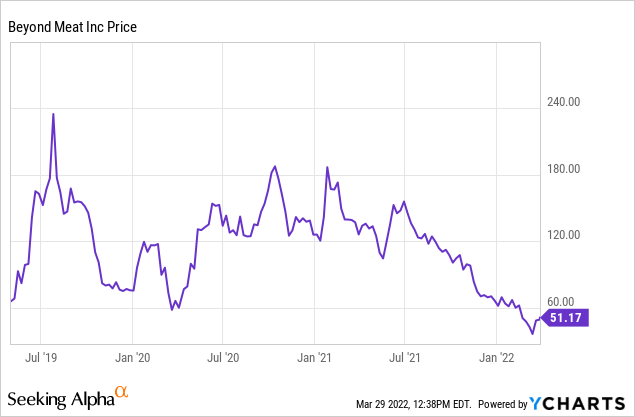

Beyond Stock Price

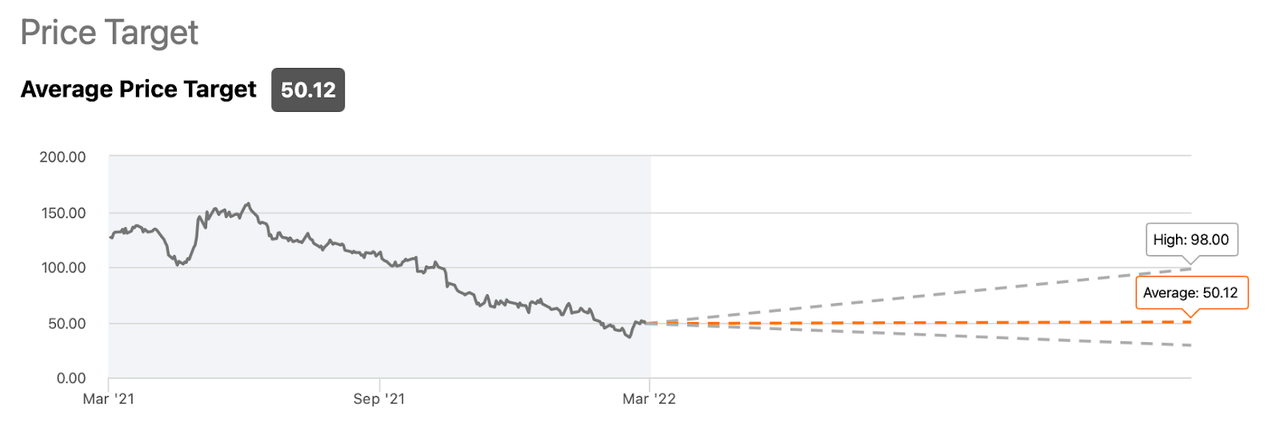

After peaking near $240 per share in 2019, BYND crashed down to below $60 per share in 2020 before surging once again to around $200 later that year. The stock has since come crashing all the way back down to around $50 per share.

YCharts

At these prices, the stock is trading just where it traded when it first came public. This is a common occurrence among hyper-growth stocks which came public in recent years, but unlike many of the other stocks I have come across, BYND is not looking buyable here.

BYND Stock Key Metrics

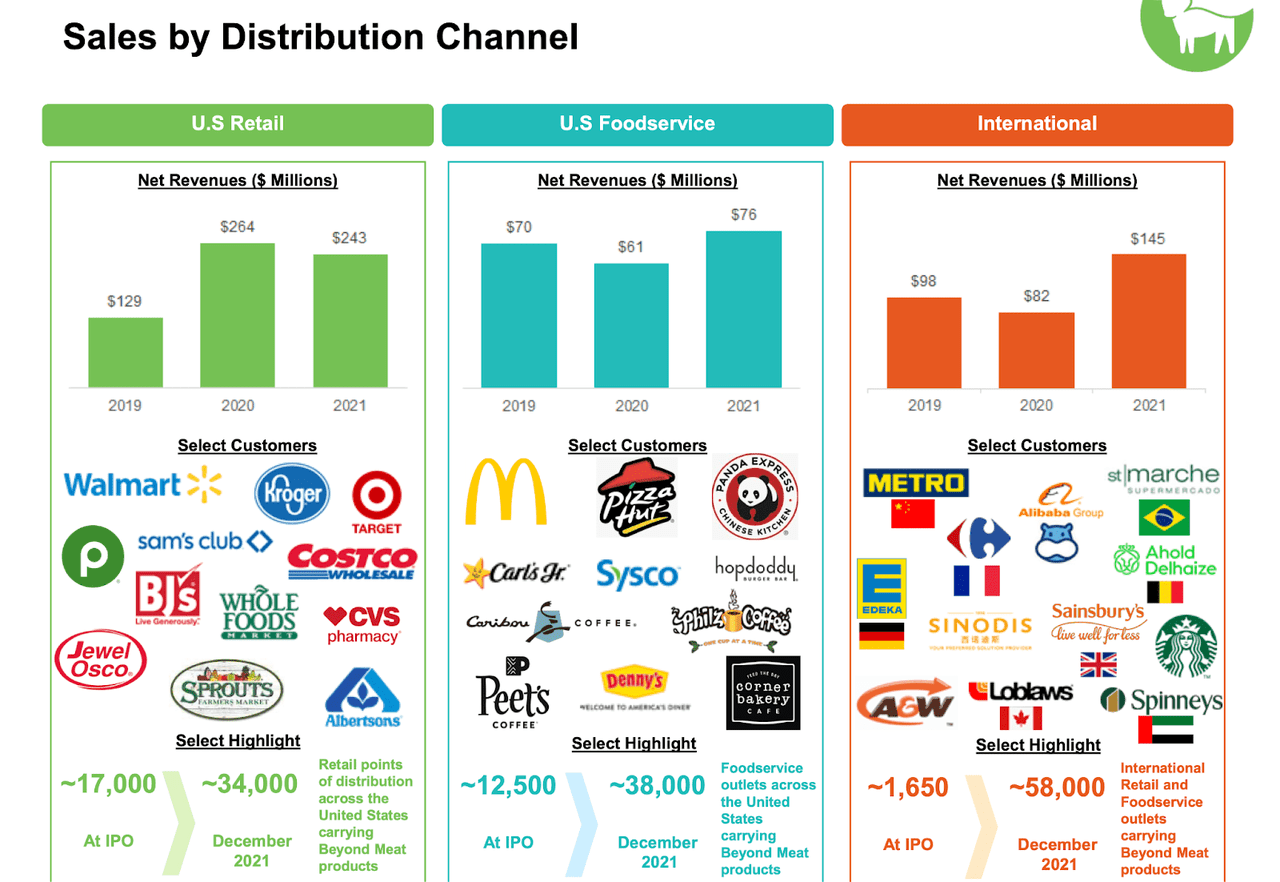

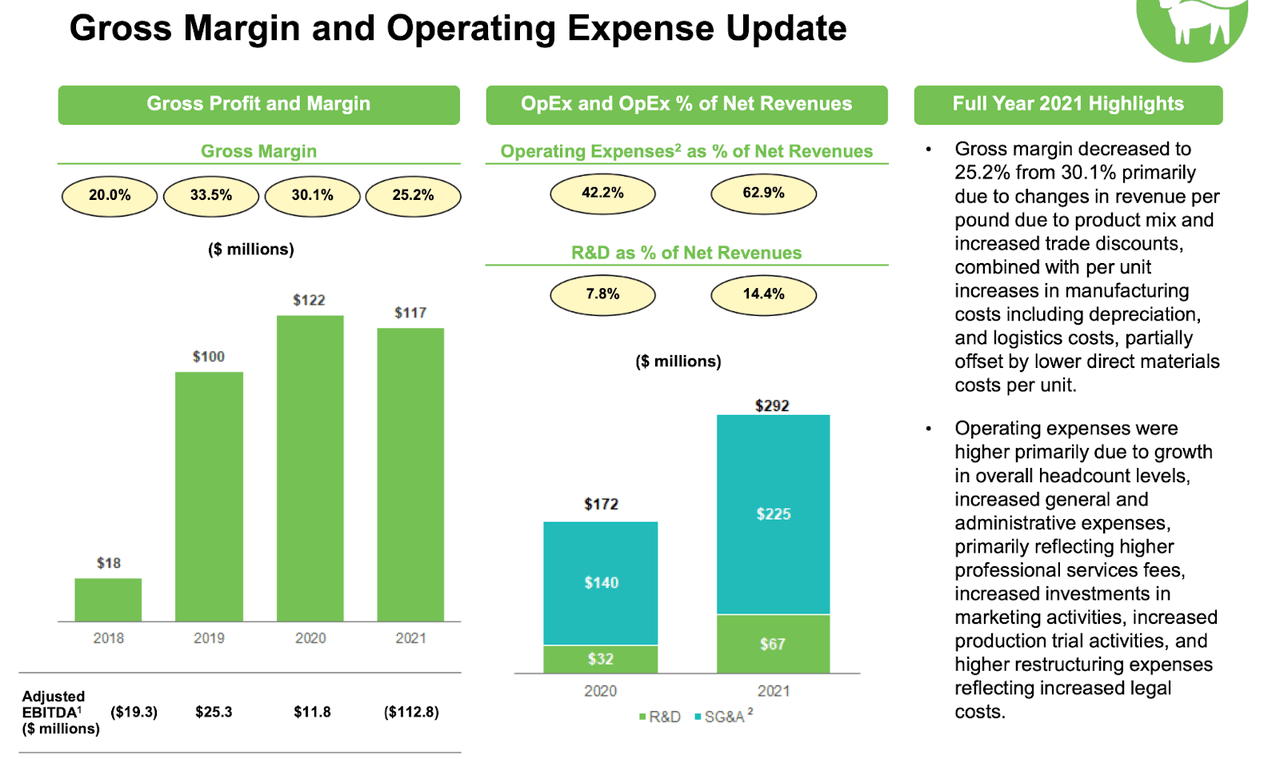

BYND saw a surge in business in 2020 as demand for groceries increased, but that tailwind turned into a headwind in 2021. BYND was able to offset that headwind with strength in its restaurant partnerships and international markets.

Beyond 2021 Q4 Presentation

We can see below a breakdown of the growth by distribution channel.

Beyond 2021 Q4 Presentation

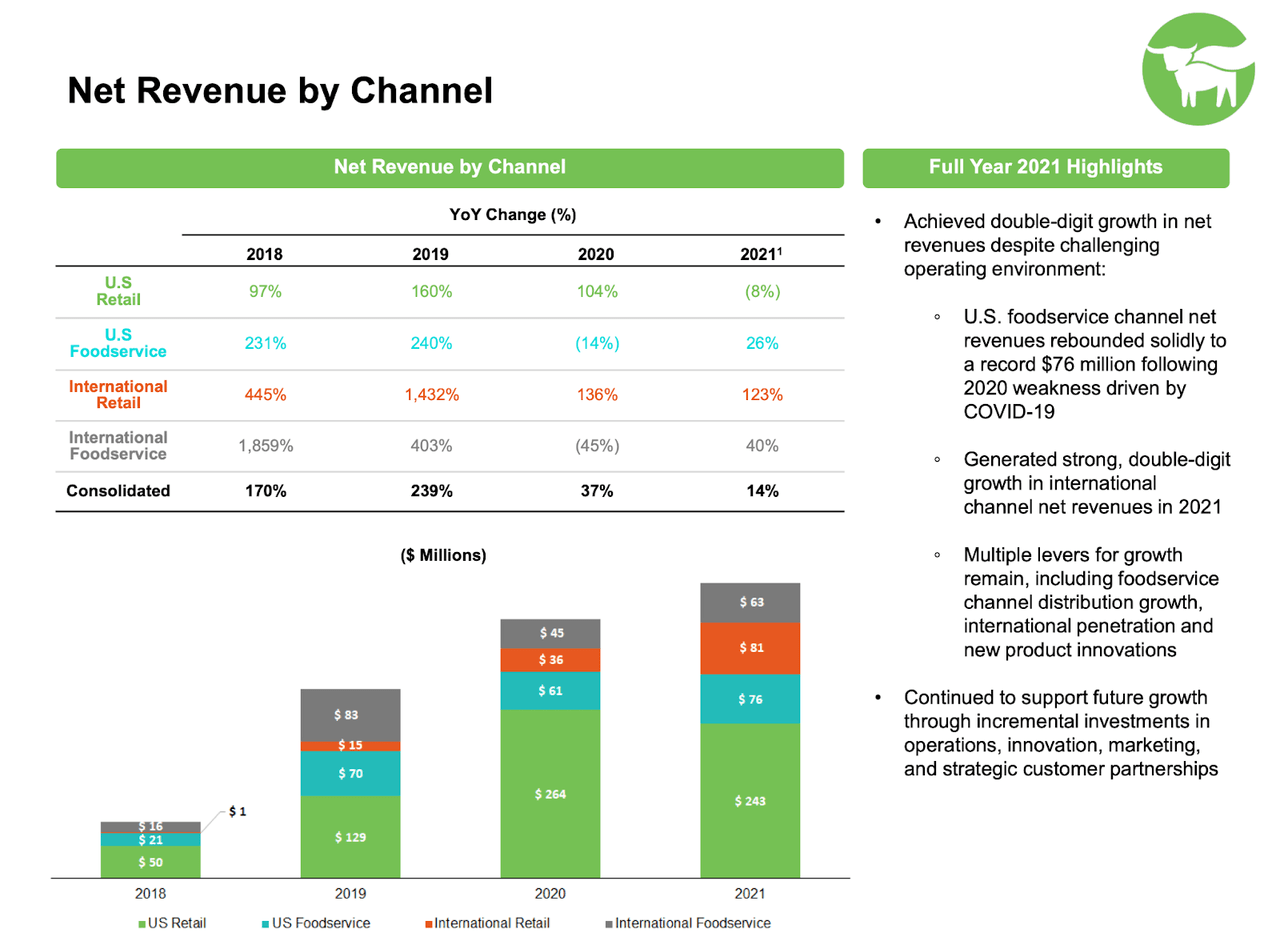

For what is typically considered a hyper-growth stock, BYND only mustered 14% growth in 2021. The slowdown in growth was surprising considering that the 37% growth generated in 2020 was already a huge step down from the 239% growth generated in 2019.

BYND also saw gross margin decline 490 basis points to 25.2% and operating expenses increased by over 2,000 basis points.

Beyond 2021 Q4 Presentation

The net result was that BYND swung from adjusted EBITDA profitability to a $112.8 million adjusted EBITDA loss. I note that BYND’s debt is primarily made up of 0% convertible notes and their $3.6 million in interest expenses in 2021 was primarily made up of non-cash amortization of debt issuance costs. As a result, adjusted EBITDA can be considered a proxy for free cash flow from a financial solvency standpoint. Analysts did ask about EBITDA moving forward on the conference call, but management just stated that they “think there will be more activity in the second, third and fourth quarters” without directly addressing future margins.

Why Has Beyond Meat Stock Dropped This Year?

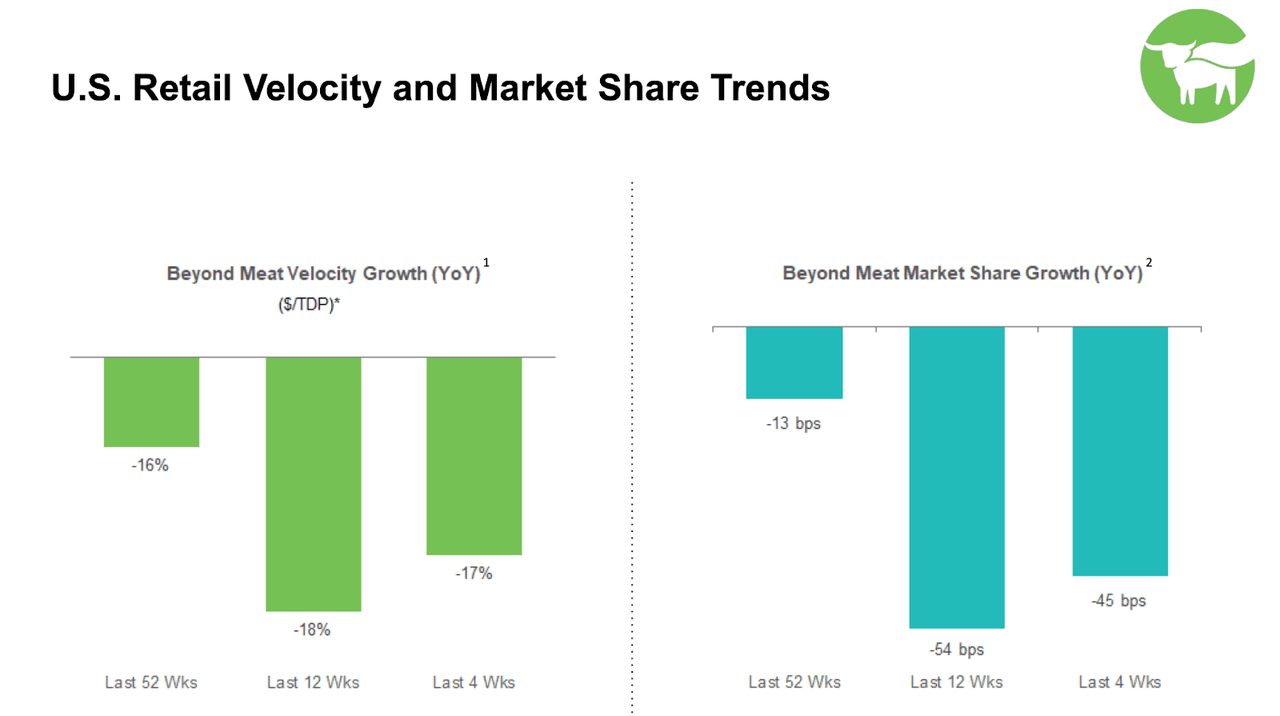

There are several potential reasons why BYND stock has dropped this year. The first may be due to its loss of market share.

Beyond 2021 Q4 Presentation

The more likely reason, however, is that the meme-stock trading environment that dominated the past two years since the pandemic has finally dissipated. Without the support of retail traders, BYND stock did not have fundamental support to prevent the fall.

Is Beyond Meat Undervalued Now?

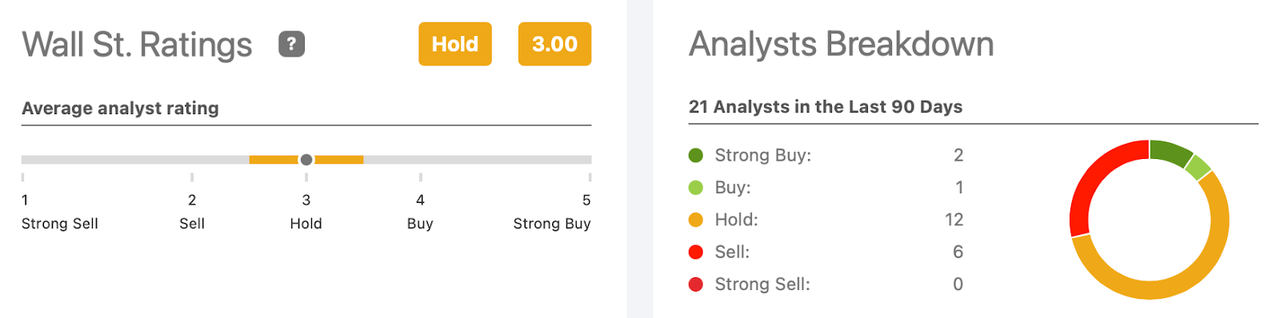

Even after the fall, Wall Street analysts only rate the stock 3 out of 5, for a “hold rating.”

Seeking Alpha

The average price target of $50.12 per share represents no upside from current levels.

Seeking Alpha

I later explain my own methodology for valuing the stock in explaining why I do not view the stock as being undervalued.

Can BYND Stock Rebound?

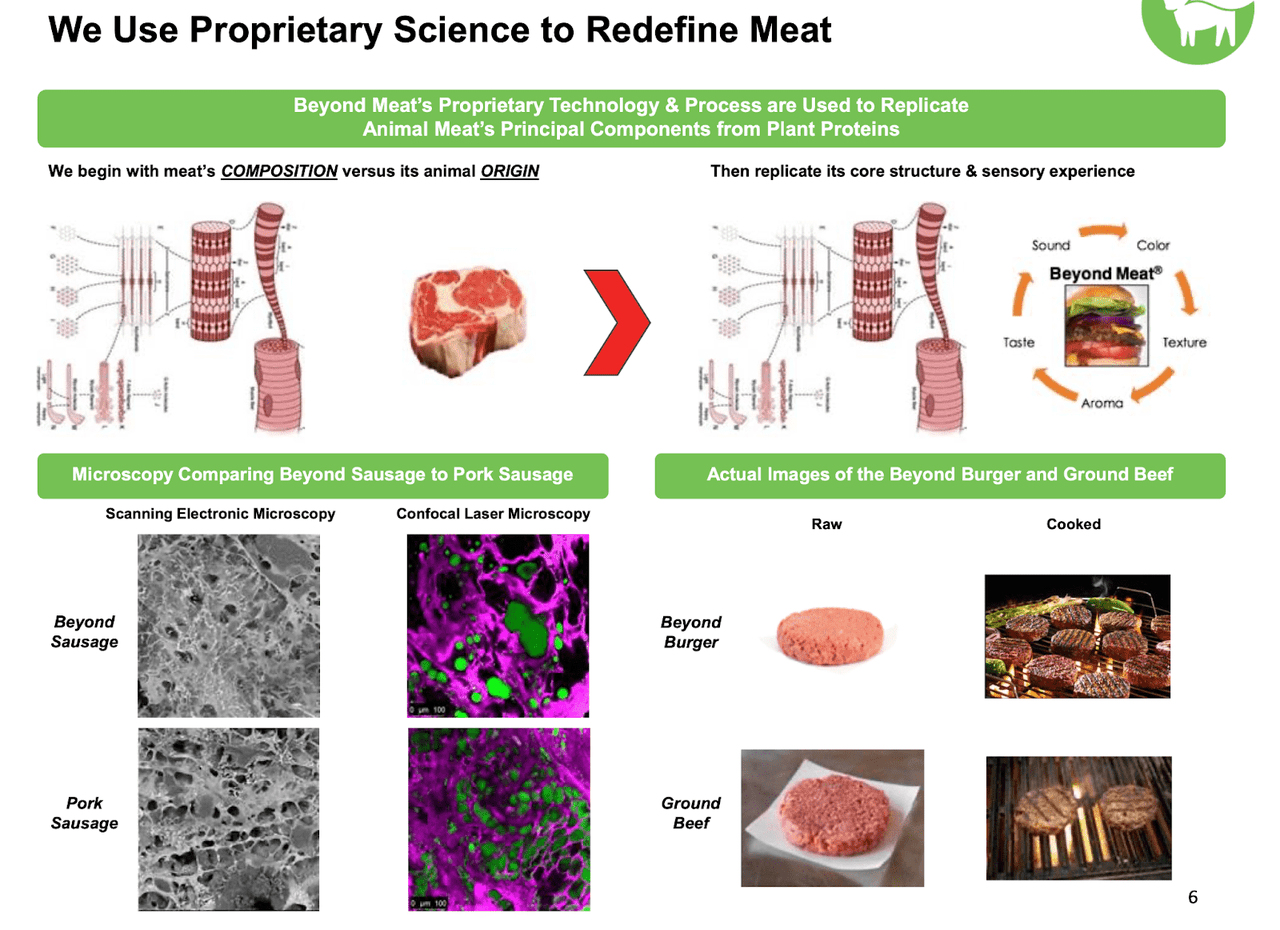

While the stock is not cheap on a fundamental basis, that doesn’t mean that the stock can’t rebound. It has traded with hype in the past, and it stands within reason that it can do so again in the future. After all, BYND’s business model is trendy and catchy. BYND is using technology to create “fake meat.”

Beyond 2021 Q4 Presentation

With 41% of shares sold short, the stock may very well benefit from a future short squeeze.

Is BYND Stock A Buy, Sell, Or Hold?

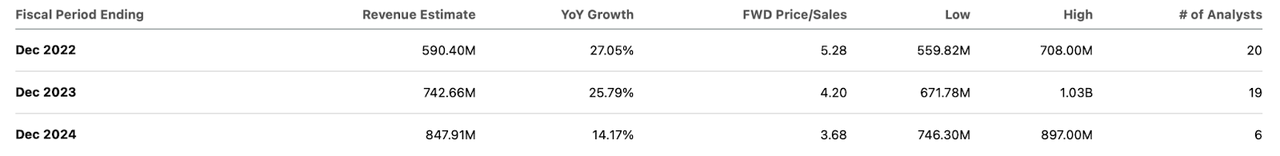

Wall Street consensus estimates call for 2022 revenues to come in at $590 million, squarely between management’s guidance of $560 million to $620 million.

Seeking Alpha

Despite trading near IPO levels, the stock is still trading at around 5.5x forward sales. For a stock with roughly 27% forward growth, that multiple isn’t cheap at all, especially considering that higher margin tech stocks are trading at comparable levels. I should also note that BYND’s gross margins hover around 25%, far lower than the 65+% gross margins at tech stocks. Would you rather own BYND at 5.5x sales and 27% forward growth or a stock like Elastic (ESTC) at 8x forward sales, 74% gross margins, positive cash flows and 26% forward growth? On the basis of gross profits, BYND is trading more richly than many tech stocks even here.

I am not adverse to purchasing stock in unprofitable growth stocks and I will use my same methodology here. I am doubtful that BYND can drive meaningful gross margin expansion due to the highly competitive environment. Due to the low 25% gross margin, it is difficult to project strong net margins in the future. Even if we assume 10% long term net margins, the stock would be trading at around 55x earnings power, which would represent a rather rich 2x price to earnings growth ratio (‘PEG ratio’).

The issue here is that I am skeptical the company will be able to achieve 10% margins in a reasonable amount of time, or at all. For operating leverage to occur, the company would need to sustain strong growth rates for many years. Yet BYND faces an issue: it does not appear to pass the taste test. In my experience trying BYND products versus Impossible products, there is simply no comparison: BYND products do not taste like meat and are not very tasty, whereas Impossible products can be mistaken for meat and are quite tasty. This is admittedly anecdotal, but there appears to be a clear consensus that Impossible products taste much better than Beyond products – at least I wasn’t able to find any instance where taste testers preferred Beyond products over Impossible products. Here is one sample taste test video. There is a clear and important difference between BYND and Impossible. Whereas Impossible uses genetically modified ingredients to effectively trick the taste buds into thinking it is meat, BYND appears to be a more advanced version of the traditional veggie burger. For that reason, I do not believe that BYND will be able to improve its products to effectively compete with meat, or even Impossible. If anything, Impossible is the company that seems most likely to create an alternative meat that can take market share from traditional meat. It seems that BYND trades at these valuations primarily because Impossible stock is not yet public, but that may change soon. While the alternative meat market shouldn’t be a “winner take all” kind of market, I don’t expect BYND to own meaningful market share over the long term due to the wide gap between its product and those of Impossible.

BYND isn’t cheap even if I assume long term profitability, but the path towards profitability looks difficult considering that its product is arguably not best in class (or even close, but I’ll lay off). What’s more, the company is still burning cash. With $400 million of net debt and $733 million of cash, BYND may quickly come under bankruptcy risk. I expect the company to raise cash in the near future to shore up its balance sheet. While my official view is bearish based on fundamental analysis, the trajectories of stocks like AMC (AMC) or GameStop (GME) have made shorting a dangerous endeavor. Perhaps a better rating is to avoid the stock in favor of better alternatives elsewhere.

Be the first to comment