Robert Giroux/Getty Images News

Investment Thesis

Adobe Inc. (NASDAQ:ADBE) stock has suffered one of its most “egregious” fallouts that surpassed even its compression during the COVID-19 bear market. Since reaching its highs in November, ADBE stock has declined almost 40%. Therefore, the market has digested the growth premium that it once “commanded” against Microsoft (MSFT) stock.

However, the fall from grace for the creative software leader is not unexpected. Notably, SaaS stocks have fallen significantly from their peaks in November. Given ADBE stock’s embedded growth premium, it has also not been spared.

Nonetheless, given its competitive moat and market leadership, we believe Adobe is a core stock for most growth investors. Moreover, despite the initial disappointment from its recent FQ1 earnings card, its stock has remained resilient. Therefore, we believe the current consolidation provides an attractive opportunity for investors to consider adding exposure.

ADBE Stock Key Metrics

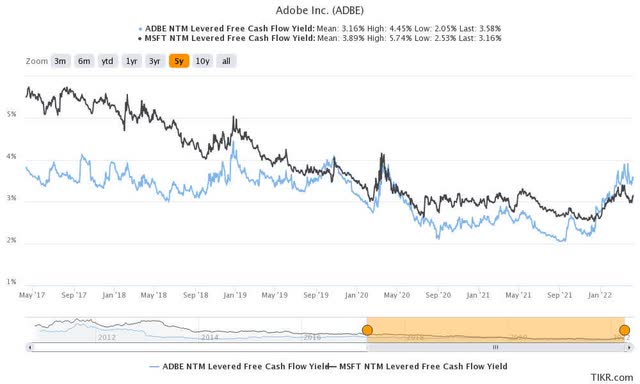

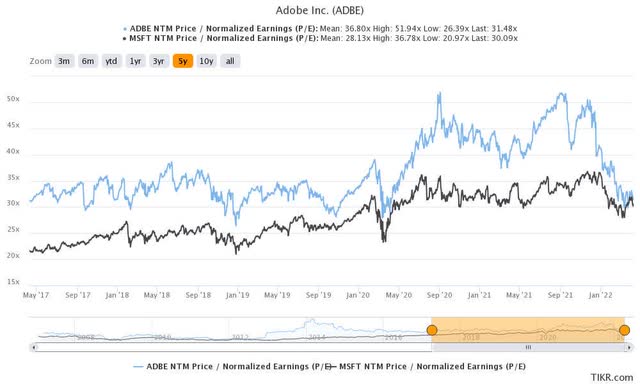

ADBE stock NTM FCF yield % (TIKR) ADBE stock NTM normalized P/E (TIKR)

A close look into ADBE stock key metrics will not be complete without comping it with the King of SaaS, MSFT stock.

Readers can glean that ADBE stock’s growth premium against MSFT stock has almost been completely digested. For example, Adobe stock last traded at an NTM normalized P/E of 31.5x against Microsoft stock’s 30.1x. Notably, Adobe stock has consistently traded at a discernible premium against MSFT stock over the past five years. Therefore, ADBE investors must have been confounded by the value compression over the past five months. Nonetheless, a closer look over Adobe stock’s NTM FCF yield metrics might reveal some insights.

MSFT stock has undoubtedly traded at a higher FCF yield over ADBE stock over the past five years. Therefore, the de-risking environment has severely impacted stocks with a marked growth premium but less robust FCF yields. Given ADBE stock decline in topline growth, we think the market has gotten it right. Adobe stock needs to take the compression on its chin for its valuation to normalize. As such, ADBE stock’s NTM FCF yield of 3.6% has moderated to its 5Y mean of 3.2%.

Is Adobe A Good Growth Stock?

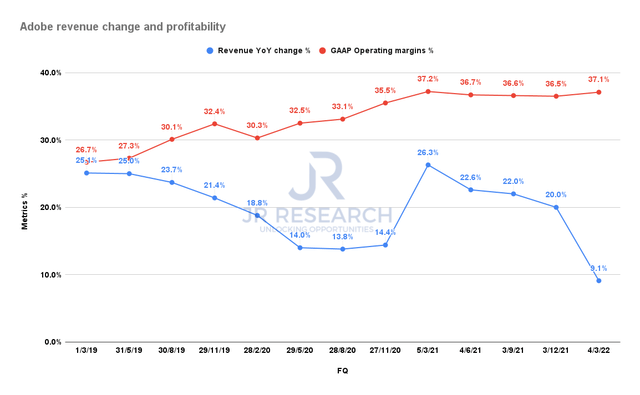

Adobe revenue change and GAAP operating margins % (S&P Capital IQ)

Adobe reported one of its weakest quarters on record as revenue grew just 9.1% YoY in FQ1’22. Even though it came in above consensus estimates, the significant deceleration was massive. However, even though Adobe offered relatively weak guidance given the ARR impact of the Russia-Ukraine conflict, the stock has not collapsed. Therefore, we think the market has an uncanny ability to price in these uncertainties ahead of time, including Adobe’s topline growth normalization.

Furthermore, the company has continued to maintain a consistent level of robust profitability despite the growth headwinds. Therefore, we are confident in the company’s well-proven business model, with incredible pricing leadership in its core markets. Hence, Adobe’s robust competitive moat validates its position as a core growth portfolio stock for investors.

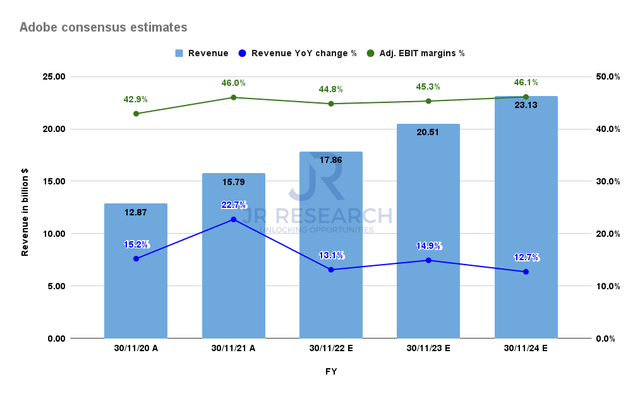

Adobe consensus estimates (S&P Capital IQ)

Notably, consensus estimates suggest that Adobe could recover from its FQ1 slump in H2’22. Even though Adobe did not provide full-year guidance for FY22, it offered constructive commentary. CFO Dan Durn articulated (edited):

Creative Cloud Express is now in the market. We’ve got millions of monthly active users on that platform. And increasingly, that will turn into a source of revenue and net new ARR performance and growth for us.

Our frame business is doing really, really well. We see momentum around our 3D and immersive technologies, our substance product line.

And then you layer on top of that the modest pricing adjustment we took, which will complement the underlying performance of the business. And we feel good as we look into the back part of the year. (Bernstein Fireside Chat)

Therefore, we believe that the inflection point for Adobe stock could come in H2’22, contingent on Adobe’s ability to execute. However, Adobe has proved itself over time, and investors shouldn’t judge Adobe on its recent weak growth. The pandemic has markedly driven its growth, so tough comps and some churn is expected. But, investors can remain optimistic in H2’22 and watch for Adobe’s inflection point moving forward.

Is ADBE Stock A Buy, Sell, Or Hold?

Adobe stock is a Buy. Nevertheless, at 31x NTM normalized P/E, it’s just below the software median P/E of 35.5x, according to S&P Cap IQ data. Yet, it’s well below the 10Y median of 45.3x. Hence, there’s little doubt that SaaS stocks have taken a significant hit over the past five months.

But we think the valuation reset is beneficial to ADBE stock. As explained above, it allows patient investors to add exposure at an attractive valuation. Furthermore, ADBE stock could see a re-rating as it’s trading below its 5Y mean.

But investors are reminded to be patient if they add ADBE stock now, as such a catalyst could arrive only from H2’22 through FY23.

Be the first to comment