A_Z_photographer/iStock via Getty Images

Investment Thesis

Iron Mountain Incorporated (NYSE:IRM) is a vertically-integrated physical and cloud data storage service provider, with exemplary consumer stickiness in its core revenue driver. Combined with an impressive 5Y Total Price Return of 90.1% and 10Y Return of 268.8%, long-term investors would have been delighted with its relatively decent dividend yields of 4.62% thus far. Given its massive potential and $120B Total Addressable Market, we expect IRM to continue growing ahead, significantly accelerated by the recovery of macroeconomics by mid-2023.

Nonetheless, investors must also be cautious since a significant correction could potentially send the stock back to its previous valuations, as previously experienced by Big Tech companies since November 2021 post reopening cadence. Therefore, given the currently elevated levels and potentially unsustainable rally, this stock is only suitable for those with a higher appetite for risk and volatility.

In the meantime, those interested in a more in-depth study of IRM’s business model should refer to Dane Bowler’s excellent analysis here:

- Iron Mountain: The Complexity Discount

IRM Continues To Outperform In Uncertain Macroeconomics Environment

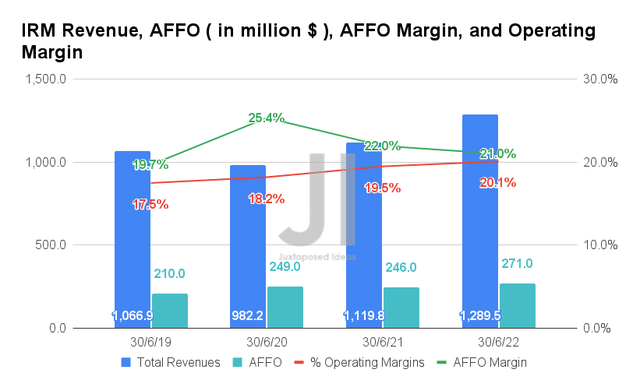

In FQ2’22, IRM reported revenues of $1.28B and operating margins of 20.1%, representing excellent YoY growth of 15.1% and 0.6 percentage points YoY, respectively, due to the multiple opportunities from the high inflationary environment. This has directly improved its profitability, with an AFFO of $271M and an AFFO margin of 21%, representing an increase of 10.16% though a notable decline of 1 percentage point YoY, respectively. Otherwise, an increase of 29% and 1.3 percentage points from FQ2’19 levels, respectively.

Seeking Alpha

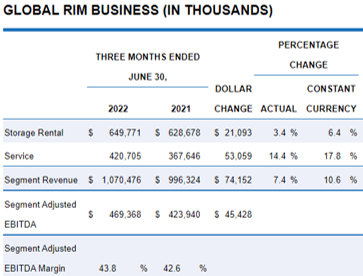

Despite IRM’s continuous push into the global data center scene, it is evident that its physical Global RIM Business remains its top and bottom-line driver, reporting revenues of $1.07B, EBITDA of $469.36M, and an adj. EBITDA margin of 43.8% in FQ2’22. The segment accounts for 83% of its total revenues, which represents an astounding number, given the massive growth and adoption of digital services during the COVID-19 pandemic.

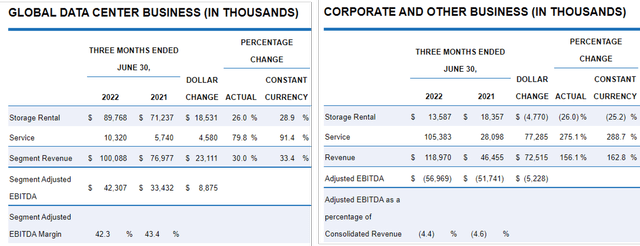

Nonetheless, IRM’s Global Data Center and Corporate segments have also done well for themselves, given the impressive YoY growth in revenues by 30% and 156.1% in FQ2’22, respectively, compared to the RIM business with 7.4% YoY growth. The company also guided elevated capital expenditures of $950M in FY2022, with $625M attributed to its data center segment. It represents an aggressive increase of 56.7% and 202.26% YoY, respectively, and an 11.7% upgrade in Capex from previous guidance.

Thereby, emphasizing IRM’s massive runway for growth, since the global data center market is expected to grow by $615.96B through 2026 at an impressive CAGR of 21.98%, with 35% attributed to the North American market comprising 66% of IRM’s revenue geographic segment in FY2021. We are already glimpsing its potential success ahead, given its sold-out occupancy thus far, with two more sites expected by Q3’25.

In the meantime, IRM investors should be encouraged by the ITRenew acquisition completed in January this year, despite the $725M price tag slightly delaying IRM’s deleveraging. The deal improves the latter’s asset disposal capabilities in the Corporate segment, with a $65M revenue contribution in FQ2’22. This is significantly made sweeter by the $30B Total Addressable Market expected to grow tremendously at a CAGR of 11% through 2027. Thereby, further diversifying IRM’s business capabilities ahead, well-funded by its highly profitable and durable physical storage segment, with an impressive 98% customer retention rate and an average of 15 years of lease.

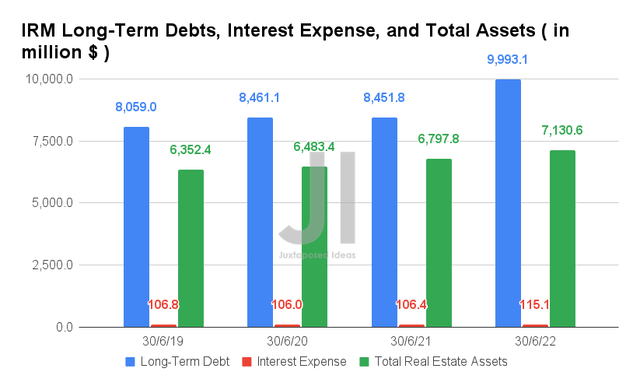

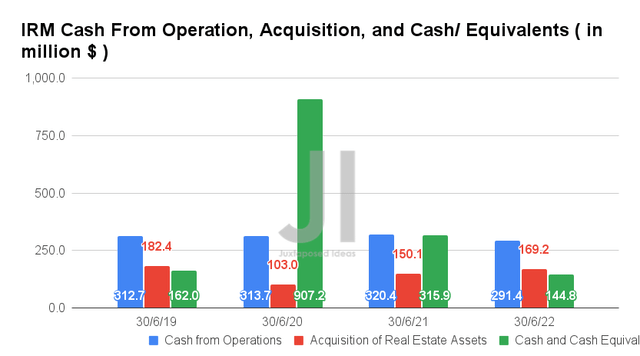

In the meantime, IRM reported elevated long-term debts of $9.99B and interest expenses of $115.1M in FQ2’22, representing an increase of 18.2% and 8.1 percentage points YoY, respectively. Part of it is attributed to the company’s continued acquisitions of $169.2M, leading to its increased total real estate assets of $7.13B in the same quarter. It indicates an increase of 12.7% and 5% YoY, respectively.

However, IRM investors have nothing to worry about, since the nearest loan maturity is in September 2023 for the UK Bilateral Facility worth $170.05M, with an option for another extension through 2024. Despite the lower cash and equivalents of $144.8M in FQ2’22, indicating a decline of -51.4% YoY, we expect its incremental pricing from Q3 onwards to preserve the company’s liquidity moving forward, especially during the next few quarters of economic uncertainties.

IRM Is Well-Poised For Expansion And Growth Ahead With Improved Profitability

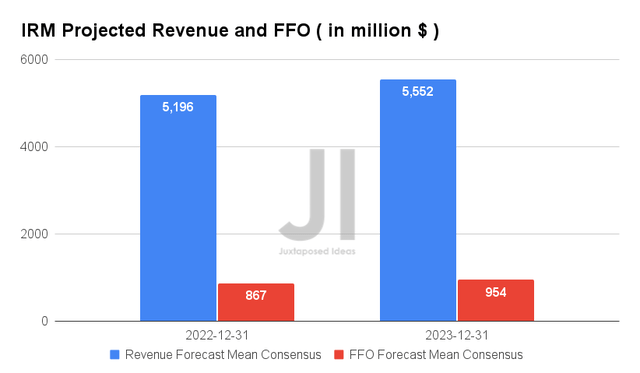

Over the next two years, IRM is expected to report an adj. revenue and adj. FFO growth at a CAGR of 6.84% and 16.35%, respectively, between FY2019 and FY2023. The COVID-19 pandemic and high inflationary environment have obviously been very kind to its forward profitability, given the rapid improvement in the company’s FFO margins from 12.21% in FY2019, to 14.69% in FY2021, and finally settling at a stellar projected 17.18% by FY2023.

In the meantime, IRM is expected to report revenues of $5.19B, FFO of $867M, and FFO margins of 16.68% in FY2022, representing a tremendous YoY growth of 15.68%, 31.38%, and 1.99 percentage points respectively, despite the tougher YoY comparison. With the management’s guidance of FQ3’22 revenues of $1.3B and AFFO of $280M indicating a 15% and 6.46% YoY growth, respectively, it is no wonder that the stock has been on an upward trend, given its improved financial performance over the past few quarters.

So, Is IRM Stock A Buy, Sell, or Hold?

IRM Dividend Payout & Yield

Despite its improved profitability, it is apparent that IRM has sustained its previous annual dividend payouts of $2.47 and dividend yields of 4.62% through the past three years. Given its growing debt load and elevated total debt/ EBITDA ratio of 5.77x, we do not expect to see the company raising dividends over the next few quarters. We shall see.

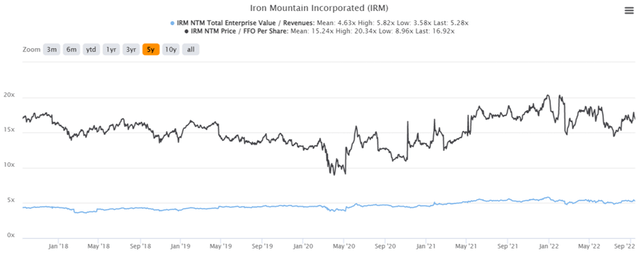

IRM 5Y EV/Revenue and Price/FFO Per Share Valuations

IRM is currently trading at an EV/NTM Revenue of 5.28x and Price/FFO Per Share of 16.92x, higher than its 5Y mean of 4.63x and 15.24x, respectively. The stock is also trading at $53.50, down -8.71% from its 52 weeks high of $58.61, though at a premium of 28.38% from its 52 weeks low of $41.67.

IRM 5Y Stock Price

Consensus estimates remain bullish about IRM’s prospects, given their price target of $58.00. However, the minimal 8.41% upside from current prices indicates its baked-in premium, significantly boosted after its FQ2’22 earnings call. We rate IRM stock as a Hold, as we expect to see this rally moderately digested ahead. Patience for now, and let’s see what happens when the Feds raise the interest rates in late September and November 2022.

Be the first to comment