Onfokus/iStock Unreleased via Getty Images

Investment Thesis

iRobot (NASDAQ:IRBT) sells innovative products in a growing market. The company has shown strong, consistent, double-digit growth. Management has extremely strong growth guidance for the next few years. But the company faces serious headwinds. I’m worried about inadequate diversification, guidance cuts, and a slowdown in retail purchasing.

At the current price, I don’t believe the potential reward justifies the risk. But management predicts significant growth in the back half of this year. I think iRobot’s shares may be undervalued if the company meets its goals for this year.

Growth And Guidance

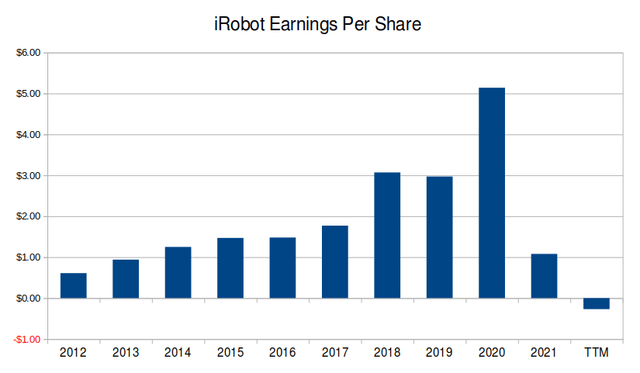

iRobot’s stock has slumped over the past few months. This follows disappointing first quarter earnings and a major guidance cut. At the end of 2021, the business had guided for 15% annual revenue growth. In the last quarter, management slashed this estimate to just 8%. The company’s profitability also suffered. After its Q1 results, iRobot is now unprofitable over the last twelve months.

Created by author with data from Seeking Alpha

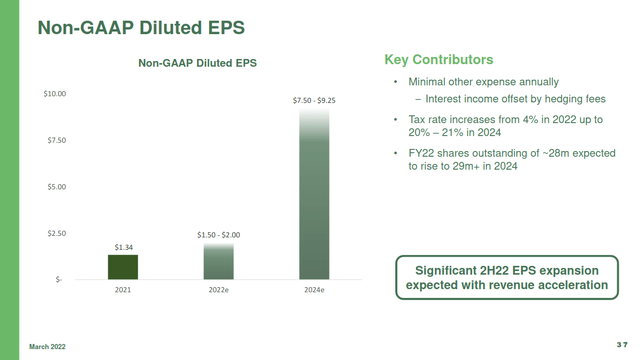

These weak results have overshadowed iRobot’s extremely bullish long term guidance. At its last investor day, iRobot released long term financial projections calling for revenue to jump almost 60% by 2024. The company also guided for EPS of $7.50 to $9.25 by 2024. This would be a 600% to 750% increase over last year’s numbers.

iRobot EPS Guidance (iRobot 2022 Investor Presentation)

On their latest earnings call, iRobot’s leadership outlined how they hope to turn the year around. They believe the company can offset a poor Q1 and Q2 with a strong performance in the back half of the year. Management actually increased the midpoint of their 2022 EPS guidance from $1.75 to $1.80 per share.

Long-Term Prospects

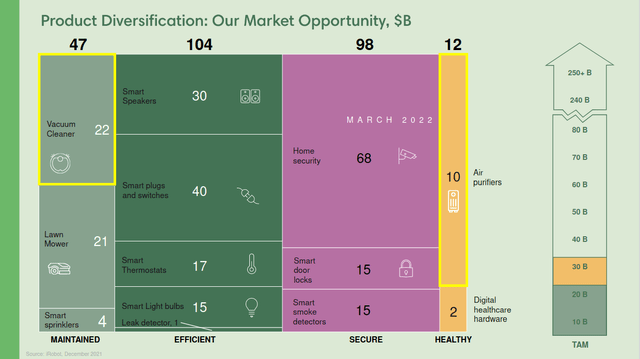

In the long term, one of the key issues I see with the company is its reliance on one product. The company sells a range of products, but its latest 10-K reveals that floor cleaning robots are its only real source of revenue. In the last fiscal year, 90% of iRobot’s revenue was from its Roomba products. Almost all the remaining revenue was from its Braava line (which are robotic mops). This makes the company overexposed to the consumer electronics and appliance markets. Those markets are highly cyclical. iRobot needs to continuously sell new units to generate revenue. This means a pullback in the broader economy would seriously hurt the company.

Management is taking steps to address these concerns. iRobot is in the very early stages of diversifying its product lineup. Late last year, the company acquired Aeris Cleantec AG, an air purifier company. The new products are still being integrated into iRobot’s product lineup. The company is also researching automated lawn mowers.

iRobot’s Current and Potential Markets (iRobot 2022 Investor Presentation)

The company’s long-term plans also address the industry’s cyclical nature. Management wants to upsell these new products and accessories to existing customers. They also plan to introduce a subscription model for more consistent revenue.

I believe these are steps in the right direction. However, there isn’t much to show for these projects at the current time. Neither air purifiers nor subscriptions have generated significant revenue so far.

Excess Inventory And Retail Exposure

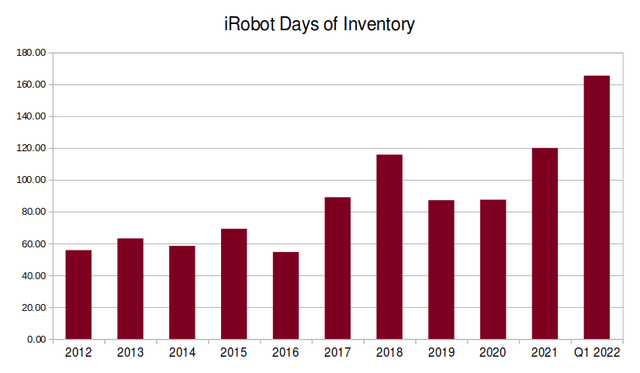

This leads me to my biggest concern with iRobot. The business has high exposure to retailers during a period of excess supply. In the previous year, retail partners generated 88% of iRobot’s revenue. This isn’t great news amid an unexpected decline in retail spending since iRobot’s last report. Retailers are cutting prices and canceling orders from their suppliers. Electronics and appliances appear to be one of the hardest hit categories. I think it’s likely this will affect iRobot negatively. I’m going to be watching forward sales guidance closely.

A pullback in spending may hurt even more due to iRobot’s problematic inventory management. The company has extremely elevated levels of inventory. As of its last quarterly report, the company had 165 days of inventory on its balance sheet. This is almost double its 10-year average of about 80 days.

Created by author with data from Seeking Alpha

As of its last earnings call, management expects this number to stay elevated for a while. The company is counting on very strong sales in the back half of the year to recover. This is a problem if the company’s demand doesn’t meet its projections. All the excess inventory will hurt cash flow and create extra expenses (like inventory holding costs).

Valuation

I don’t find iRobot’s valuation to be notably cheap. The company is trading at a forward P/E of a little above 20. That’s about what I’d be willing to pay for a company growing at a high single digit rate.

This valuation gets trickier when I consider the company’s long term guidance. The 2024 guidance of $7.50 to $9.25 per share would give iRobot a P/E of 4 to 5. This would make their shares a bargain. Even if growth moderates significantly after that, I’d still be willing to pay three or four times the current valuation.

But if iRobot doesn’t meet its financial targets, its shares look too expensive. If revenue is flat or declining, I wouldn’t be willing to pay over 20 P/E. The market is pricing in some pessimism, but I don’t feel it’s enough to cover potential downside.

Final Verdict

iRobot is a company with the potential for fantastic growth. However, the company is also a cyclical business without a diversified product lineup.

I think the next two quarters are an opportunity to test management’s guidance. I want to see that iRobot is able to generate good revenue growth and increase its inventory turnover. If this happens, I’d be willing to buy the stock (even at a higher price).

There is a lot of uncertainty surrounding iRobot, and I think a bearish outcome is more likely. I don’t think the risk to reward is favorable at the current price, so I don’t recommend buying or holding this stock. The business may be worth watching for investors interested in consumer appliances or the robotics industry.

Be the first to comment