Spencer Platt/Getty Images News

While Chinese long-form video platform iQIYI, Inc.’s (NASDAQ:IQ) recent private placement helps alleviate any near-term liquidity concerns and comes with a vote of confidence from key partner Baidu (BIDU), I don’t think IQ is out of the woods just yet. Following another quarter of declining subscriber numbers in Q4 2021, 2022 is shaping up to be a transitional year for IQ as it turns to price hikes and cost-cutting to get to break even, while also navigating execution, regulation, and competition risks. Plus, IQ is still on the hook for another $1.2bn CB repurchase option in April 2023.

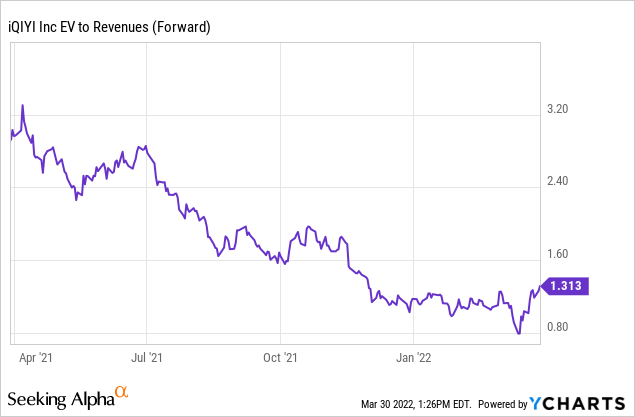

Given the current share price weakness, IQ might still need to raise outside capital to plug the funding gap. Thus, the currently discounted ~1x EV/Revenue multiple (a wide discount to long-form video peer Mango Excellent) seems warranted at this stage of the IQ story.

iQIYI‘s $285m Private Placement to Plug Near-Term Funding Gaps

IQ has outlined a subscription agreement with key stakeholder Baidu and a consortium of financial investors led by Oasis Management for 164.7m newly issued Class B ordinary shares and 304.7m newly issued Class A ordinary shares. In total, the placement amounts to a total purchase price of $285m (or RMB$1.8bn) in cash, with the Class B portion (10x the voting power of Class A) allocated to Baidu and the Class A ordinary shares allocated to financial investors. The deal implies a dilution of 7.7% for existing equity holders, with Baidu maintaining a controlling stake at ~50.3% ownership. Assuming the deal clears customary closing conditions, the placement is slated for close shortly.

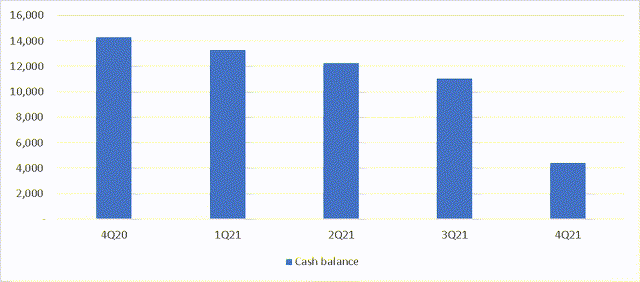

The announcement marks a significant milestone in the IQ/BIDU relationship given this is the first time BIDU has participated in a funding round for IQ post-IPO. The case for BIDU as a funding backstop makes sense, in my view – the IQ/BIDU partnership has deepened in recent years and now spans cooperation across Baidu Cloud, Xiaodu, and key AI applications. The $100m commitment also represents a relatively small portion of BIDU’s cash position, so there should be plenty more to come. After all, IQ still has a big net debt position – relative to the ~RMB4.4bn of cash and equivalents (including restricted cash and short-term investments) as of its last filing, IQ’s debt obligations include RMB4.1bn of short-term loans and RMB12.7bn of convertible senior notes.

Even with the placement proceeds, outstanding cash should only cover about six quarters of operating cash burn and potentially less if the operating backdrop worsens and IQ misses its full-year non-GAAP breakeven target for 2022.

iQIYI

Convertible Debt Stack Remains the Key Liquidity Overhang

Despite the latest equity raise, IQ will likely need a lot more if it is to fund another $1.2bn convertible bond repurchase option due in April 2023. With IQ only guiding to (non-GAAP) operating break even in 2022, it’s hard to see earnings picking up meaningfully until 2023, which could raise liquidity risks.

For context, the convertible bond repayment schedule is as follows – $1.2bn in principle due 2025 (with an April 2023 repurchase right) and $800m in principle due 2026 (with an August 2024 repurchase right). The most likely scenario here is that convertible holders push for a full $2bn repurchase of the convertible notes in 2023/2024, with IQ having to cover the repurchase obligations while also funding the cash burn.

Depending on where the stock price goes and IQ’s progress toward breakeven, IQ could resort to either more loans and an additional issuance of convertible notes (i.e., duration extension) or equity financing to address the put option. In the meantime, proving self-sustainability via its breakeven target in 2022 will be crucial for securing a capital injection in the coming months.

Sustainable Profitability is the Key to the iQIYI Story

If IQ’s last earnings call was any indication, management is now laser-focused on profitability over growth. The target is to achieve non-GAAP operating break-even in 2022 and quarterly breakeven as soon as possible. If IQ continues axing costs as quickly as it has in recent quarters (mainly by reducing headcount and pulling the plug on low ROI projects), I think near-term margin improvement could well be within reach.

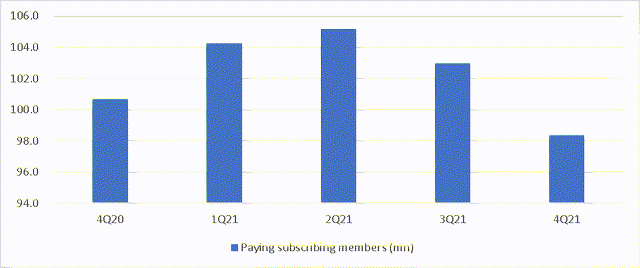

That said, membership numbers could suffer as well – subscriber count has been on a downtrend for two consecutive quarters, reaching 97m in 4Q on a lackluster content pipeline and the ongoing price hike. The breakeven announcement was met with a positive stock price reaction, though, implying at least some of the upside has now been priced in.

Long-term, I have my doubts about the stickiness of cost-cutting. While cost cutbacks should prop up earnings for a few quarters, it remains to be seen if a leaner cost base can offset the corresponding membership declines over the long term. Plus, the revenue growth outlook could take a further hit from regulatory implementation through the year, with long-form video platforms like IQ increasingly seen as competitors to state-run media. Regulation on internet advertising remains in the works and could result in limits to flash, landing, and pre-roll ads, weighing on the monetization outlook.

Worrying Times Ahead for iQIYI

The $285m (or Rmb1.8bn) private placement financing announced by IQ should help alleviate immediate concerns about its funding position. After closing, IQ would have not only a strong cash position, but also lines of credit/financing available to satisfy the cash flow requirement in its operating and investing activities for the coming months. That said, IQ’s convertible repayment schedule remains unaddressed beyond this year – the $1.2bn 2025 Convertible Senior Notes, with a conversion price of $30.30/ADS, will be puttable on April 1, 2023.

Continued share price weakness could mean IQ equity holders have to endure more dilution as the company looks to more outside capital to fund the pending repurchase. Net, I believe the current valuation discount is justified, as the revenue growth outlook slows amid uncertainties on execution and content regulations in China going forward.

Be the first to comment