metamorworks

Investment Thesis

In my previous two articles (first and second) about IonQ (NYSE:IONQ), I was skeptical about the prospects. I had doubts if the company could afford enough capital and brainpower to be technologically superior against the competition in the long run. A few days ago, the Q3 numbers were released, and I want to see what’s new and if anything changes in the outlook. Although skeptical, I still think it is an exciting company in an industry of the future, so I want to continue to watch the company.

Unknown possibilities

My first article was about quantum computers’ future prospects in general, so I want to avoid repeating too much. These TAM numbers are only rough estimates, and a mature quantum computer could offer unimagined application possibilities. It is always tough to predict the applications of entirely new technologies with today’s knowledge. At the time of horses and carriages, it was impossible to imagine what the steam locomotive would change in the world. Only when it was there and was used more and more, it slowly became clear what significant changes this technology would bring. It could be similar with quantum computers and AI.

But we are not at that point yet. AI is a buzzword and, so far, nothing more than slightly better algorithms. We are slowly getting to the point of real self-learning systems, but this has little to do with artificial intelligence, like in science fiction movies. Here I want to mention my article about Google’s Deepmind. This branch of Google is probably one of the most advanced companies in terms of AI.

In quantum computing, many companies are researching and publishing press releases about new achievements and records, but they are mostly isolated cases in research institutions. One of my criticisms of IONQ in my past articles was that it is so difficult to understand what benefits their system offers. They state that other companies can use their system via the cloud, but there needs to be more information about what benefits IONQ offers their customers. What do these customers say? Are they satisfied? What advantages has this experiment brought them? Will they become returning customers? There is almost no information on all these points, although these are essential questions for us as investors to assess the long-term potential.

Technological developments

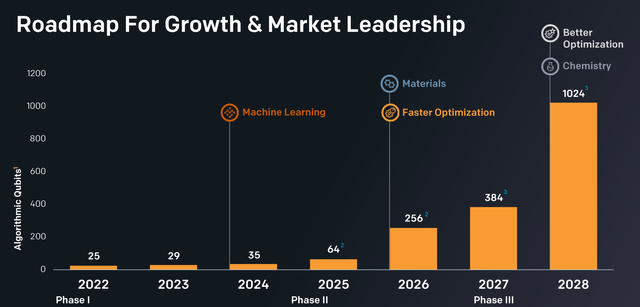

Again, I would like to refer to my first article, where I write in detail about the technical differences between IONQ and competing systems. The article is from April 11, and IONQ was working with 20 algorithmic qubits at that time. In the latest Investor Presentation, they state that they have now reached 25 algorithmic qubits. The long-term goal looks like this.

IONQ Q3

So we can see that in the next two years not so much should change. But from 2026, there is suddenly an explosion in development. Why is that? Unfortunately, I can’t tell you anything about that, because the company doesn’t say anything either. The footnotes say that these estimates can have a high degree of uncertainty and that these results could be achieved later or not at all.

This is another point of my general criticism of the company and a pattern that can be seen in many highly valued hype stocks: big promises for the future but little evidence that it will happen. This means that we as investors have to hope, and as we all know, hope is not a good strategy on the stock market.

In general, the development of quantum computer research is so fast and confusing that hardly anyone here can have a complete overview. Perhaps one has this if one is an expert in the field, but 99.99% of the private investors will not count to this. As an example, one can look at the headlines on sciencedaily.com. In the last few months alone, there have been so many innovations. Of course, these are primarily theoretical laboratory discoveries, but it shows how much potential and, thus, uncertainty prevails in this technology. Given this, how can one make predictions up to 2028? Some examples are:

- “Twisty photons could turbocharge next-gen quantum communication”

- “For the longest time: Quantum computing engineers set new standard in silicon chip performance”

- “New method to systematically find optimal quantum operation sequences for quantum computers developed”

- “New quantum technology combines free electrons and photons”

New partnerships

But there is also good news that I don’t want to hide. These are new partnerships that are entered into with larger companies, research institutes, or government institutions. One of them is a $13.4M partnership with the U.S. Air Force Research Lab.

The company will provide the lab with access to its trapped ion systems for quantum computing hardware research and for the development of quantum algorithms and applications.

Furthermore, there is a partnership with Dell “to offer joint customers a world-class hybrid computing solution.” But there is not much information about it in the investor presentation. Furthermore, there is also a new project with Oak Ridge National Laboratory. This does not seem to be a commercial project but focuses on joint research “for the discovery of new quantum chemistry applications.” Overall, such partnerships are crucial for IONQ, both for research and commercialization, because you have to remember that this is a tiny company with currently 130 employees.

Valuation & Q3 results

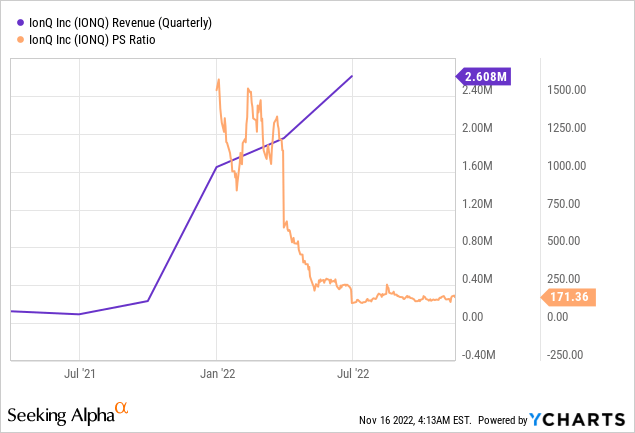

The current market cap is $1.16B, and the enterprise value is $846M. The TTM price-to-sales ratio is 171.

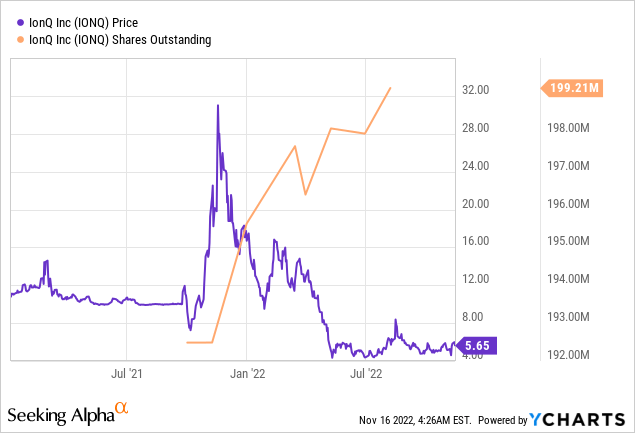

In Q3, revenue was $2.7M, and net loss was $24M, according to IONQ. That equates to a loss per share of $0.12. For the full year 2022, the net loss is $30M.The report shows they currently have only $57M in cash left. While total assets are significantly larger, they are tied up elsewhere, primarily in short and long-term investments. $57M cash means the company will soon require new financing. There has been slight share dilution so far this year.

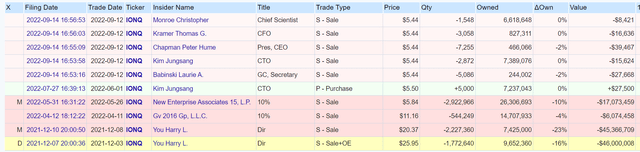

Stock-based compensations amount to $22M in 2022 to date. This will be roughly two times as much as the company’s total revenue in 2022. And considering the company has 130 employees, that’s $170k per employee. Not so much in the last few months, but since the company went public, there has been insider selling for more than $100M. Who lost? Shareholders who believed in the hype and bought at much higher prices while management itself sold.

openinsider

Conclusion – The company has too many risks

The further the company’s valuation decreases, the more attractive an investment becomes. However, I still don’t see any reasons to invest at the current level. The valuation is still very high in relation to sales. Technological challenges will also persist, especially with regard to rapid technological development and financially much more robust competition.

I think as an investor, you have to be very careful with business models you don’t fully understand. Theoretically, the company wants to offer quantum computers via the cloud for other companies. That can be understood. But the technology behind it is not understandable, and the technological development is tough to keep track of. That’s vastly different from an investment in Adobe (ADBE), for example, which also offers its products via the cloud. But Photoshop and video editing programs can be understood, and you know exactly what they provide Adobe’s customers. As I said before, you can’t estimate that for IONQ.

Furthermore, I don’t want to suffer any share dilution so that the employees get $170k per employee per year. But that’s understandable because the company needs a lot of talent and intelligent people. But as an investor, you still get the short end of the stick. A few secured partnerships have potential and are positive news, but at this point, the risks far outweigh the opportunities.

Be the first to comment