da-kuk/E+ via Getty Images

Ionis Pharmaceuticals (NASDAQ:IONS) specializes in RNA research to discover novel drugs to tackle a wide range of diseases. The company’s technology employs the use of antisense therapies, which target and destroy disease-causing mRNA, or copies of DNA that contain instructions on the production of proteins. This highly effective method of disease prevention has proven crucial especially in the wake of the pandemic, as COVID-19 became the focus of the entire healthcare industry. In addition, the company has 30 years of experience in RNA-targeted drug discovery and development, which have been used to treat cancer and cardiovascular, neurological, infectious, and pulmonary diseases.

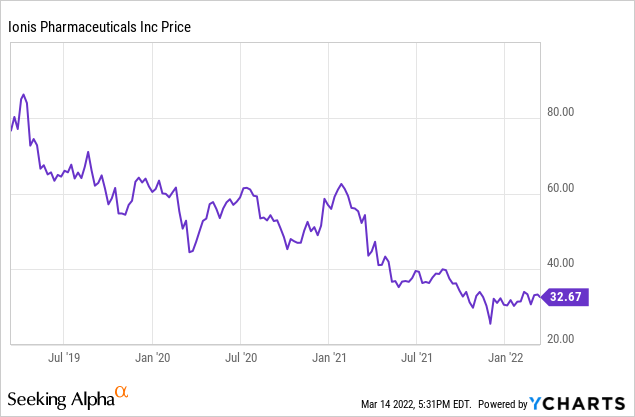

ycharts.com

As the company’s research highlights the importance of early prevention and efficient drug development, Ionis can expect to find a space in the growing sector and improve its recent financial figures. In that case, investors would do well to keep an optimistic bullish outlook on the company, based on recent rising numbers and drug potential.

Biotech Trends

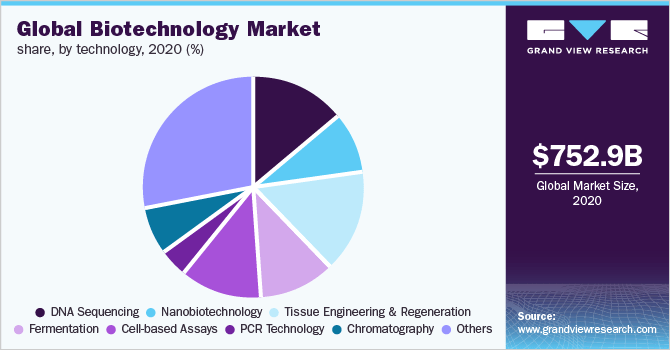

Biotechnology has made a lot of progress in recent years and the COVID-19 pandemic has just further accelerated this growth. As of 2020, when the spread of the virus was increasing, the global biotechnology market size was valued at $752.88 billion. By 2021, the biotech sector had surpassed $1 trillion in market value. The industry’s expected compound annual growth rate from 2021 until 2028 is currently estimated at 15.83% as companies continue to make advances and expand their reach.

grandviewresearch.com

As for 2022, analysts are expecting market growth to continue to climb, primarily due to the success of vaccination rollouts and the overall improvement in how the global pandemic is being handled. However, unless there is another variant outbreak, which, needless to say, no one is hoping for, the biotech sector is not expected to see the rate of growth it experienced in the past two years and should slow down a little. Still, the biotech sector should outperform the broader market in 2022. In any case, there is no doubt the sector will continue to see impressive growth; it is only a question of how large that margin will be.

Company Financials

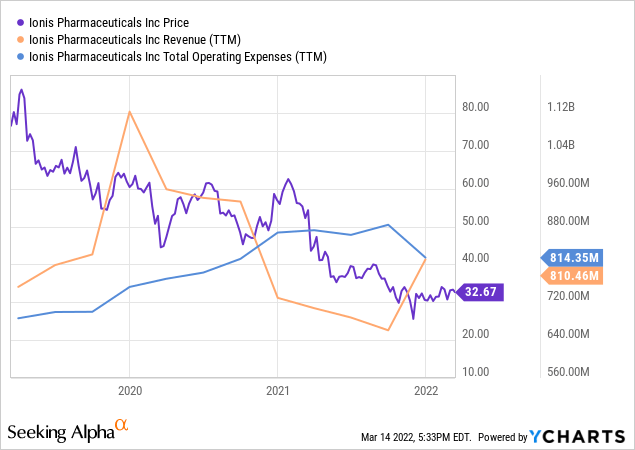

ycharts.com

Ionis saw significant annual growth in the past year, with the company’s revenue increasing nearly 10% from $729.264 million in 2020 to $810 million by the end of 2021. Revenue in the fourth quarter was significantly higher than reported in all other three quarters of 2021, with the company reporting a jump from $133 million in Q3 to $440 million in Q4. This growth can be attributed to the payments across multiple partnered programs throughout the year. Ionis earned $200 million from its new collaboration with AstraZeneca (AZN) to jointly develop and commercialize eplontersen. The company also earned more than $160 million from Biogen (BIIB) for advancing several neurology disease programs. Ionis is advancing a large late-stage pipeline, and as a result, its non-GAAP operating expenses increased in 2021 compared to 2020. Higher R&D expenses were driven by the expanded number of Phase 3 studies the Company was conducting, which doubled throughout 2021 from 3 to 6 studies. Additionally, the Company recognized $35 million in R&D expense in the third quarter of 2021 for licensing Bicycle Therapeutics’ (BCYC) technology. Lower SG&A expenses primarily reflected operating efficiencies achieved from integrating Akcea and restructuring the company’s commercial operations.

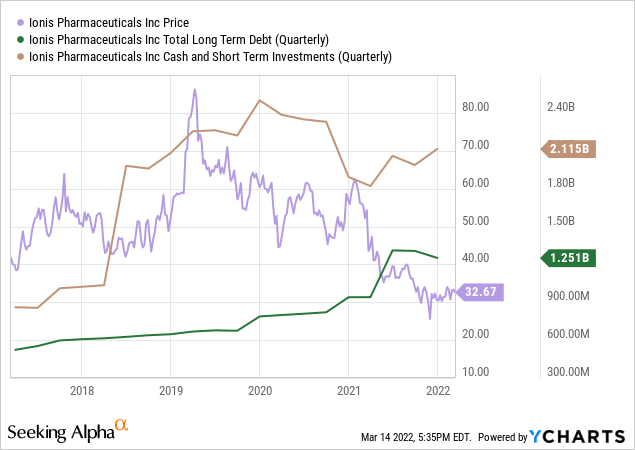

ycharts.com

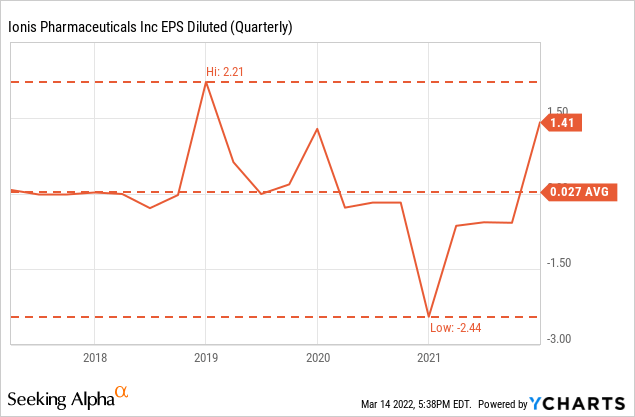

Ionis closed the year with a record-high total debt, at $1.247 billion by December 2021, up from $839.574 million the year before. However, given the growth in assets and the deals being made, this shouldn’t affect the long-term future. The company held cash, cash equivalents, and short-term investments of $2.1 billion by the end of the fiscal year, compared with $1.9 billion as of December 31, 2020. This will enable accelerating investments in 2022 with the goal to drive substantial future growth. For the first time in 2021, Ionis reported positive EPS, with diluted EPS in the fourth quarter at $1.41, compared to $-0.58 in the previous quarter. This was a massive surprise in earnings, which beat estimates by $1.13 and was only the second quarter to do so, with Q2 just slightly beating estimates by $0.03. This should prove to be an encouraging sign for investors, who are starting to see a recovery in the company’s income statements as of late. While the business has been secure throughout, recent financials have caused some concern, especially with regards to income. While 2020 closed at $-172.082 million in total operating income, last year saw this number drop to $-30 million, as per reports.

ycharts.com

Main Takeaways

Ionis saw a 51.58% year-on-year rise in revenue by the end of 2021, beating their peers in the pharmaceutical preparations industry, which saw an average 19.9% rise in the same period. This is even more impressive compared to the healthcare sector, which saw a mere 12.41% rise. The company will need to manage its assets better and improve on the current cost of operations, which is why news of its decision to discontinue the Pfizer (PFE)-led clinical development program for vupanorsen, an investigational antisense therapy that was being evaluated for potential indications in cardiovascular risk reduction and severe hypertriglyceridemia, should come as welcome news. The capacity to determine early on the scientific validity of all operations will help save the company money and help quickly redirect focus on research that can have more immediate and efficient results in providing novel treatment to those in need.

If Ionis continues on this trajectory, then their nearly three-year downtrend may finally reverse. In this case, bullish investors may be wise to target recovery back to pre-pandemic prices of around $60 per share, equating to a nearly 70% increase in valuation in the time to come. Biotechnology will also continue to see growth in all sectors, and competition shouldn’t prove to be an issue, given how diversified the sector is and how companies like Ionis can indirectly influence areas such as the pandemic. As for the areas of research where the company is directly involved, their value will continue to appreciate as results come in and as they continue to find backing through government institutions and lucrative partnership deals.

Be the first to comment